Asia’s the engine of global growth and it’s hungry for gas

Energy

Energy

While jurisdictions such as Australia and Europe grapple with the future of natural gas supply, the quantities they are concerned about pale in comparison to sheer volumes required by the monolithic Asian region.

According to the International Energy Agency’s Q3 2024 gas report, the Asian region accounted for 60% of the 3% year-on-year increase in global gas demand during the first half of 2024.

This is due in large part to burgeoning demand in both China and India – the two most populous countries in the world – that was supported by economic expansion.

Outside of these two countries, South East Asia is also expected to see tremendous growth with the IEA projecting that demand in this area will double between 2020 and 2050, a finding that is unsurprising due to a growing population and increasing industrial development.

Veteran oil and gas executive and Conrad Asia Energy (ASX:CRD) non-executive director Mario Traviati told Stockhead that the IEA’s findings made sense as Asia is the epicentre of the world’s economic growth and energy consumption.

“It is consuming almost 50% of the world’s energy yet it is a bit of an untold story. It affects the world in terms of energy security, supply and pricing,” he added.

A large part of this energy is derived from natural gas, with Traviati pointing to Singapore as an example.

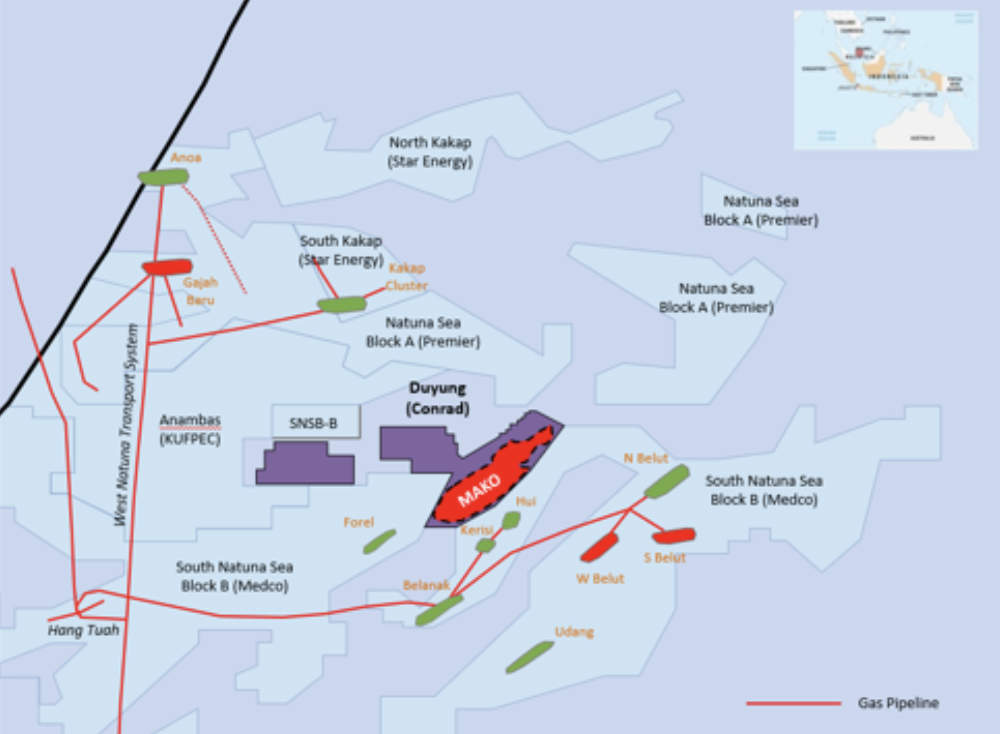

“95% of its energy comes from natural gas, so they have been taking gas from the Natuna Sea and also from Sumatra by pipeline,” he said.

“But that gas is running out, so they have been progressively increasing their LNG (liquefied natural gas) imports, which could hit almost 100% without CRD’s project.

“But then you will be exposed to diversification, supply energy security and carbon emission issues, which are front and centre at the moment and will be for the next few years.”

Studies have shown the carbon intensity of producing gas domestically – that is transported from field to user by pipeline – is on average almost four times lower compared with importing gas in LNG form.

So why does Asia have such a big demand for gas?

