ASX Renewable Energy Stocks: Australia falls to 52nd place in Green Future Index 2022

Pic: Getty Images

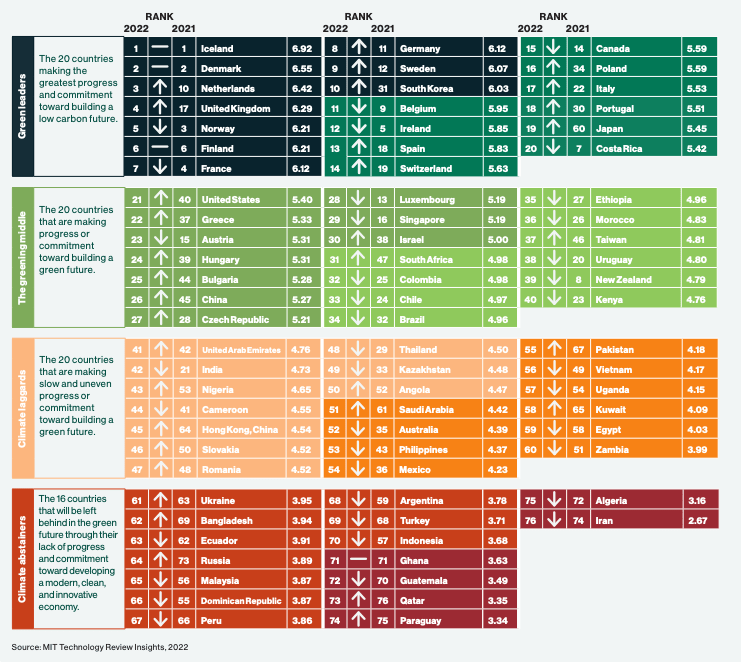

- Australia falls to 52nd place from its 35th place in 2021 in latest Green Future Index

- Twiggy’s Tattarang invests $28.8mn to remove plastics and other synthetics from supply chains

- Green nickel explorer BSX mobilises drill rig in Vietnam

MIT Technology’s Review’s Green Future Index 2022 demonstrates a bleak overall picture of Australia’s efforts towards a low-carbon future.

The second edition of the comparative ranking of 76 nations and territories tracking how economies around the world are placed in terms of investment in renewables, innovation and green policy marked Australia as 52nd – a hefty drop from its 35th placement last year.

Released only a few weeks ago, the report put Australia in the category of 20 countries “making slow and uneven progress or commitment toward building a green future”.

Here is a breakdown of Australia’s overall ranking:

- Carbon emissions – 21st place

- Energy transition – 60th

- Green society – 21st place

- Clean innovation – 68th

- Climate policy – 47th

“Australia did not sign the COP26 pledge to phase out coal by 2030, but is speeding up some transition targets, such as closing its biggest coal-fired power station by 2025, seven years ahead of schedule,” the report said.

Clean innovation was the country’s worst score covering all things from green patents to investment in cross-border clean energy initiatives and investment in food tech.

Twiggy’s Tattarang invests millions next-gen plastic free fabric

Tattarang, the private business interests of Twiggy (Andrew) and Nicola Forrest has invested in the future of sustainable fabrics with an injection of $26.8mn as part of a Series B capital raise by US-based material innovator Natural Fiber Welding (NFW).

Tattarang joins some of the world’s leading fashion and automotive brands who have invested in NFW to help the company build scale and meet rising global demand for plastic free fabrics, textures and materials.

John Hartman, chief investment officer at Tattarang said the business sees an opportunity to use NFW’s MIRUM product for R.M Williams, the iconic Australian bootmaker and outfitter owned by Tattarang.

“Aligning with Andrew and Nicola Forrest’s ultimate goal to eliminate all plastic waste through the initiatives of Minderoo Foundation, Tattarang and R.M.Williams are on a journey of continuous improvement to remove plastics and other synthetics from our supply chains,” Hartman said.

‘Green nickel’ explorer mobilises drill rig at Vietnam Chim Van target

Aspiring green nickel miner, Blackstone Minerals (ASX:BSX) has obtained drilling approvals to begin a program of works at the Chim Van target, within the wider Ban Phuc Nickel Mines (BPNM), only 10km from its flagship Ta Khoa nickel-copper-platinum tenement holdings in Northern Vietnam.

The company has completed the initial phase of collaboration with the General Department of Geology & Minerals of Vietnam and is focusing its efforts on drilling the first priority hole, where geophysical modelling suggests a concealed ultramafic target similar to the Ban Phuc disseminated sulphide deposit.

In fact, Chim Van features a magnetic anomaly larger than the Ban Phuc ultramafic intrusion and with drilling, BSX plans to test the Chim Van target for nickel-copper-PGE sulphides.

If successful, BSX says the next steps will be to secure an exploration licence.

“Exploration continues to be a major focus for the company as we look to organically increase our mining inventory available to feed the Ta Khoa Refinery,” BSX mangiang director Scott Williamson said.

“We are excited for the potential that Chim Van has to feed into our longer-term growth profile.”

Blackstone Minerals (ASX:BSX) share price today

NRZ appoints urea licensor

NeuRizer (ASX:NRZ), previously named Leigh Creek Energy has approved the appointment of a urea licensor – Stamicarbon only a week after inking an ammonia licensor for its Urea project north of Adelaine, South Australia.

Stamicarbon is a global market leader in the design and development of fertiliser plant technologies, with urea, green ammonia and nitric acid being the core business and has overseen 250 projects through to commissioning.

NRZ says this marks another milestone and signifies the last step in closing the technology gap by locking in all the licensors and proprietary equipment for completion of the FEED.

Due to the complexity of the NRUP ammonia and urea manufacturing facilities, NRZ and its EPC partner – South Korean conglomerate DL E&C Ltd (DL) undertook the search for the appropriate urea licensor.

Stamicarbon will deliver the Process Design Package (PDP) for the NRUP, a critical requirement for DL to complete its commitment to provide a Front-End Engineering and Design (FEED) package.

Neurizer (ASX:NRZ) share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.