Polkadot season? It’s a big month for the crypto platform and its top parachain auction contenders

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Certain “layer 1” crypto platforms have been receiving plenty of attention lately. And price action, too (okay, not Cardano just yet). Polkadot, however, despite steady growth since July, has been somewhat overshadowed in recent months. That’s about to change.

There’s a lot to like about the rivals of OG smart-contract platform Ethereum (ETH). The likes of Solana (SOL), Avalanche (AVAX), Fantom (FTM), Cardano (ADA), Terra (LUNA), Elrond (EGLD), Cosmos (ATOM) and Algorand (ALGO), just to name a select bunch, are all building out growing ecosystems of innovative, decentralised projects and strong and passionate communities.

Polkadot (DOT) is also very much in that boat. In fact, it’s arguably second only to Ethereum for the breadth and quality of its network of developing projects and dApps (decentralised applications).

The current question is, with its highly anticipated parachain-slot auctions officially kicking off on November 11, are we about to see another “Polkadot season”? In other words, a period of project-pumping froth and FOMO, the likes of when Polkadot first hit the crypto scene in mid-late 2020?

#polkadot #dot $dot @Polkadot Polkadot season is just around the corner! And It’s bringing the bull! Fomo and price shock will occur! pic.twitter.com/sY4nmteqd8

— polkadot-Rick (@rickybo69909532) October 28, 2021

Well, after several months of comparatively low-key engagement since those initial heady days of DOT-ecosystem excitement, buzz is building around the project once again, and you can expect that to kick further into gear very shortly.

But before we take a closer look at the parachain auctions, what they actually are, and which of the contenders look the strongest, let’s broadly cover some general bases.

What is Polkadot?

Polkadot describes itself as a “heterogeneous multichain”. Catchy, huh?

Essentially, it’s one of crypto’s top “layer 1” projects, which, in a general sense, is a base-layer blockchain on which secondary decentralised applications (dApps) can be built on, plug into and operate on top of.