Traviati pointed to a number of factors: Growing energy demand, the transition from coal to natural gas as part of the energy transition and declining production from existing mature fields which has countries such as Vietnam, Philippines and India to starting to import LNG.

Once again focusing on a specific country to illustrate his points, Traviati said most people don’t realise that Indonesia is the fourth most populous country in the world.

“It has got the largest nickel reserves, it has a huge commodity resource base, and they are implementing policies forcing companies to do their smelting and refining in-country, which puts more pressure on energy demand,” he added.

“As a result of this growth, countries like Indonesia probably have the fastest growing carbon emissions on a percentage basis.

“Indonesia has always said that they are looking to double their gas production, but with the population, the economic growth and the transition away from coal, they are truly inflating their demand for gas.”

He noted that the transition away from coal is important as Asia still has the highest coal consumption in the world and that the coal used typically isn’t the high-quality as cleaner burning thermal coal exported by Australia.

Given this hunger for gas, it is obvious that Asian countries are doing all they can to stimulate exploration and development, with Traviati noting that Indonesia has been very good at doing so.

“The fiscal terms of what they call Frontier Basins are actually really attractive,” he said.

“A lot of companies don’t like exploration risk … so governments need to work with them to stimulate exploration and development.”

Indonesia’s ability to do so appears to have paid off in spades, with companies such as Mubadala Energy and Harbour Energy making some big 5-10 trillion cubic feet (Tcf) gas discoveries offshore Aceh.

CRD is currently closing in on a final investment decision for the Mako gas field within the Duyung production sharing contract (PSC) in the Natuna Sea.

It has export and domestic sales agreements in place that lock up all of the current 376 billion cubic feet of best estimate (2C) contingent gas resources at Mako.

“If you look at the Natuna Sea, the fields there would have run out in 2028. But because of our gas discovery, we have extended the life of the West Natuna Transportation System to probably close to 2040,” Traviati said.

