Aura eyes more resource growth at Tiris, one of the lowest cost uranium projects in the world

The company is confident new exploration targets could significantly expand the project’s resource. Pic: via Getty Images.

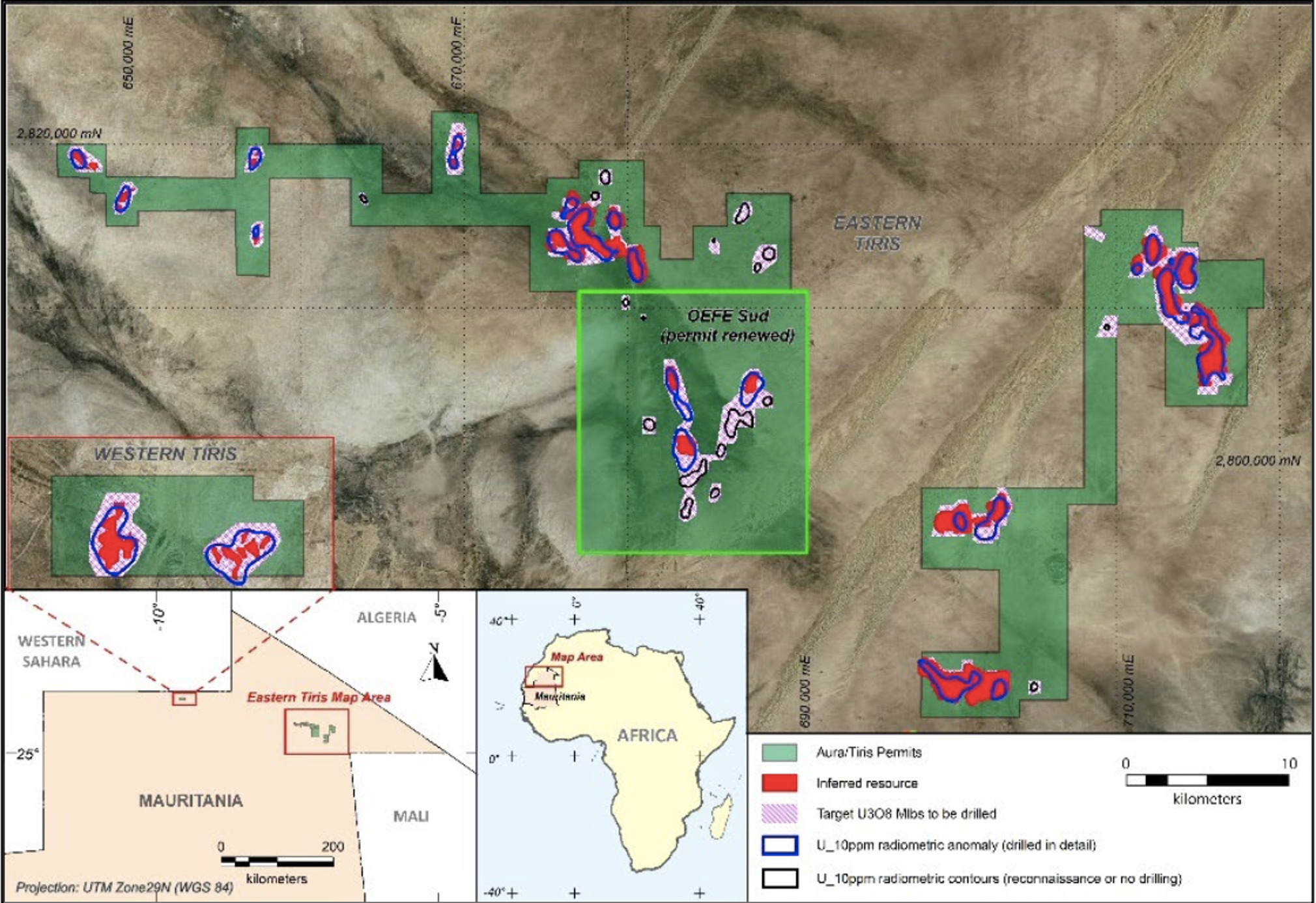

- AEE finds new exploration targets at 58.9Mlb Tiris uranium project in Mauritania

- Tiris one of the lowest capex, lowest operating cost undeveloped uranium projects worldwide

- New targets could bolster project resources to ‘global scale’ of +100Mlbs

- Exploration program to commence ASAP

Aura Energy is looking to expand the existing 58.9Mlbs uranium resource at its Tiris project in Mauritania after spotting seven exploration targets extending from the resource.

The company’s plan is to transition from a uranium explorer to a uranium producer to capitalise on the rapidly growing demand for nuclear power as the world shifts towards a decarbonised energy sector.

This strategy is bolstered by the recent enhanced feasibility study from Tiris which delivered a 180% bump in the base case NPV to US$226 million, and a base case IRR of 28%, with further capacity to improve as nearby resource growth is targeted.

The resource of 113Mt at an average grade of 236ppm U3O8 containing 58.9Mlbs U3O84 was based on 21,990 metres of drilling in 5,619 holes for a total project cost of US$11.9m or US$0.20 per lb U3O8.

This reconfirmed the project as one of the lowest capex, lowest operating cost uranium projects that remain undeveloped worldwide.

Aura Energy (ASX:AEE) has now acquired additional radiometric survey data, reviewed historical drilling results, and identified strong indications of mineralisation extensions on its existing tenements that could significantly expand the project’s current resource.

Potential for near-term production

Preliminary work has identified the seven exploration targets of 30-60Mt at 12-240ppm U3O8 for 8-32Mlbs U3O8, highlighting the project’s potential to achieve world-class scale, Aura MD David Woodall says.

“Aura’s strategy is to be development-ready in relation to our Tiris project, and this strategy is progressing and accelerated as we aim to expand our mineral resource,” he said.

“The near-term, low-cost, producer status of our Tiris project was confirmed by our March 2023 enhanced definitive feasibility study.

“Further resource expansion towards 100Mlbs of U3O8 progresses the project towards a global scale and reinforces the potential for Mauritania to be a material producer in the near term.”

The exploration target will be tested with a 15,500m drilling exploration program planned to commence shortly.

Potential to grow annual production capacity

Proving up these additional resources is likely to expand the ore available to the Tiris project and potentially facilitate modular expansion.

The company says the development of targets within currently held leases has the benefit of providing tonnage close to presently planned operations, increasing the likelihood of mine life extension without significantly modifying the existing mining plan.

“The robust economics of our Tiris uranium project will be further enhanced by increasing our mineral resources and reserves,” Woodall said.

“Due to the modular nature of the project, we see outstanding opportunities to grow the annual production capacity of the project to 3.5Mlb per annum, equivalent to the planned back-end plant capacity.

“To that end, Aura will commence key pre-construction activities, including the geotechnical drilling of the proposed plant site, and allow some trial mining to provide valuable data in the production planning for the Tiris operation once developed.”

Pic: Tiris project exploration program target areas. Source: AEE.

Exploration planned asap

Aura is now planning an exploration program of 15,500m air core drilling over approximately 78 km2 on existing tenements, which should commence shortly.

The aircore drilling program in Tiris East is expected to be completed within two months of the commencement of drilling, with an updated resource estimate to be completed shortly after the completion of the drilling program.

Meanwhile, Aura says the project’s Front-End Engineering Design (FEED) study is 80% complete.

This article was developed in collaboration with Aura Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.