If you thought NFTs were basically all about cartoon avatar animals, accusations of cash grabs, and losing money in the bear market, think again. An entire house has just sold in the US as a non-fungible token.

Digital property in the metaverse is one thing, but an actual house takes NFT ownership up a notch or several.

Then again, as strange as it sounds, it really actually isn’t when you think about it. After all, as, erm, Paris Hilton told Jimmy Fallon earlier this year, an NFT, in its simplest explanation, is “basically a digital contract on the blockchain… art, music, experiences, physical objects…”

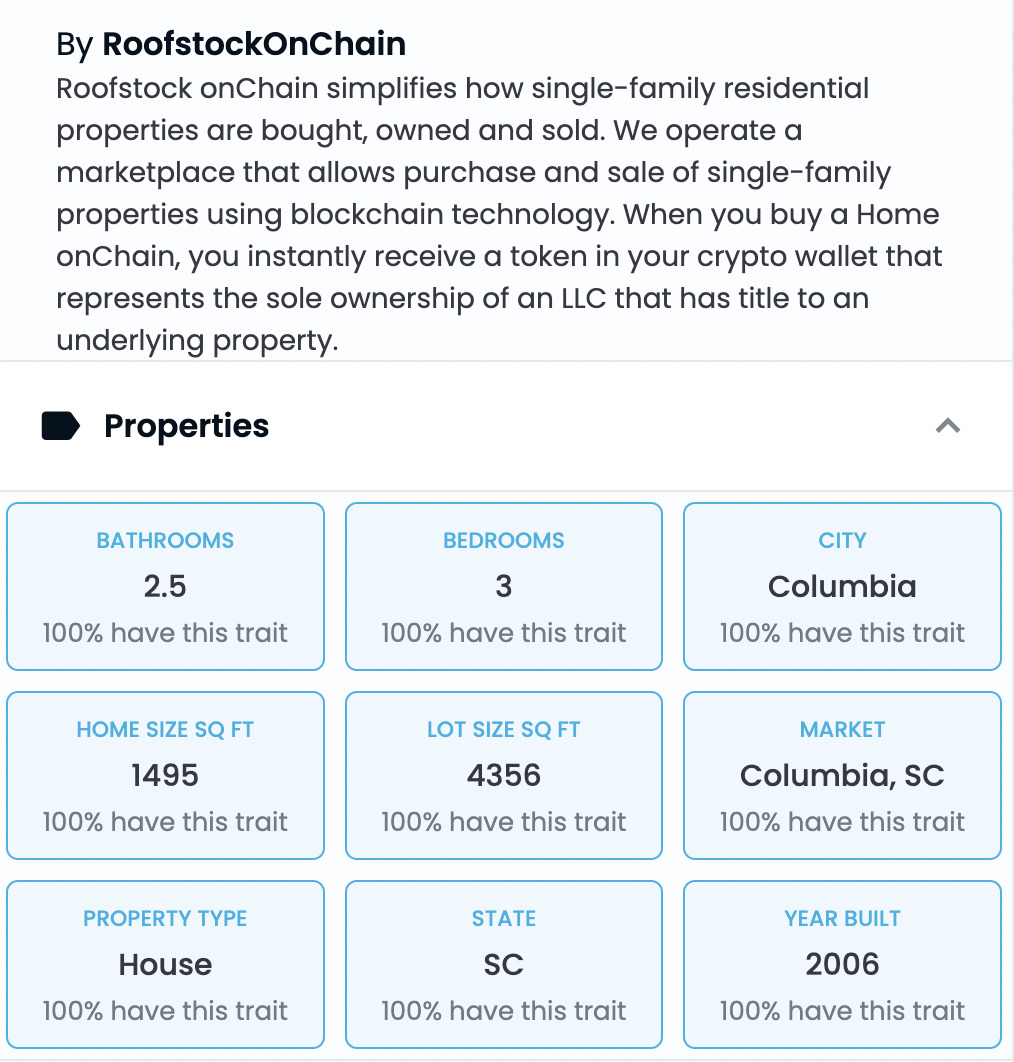

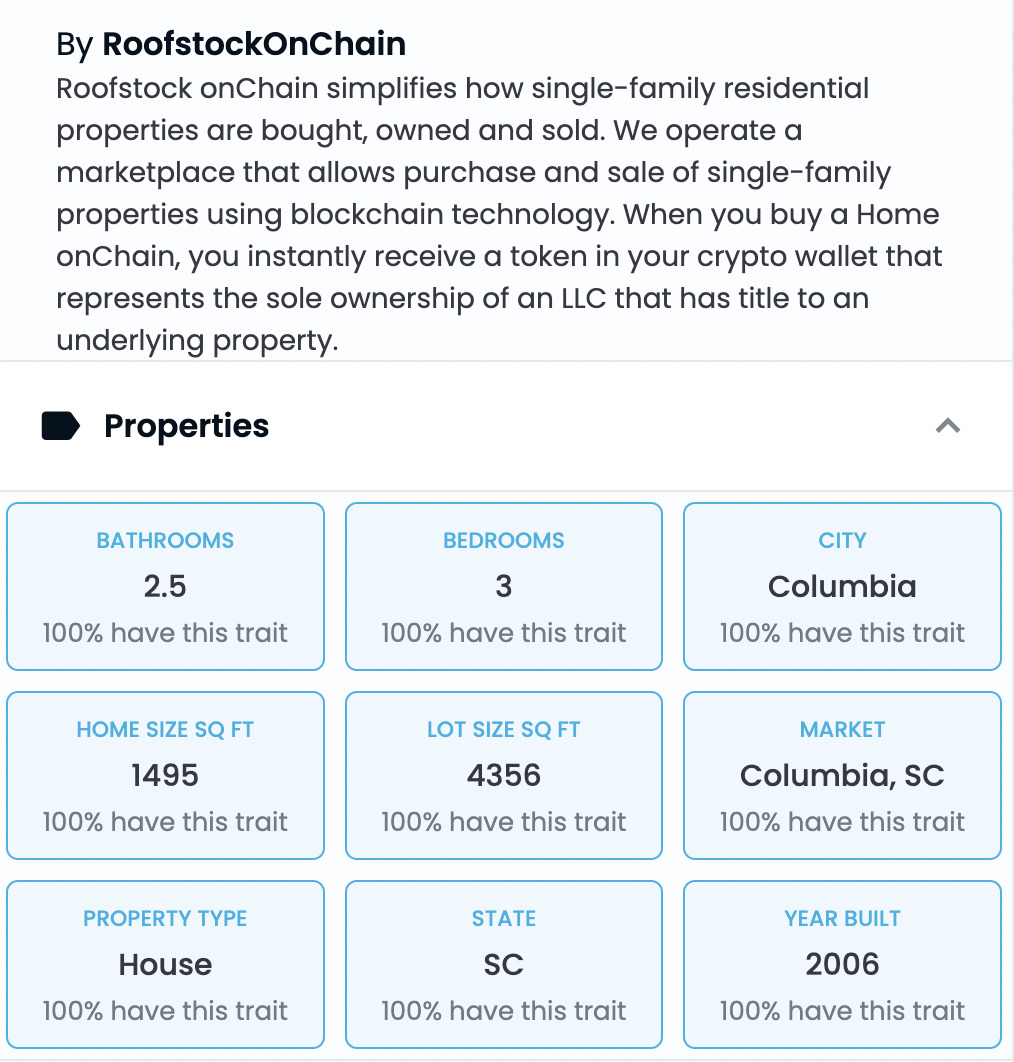

The house is a three-bedroom South Carolina property and was listed on OpenSea via Roofstock, a real-estate fintech firm that combines NFTs with physical property.

The NFT holder, who paid for it using the Ethereum-based stablecoin USDC, now has full rights to the property, which has its “traits” listed on OpenSea like any other regular NFT (see below).

Blockchain tech – used as a decentralised and distributed, incorruptible and immutable database – has long been mooted as a real-estate sector disrupter, mainly for its potential to connect buyers and sellers, cut out intermediaries in the transaction process (seeya, agents) and reduce overall costs.

According to Roofstock “chief blockchain officer” Geoffrey Thompson, tokenising property has gained traction over the past year or so as it “creates frictionless transactions, simplifies the process, and makes information more readily available.”

