Roundup: Ethereum parties like it’s 1559; BTC rebounds; Uruguay and Colombia push crypto adoption

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

London has forked hard for Ethereum, upgrade EIP-1559 is in the can, gas fees are burning and the price has been lighting up. Meanwhile, Bitcoin was looking sorry for itself, but has lifted back above US$40K.

Large parts of the crypto community have been wondering all week what sort of price action Ethereum’s much-anticipated London hard fork, and EIP-1559 upgrade, would bring. They have their short-term answer.

At the time of writing ETH is burning gas and seemingly building pace, up 4.5% in the past 24 hours and trading at its highest levels in a couple of months. It’s changing hands for US$2,786… hang on, we’ll hit refresh… it’s US$2,800.

According to Crypto Briefing, which has been tracking data from ultrasound.money today, Ethereum burned more than $1 million worth of ETH within the first three hours of EIP-1559 going live.

While it would appear post-upgrade Ethereum is off to a flyer, well-reasoned downplaying of the hype is still something to take heed of amid the champagne corks popping at ETH parties all over the world.

But that won’t make some Ethereum bears feel any better right about now…

https://twitter.com/mskvsk/status/1423289536956698628

Looks like a RE- Accumulation after decline for #ethereum#wyckoff pic.twitter.com/sB3HVctZjZ

— Dr. 𝘼𝙧𝙘𝙖𝙣𝙚 𝘽𝙚𝙖𝙧 (@arcanebear) August 5, 2021

Even some of the most bullish advocates for the no.2 crypto were cautioning that it might pay to not get too far ahead of things just yet…

Can we please not over react to gas prices just 3 hours after the fork while: wallets still haven’t updated, MEV bots are broken, gas limit is being fixed and ETH is pumping?

It’ll take weeks if not months to properly assess 1559s impact on gas fees.

— eric.eth (@econoar) August 5, 2021

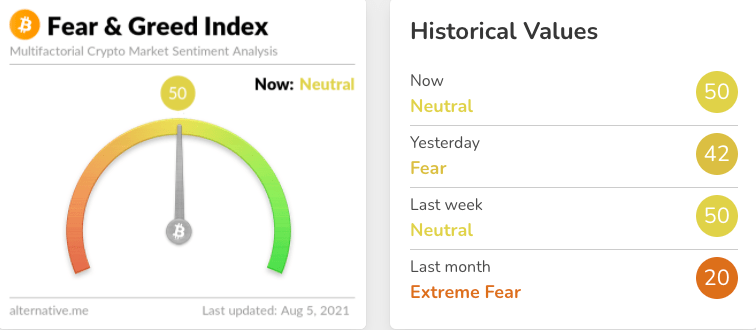

Depending on how Ethereum performs over the next 12 hours or so, it’ll be interesting to check in on the Fear & Greed Index tomorrow. At the moment it’s bang on Neutral, up considerably since yesterday.

As for last month’s extremely fearful mood… let’s not go there, although it would’ve been a good time for buyers.

Bitcoin hops back on the roller coaster

With Ethereum rightfully enjoying the limelight today, Bitcoin’s price was looking a bit down, left out and lost for much of the past 24 hours, before pulling itself together again.

Having recovered from a dip below $38K to $US37,595, at the time of writing it’s now going for US$40,251. A $2,656 swing back and forth in half a day. Moody, much?

Several technical analysts, including Michaël van de Poppe, have still been keeping a “higher-low” level of support for the OG crypto in mind, somewhere between about US$34K and $36K. Unless things flip up significantly, of course.

A bit of a BTC surge on the back of general market positivity is certainly not off the table. There seems to be enough around to keep Bitcoin bulls interested…

@LguiseppeBBE crackdown had zero drawdown on the network,after south america becomes the new china in btc we are going to see prices up and never coming down

— Allan Ssonko (@Allan_Ssonko) August 5, 2021

‘(South) America… f**k yeah!’

Adding to the Central American embrace of Bitcoin in recent months, most notably El Salvador, politicians in the South American countries of Uruguay and Colombia have been giving crypto some positive vibes in the past 24 hours or so.

According to various reports today, senators in both countries are pushing for regulations that could help support the adoption of Bitcoin and cryptocurrencies in their respective nations.

In what would be a similar legislation to that of El Salvador’s, Uruguayan senator Juan Sartori has put forth a bill to make Bitcoin and other cryptos legal tender in Uruguay.

Colombian Senator Mauricio Toro, meanwhile, is proposing an accommodating regulatory stance on crypto exchanges that would see them operate legally in Colombia.

Rumour has it that they will change the Sun to the #Bitcoin logo if the bill passes.

— J11 (@LinkWarLord) August 4, 2021

Also making news: French ETF, FTX and YGG, CFTC and the SEC

• French fund manager Melanion Capital has won approval for a Bitcoin ETF in the EU, according to reports. It will track a basket of stocks with 90% correlation to BTC’s price.

• US investment bank JP Morgan has begun pitching a Bitcoin fund in partnership with New York Digital Investment Group (NYDIG) to its wealthy clients, as reported by Coindesk.

• Crypto exchange FTX has partnered with Yield Guild Games to sponsor Axie Infinity “scholars” in developing countries and help them earn a living from the play-to-earn game.

• Brian Quintenz, the US Commodity Futures Trading Commission (CFTC) commissioner, has tweeted that the SEC “has no authority” over certain crypto assets.

This is precisely the reason so many in crypto are keen to understand which #crypto assets fall under the purview of either the CFTC or the SEC. Is it the CFTC's current position that both $ETH (despite conducting an ICO) & $BTC are commodities?

— Brad Laurie (@Brad_Laurie) August 4, 2021

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.