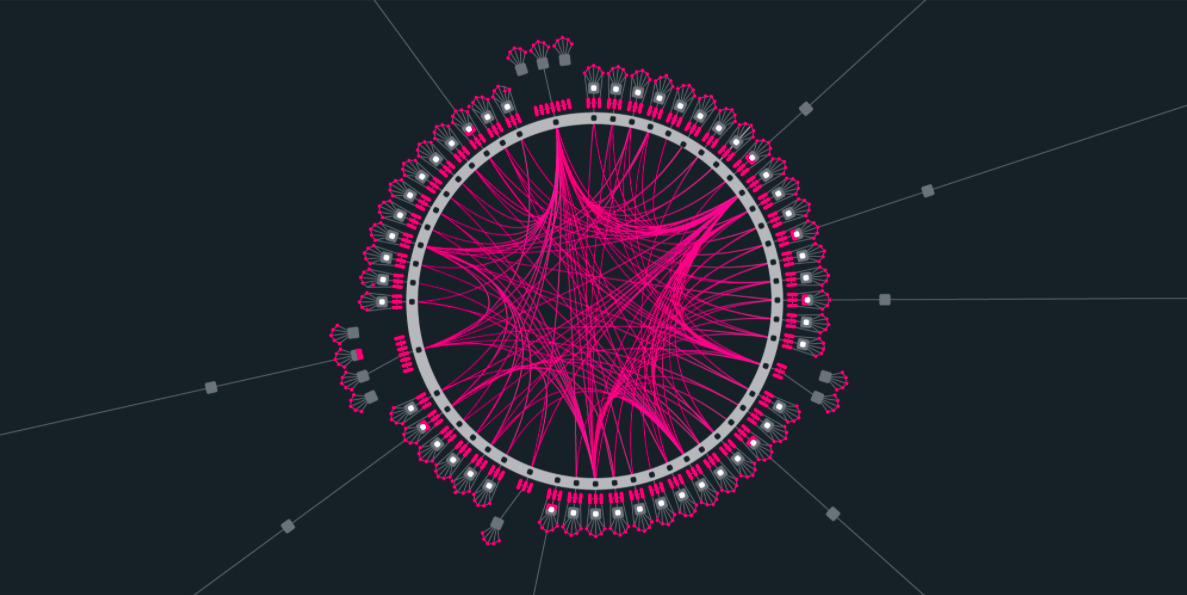

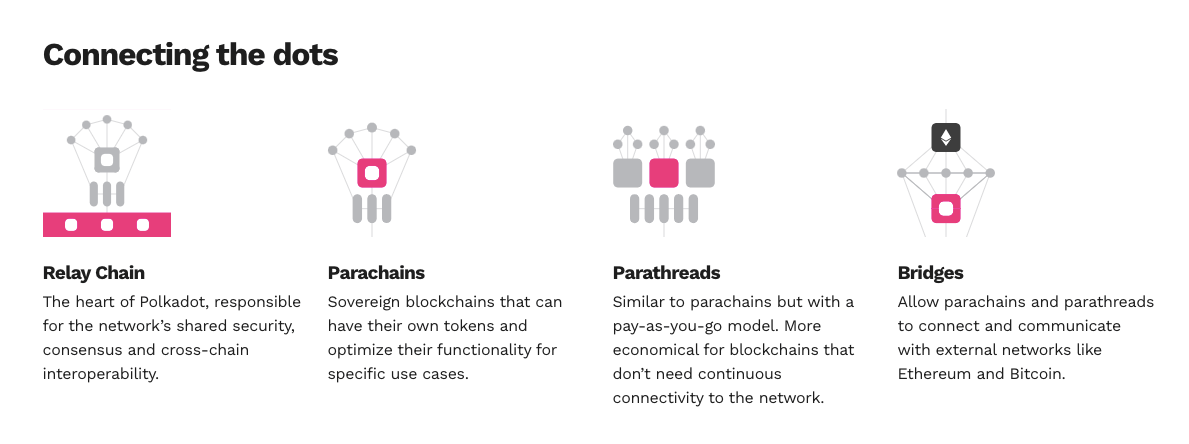

What makes Polkadot slightly different, however, is that the Polkadot’s base chain – called the Relay Chain – can connect and secure other layer-1 blockchains in its ecosystem (called parachains) with pooled security and interoperability.

This means that the Relay Chain itself is not actually smart-contract compatible – it only supports transactions related to DOT transfers, staking, governance and parachain slot auctions (more on those further below).

The parachains (the separate blockchains that plug into the Relay chain) ARE smart-contract compatible, however, and are the blockchains that will host all of Polkadot’s dApps – such as stablecoins and decentralised exchanges, for example.

Okay, think I got it… so it’s like Bitcoin?

Insofar as it’s a cryptocurrency and a blockchain, yes. But otherwise, no, not at all – it’s more like Ethereum, in that its technology (built with a bespoke framework called Substrate), uses a proof-of-stake (PoS) consensus mechanism to secure its network. And that’s unlike Bitcoin, which uses proof of work (PoW), relying on a humungous network of miners and nodes to maintain the integrity of its secure and decentralised system.

In fact, Polkadot’s PoS is actually called “nominated PoS”. In a nutshell, that means DOT holders nominate network-securing validators by delegating their DOT to them, for which the holders can earn ongoing passive staking rewards.

The current annual yield on Polkadot for staking is said to be about 10 per cent, minus the validators’ commission rate, which varies from validator to validator. But generally, we’re talking about 9-10 per cent – it’s not too shabby.

Polkadot validators secure the Relay Chain, which can apparently process over 1,000 transactions per second – pretty impressive, although still nowhere near as speedy as the likes of Solana (50,000 tps) and Avalanche (4,500 tps) purport to be capable of achieving.

Transactions per second and high throughput, while an important factor, is not the only peg for these projects to hang their multi-coloured propellor hat on. Ethereum’s first-mover advantage and network effect, for instance, keep it firmly in the lead in terms of market capitalisation value and overall usage.

