Emission Control: Bloomberg’s 20 MILLION EV forecast, Hyundai’s cars will fly, and Japan gets some Top End gas

Pic: Vertigo3d / E+ via Getty Images

- BloombergNEF says the world will see 20 million plug-in EVs on the road by June

- Hyundai confirms electric air vehicle plans at workshop in Longbeach, California

- Japan’s Osaka Gas backs Northern Territory green hydrogen project

Global renewable energy research provider, BloombergNEF says the world will pass another electric vehicle milestone in June with 20 million plug-in vehicles on the road globally.

In the second half of 2022, the firm says roughly six million EVs will be added to the global fleet, equal to about one every three seconds as more than 26 million plug-in EVs are set to hit the road by the end of 2022.

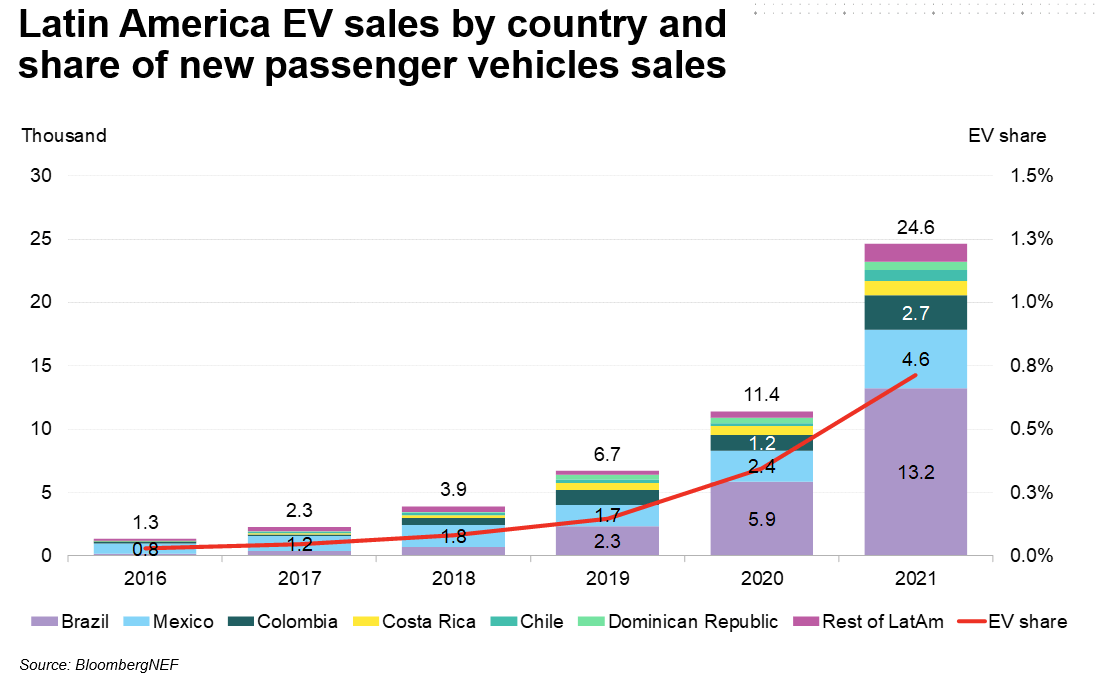

While China accounts for 46% of the total sales to date, followed by Europe at 34% and North America at 15% (with all remaining countries combined making up 5% of the global EV fleet), BNEF says sales are rising in Latin America with luxury buyers driving the uptick.

The region registered nearly 25,000 EVs sold in 2021, more than doubling its 2020 level. Even though sales remain a sliver of those in Europe, the market is growing briskly.

From Mexico to Chile, EVs were 0.7% of total car sales in 2021, with rates varying by country.

Brazil saw the most units sold, with 13,000, and Costa Rica led on a percentage basis with 2.7% of all cars sold with a plug.

Mexico is the only LATAM country that manufactures EVs, which it also targets exports to the US.

Hyundai’s hydrogen aviation plans

Back in November last year, Hyundai Motor Group revealed a new group – Supernal LLC, part of the entity’s Urban Air Mobility Division – which is developing a family of electric air vehicles that plans to launch its first commercial flight in 2028.

At the time, chief executive officer of Supernal and president of Hyundai Motor Group Jaiwon Shin said in adding a new dimension to mobility, the business is “on a mission to transform how people and society move, connect, and live”.

