2024’s top gas performers have their eyes on the future

Here are the top 10 gas companies on the ASX that have threaded the challenges and made the most of opportunities. Pic: Getty Images

- Top gas plays have weathered the challenges and embraced opportunities in 2024

- Gas will continue to play a major role in the global energy mix

- Australia still needs new sources of gas to avert forecast supply shortages

One of the key themes in any discussion about energy has been about the continued role gas plays even as the world continues its march towards net zero emissions.

In Australia, this is marked by the growing realisation that years of under investment in exploration means there are no ready replacements for ageing gas fields.

This has led the Australian Energy Market Operator to warn in its 2024 Gas Statement of Opportunities that eastern Australia could experience shortfalls on extreme peak demand days from 2025, small seasonal supply gaps from 2026, and the controlled reduction of electricity supplied to homes and business during periods of peak demand from 2028.

Energy consultancy EnergyQuest is far more pessimistic, saying that its calculations have indicated that there was only enough gas to meet 70% of NSW and ACT needs in the winters of 2026, 2027 and 2028 while Victoria would likely need to source 32% of its gas from LNG from the winter of 2028.

Things aren’t much better globally, with the World Bank projecting the tightness of gas supplies in 2024 will persist in 2025 and 2026 with demand growth outstripping corresponding growth in supply.

Natural gas storage in the European Union is already under pressure from high withdrawal rates and supply tightness is likely to get worse if forecasts that the region will experience its coldest winter since 2020 prove accurate.

Gas company struggles are real

While this might seem like the perfect environment for ASX gas plays to benefit from, the reality is that the demonisation of all fossil fuels has made investment almost taboo.

One recent example is Commonwealth Bank, which announced in August 2024 that it would no longer offer money to fossil fuel companies that are not aligned with the Paris Agreement.

Government action has also served to disincentivise investment with the $12 per gigajoule gas cap introduced in December 2022 acting to slow investment and introduce uncertainty about further market intervention.

Environmental policies also appear to have disproportionately targeted gas, making it difficult to secure approvals for larger projects.

It is not all negative though.

The Federal government has recognised that gas is important and introduced a Future Gas Strategy that acknowledges this.

Increasing pressure when power outages occur and the opposition, which backs faster approvals and development schedules, could also force the Albanese government to improve these areas if it stays in power following the 2025 election.

With this in mind, here are some of the top performing gas plays in 2024 that have the potential to make further gains in 2025.