The power of a large and faithful network is crucial in this game, but fast, super efficient, secure, scaleable and interoperable technology are the foundations that every one of these layer 1 projects need to develop if they want sustained success.

Who built Polkadot?

Polkadot’s founder and figurehead is a bloke called Dr Gavin Wood. Along with Vitalik Buterin, Charles Hoskinson (Cardano’s founder) and other fellow brainiacs, Wood was a co-founder of Ethereum.

He also happens to have one of the most circular, bowlish haircuts in the crypto industry, judging by this photo anyway. And that’s a green flag. You don’t want your genius computer-scientist crypto founder running around with styled, Fox Sports-presenter hair, do you?

Wood served as the Ethereum Foundation’s CTO until late 2015, then pulled up stumps, creating Polkadot in 2016 with Parity Technologies, based in the UK. The project’s development is coordinated by a separate entity, called the Web3 Foundation, which is a not-for-profit organisation based in Switzerland.

The Web3 Foundation hosted the first Polkadot ICO in 2017, which raised US$145 million in ETH. After losing more than US$90 million of that due to a smart-contract bug in the wallet, the Web3 Foundation hosted another ICO in 2019, which raised roughly US$100 million more, recouping the horrendous loss.

Polkadot’s mainnet then went live in mid 2020, with DOT available for trading in August of that year. Industry excitement ensued, largely due to the traction the blockchain was gaining with developers building projects in the Polkadot ecosystem.

In fact, rather than the DOT token itself, it was Polkadot’s early ecosystem projects that pulled in most of the price-pumping excitement and FOMO. Coins like Kusama (KSM) and Ankr (ANKR), for instance.

Originally hitting the open market around US$2.70, DOT’s price remained reasonably flat in its first four months of trading, but is now about US$52, with a market capitalisation about a 10th the size of Ethereum’s at this stage.

Polkadot’s 2021 so far

• In January, the institutional asset manager Grayscale filed for a Polkadot trust with the US Securities and Exchange Commission. A product that would potentially give DOT some high exposure to wealthy investors.

This application must be buried in the SEC’s in-tray, under various spot Bitcoin ETF filings, documentation regarding crypto lawsuits, and a stack of letters from Senator Elizabeth Warren imploring Gary Gensler to hassle more ne’er-do-well “shadowy super coders”.

Upshot: the Grayscale Polkadot trust approval is a waiting game.

• But in April, another similar institutional-grade trust product was actually approved – and this one is with the New York-based Osprey Funds. It saw immediate pick-up, although it’s only limited to accredited investors (net-worth millionaires, basically) at this stage.

• Also in April, Coinbase Ventures revealed it was investing heavily into DeFi projects building on Polkadot and largely based around the potential (actually extremely likely) parachain Acala (ACA). We’ll get to Acala further below…

• In June, the Asian-Pacific-based VC firm Master Ventures launched a US$30m Polkadot ecosystem-pumping fund, investing in projects vying for parachain slots on both Polkadot itself and its “testnet” project called Kusama (KSM).

• Also in June, a Polkadot ETP (exchange-traded product) called Valour DOT SEK began trading on the Swedish Stock Exchange. The ETP is fully backed by the underlying asset, DOT.

• Again, in June, Kusama began its first round of parachain auctions. Kusama is a clone of Polkadot that the project essentially uses as “canary network”. This means Polkadot can play faster and more loosely in Kusama as a testing ground.

That’s not to say Kusama is not valuable – quite the opposite, in fact. The Kusama chain and its parachains (particularly Moonriver) are powerful networks in their own right, and continue to build their own ecosystems and users. Both tokens, in fact, have seen impressive price gains in their respective lifespans so far. KSM is up 50,000 per cent since launch, while MVR is up about 610 per cent overall.

• But we digress… back to June (it was a big month), DOT received an overdue Coinbase-exchange listing. Did the price pump? Nope. It was a buy-the-rumour-sell-the-news kinda deal, with DOT losing more than 50 per cent in value over the following 30 days or so.

