Triple bottom for Bitcoin? The big orange crypto bounces from US$40.8k for 3rd time in 5 days

Some traders are seeing signs BTC has formed the bearish-to-bullish reversal pattern known as a triple bottom. (Getty Images)

Wen bottom?

Bitcoin continues to be in a state of indecision this morning, with dips to US$40,000 being quickly bought up and efforts to reclaim $42,000 being speedily sold off.

At 11.48am AEST, BTC was trading at US$41,482, down 2.6 per cent from the same time yesterday.

The original crypto dipped as low as US$40,800 at its daily close at 10am AEST (midnight UTC) but then bounced off that level for the third time in five days.

“Hoping that this is it triple bottom reversal with swing on monthly close for $btc #Bitcoin,” wrote chartist Crypto Filipino on Twitter. “We just really need to hold 40k IMO”

triple bottom??

— .. (@DreMarseille) September 29, 2021

Crypto market at US$1.92t

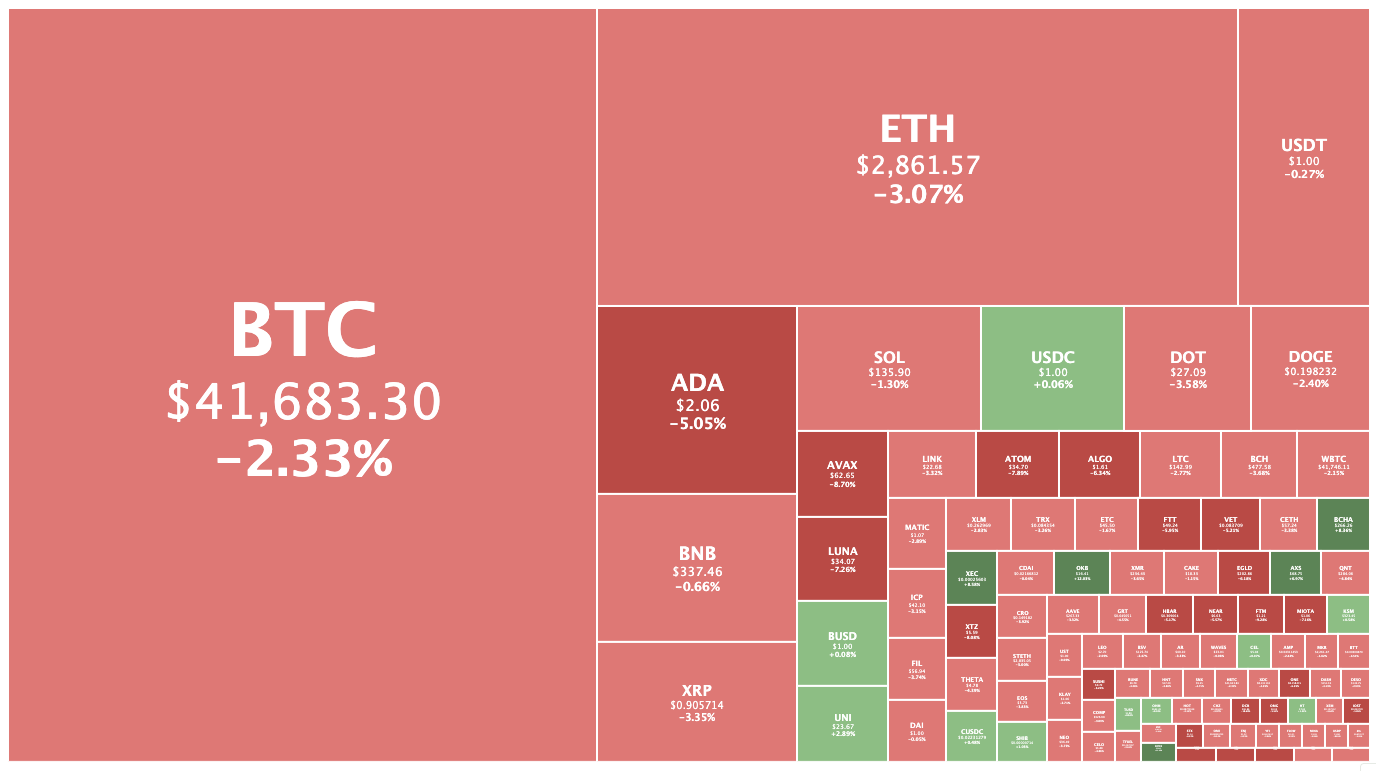

Ethereum meanwhile was trading at US$2,864, down 3.2 per cent from yesterday.

Overall the crypto market was stood at US$1.92 trillion, down 2.3 per cent from yesterday.

Just 17 of the top 100 coins had gained ground in the past 24 hours, but there was only one double-digit loser – Decred, which had fallen 10.6 per cent to US$97.11. Fantom, Tezos and Osmosis were all down around eight per cent.

OKB Coin was the biggest gainer in the top 100, rising 11 per cent to $16.32, followed by dYdX, which had risen 10 per cent to an all-time high of US$23.49. Now the No. 88 crypto, dYdX is the governance token for a decentralised derivatives exchange.

Since Friday, when China announced a harsh ban on crypto-trading, the token is up 66 per cent.

“Investors are betting that the Chinese will be drawn to decentralised exchanges to circumvent the ban,” the crypto platform Luno said in its weekly report, powered by Arcane Research.

“Tokens like Uniswap, Sushiswap, Perp and dYdX have all gained double-digit percentages following the ban.”

But Huobi Token, the currency of the Huobi Global exchange which is shuttering its users from mainland China, has declined from US$12 on Friday to under $8 today.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.