“We have bold ambitions at Supernal but being first to market is not one of them,” Shin said.

“We are working to build the right product and the right integrated market, and we will leverage Hyundai Motor Group’s scaled manufacturing expertise to ensure AAM reaches the right price point and is accessible to the masses.”

Fast forward to earlier this month at the Vertical Flight Society’s H2 Aero workshop in Longbeach, California where the group presented on its ambitions to bring hydrogen expertise into the aviation world. Supernal senior manager Yesh Premkumar confirmed the company wants to be “a prominent player in the aviation market.”

While admitting Hyundai might not be the first name customers think of when talking about aviation, he said the business is looking to form “bilateral relationships as much as possible” from aircrafts to infrastructure, operations and city planning.

Japan’s Osaka Gas backs NT hydrogen project

Aqua Aerem, the proponents of the US$10.75bn 10GW Desert Bloom Hydrogen Project in the Northern Territory, has entered into a joint development agreement with Japan’s Osaka Gas.

Last December, Stockhead reported on Aqua Aerem receiving major project status by the Northern Territory Government where the project is located.

The project aims to utilise atmospheric water capture technology, powered by off-grid solar to produce around 410,000 metric tonnes of green hydrogen per year.

After having developed the technology over a period of two years, and running a pilot plant at the site in Tennant Creek, the agreement sees the two companies working together on activities such as project management, engineering and technical support, identifying customers and negotiating with equipment manufacturers.

Aqua Aerem CEO Gerard Reiter said the company was looking forward to working closely with Osaka Gas, which, in addition to being one of the world’s largest gas buyers and distributors, has an extensive global portfolio of energy projects, including LNG terminals, pipelines and independent power projects.

“This deal is a strong endorsement of the massive value of the project and Aqua Aerem’s innovative air-to-water technology, which is opening the door for green hydrogen projects to be located where the best renewable power sources are available, which is generally in the driest areas of the planet.”

Huge QLD green hydrogen hubs gets off the ground

Multi-national mining and infrastructure company, Orica, is partnering with green hydrogen infrastructure company H2U to initiate the first phase of a green ammonia H2-Hub in Gladstone, Queensland.

An MoU was signed yesterday for the undertaking of a master plan study where both companies will explore opportunities for an exclusive domestic green ammonia offtake and supply agreement.

Potentially, the two companies hope green ammonia supply could be delivered to Orica’s Yarwun manufacturing plant from H2U’s proposed plant.

A great ammonia export terminal at the Port of Gladonstone is another exploration pathway, leveraging the existing ammonia storage capacity at the Fisherman’s Landing Wharf and the associated connecting infrastructure in the Gladstone State Development Area to facilitate large scale exports.

The H2-Hub has a planned capacity of up to 3 gigawatts of electrolysis and up to 5,000 tonnes per day of green ammonia production, using 100 per cent renewable energy from new-build solar and wind resources in the Queensland region of the National Electricity Market.

The proposed facility could also contribute to improving the reliability of renewable electricity supply, with the integration of new renewable generation assets in Central Queensland.

Before a final investment decision is made and development kicks off in 2023, a master plan study will run for about six months as front-end engineering and development approval get underway at the back end of 2022.

Here’s how ASX renewable energy stocks are tracking today:

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AST | AusNet Services Ltd | 0 | -100% | -100% | -100% | -100% | $9,919,608,018.74 |

| AVL | Aust Vanadium Ltd | 0.076 | -28% | 105% | 245% | 204% | $243,443,841.55 |

| BSX | Blackstone Ltd | 0.37 | -10% | -21% | -28% | -3% | $178,694,074.70 |

| DEL | Delorean Corporation | 0.1775 | -4% | -19% | -12% | -11% | $31,892,894.70 |

| ECT | Env Clean Tech Ltd. | 0.032 | -14% | 39% | 129% | 60% | $52,685,890.37 |

| FMG | Fortescue Metals Grp | 21.16 | -2% | 16% | 41% | 1% | $65,243,266,612.42 |

| GEV | Global Ene Ven Ltd | 0.1 | 0% | 4% | 0% | 5% | $54,448,046.50 |

| GNX | Genex Power Ltd | 0.145 | 4% | 4% | -33% | -28% | $193,924,799.60 |

| HXG | Hexagon Energy | 0.042 | -2% | -19% | -45% | -58% | $18,749,607.79 |

| HZR | Hazer Group Limited | 0.955 | -12% | 7% | -12% | -15% | $159,639,250.12 |