| Code | Company | Price | % Month | % Year | Market Cap |

|---|---|---|---|---|---|

| ROG | Red Sky Energy. | 0.01 | 37.5 | 120.0 | 59,644,499 |

| AXP | AXP Energy Ltd | 0 | 33.3 | 100.0 | 5,824,681 |

| CUE | CUE Energy Resource | 0.09 | -6 | 86.5 | 65,675,634 |

| HYT | Hyterra Ltd | 0.04 | -22.2 | 78.6 | 61,786,438 |

| TDO | 3D Energi Ltd | 0.1 | 6.74 | 63.8 | 31,489,988 |

| AEL | Amplitude Energy | 0.19 | 11.8 | 46.2 | 501,607,264 |

| ORG | Origin Energy | 10.4 | 0.14 | 22.8 | 17,968,000,000 |

| HZN | Horizon Oil Limited | 0.19 | 4.17 | 21.0 | 300,680,864 |

| LIO | Lion Energy Limited | 0.02 | -21.7 | 9.1 | 7,686,851 |

| CND | Condor Energy Ltd | 0.02 | -32.1 | 5.6 | 11,726,674 |

| CODE | COMPANY | PRICE | MONTH % | YEAR % | MARKET CAP |

| ROG | Red Sky Energy. | 0.01 | 37.5 | 120.0 | $ 59,644,499 |

| AXP | AXP Energy Ltd | 0.002 | 33.3 | 100.0 | $ 5,824,681 |

| CUE | CUE Energy Resource | 0.09 | -6 | 86.5 | $ 65,675,634 |

| HYT | Hyterra Ltd | 0.04 | -22.2 | 78.6 | $ 61,786,438 |

| TDO | 3D Energi Ltd | 0.1 | 6.74 | 63.8 | $ 31,489,988 |

| AEL | Amplitude Energy | 0.19 | 11.8 | 46.2 | $ 501,607,264 |

| ORG | Origin Energy | 10.4 | 0.14 | 22.8 | $ 17,968,000,000 |

| HZN | Horizon Oil Limited | 0.19 | 4.17 | 21.0 | $ 300,680,864 |

| LIO | Lion Energy Limited | 0.02 | -21.7 | 9.1 | $ 7,686,851 |

| CND | Condor Energy Ltd | 0.02 | -32.1 | 5.6 | $ 11,726,674 |

Red Sky Energy (ASX:ROG)

Red Sky holds a 20% interest in the Santos-operated Innamincka Dome project in South Australia and started receiving revenue in August 2023 from the sale of natural gas (76%) and liquids after the Yarrow field was tied into the grid.

The company received $2.86m in cash receipts from then till the end of September 2024.

About 76% of this comes from natural gas sales while the remainder is derived from ethane, LPG and condensate.

The company recently completed the re-entry of the Yarrow-1 well and noted in mid-November that it is mobilising a workover rig to fracture stimulate it. The well is expected to boost output and revenue once it becomes fully operational in Q2 2025.

AXP Energy (ASX:AXP)

AXP is focused on establishing its Pathfinder gas field in Colorado as a reliable, off-grid gas-fired power generation operation.

The company recently connected two modular data centres used for Bitcoin mining to the gas-to-power infrastructure at its Pathfinder #2 well site.

Once this is completed, it will commence the setup of two more sites at the JW Powell and Kelce Court well sites.

Cue Energy Resources (ASX:CUE)

Cue Energy holds a diverse portfolio of oil and gas assets in Australia, Indonesia and New Zealand that generated $49.7m in revenue during FY2024 and delivered net profit after tax of $14.2m.

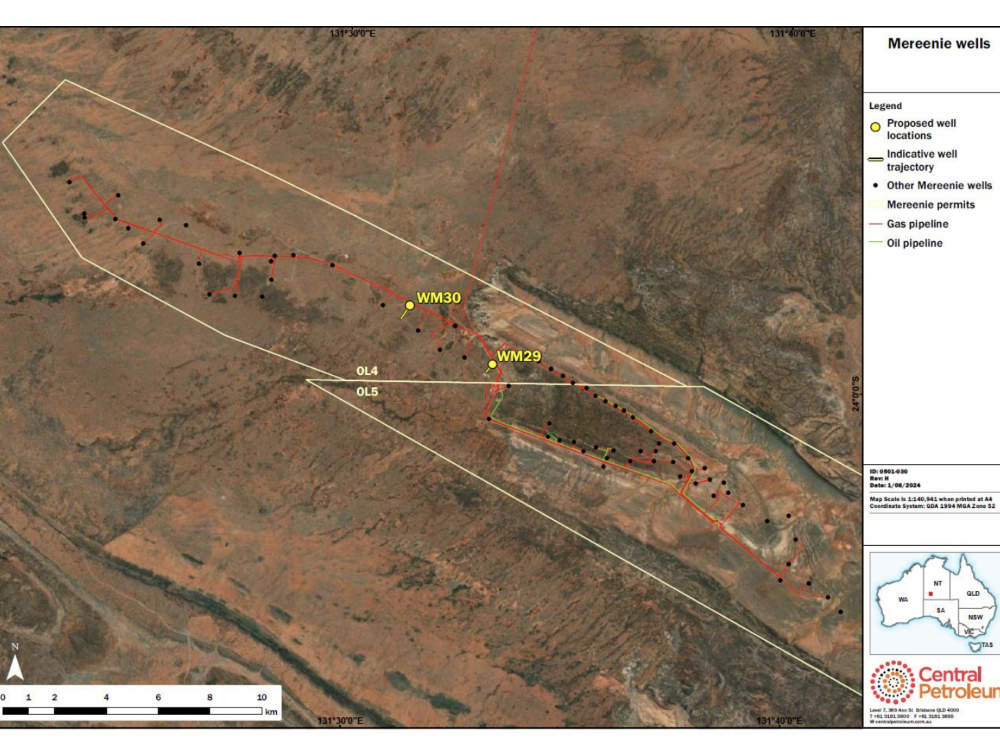

In early December 2024, operator Central Petroleum started infill drilling at the Mereenie field in the Northern Territory to increase its near-term gas production back towards field capacity above 6 terajoules per day.

