ADX Energy could become the ASX’s Italian Stallion with hard won gas permit

ADX Energy will benefit from a pro-development Italian government and potential for significant gas resources. Pic: Getty Images

- Europe is still hungry for gas as it adapts to a future without cheap Russian supply

- ADX’s new licence offshore Italy in the Sicilian Channel has plenty of gas potential

- Plan to acquire seismic from Eni to gain a clearer picture, attract partners

Europe is a major consumer of gas but is also hugely reliant on imports in order to meet demand, with storage entering the equation during winter when usage increases for heating purposes.

Historically, the region sourced a third of its gas from Norway, another third from Russia and the rest from domestic resources.

This changed when Russia invaded Ukraine in February 2022, leading the European Union to turn away from Russian gas and replace it – not completely – with more expensive liquefied natural gas.

While its gas storage levels remained strong thanks to a couple of mild winters, the most recent winter has been much colder, resulting in larger drawdowns.

This has depleted gas stocks which will likely lead to elevated gas prices through the current winter and possibly through summer as well as the various countries move to rebuild storage.

It also reinforces the urgent need for Europe to secure its gas supplies, whether by importing more LNG or increasing domestic gas supplies, exactly what companies like ADX Energy (ASX:ADX) have been attempting to do.

Italian adventure

While ADX has long been focused on its Austrian operations which produced both oil and gas, what is less known is that the company had all the way back in 2018 applied for an Italian offshore exploration licence.

However, the application remained stuck in limbo with the then socialist-led government placing a moratorium on the award of new exploration licences.

The seeds for change occurred when Giorgia Meloni – leader of the decidedly right-wing Brothers of Italy party – swept to power in October 2022 at the head of a centre-right coalition.

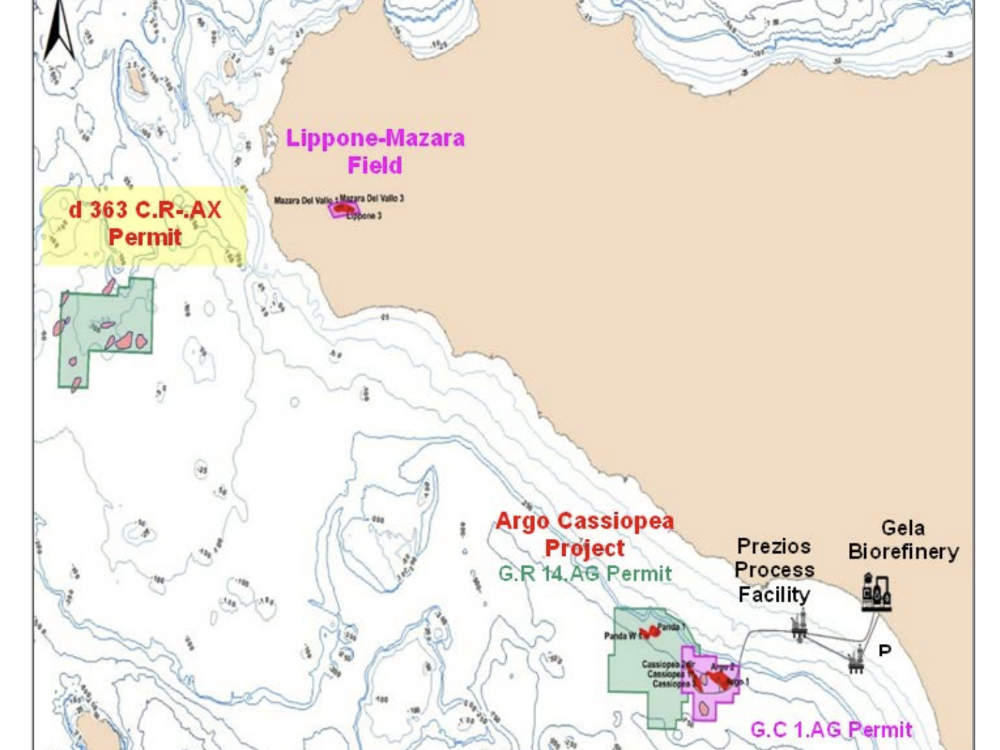

Importantly for ADX, the development-friendly government recently offered the company the 346km2 licence with the permit code d 363 C.R- .AX in the Sicily Channel offshore Italy.

But the change in government isn’t the only difference for the company.

Speaking to Stockhead, executive chairman Ian Tchacos said the company had originally applied for the licence on the strength of its oil potential.

“Eni and Shell had actually developed an offshore oilfield here in 1980s, but unfortunately the oil price dropped and they shut it in,” he added.

“Eni held onto this acreage into the early 2000s and shot a lot of seismic before it started focusing more on its international operations rather than Italy and didn’t reapply for the permit.

“We did evaluation work and could see more potential in this field.

“However, after the oil spill at Macondo in the Gulf of Mexico following the Deepwater Horizon explosion, the greater scrutiny on oil and gas projects as well as shift towards gas rather than oil led us to look more deeply into the gas potential of this permit.

“What we saw was there were quite a few wells drilled in this permit exploring for oil in the 1980s and what they found was sweet gas, which is low in CO2 and nitrogen, at a relatively shallow depth of about 1000m.”

He also noted the Sicilian Channel permit is close to the onshore, shallow Lippone-Mazara gas field as well as Eni fields that came into production in August last year.

“That’s created new infrastructure very close to our permit besides the Trans-Mediterranean pipeline that transports gas from Algeria to Italy via Tunisia and Sicily.”

Plenty of gas

This existing infrastructure greatly simplifies any decision to develop the permit, which has best technical prospective resource potential estimated at 369 billion cubic feet in five high-grade prospects.

Besides having nearby shallow fields that are very similar to ADX’s prospects, Tchacos flagged that there was potential for more gas.

“We looked at it in a very conservative way because a lot of these gas targets have stacked pay, multiple layers,” he said.

“What we have got to do is look at each structure that we could see gas shows in and basically took one zone, but what we have seen from the fields around is that they actually produce from multiple zones.”

ADX currently expects to be officially awarded the permit by the end of the quarter, following which it will do a resource assessment on the back of additional seismic that it will purchase from Eni.

This will then result in the company release a revising of its resource expectations in the second quarter of 2025.

“Probably by the beginning of next year, we will be maturing prospects for drilling and also potentially looking for partners to come in and explore alongside with us,” Tchacos said.

He added that drilling will likely begin towards the end of next year. But that’s not all.

ADX will also start looking at other Italian permits as it will become an accredited operator once it secures the Sicilian Channel permit.

“We will also start looking at other acreage we could bid for or whether there are other assets that are more advanced that may involve production,” Tchacos said.

“Typically what we have seen in Italy is onshore it is quite difficult as developing fields can sometimes take a long time, so will probably focus on offshore even though our other operations in Europe are onshore.

“And if there’s an existing project that is in production and there’s additional opportunity, then we will look.

“In parallel, we have a very active program coming up in Austria, which will also involve further gas drilling, so we will probably be progressing both jurisdictions in parallel.”

At Stockhead we tell it like it is. While ADX Energy is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.