| IFT | Infratil Limited | 7.6 | 0% | 0% | -4% | 15% | $5,525,828,737.50 |

| IRD | Iron Road Ltd | 0.195 | 3% | 8% | -17% | -34% | $155,594,436.27 |

| LIO | Lion Energy Limited | 0.053 | 6% | 2% | 26% | 89% | $23,436,062.27 |

| MEZ | Meridian Energy | 4.54 | -4% | -8% | -4% | -11% | $5,546,961,508.00 |

| MPR | Mpower Group Limited | 0.036 | -3% | -3% | -44% | -74% | $7,996,318.06 |

| NEW | NEW Energy Solar | 0.83 | 2% | -10% | 4% | 4% | $266,088,028.38 |

| PGY | Pilot Energy Ltd | 0.034 | -6% | -28% | -39% | -59% | $17,653,660.92 |

| PH2 | Pure Hydrogen Corp | 0.485 | -5% | 26% | 98% | 120% | $164,019,648.48 |

| PRL | Province Resources | 0.093 | -7% | 1% | -38% | -38% | $107,708,862.42 |

| PRM | Prominence Energy | 0.013 | 0% | 8% | -7% | -19% | $33,755,523.47 |

| QEM | QEM Limited | 0.235 | -16% | 34% | 52% | 31% | $26,654,483.26 |

| RFX | Redflow Limited | 0.04 | -5% | -7% | -34% | -46% | $60,411,224.08 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,783.60 |

| VUL | Vulcan Energy | 8.83 | -17% | -6% | -24% | 39% | $1,186,122,260.90 |

| CXL | Calix Limited | 8.495 | 8% | 22% | 53% | 266% | $1,372,255,572.00 |

| KPO | Kalina Power Limited | 0.031 | 7% | 48% | -6% | -37% | $47,621,006.53 |

| RNE | Renu Energy Ltd | 0.052 | 2% | -10% | 6% | -34% | $18,947,301.95 |

| NRZ | Neurizer Ltd | 0.22 | 16% | 52% | 83% | 42% | $199,139,673.39 |

| LIT | Lithium Australia NL | 0.105 | -5% | 0% | -9% | -9% | $108,533,903.52 |

| TNG | TNG Limited | 0.085 | -15% | 31% | 6% | -15% | $123,569,221.76 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 30% | 13% | $31,927,138.80 |

| NMT | Neometals Ltd | 1.68 | -13% | 14% | 96% | 289% | $954,174,929.04 |

| MR1 | Montem Resources | 0.032 | 3% | -22% | -32% | -75% | $8,241,954.11 |

| FGR | First Graphene Ltd | 0.17 | -3% | 6% | -11% | -23% | $97,984,910.80 |

| EGR | Ecograf Limited | 0.56 | -12% | 5% | -13% | -12% | $252,186,737.04 |

| EDE | Eden Inv Ltd | 0.016 | 0% | 0% | -24% | -57% | $34,716,614.57 |

| CWY | Cleanaway Waste Ltd | 3.05 | 0% | 7% | 10% | 23% | $6,435,273,293.28 |

| CPV | Clearvue Technologie | 0.34 | -18% | 8% | 19% | -38% | $76,226,523.84 |

| CNQ | Clean Teq Water | 0.585 | -3% | -8% | -11% | 0% | $26,129,711.79 |

| M8S | M8 Sustainable | 0.021 | 17% | 17% | -9% | -36% | $8,389,599.20 |

| EOL | Energy One Limited | 6.4 | 0% | 2% | 11% | 5% | $169,939,667.20 |

| FHE | Frontier Energy Ltd | 0.24 | -8% | 23% | 85% | 55% | $54,967,560.48 |

| LPE | Locality Planning | 0.078 | -8% | 11% | -53% | -65% | $13,693,498.88 |

This fortnight’s biggest winner is waste management stock M8 Sustainable (ASX:M8S) on news that it launched a software platform with iHub Technologies to streamline the ordering, logistics and end-to-end supply chain process for its waste management and transport related activities.

NeuRizer Limited (ASX:NRZ), previously named Leigh Creek Energy (ASX:LCK) surged after appointing an ‘ammonia licensor’ at its urea project, north of Adelaide in South Australia.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.