• In August, Kusama began its second round of parachain slot auctions, ending on October 13.

• In September, Polkadot (and Solana and Tron) ETNs (exchange-traded notes) operated by VanEck, began trading on the German stock market.

Which just about brings us to the Polkadot parachain auctions…

Parachain auctions – what’s this all about then?

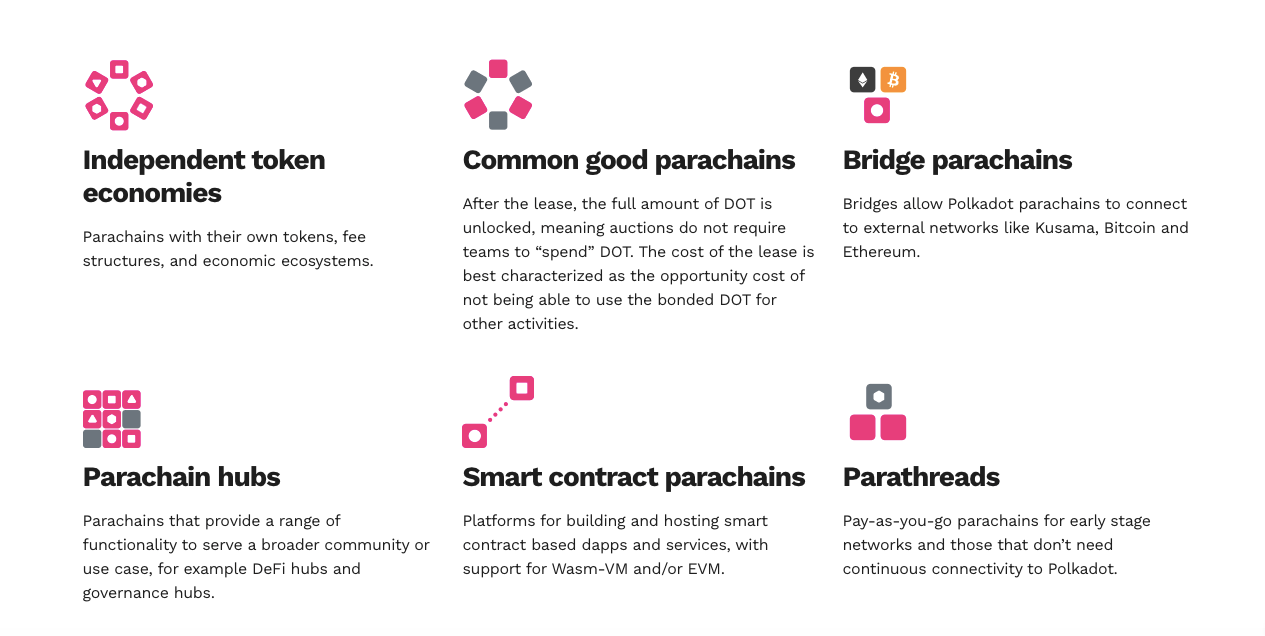

As briefly mentioned earlier, parachains are individual, simpler layer-1 blockchains that operate in the Polkadot and Kusama multi-chain networks, attached to the Relay Chain.

Parachains can be considered the final, important piece of the core functionality of Polkadot, and a crucial element for the entire protocol to achieve scaling and become a multi-chain beast.

They’re leased out in an auction format, with a maximum of 100 slots available. Because there are hundreds of projects building on Polkadot, parachain slot auctions are used to determine which project gets a slot – and the competition is white hot.

Very simply then, to launch on Polkadot, a project must secure enough DOT to win a parachain slot in the Polkadot parachain auctions.

Why are parachains coveted?

The chief reason is that parachains benefit from a ready-made, highly secure network in the Relay Chain.

So, if a project wins a parachain slot, it can plug straight into Polkadot’s validators and harness significant security from the get-go.

