Cheaper, better battery storage will underpin the global modern energy system

Pic: Vertigo3d / E+ via Getty Images

For stationary storage, that decisive moment when cost and performance reaches parity with established alternatives is arguably here.

Stationary storage systems are big batteries often designed to store excess power from the power grid, including from renewable sources, for use during expensive peak demand periods.

It also includes residential and industrial ‘behind the meter’ systems.

By 2028, Benchmark Minerals Intelligence predicts 50 per cent of the burgeoning stationary storage market will be lithium-ion, and 25 per cent vanadium flow batteries, also known as vanadium redox flow batteries (or VRFBs).

At present, most stationary storage is lithium-ion, with VRFB uptake – a better alternative for grid style storage in many respects – hindered by a sky-high vanadium price.

Yet analysts and industry insiders are constantly revising their stationary storage projections upwards as the industry accelerates.

High Voltage: the latest news driving battery metals stocks>>

Bloomberg New Energy Finance (BNEF), for example, has significantly increased its forecast for global deployment of behind-the-meter and grid-scale batteries over coming decades.

In 2016, BNEF expected 25GW of installed storage by 2028, and for the market to be worth $US250 billion by 2040.

This article called it an “ambitious forecast”.

Last year it predicted 125GW of batteries would be sold for global energy storage by 2030.

In November 2018 it revised those figures again. Now, global installed battery storage capacity could reach 100GW as early as 2025, with 300GW breached around 2030.

By 2040, BNEF reckons the global energy storage market will grow to a cumulative 942GW worth about $US620 billion in investment over the next 22 years.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

(Incredibly, batteries for stationary storage will make up just 7 per cent of total demand by 2040, with EVs taking dominant market share.)

The main driver for the bullishness? Faster-than-expected falls in storage system costs.

BNEF now believes the cost of a utility-scale lithium-ion battery storage system is forecast to fall by 52 per cent between 2018 and 2030.

This would transform the economic case for batteries in both the vehicle and the electricity sector, it said.

Battery storage is booming

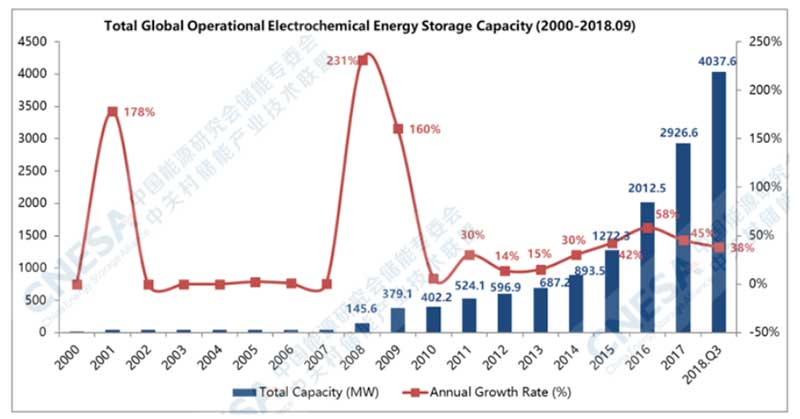

According to the China Energy Storage Alliance (CNESA), by October this year global battery storage capacity was over 4GW by October 2018 — an 80 per cent increase on the same time last year.

China’s operational battery storage capacity increased 104 per cent year-on-year to 649.7MW by October.

Europe’s battery storage market is expected to reach 3.5GW capacity by end of 2019, more than doubling in two years, while United Kingdom battery storage capacity is approaching 5GW, according to S&P Global Platts.

In the United States, the pipeline for energy storage projects in the doubled in 2018 to nearly 33GW, according to a new report from Wood Mackenzie and the Energy Storage Association (ESA).

While not all of these projects will happen, it is a clear signpost that developers are “bullish on energy storage”, Wood Mackenzie senior energy storage analyst Dan Finn-Foley says.

“With everything energy storage can do there really is no US market that isn’t emerging as an opportunity,” Mr Finn-Foley says.

