BNEF’s stationary storage forecasts have now almost tripled since 2016 as Tesla unveils its utility scale Megapack

Pic: Vertigo3d / E+ via Getty Images

Let’s be honest, forecasts are just educated guesses.

And when it comes to growth markets like electric vehicles and battery storage, these forecasts — especially long term ones — are made redundant pretty quickly.

Stationary storage systems are big batteries often designed to store excess power from the power grid, including from renewable sources. They also includes residential and industrial ‘behind the meter’ systems.

Analysts and industry insiders are frequently adjusting stationary storage projections upwards.

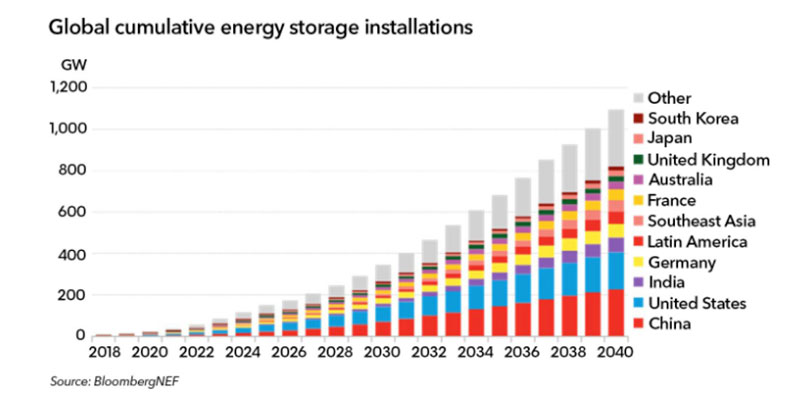

Bloomberg New Energy Finance (BNEF), for example, has significantly increased its forecast for global deployment of behind-the-meter and grid-scale batteries over the coming decades.

In 2016, BNEF predicted 25GW of installed storage by 2028, and for the market to be worth $US250 billion by 2040.

This article called it an “ambitious forecast”.

In 2017, it predicted 125GW of batteries would be sold for global energy storage by 2030.

In November 2018 it revised those figures again — global installed battery storage capacity could reach 100GW as early as 2025, it said, with 300GW breached around 2030.

By 2040, BNEF predicted the global energy storage market would grow to a cumulative 942GW worth about $US620 billion in investment over the next 22 years.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Yesterday, BNEF released its latest update for global energy storage out to 2040 and guess what? Their predictions are skewed to the upside once again.

It now predicts energy storage installations around the world will multiply exponentially to 1095GW by 2040.

This 122-fold boom of stationary energy storage over the next two decades will require an estimated $US662 billion of investment.

The new Energy Storage Outlook 2019 also predicts a further halving of lithium-ion battery costs per kilowatt-hour by 2030, as demand takes off in stationary storage and electric vehicles.

“Two big changes this year are that we have raised our estimate of the investment that will go into energy storage by 2040 by more than $40 billion, and that we now think the majority of new capacity will be utility-scale, rather than behind-the-meter at homes and businesses,” BNEF analyst Yayoi Sekine says.

There is a fundamental transition developing in the power system and transportation sector, BNEF says, as wind and solar are set to make up almost 40 per cent of world electricity in 2040, up from 7 per cent today.

Batteries will increasingly be chosen to manage this dynamic supply and demand mix.

… And along comes the Megapack

This week, Tesla unveiled a stationary storage disruptor called the Megapack.

This is a utility scale monster. Using Megapack, Tesla reckons it can deploy a 250 MW, 1 GWh power plant in less than three months on a three-acre footprint – four times faster than a traditional fossil fuel power plant of that size.

1 Gigawatt hour (GWh) project provides enough power to keep the lights on at every home in San Francisco for six hours.

And this larger battery pack has a 60 per cent increase in energy density over the current Powerpack; the type used at the ground-breaking Hornsdale installation in South Australia.

“In the past year alone, we have installed more than 1 GWh of global storage capacity with our current storage products, Powerwall and Powerpack, bringing our total global footprint to more than 2 GWh of cumulative storage,” Telsa says.

“With Megapack, this number will continue to accelerate exponentially in the coming years.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.