Up to an additional 6TJ/d of gas from the two wells can be sold by the JV on a firm basis under the recently executed NT government gas sales agreement.

Cue has a 7.5% interest in Mereenie.

It also has a 15% stake in the Sampang PSC offshore Java, Indonesia, where the JV is moving towards a final investment decision on the Paus Biru project that could produce 20-25 million cubic feet of gas per day.

3D Energi (ASX:TDO)

3D Energi holds a number of exploration licences across Australia, however its focus is on the Otway permits that were farmed out to supermajor ConocoPhillips.

Conoco is carrying TDO for the drilling of two wells in 2025 under Phase 1 to a total of $65m.

While the exact locations of the wells will be determined after 3D seismic is acquired and interpreted, the T/49P and VIC/P79 permits have the potential to host multiple trillion cubic feet of gas.

Successful drilling could deliver much needed gas into the east coast market.

Amplitude Energy (ASX:AEL)

Formerly known as Cooper Energy, Amplitude is a significant producer of gas in Australia’s southeastern states.

During FY2024, the company produced 62.1 terajoules of gas equivalent per day which returned underlying EBITDAX of $127.5m.

Looking ahead, it expects production to increase to between 65 and 72TJe/d in FY2025 due to continued improvements at its Orbost plant in Victoria that will be accompanied by growing exposure to high spot and current market prices.

The company has plans to start drilling in H2 2025 to test gross unrisked resources of >350 billion cubic feet in established basins.

This is aimed at delivering first gas in 2028.

HyTerra Limited (ASX:HYT)

