The market psychology that made Lisa N Edwards a crypto success, and why women are ‘mostly better’ traders

Getty Images

Lisa N Edwards might be the only crypto-trader who learned the craft while working at KFC as a teenager.

“Yeah, that’s a really funny story,” the mother of five told Stockhead with a laugh last month.

She was just 16 at the time and a regular customer at the fast-food restaurant was just a few years older, around 19 or 20.

“And he had like this really expensive car, and he’s telling me all the time he got it because he’s trading, doing this and doing that. And he tells me, ‘Oh, I can teach you.'”

Edwards was eager to learn – and it’s always been something she’s fallen back on. Then in 2013, the Melbournian sold her modelling/talent agency and went into trading full time.

“Before that, I hadn’t been trading crypto regularly, I owned crypto but I hadn’t been trading it because it wasn’t worth very much,” she says, recounting how excited she was when Bitcoin breached the US$100 mark.

Edwards started writing books and movies, while trading crypto on the side.

“And then I thought, well, there’s a whole heap of people coming into the space, and everyone was getting absolutely wrecked,” Edwards said.

The first crypto derivatives platform, BitMEX, was launched in 2014, offering traders up to 100x leverage in return for the possibility of having their positions liquidated.

“The market exploded and changed at that point, and I went okay, cool, I have to kind of step in and help some people. And that’s kind of my journey in crypto.”

Tens of thousands taught

These days, Edwards estimates she’s taught more than 20,000 people from her Gettingstartedincrypto website and paid “signals” group, for which members pay US$69 a month.

“Within the group, I have a thing called the Lisa Bot, where I put out trading signals and the bot then picks out these signals and trades. You don’t have to do anything once it’s set up, just monitor it,” she says.

Edwards trades mostly on Kucoin, Binance, and Bybit, and generally doesn’t use leverage, although sometimes might use up to 3x.

“The majority of the time I’m in spot, because you can make hundreds of per cent on altcoins without any leverage,” she says.

“Leverage is a money-killer. The exchanges talk about how you can make 10 times the profit, but you can also make 10 times the losses.”

