XRP is mooning again, so we asked to 2 pro crypto investors; what’s going on?

(Pic: Getty)

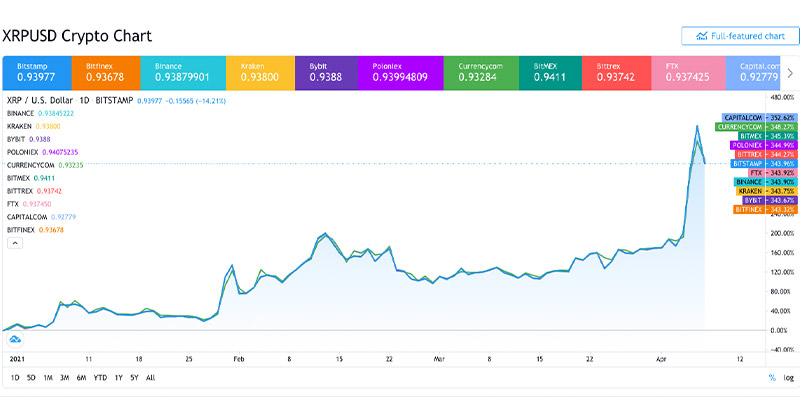

Ripple’s XRP token has been back on the ramp, as the bulls stay in control of broader crypto markets.

And while alt coin season is in full effect, XRP has posted a 5x return in 2021 to-date.

It’s also doubled in April, and this week traded above $US1 for the first time in over three years.

So we asked a couple of pro crypto investors — what’s going on? But before that, a bit of history:

XRP – some background

Ripple Labs was founded back in 2012 — a relative eternity by crypto standards.

It was established with the goal of deploying blockchain technology to speed up transaction times for fund transfers between financial institutions.

The concept was strong enough to attract a $US55m funding round in late 2016, just before the first major crypto bull market.

By that point, Ripple had already taken on investments from big names such as Google Ventures and Andreesen Horowitz. The platform also created its own cryptocurrency, XRP.

When crypto went parabolic in 2017, the fiat value of XRP tokens soared from around US15c to a high of $US3.50. But banking adoption rates failed to materialise, and a few controversies have followed.

In 2019, Ripple inked a deal with Nasdaq-listed forex platform MoneyGram (MGI) to integrate its technology as part of MGI’s global transfer network.

Fast forward to 2021, and MGI dropped something of a bombshell by advising it has been paid handsomely (by Ripple) to use Ripple’s liquidity platform — to the tune of more than $US60m in incentive fees.

Moneygram has now ended the partnership, and Ripple’s founders are fending off a lawsuit brought by the US Securities and Exchange Commission (SEC) in December.

The SEC thinks XRP is a centrally-issued security (not a decentralised commodity, like Bitcoin).

It also alleges the founders didn’t register XRP properly, before issuing over 14 billion units and generating over $US1.3 billion in fiat currency (partly to enrich themselves).

It’s a serious allegation, and trading in XRP tokens has been banned on leading US exchange Coinbase.

The response so far from Ripple investors? We do not gaf:

Investor view

So, what’s all the fuss about? To get the expert view we spoke with two pro investors in the space.

Alex Saunders is the founder of industry news website Nugget’s News and the recently launched crypto education platform Collective Shift.

Stockhead also spoke with Matt Harcourt, an analyst at Australian crypto investment firm Apollo Capital.

Neither is an XRP advocate.

“For me it’s just a no-brainer that their software isn’t that good,” Saunders said.

“There’s no need to use XRP tokens. Visa can use stable coins and send funds direct — why do you need this token in the middle?”

He also agrees that ownership of XRP tokens is largely centralised.

“They’ll try and claim its decentralised but it’s all smoke and mirrors. To me (the platform) is already obsolete and outdated when you look at the tech available in DeFi.”

DeFi (decentralised finance) is also Harcourt’s specialty area, where Apollo runs two investment funds based on ‘yield farming’ in the DeFi ecosystem.

“We’re big DeFi investors,” Harcourt said.

“For us there’s value in locking your capital up in set protocols and earning yield on that capital, because your funds are providing a service.”

For Harcourt, the value of a platform like Ethereum is the network effect.

“And what really drives that network effect are the valuation protocols that are built on top of it,” Harcourt said.

“With XRP, the network effect would be recognised through its adoption by banks and financial institutions to improve the speed and cost of international transactions.”

“But I think in their entire history, there’s no real evidence of that occurring.”

Flows before pros

Along with a relative lack of actual adoption, Ripple has faced some major headwinds in 2021.

But in response, XRP tokens have ramped 5x. So is there more to the story?

Broader sentiment in the market remains bullish. Liquidity is plentiful, and that’s not just a crypto story — equities have also benefitted from historic levels of post-COVID stimulus.

In other words, flows sometimes trump fundamentals.

Harcourt observed that although XRP trading has been banned on Coinbase, huge global exchanges such as Binance aren’t being prevented from making the market.

“There’s always going to be (exchanges) that keep trading XRP because they can make money on the massive amount of volume,” Harcourt said.

“Binance are a profit-making entity. There’s been almost $US4bn of trading volume in XRP on Binance over the past 24 hours, so they’re making a lot of fee revenue out of that.”

How much fee revenue? Binance is privately held, but Coinbase is listing on the NASDAQ next week. And based on data from Nasdaq’s private market activity, it will be go public with an indicative valuation of $US90 billion.

“It’s definitely a global market. As a side-anecdote, I’ve got mates from school who are wholeheartedly invested in XRP,” Harcourt says.

“When you get to this stage in the cycle, you definitely have a lot of people jumping in who don’t think they have time to figure out the asset class in-depth.”

In that context, both Saunders and Harcourt said other factors come into play — such as where coins are ranked by market capitalisation.

As one of the older cryptos with a huge amount of volume on issue, XRP sits comfortably in the top 10. And at $1, its entry price is a bit easier to stomach than Bitcoin (almost $US60,000).

“It (XRP) can be a bit of a religion. You’ve still got YouTubers or guys on Twitter telling retail followers that it’s going to $500,” Saunders said.

“There’s still projects in the top 10 that I believe have got zero value. That’s starting to change but the market is still maturing.”

Harcourt also thinks the XRP faithful see the SEC lawsuit as more of a “bump in the road”.

He raised the prospect that Ripple ends up getting “a slap on the wrist” from regulators “but nothing near the treasury they hold, and then they’d keep going business as usual”.

And as an investment firm, Apollo is wary of the XRP army.

“When the SEC news came out I did some digging and we were looking to see if (XRP) would be a good short opportunity,” Harcourt said.

“But we decided against it, because we think the investor base is a bit irrational and lack the fundamental understanding of cryptocurrency.”

As the hedge funds that shorted GME stock would know, it pays to be watchful of flows in post-COVID asset markets, lest the pros get left under water.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.