Brookside secures more oil-rich ground near Top 10 US producer

Brookside has hunted itself out some hotly sought after ground in one of Oklahoma’s most prolific oil producing formations.

Brookside Energy has increased its strategic position in one of Oklahoma’s most prolific oil producing formations, the “Oil Window” in the Woodford Shale.

Brookside Energy (ASX:BRK) has expanded and consolidated its position in the core of what is known as the Woodford “Oil Window”, responsible for a substantial proportion of Oklahoma’s oil production.

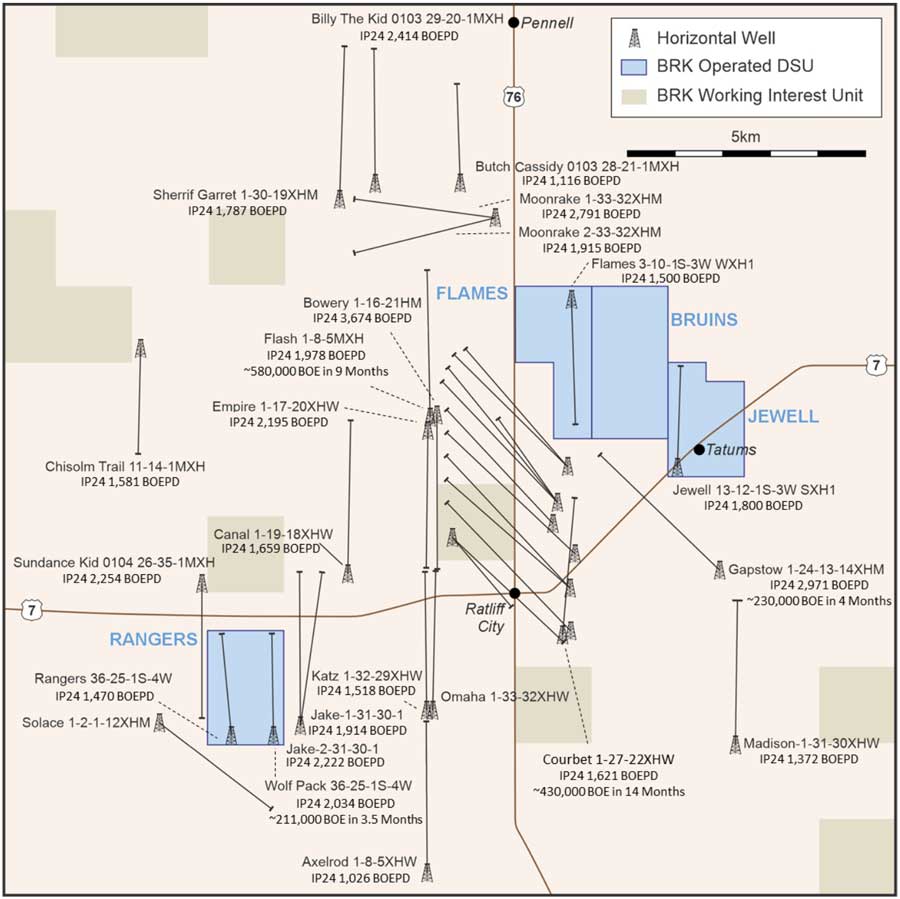

This fresh patch of 400 acres, which increases Brookside’s acreage position in the area by 12.5%, sits adjacent to and north of the successful Courbet wells and the Gapstow well owned by top 10 independent US oil producer Continental Resources.

Continental’s Courbet wells, which are a full field development of a six square mile area, have delivered very high initial production rates above 2,000 barrels of oil equivalent per day (BOEPD) and several above 3,000 BOEPD, demonstrating the oil-rich nature of the Woodford shale.

Courbet Wells full field development south of the Flames DSU and Continental Resources’

Gapstow Well south of the Bruins and Jewell DSUs.

This early success has provided a road map for the optimal development of Brookside’s liquids rich reserves in the SWISH Area of Interest, which reached full production in the June quarter, producing more than 1,500 BOEPD net to Brookside.

This delivered Brookside record free cash flow of $7.5m, boosting the company’s cash pile to $23.5m.

The company noted that the multi well pads and simultaneous development of the Woodford and Sycamore formations could potentially deliver material efficiencies in both recoveries and costs.

“This is a very significant milestone for the company and more importantly for our shareholders,” managing director David Prentice told Stockhead.

“The team has maintained its focus on taking full advantage of our footprint in this very hot area to build on our existing landholding such that we now have a material position in the core of this very productive liquids rich high-grade core of the greater SWISH area.

“The early Courbet results are clearly world-class and provide us with the blueprint for the efficient monetisation of these oil reserves – the timing could not be better with oil prices strengthening and services costs normalising.

“Our strategy of maintaining maximum optionality on our acreage position is paying off and we are confident that at some point this will be rewarded with recognition of value in the market.”

Locking in drilling approvals

Meanwhile, Brookside has secured initial approvals required for the development of the Flames Drilling Spacing Unit (DSU), which is a major step in clearing the way for future drilling and completion operations to be undertaken.

A DSU is the acreage area that can be used to drill a well, and establishes the distance required between a new well and existing wells.

The Oklahoma Corporation Commission has also approved Brookside’s application to expand its Bruins DSU by 33% to 1,280 acres, and the company has acquired additional acreage within the Jewell DSU.

This success, combined with activity in the Flames and Bruins DSUs, has delivered a contiguous block of 3,200-acres (gross) in the heart of this core area.

This is in addition to the Rangers DSU that hosts Brookside’s highly successful Sycamore wells – Rangers and Wolfpack.

This article was developed in collaboration with Brookside Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.