This isn’t the first instance of an NFT real-estate sale, although Roofstock appears well positioned to make one of the first serious forays into the space, as it’s managed to raise some seriously large capital this year – US$240 million in a Series E funding round led by SoftBank, giving it a US$1.9 billion valuation.

The firm has also teamed up with Ethereum-based NFT and DeFi platform Origin Protocol (OGN) to create its own NFT marketplace focused on physical real estate. And that’s something that aims to cut seller fees by up to 50%.

Ripple NFTs could be hitting XRP Ledger soon

You might not be aware of this but Ripple, developer of its native cryptocurrency XRP, is into NFTs, and has been for a while. It, and the community-led, decentralised public blockchain XRP Ledger (XRPL), is gearing up for some hefty NFT-related activity very soon.

This week, Ripple announced the second wave of creators to receive funding for NFT projects through its US$250 million Creator Fund, which is focused on the development of NFT enterprises on the XRPL network.

The fund’s second wave will include metaverse platform 9LEVEL9; Japanese NFT marketplace Anifie; NFT sports platform Capital Block; Cross-Metaverse Avatars; marketplace NFT Master; NFT IP company SYFR Projects; and NFT membership project ThinkingCrypto.

And, while NFTs are not yet live on the XRPL chain, they could very well be within a couple of weeks, according to XRPL community members (see tweet below, for example).

First, though, a proposal known as XLS-20 needs to receive 80% approval from the network’s validators.

Don’t ask us how exactly, but what that would do is essentially enable the creation of Ripple NFTs (along with minting and auction capability) on the XRP Ledger with minimal or no use of smart contracts.