NFT news: Floor prices tank for Bored Ape Yacht Club and other blue chips; Bill Gates kicks ’em while they’re down

A seriously bored ape, yesterday. (Getty Images)

With the Bored Ape Yacht Club floor price slashed – now below $100k in USD value for the first time in nearly a year – no sector is safe from the crypto cataclysm, very much including NFTs.

Well… for the most part, that is… There’s still the odd report of stupendous profit being made on a cartoon-creature jpeg here and there. Bored Ape #7537, for example.

While crypto was this week plummeting to levels not seen since December 2020 and the Fear & Greed Index hit a particularly extreme level of pants crapping-ness, this helmeted, shut-eyed simian (below) sold on the OpenSea market for an utterly ridonculous 1024 ETH (US$1,213,265).

The trade reportedly netted about US$914,000 in profit for the seller, “DB1C00. Laughing, and “ooh-ooh-ing” all the way to the self-custodied hardware wallet hidden at the back of the sock drawer.

Bored Ape #7537 sells for 1024 $ETH / $1,213,265 🤯🤯🤯

WTF?!!#BAYC 🦍 pic.twitter.com/YDKsemVOqh

— APE G4NG (@ape_g4ng) June 14, 2022

Falling floors for NFT blue chips

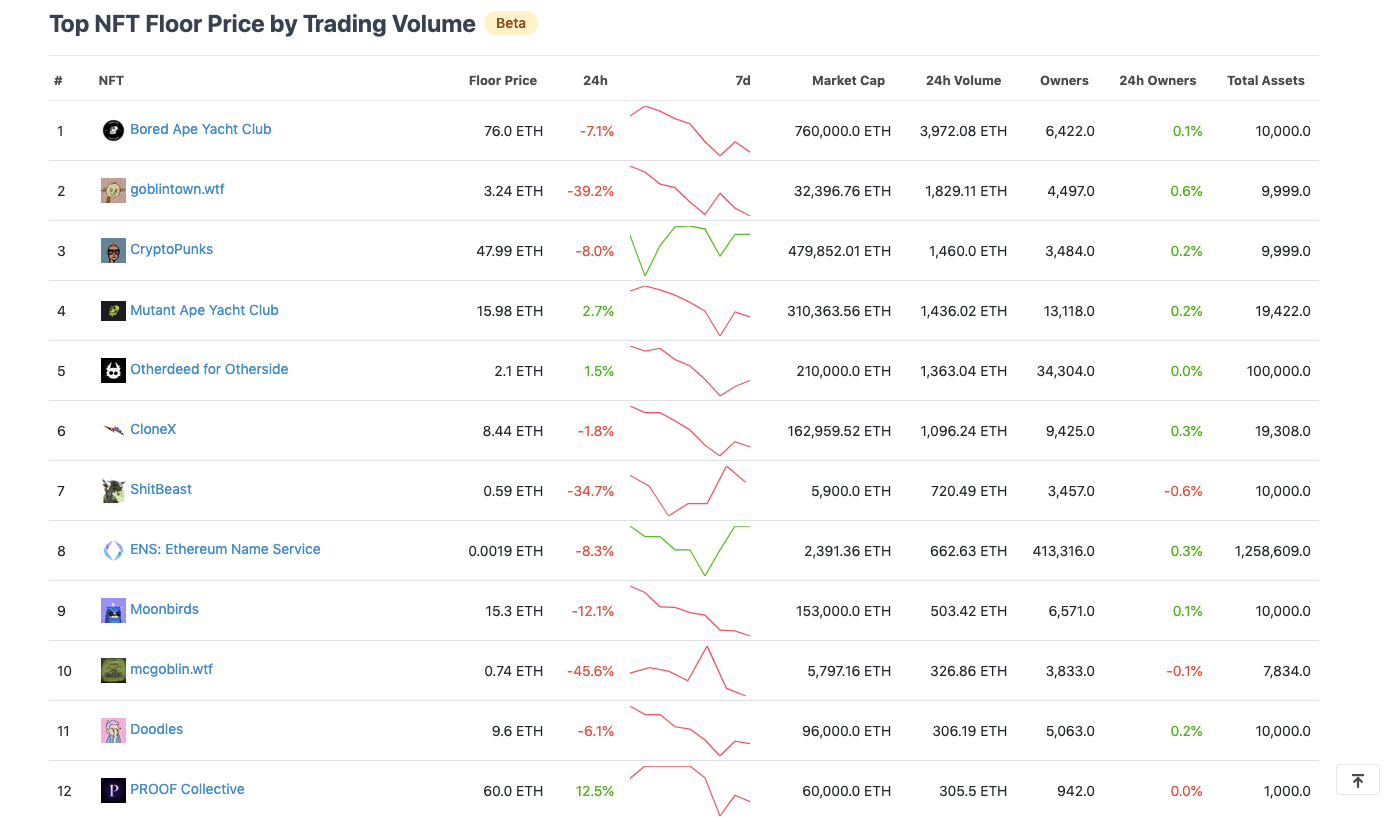

But we digress… because on the whole, the floor prices of Bored Ape NFTs, and other major non-fungible token projects, have been taking a dive. As shown on this CoinGecko chart below.

BAYC’s floor price has more than halved since it peaked at 153.7 ETH only about a month and a half ago, and other “blue chips” have followed a similar trajectory.

Peak floor in ETH terms for CryptoPunks was late March (72.9 ETH – now trading at 49 ETH); Moonbirds NFTs were fetching at least 38.5 ETH in mid April (now about 15 ETH); while the Doodles floor hit a 23.95 ETH zenith early last month and is now less than 10 ETH.

Meanwhile, the not-quite-as-mysterious-anymore goblintown.wtf (the project’s team doxxed itself the other day) is copping the heaviest percentage loss of top-trading NFTs over the past few days. Its floor was 7.35 ETH a couple of weeks ago but is now hanging around 3 ETH.

Of course, the USD value of all these projects is where the real impact is being felt, considering the tanking price of ETH (down about 44 per cent over the past month).

If you priced current floors in USD at the price of ETH 2 months ago:

CloneX: 2.2 ETH

BAYC: 24 ETH

Mutants: 4.5 ETH

CryptoPunks: 13 ETH