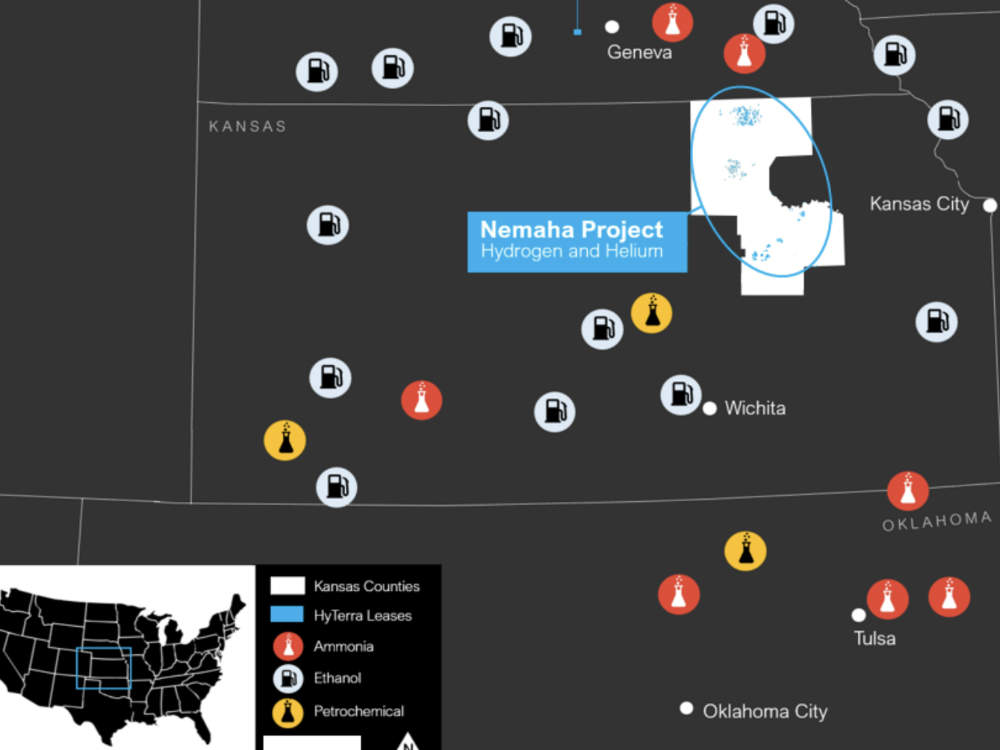

Natural hydrogen focused HyTerra recently expanded its Nemaha project landholding in Kansas by >15% to more than 60,000 acres, giving it plenty of room to expand should its upcoming drill program be successful.

To top it off, Andrew Forrest’s Fortescue (ASX:FMG) made a $21.9m investment to earn a 39.66% stake in the company, a clear sign that big players are interested in the potential to find naturally occurring hydrogen with which to decarbonise existing uses of the gas.

The investment also allowed the HYT to expand its original two well exploration program into a six well campaign to test a number of geological plays across its acreage.

Historical exploration wells have already confirmed the presence of natural hydrogen and helium, with some returning up to 92% hydrogen and 3% helium.

Origin Energy (ASX:ORG)

The only major energy company on our list of top performers in 2024, Origin has benefitted from continued strength of its LNG export business and domestic gas sales.

During the September 2024 quarter, Australia Pacific LNG returned a 1% increase in revenue to $2.6bn due to higher sales volumes while domestic gas volumes were steady compared to the September 2023 quarter as higher retail sales and gas to generation were offset by a decrease in business volumes.

For FY2025, it expects its LNG business to perform similarly to FY2024, when it produced 694 petajoules of gas while domestic gas profit is expected to moderate due to lower market prices.

Horizon Oil (ASX:HZN)

Like CUE, Horizon holds a 25% interest in the Mereenie gas field where Central is drilling two infill wells to increase near-term gas production.

Mereenie currently accounts for 30-40% of the Northern Territory’s domestic gas supply, a number that will rise under the new gas sales agreement with its government.

It also holds the producing Maari and Block 22/12 oil fields in New Zealand and China respectively.

Lion Energy (ASX:LIO)

While Lion has long enjoyed production from its small 2.5% (soon to be 2.25%) interest in Seram (Non-Bula) production sharing contract offshore Seram Island, Indonesia, and progressed oil exploration at its East Seram PSC, it is now progressing its green hydrogen ambitions.

In Q3 2024, it signed a joint development agreement with Mitsubishi Corporation subsidiary DGA Energy Solutions Australia and Samsung C&T Corporation for the joint development of the Port of Brisbane green hydrogen project.

DGA and Samsung will pay a total of $3.7m for historical and ongoing pre-construction costs in return for each taking up a 25% stake in the project.

They will also procure $6.3m in debt financing, which will satisfy the capital requirement to complete the project.

The Port of Brisbane project is designed to produce an initial 420kg/day of green hydrogen for public bus fleets and also to supply fuel cells providing onsite off-grid power to the Queensland construction and mining sectors.

It is close to most of Brisbane’s 70+ bus depots as well as significant heavy vehicle traffic to and from the Port.

Condor Energy (ASX:CND)

Stepping a little further afield, Condor holds the Piedra Redonda gas field that covers almost all of the Tumbes Basin offshore Peru.

The underexplored 4858km2 block is surrounded by multiple historical and currently producing oil and gas fields while Piedra Redonda itself has best estimate contingent resources of 404 billion cubic feet of gas.

Its prospectivity has been enhanced by interpretation of newly reprocessed 3D seismic data which suggests the field is stratigraphic trap.

This could improve reservoir connectivity and potential for future development.

Adding further interest, a new petrophysical evaluation of the C-18X discovery well has indicated that a significant 500m gas column could be present from the crest of the structure down to the observed base.

An updated resource estimate is currently being progressed.

At Stockhead we tell it like it is. While HyTerra is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.