Brookside says a single well has delivered 1.4bn cubic feet of gas in four months

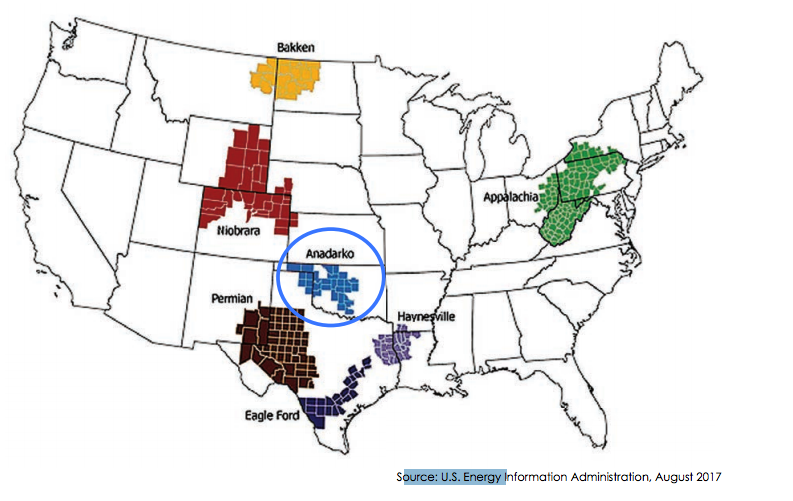

Special Report: Brookside Energy says it’s got 1.3 billion cubic feet of gas and 10,200 barrels of oil from the Herring well in its Anadarko Basin play in Oklahoma.

The well started production in late-October 2017.

Brookside (ASX:BRK) has also increased its working capital in the well from 13.6 per cent to 18.2 per cent.

As news flow continues to ramp-up, flow back operations are set to commence on another of Brookside’s non-operated working interest wells in the STACK Play.

The Continental Resources-operated Kevin FIU well has been successfully completed for production and the company expects to have initial production rates available toward the end of April.

This well is located in the southern core of the STACK Play in Blaine County, in an area where several of best “record setting” wells have been drilled, including the Angus Trust (4642 BOE per day), Lorene (6715 Boe per day) and the Tres C FIU (5953 Boe per day).

“Excellent initial production rates like these together with continued ‘play scale’ drilling success and the on-going successful density pilots are the catalysts that drive per-acre valuations higher,” the company told investors.

Brookside is not an oil producer per se, but a property investor, pursuing a buy low/sell high strategy that has traditionally had great success in the US.

It buys leases and brings in drilling partner Black Mesa to establish a reserves, produce oil and increase the value of the land. Ultimately the partners sell the “renovated” land for considerably more than they paid.

Managing director David Prentice told Stockhead he’d seen the value of land in the area rise from from $1000 an acre to $16,000 in just 12 months.

Further, a $3.8 billion deal in February between Silver Run and Alta Mesa valued the land nearby at $US29,000 an acre.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

Mr Prentice is hopeful they can sell for upwards of $50,000 an acre.

Brookside has already leased about 2100 acres and is currently working to expand that position to in excess of 9000 acres.

The oil producer is currently on a roadshow around Australia and accompanied by its drilling partner Black Mesa.

This special report is brought to you by Brookside Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.