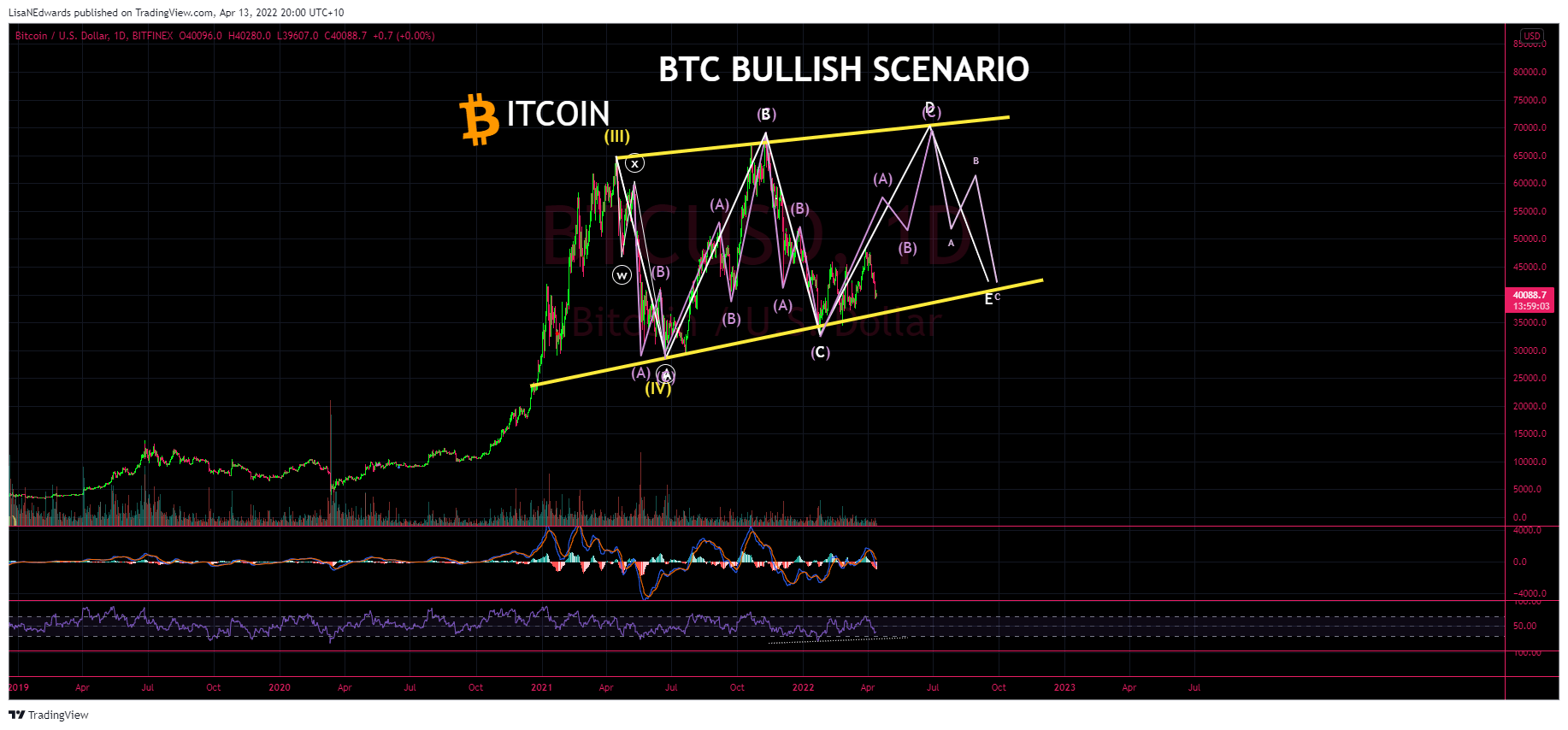

Edwards is an Elliot wave trader, a type of technical analysis developed by American accountant Ralph Nelson Elliott in in the 1930s, although Edwards has modified his Fibonacci levels to work better with crypto. She calls it Lisanacci.

It’s basically a type of market psychology, she explains. “So basically, it’s a five-wave system within a correction. Once you get to the five waves, you know you’re getting a correction that that point, that’s what I teach people.”

When Stockhead talked to Edwards last month, she was mostly out of the market, which has been choppy this year. But when the market’s good, she recommends clients have 25 per cent Ethereum, 25 per cent Bitcoin, 30 per cent long-term altcoins and 20 per cent tradeable altcoins.

“So they’re the ones that you’re actively trading,” she says. “When the market’s good, most altcoins will go 200 to 300 per cent.”

Edwards says her best trade was probably buying Elrond (eGold) when it redenominated with a 1,000-for-1 split in July 2020.

“It went up like 6,000 per cent … The profits were insane, it was just printing money,” she says.

Speaking to Stockhead early last month, Edwards forecast that the crypto market was in a “corrective triangle” and in the fourth of the five waves predicted by Elliot wave theory.

“Hopefully, if my pattern is correct, we should head up and retest and triple top,” she said. “If we can break through – fingers crossed – that $65 to $68 [US$65,000 to US$68,000 for Bitcoin] mark, and then turn back again.”

A female advantage

While both crypto and short-trading are male-dominated fields, Edwards is passionate about bringing more women into the space and says ladies are generally better at trading than men. (Something this reporter has also heard from male trading tutors).

For men, “it’s kind of like Scarface, ‘first you get the money, then you get the power, then you get the women,'” Edwards says. “It’s that mentality.”

But women don’t think that way — for them, money is simply a means to afford a better standard of living, she says.

“Because women aren’t actually attached to that (money), they’re mostly better traders,” she says.

Men can also be ego-driven and inclined to “revenge trade” when a trade goes against them, which seldom works out to their benefit.

About 30 to 40 per cent of her community with Getting Started in Crypto is women, Edwards estimates.

Edwards says her slogan as a trader is, “the only way to make money is to make your own,” adding that at least it’s the only way to make real money.

Trading also offers a flexible lifestyle, says Edwards, whose youngest child is 17.

“You can basically do it from anywhere, the beach or your lounge room with kids running around,” she says.

“Some advice my mum gave me — always have your own money. It’s essentially because you never know where life’s going to take you. Just always have that backup plan.”

Having children sometimes leaves women “completely dependent on a man, after giving up their career to raise them,” Edwards says, adding that she’s not man-bashing “by any means” and realises that more and more men are also foregoing a career for kids.

But “if you’ve got that backup plan, and you’re got that little bit of money, then you’re able to be secure and safe and look after your family,” she says.

#ProTip – Sometimes you need to know where to pull the stop loss! (or at least have one)

Failing that, if $BTC holds here & follows pattern the rest of the market should follow including $LTC

PS – never risk more than you can afford to lose! https://t.co/VwW5LiIBK1 pic.twitter.com/HpuDz6pQov— ❣️Lisa N Edwards ❣️ (@LisaNEdwards) April 10, 2022

Coinrunners movie

Edwards is also working on a movie — Coinrunners — based on a bad romance she got into with a high-profile, charismatic crypto trader a few years back.

It was a toxic relationship and a “roller coaster ride,” Edwards says, with her partner returning to his previous life of addiction and ripping people off.

The movie is in pre-production, Edwards says, adding she hopes it’ll make it into cinemas.

Edwards is understandably less open to chatting publicly about her famous brother, computer scientist Craig Steven Wright, the purported creator of Bitcoin and one of the most controversial people in the crypto space. But she realises it’s a standard question that interviewers will ask her.

“I tend not to comment, just due to the fact that we do different things in crypto,” she says. “I think I’ve paved my own way, without his help.”

They haven’t spoken since they had a falling out in January 2020, Edwards says.

Edwards says people interested in joining her welcoming community should check out her website. She’s also active on Twitter, where she has nearly 110,000 followers.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

For more crypto news, follow the author on Twitter, Stockhead’s crypto-themed Twitter account, and its Facebook page.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.