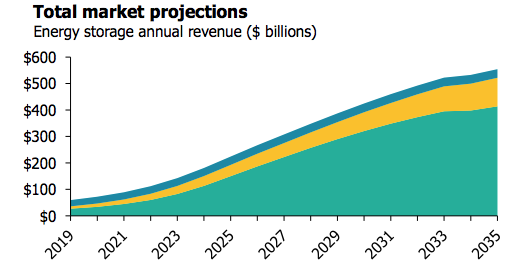

Analysts say energy storage is already taking off — and its going to be a $546bn market

Energy storage systems are expected to take off in the 2020s (Picture: Getty)

A few weeks into the 2020s and things may not seem different than in 2019, but analysts are predicting energy storage will take off over this decade and it’s already begun.

The market has already quadrupled to 4 gigawatts (GW) of new installations in 2019 alone. Wood Mackenzie predicts it will reach 15GW annually by 2024.

While many projects built in the 2010s were limited to shorter duration applications, the 2020s roll-outs will be larger-scale.

Wood Mackenzie’s Foresight 20/20 report on Energy Storage says “2020 begins with an energy storage industry transitioning from its infancy into true scale.”

“The past 10 years paint a picture of these first bold but unsteady steps as the industry and policymakers still work to fully understand and value the technology.”

The only way is up

Already there are signs of the industry progressing to the next level and big players taking steps into the market.

Last month Google and NV Energy did a deal that would see the American tech giant power its Nevada data centre from a proposed solar plant, which would be backed up with an energy storage system.

Only days later, German carmaker Daimler did a deal with Norwegian power firm Statkraft to meet its 24/7 electricity needs in Germany from renewables.

Wood Mackenzie’s head of energy storage, Daniel Finn-Foley, thought the Google deal was noteworthy.

“If this catches on among other climate-forward corporations, the upside could be huge,” he said.

Finn-Foley said the industry was in the “enviable position of juggling growth game-changers from multiple directions”.

2030 and beyond

WoodMac also offered its predictions on what the industry would look like by the end of the 2020s.

“The end of the decade will benefit from stabilising supply chains and mature and experienced players but with even more potential for disruption from new technologies and policies,” the consultancy said.

Analysts expect further growth well into the next decade.

Lux Research expects the energy storage market to reach $546bn in annual revenue in the 2030s.

The three main drivers of energy storage — mobility applications, electronic devices and stationary storage — will reach an annual deployment level of 3,045 gigawatt-hours (GWh) up from 164GWh currently.

The primary driver of this will be mobility applications, which includes light duty passenger vehicles but also e-bikes and e-scooters.

Many of these technologies have not yet been rolled out on a commercial scale, but Lux Analyst Chloe Holzinger says that as soon as commercialisation happens, it’ll be game on for these technologies.

Specifically for things like battery recycling, electric aviation, flow batteries, solid-state batteries and thin-film batteries.

One barrier to the mass roll-out of energy storage systems is high costs, and while these are coming down, it’s at a relatively slow rate of 2 to 4 per cent reduction annually.

But Lux thinks customers will be happy to pay a premium.

“The increased value proposition of energy storage in electricity markets will more than make up for a slowdown in cost reductions,” the market researcher says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.