ADX Energy closes in on drilling to increase oil production and find more gas in Austria

ADX Energy could be on the cusp of becoming a significant oil and gas player in Austria. Pic: Getty Images

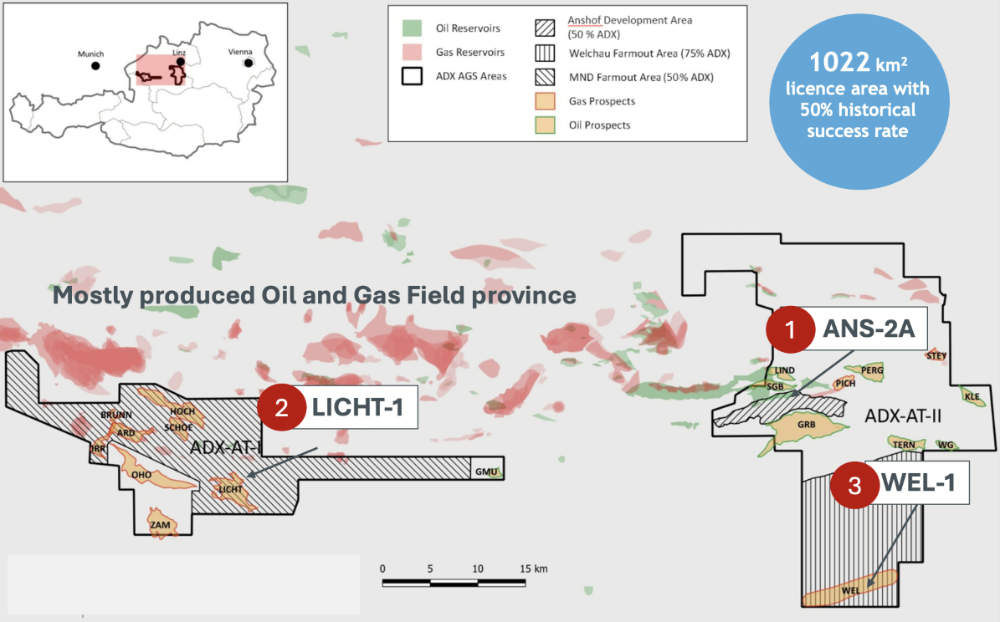

- ADX Energy will soon start drilling the Anshof-2A appraisal well that could significantly increase oil production

- The company will also drill the LICHT-1 gas exploration well that could upgrade a number of nearby prospects for drilling

- Production testing of Welchau-1 gas liquids discovery could deliver potentially transformational gas and liquids reserves

Special Report: European oil and gas focussed ADX Energy is poised to embark on a high-impact operations program primarily focussed on its Upper Austrian assets for the remainder of 2024 that includes testing of a potentially transformational gas liquids discovery at Welchau.

First up on the list is the drilling of the Anshof-2A oil appraisal well that is currently scheduled to begin in early September.

Anshof-2A targets thicker and higher porosity Eocene reservoirs updip of the Anshof-3 well, which restarted oil production in the June 2024 quarter at rates of 110 barrels oil per day (bopd) after the installation of a 3000 bpd permanent production facility.

ADX Energy (ASX:ADX) believes Anshof-2A could potentially deliver greater oil production compared to its existing producer and that all valid closures in the targeted area are filled to spill with oil.

This could be another step towards filling the company’s permanent production unit that was installed and commissioned in April 2024 and has the capacity to handle 3000 bpd of oil production as well as significantly increase reserves at the Anshof field.

While a success at Anshof-2A won’t quite be transformational, it will nonetheless be able to significantly increase the company’s oil and gas production in the near-term, thereby enhancing its financial capacity and profitability.

Cost of drilling Anshof-2A will be minimised by using the existing Anshof-2 well bore and side-tracking below the 9 5/8 casing towards the target reservoirs.

Gas exploration and testing

What’s potentially more likely to transform the company are the upcoming drilling of the LICHT-1 gas exploration well in October and extended production testing of the Welchau-1 liquids-rich gas discovery from the same month.

LICHT-1 will test a reservoir that was identified from updated mapping from 3D reprocessing and a review of reservoir distribution with best estimate prospective resources of 21.1 billion cubic feet of gas.

Drilling of LICHT-1, which is expected to cost $8.5m on a dry hole basis, is largely covered by partner MND Austria’s commitment to fund €4.5 million ($7.4m) to earn 50% of the MND Investment area within the ADX-AT-I licence.

The well targets an anticlinal P90 closure with a seismic anomaly that may represent direct evidence of gas fill where the discovery of hydrocarbons is assessed to be low risk.

Should LICHT-1 be successful, ADX has three low-risk follow-up prospects that are both near LICHT and existing facilities.

Transformational gas testing

While success at LICHT-1 will add further resources and potential gas production in gas- hungry Austria, it is the multi-zone production test program that will be carried out between 1 October 2024 and 31 March 2025 at the Welchau-1 discovery that could really take ADX to the next level. The potentially large-scale Welchau discovery lies in the heart of Europe and is near major gas pipelines.

The company plans to carry out multiple tests across 450m column of hydrocarbon shows intersected over three carbonate formations to determine hydrocarbon type, productivity and resource potential.

Should testing be successful, it will open up a new play with multiple follow-up targets that is close to existing gas and liquids infrastructure, which will simplify and reduce the cost of any development.

Welchau is also relatively shallow, meaning that wells will have relatively low drilling costs though there is deeper exploration potential that could add even more gas and liquids resources.

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.