In other words, it doesn’t have to spend valuable time and resources building a network of its own validators to secure its own chain, and can instead focus on developing and improving its use cases.

Parachains also benefit from the interoperability (network connections with other parachains) and scalability that Polkadot’s main chain will ultimately provide.

Also, they will be able to have a say in Polkadot governance and link to external blockchains such as Bitcoin and Ethereum using cross-network bridges.

How do the auctions and crowdloans work?

The parachain slot auctions are enabled, or funded, through means of a crowdloan system – which essentially engages the community of DOT holders to participate by loaning DOT to the potential parachain(s) of their choosing.

The crowdloan involves bonding DOT to the Relay Chain. And, as part of the “candle auction” process, a snapshot is then taken at a random time shortly before the auction period ends, with the project winners nabbing a parachain slot.

Candle auctions, by the way, are a variant of open auctions, where bidders submit bids that are increasingly higher and the highest bidder at the end of the auction is considered the winner.

This is exactly how the Kusama slot auctions were run in June and August, but with KSM as the core bonding token instead of DOT.

Moonbeam, one of the competing projects vying for an upcoming parachain slot, gives an excellent, more detailed explanation of how the auction process works, which you can read here.

The Crowdloan functionality is now live on @Polkadot!

Teams can now begin opening crowdloans to accept $DOT contributions ahead of the Nov. 11th start of the first 7-day parachain slot auction. https://t.co/08Nab3bLT4 pic.twitter.com/Va0OaZHmsv

— Dan Reecer (@danreecer_) November 4, 2021

In the crowdloan process, DOT holders loan their precious DOT tokens in exchange for the individual competing project’s tokens (for example Acala tokens).

Their DOT is locked up for quite an extensive period of time – two years, to be precise – so it’s a leap of faith in a way, but it’s potentially very rewarding, as holders receive free tokens of a parachain that’s likely to be pretty hot property initially (not financial advice), while also eventually getting their stake of DOT back at the end of the lease period.

It all amounts to an entirely unique and innovative way of raising funds in the crypto world, which Polkadot calls Parachain Loan Offerings (PLO).

Think of it this way… as opposed to standard Initial Coin Offering (ICO) or Initial DEX Offering (IDO) funding mechanisms, with a PLO, crypto (DOT) is simply loaned… and not given outright to projects.

One further thing… if you’re participating in the crowdloan and your chosen project fails to win a parachain slot, you will, of course, be able to get your DOT back pretty quickly. It should apparently only take a couple of days to get it all back in this instance – not two years!

What’s the parachain auction schedule?

There are 11 parachain slots up for auction in the coming months. Five initial auctions will occur sequentially, each lasting a week. The final auction of these first five will end on December 16. After that, another batch of six auctions will begin on December 23.

- Auction 1: November 11-18, 2021 (winning parachain announced Nov 18)

- Auction 2: November 18-25, 2021 (winner announced Nov 25)

- Auction 3: November 25-December 2, 2021 (winner announced Dec 2)

- Auction 4: December 2-9, 2021 (winner announced Dec 9)

- Auction 5: December 9-16, 2021 (winner announced Dec 16)

There are various sites and Twitter feeds that give you good up-to-date information on the parachains auctions and crowdloan details. Here’s a good one: parachains.info; @parachains, which provides a projects comparison table; up-to-minute contributions and funding status; project news and watchlists, and more.

First Crowdloans on Polkadot STARTED!https://t.co/FJfPLmiRqO

— Parachains Info (@parachains) November 5, 2021

Top parachain picks and where to participate in the crowdloans

From extensively looking for community consensus on Twitter and in Discord groups, as well as reading and watching the opinions of various analysts, we can confidently say there are two extremely strong, standout candidates for parachain slots in this initial batch of five auctions.

And these are Acala, and Moonbeam. If you’re reading this and you’re already well inside the crypto bubble, you’ll know that this isn’t exactly going out on a limb here. At this point, it would be very surprising if either of these two projects don’t make the cut as one of the first five parachains…

ACALA: This top-tier project is essentially the DeFi hub for Polkadot. It’s been building its platform for quite some time, has a large following on Twitter (170K+ followers), and has been conducting exhaustive testing and auditing all year.