In total, the US saw 136.3 megawatt-hours (Mwh) of storage deployed in the third quarter of the year, up from 44MWh deployed in Q3 2017.

Wood Mackenzie forecasts 686MWh of energy storage will be deployed in the US by the end of the year.

MW or GW refers to maximum possible power, while MWh or GWh refers to how much power is actually generated over a period of time.

Hornsdale: proving the economics of grid storage

Matt Canavan, Australia's minister for resources, is dismissive of the large Tesla battery in South Australia. "It's the Kim Kardashian of the energy world: it's famous for being famous. It really doesn't do very much." #CERAWeek2018

— Ed Crooks (@Ed_Crooks) March 7, 2018

In December, it was revealed that the misunderstood and much maligned 129MWh Hornsdale power reserve in South Australia, better known as ‘Tesla’s big battery’, had already saved $40 million in wholesale market costs after just one year in operation.

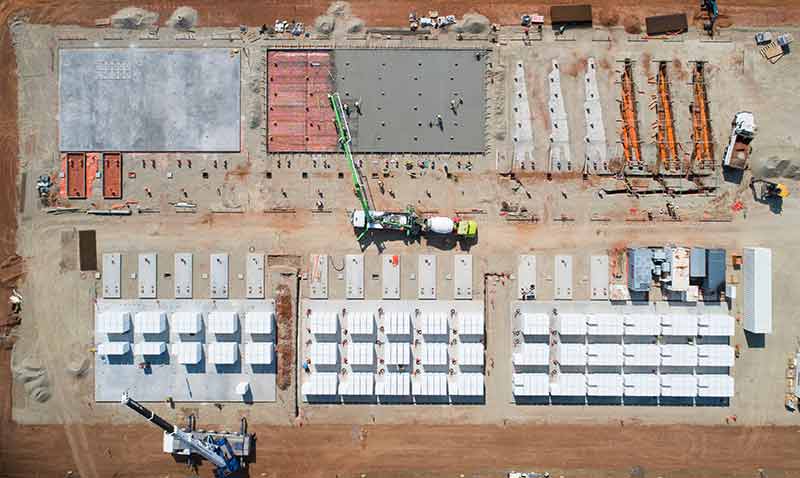

The world’s largest lithium-ion battery energy storage system was built at a cost of about $90 million and is owned and operated by French company Neoen.

The positive impact of the battery’s services have already been recognised by the Australian Energy Market Operator (AEMO), which stated that frequency and ancillary services (FCAS) provided by Hornsdale were more “rapid and precise, compared to the service typically provided by a conventional synchronous (usually gas) generation unit”.

FCAS is a group of services that help stabilise the grid.

If the frequency falls or rises outside a certain range, blackouts will happen such as the one South Australia experienced in September 2016.

Franck Woitiez, Managing Director Neoen Australia said the success of Hornsdale had strengthened the commercial case for new battery projects in Australia.

It enables their deployment to support the ongoing energy transition and will continue to prove the value of similar investments, he says.

“Hornsdale Power Reserve is an example of the projects that will underpin a modern energy system in Australia and Neoen is excited to continue leading this sector.”

Telsa’s battery has remained uncontested as the world’s largest since it became operational late last year.

In September, Cairn Energy Research Advisors managing director Sam Jaffe said that within two years, Hornsdale is “probably going to be 20th or 30th on the list, in terms of what is being built today”.

He could be right.

The new world’s largest lithium-ion battery could be built in Queensland.

Private operator Sunshine Energy Australia has been granted development approval to build a 1500MW solar farm and a 500MW lithium-ion battery storage facility.

California-based Recurrent Energy has also proposed a 350MW battery storage facility.

Another US-based company, Vistra Energy, is also working to make operational a 300MW battery system in 2020.

“The rate of stationary storage is going to grow exponentially,” Tesla’s Elon Musk said at a shareholder meeting earlier this year.

“For many years to come each incremental year will be about as much as all of the preceding years, which is a crazy, crazy growth rate.”

Chances are, analysts will be forced to revise their stationary storage projections again pretty soon.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.