ADX Energy tucks into long awaited Sicilian gas prize

Rich gas pickings are likely at ADX Energy’s newly offered permit in the Sicily Channel offshore Italy. Pic: Getty Images

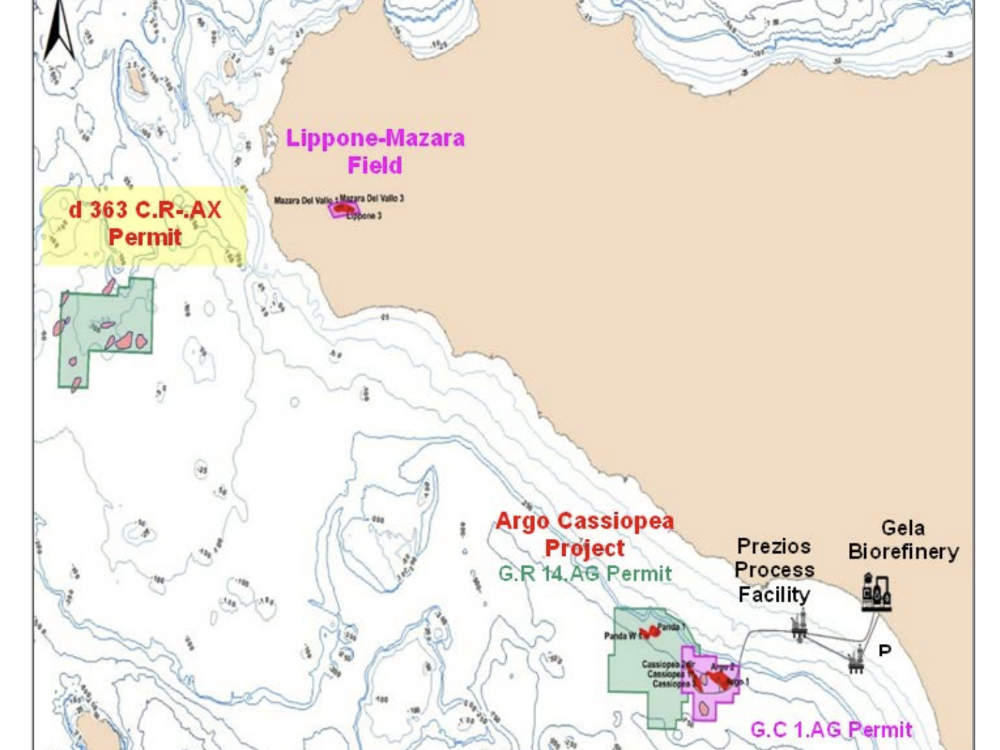

- ADX Energy has been offered 346km2 gas permit in the Sicily Channel offshore Italy

- Historical drilling has proven that sweet gas is present in relatively shallow reservoirs and shallow water dpths

- Five high-graded prospects with best technical prospective resources of 369Bcf of gas have already been identified

- The recent development of nearby offshore gas project enhances economic viability for new gas discoveries

Special Report: ADX Energy has spread its wings following the award of a large permit in the Sicily Channel offshore Italy where historical drilling has proven gas is present.

The award of the maximum 346km2 acreage area – known by the permit code d 363 C.R- .AX – marks the end of a long wait on the company’s part, with the original application delayed since 2018 due to a moratorium on the award of new exploration licences in Italy.But a political shift in Italy brought the licence application back to life.

Reflecting current national energy supply priorities, the Italian Ministry of Environment and Energy Security had verified the technical, organisational and economic capacity of ADX Energy’s (ASX:ADX) wholly-owned subsidiary Audax Energy before offering the permit.

The permit is highly prospective for gas with best technical prospective resource potential estimated at 369 billion cubic feet in five high-grade prospects.

Sweet gas – a term for natural gas with very low or no contaminants such as hydrogen sulphide and carbon dioxide – has been proven to exist in relatively shallow (700-1300m) reservoirs by several historical wells that were drilled in moderate water depths of ~100m.

These include the Nilde-2 production well, targeting deeper oil that encountered gas while drilling through the shallower reservoirs.

Similar reservoir productivity is expected as the onshore, shallow Lippone-Mazara producing gas field, which exhibits very high porosities.

“The relatively large permit area is highly prospective for high quality gas, which is also proven by the close by and geologically similar ENI operated Argo-Cassiopea project, which commenced in August 2024,” executive director Paul Fink said.

“The demand for European gas, produced without CO2 and methane emissions is high, as opposed to imported gas (LNG) that has produced, processed and transported with significantly higher CO2 emissions.

“The permit has a high quality 2D seismic data set which can be used to high grade prospects and is ideally located in shallow water proximal to infrastructure. It is envisaged that 2D seismic reprocessing and future 3D seismic will identify more gas prospects.

“It’s taken a while, but our persistence, as well as the development of our technical, operational and financial capability, means we have the opportunity to join existing producers and explorers ENI, Shell, Total and Energean (among others) as holders of highly prospective acreage in Italy.”

A formal permit agreement is expected during Q1 2025 following a meeting with the main local authorities involved, including the Port Authority, Harbour Master’s Office, Financial Police and the Fire Department.

Identified gas prospects and attractive fiscal terms

The d 363 C.R- .AX permit hosts five high-grade gas prospects that are considered to be relatively low risk as they are mainly simple, four-way dip closures featuring seismic amplitude responses that are visible on historical 2D seismic data acquired by ENI and Shell.

Adding interest, the original ENI seismic data that is available to the company also shows further stratigraphic leads which have large upside resources potential due to the possibility of stacked gas reservoirs as is the case at the nearby Argo-Cassiopea project.

ADX has the option to purchase a more extensive 2D seismic data set acquired between 1967 and 1990 from ENI though it noted that its existing seismic data set already provides the ability to identify the presence of Upper Miocene to Pliocene sandstone reservoir.

It adds that reprocessing of seismic data will likely show the difference between sandstone reservoirs filled with water versus reservoirs filled with gas.

The permit is accompanied by attractive fiscal terms consisting of a 10% royalty and 29% effective tax rate along with expected strong demand for gas at high prices in Italy and Europe.

Permitting terms are flexible with low financial commitments while the permit’s proximity to two geologically similar producing field areas – one onshore and one offshore – with existing pipeline infrastructure could allow for rapid development.

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.