The platform offers a trustless staking derivative (liquid DOT), a multi-collateralised stablecoin (aUSD), and an AMM DEX. (What’s an AMM DEX? Find out here.)

Acala has partnered with Chainlink, Moonriver and Shiden Network, among several others. Major investors include Digital Currency Group, Polychain Capital, Alameda Research and Coinbase Ventures.

Acala’s native token will be ACA, with a total supply of one billion tokens.

You can participate in the Acala crowdloan through its gamified campaign which is currently underway.

🚀 The Acala Crowdloan is now live! Get your piece of the network before it launches on @Polkadot. Join now to get your 5% Crowdloan Kickoff bonus!

Join now: https://t.co/QgtyWtydyW

— Acala (@AcalaNetwork) November 5, 2021

MOONBEAM: This is a smart-contract platform that you might consider “the Ethereum of Polkadot”, with a strong focus on interoperability (with Bitcoin and Ethereum) and building out decentralised applications.

Moonbeam can also be considered the “big brother” of Moonriver – the affiliated and equivalent platform that won a parachain slot on Kusama in September.

Moonriver has been one of the most successful (and rewarding for crowdloaners) projects on Kusama so far. If Moonriver’s success is any harbinger for Moonbeam, then a Polkadot parachain slot for the latter is extremely likely.

Moonbeam’s native token is GLMR, and it has a total supply of one billion tokens.

Find out how to participate in the Moonbeam crowdloan here.

1/ ⚡️THE MOONBEAM CROWDLOAN IS NOW OPEN! ⚡️

Contribute now & help Moonbeam bring multi-chain applications & thousands of new users to @Polkadot 🔥

🚀 Get started & contribute here 👇

https://t.co/9ScFm7xRNK🤩 Read the announcement 👇https://t.co/KAYjITUoEg pic.twitter.com/77JoB7N3xw

— Moonbeam Network (@MoonbeamNetwork) November 5, 2021

Some other strong parachain contenders include:

• Efinity – gaming protocol Enjin’s upcoming Polkadot parachain for NFTs. Enjin announced a US$100 million Efinity Metaverse Fund this week – “to formalise support for our ecosystem partners, and help make the decentralised metaverse a reality.”

Efinity #Parachain Crowdloan announcement incoming!

Join Enjin CTO @witekradomski at @binance $DOT Slot Auction event now to learn more about our plans to secure a slot in Batch 1 of the @Polkadot parachain auctions.

▶️ Live now: https://t.co/bxutSEynFQ pic.twitter.com/fHZtsC1A9n

— Enjin (@enjin) November 4, 2021

• Astar – a scalable, interoperable Web3 platform previously known as Plasm. This one can be considered the Polkadot-native dApp hub supporting Ethereum, WebAssembly, dApp staking, and layer 2 solutions.

Astar crowdloan is open!🚀

Please read carefully the information below⏰ You can now start contributing on #Polkadot by locking $DOT to secure the parachain slot and earn $ASTR in return

1/5 pic.twitter.com/9mQf9Ocein

— Astar Network (@AstarNetwork) November 5, 2021

• Litentry – a multichain identity aggregation protocol that enables its users to manage their identities and get real-time credit.

Litentry's crowdloan is now available on Polkadot.js app and Litentry Crowdloan WebApp:https://t.co/QGZWMlcVRy

The genesis state of Litentry Parachain is submitted on Polkadot, now you can vote for it and share 20M $LIT reward pool **plus** early bird and DID-related bonuses.

— Litentry (@litentry) November 5, 2021

This Polkadot News breakdown gives a bit more information on some other potential parachain projects and their crowdloan details.

None of the information in this article should be regarded as financial advice. At the time of writing, the author holds various crypto assets, including Bitcoin, Ethereum and some Polkadot.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.