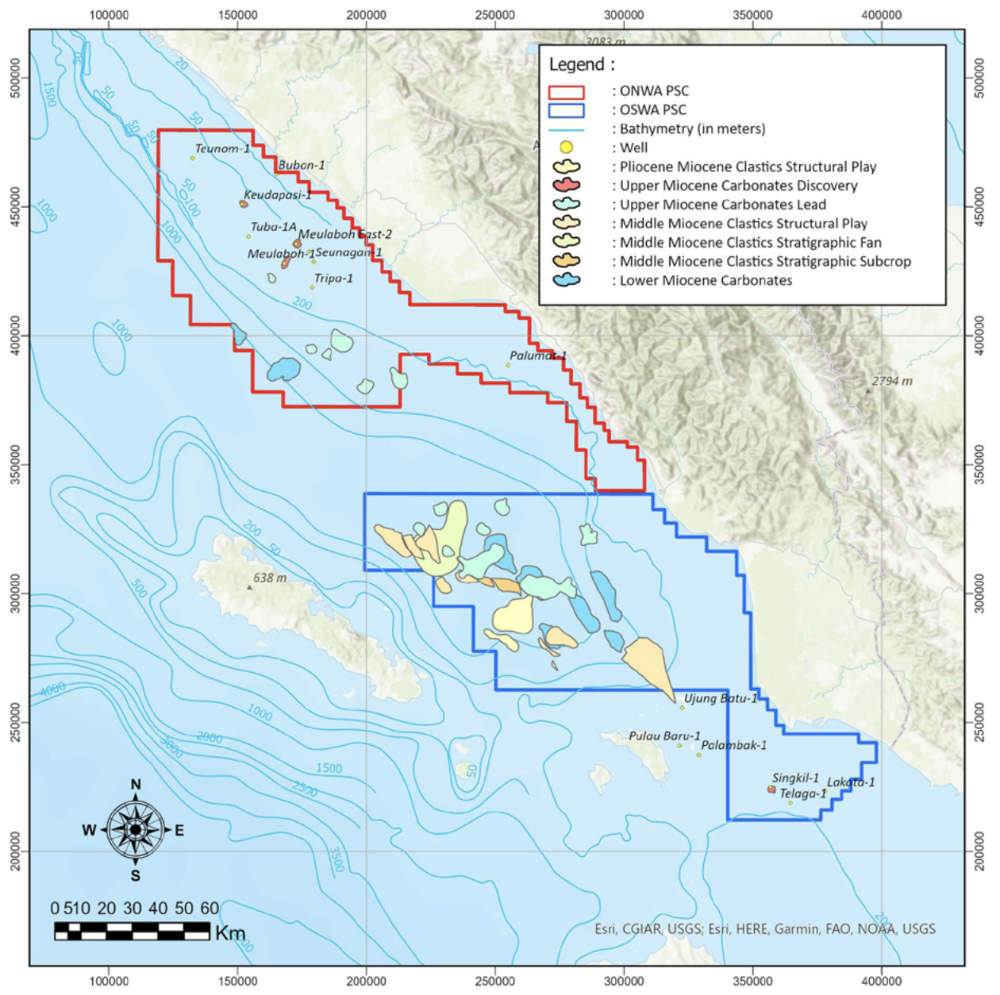

“In Aceh, we have almost 20,000km2 of exploration acreage that we are really excited by as we have four discoveries sitting within the shallow water area which we can develop ourselves.”

He noted that the exploration success rate in those shallow areas is about 70% using 2D seismic shot in the 1970s and that the company would be hoping to at least replicate that success rate after shooting more detailed 3D seismic later this year.

“The big story is moving into the deep-water, where you get the likes of Harbour, Exxon and Eni looking for multi-Tcf fields.

“We announced that we had prospectivity in the deeper water to the tune of about 15Tcf and that’s pretty significant, that sort of size attracts major companies.”

Traviati added that discoveries of this size tended to be LNG opportunities.

“Indonesia has two pricing mechanisms. One for domestic gas, which is regulated to somewhere between US$5 to US$6 per thousand cubic feet and almost double that under the current Brent-linked price for LNG,” he explained.

“While the domestic price is still attractive as it is higher than what Australian producers are getting, the big prize is LNG as the regional demand is really strong.”

CRD also has a memorandum of understanding with PGN for its onshore Aceh gas and the company is looking at mini-LNG concepts for three of the finds and domestic gas for the fourth.

“Mini-LNG is a sector that you are going to hear a lot about, you can virtually buy them off the shelf now,” he said.

“They work really well if you have resources that are near shore, shallow water and are high in methane without inerts (like nitrogen) and liquids, so dry gas like what we have nearshore Aceh.

“PGN are building regasification plants around Indonesia and selling LNG to places like Batam Island or even Singapore would be perfect.

“They are also easier to finance because you have these trading companies that are keen to take cargoes.”

Looking ahead, Traviati said the company is now looking to sell down its 76.5% stake in Mako to under 50% to partially finance the development.

Cost pressures have also come down with prices actually stabilising and in the case of drilling rig rates, coming down quite sharply for the first time in probably four years.

“In fact we are confident that we can develop it at under the costs that we had articulated previously,” Traviati added.

“Once we farm down, then we will know what percentage interest we have got, we have our financing back up in place, it is just a question of what we end up with and how much we are going to need in terms of financing.”

This will in turn lead to a final investment decision for the project.

CRD is also looking to farm-down the deeper water areas of its Aceh acreage.

“With Aceh, we are talking to companies at the moment on a farm-down for the deeper water areas. And they are all giant companies who are looking at what we have got,” Traviati said.

“We have one seismic line there across Aceh. It is just a giant anticline and what you can see in that seismic is a flat spot, which is a direct hydrocarbon indicator.

“The other important thing about Aceh is, it is what is called a fore-arc basin, which were previously deemed to be immature for oil and gas generation until giant discoveries were made in the east Mediterranean offshore Cyprus, Egypt, Israel and Gaza where they found over 100Tcf of gas in a fore-arc basin.

“This led people to start looking over other overlooked fore-arc basins.”

CRD was amongst the earlier movers in this space, with Traviati noting that it had started looking at fore-arc basins some six years ago even though it only picked up the Aceh acreage 18-24 months ago.

“Aceh, we have news flow in the shallow water, deepwater and we will be talking a lot more about mini-LNG,” he said.

At Stockhead, we tell it like it is. While Conrad Asia Energy is a Stockhead advertiser, it did not sponsor this article.