Moonbirds: 4 ETHPeople would mortgage their house to buy in at these prices 2 months ago yet are scared shitless today 🤔🤔🤔

— Alex Finn (@AlexFinnX) June 15, 2022

NFTs in general have seen a steady decline in sales volume since the market began selling off earlier this year. The sales volume of CryptoPunks, for instance, has dropped nearly 70 per cent over the past month, while other popular collections, including Azuki, Moonbirds and Doodles, have been hit even harder in terms of sales action in the same period.

One bear-market-bucking NFT project that immediately springs to mind during this downturn, however, is Illuvium Land, which launched a couple of weeks ago selling out 20,000 plots for an impressive US$72 million in sales.

The current floor price for the basic-level Tier 1 plot of land is 0.4471 ETH, up about 2 per cent over the past 24 hours.

The Illuvium Land Sale is officially over!

🥳🥳🥳💥 All Land Plots Sold Out

💥 $72M+ in Total Sales

💥 239,388 sILV2 to be burned

💥 4,018 ETH to be redistributed

💥 NO GAS WARSMASSIVE thank you to all participants and partners that helped make this a historic success ♊️ pic.twitter.com/adMTq6PpKe

— Illuvium (@illuviumio) June 5, 2022

NFTs based on ‘100% greater fool theory’: Bill Gates

As has been well established, Microsoft co-founder Bill Gates is no fan of NFTs, or cryptocurrencies in general, for that matter.

Speaking at a TechCrunch talk on climate change on Tuesday, the billionaire businessman described interest in non-fungible tokens as being “100% based on greater fool theory”. And that refers to the idea that overvalued assets will shoot up in price when there are enough people willing to fork out more for them.

Bill Gates is not a fan of cryptos or NFTs.

In a TechCrunch talk Tuesday, the Microsoft co-founder said that the hype around them is “100% based on greater fool theory." pic.twitter.com/v49RGa133u

— Morning Brew ☕️ (@MorningBrew) June 15, 2022

“I’m used to asset classes … like a farm where they have output, or like a company where they make products,” Gates said.

As for crypto, “I’m not involved in that,” he added. “I’m not long or short any of those things.”

The Microsoft man then cynically joked that “expensive digital images of monkeys” would “improve the world immensely,” referring, of course, to the Bored Ape Yacht Club collection.

The Cryptoverse largely disagrees with his statements, and here’s why…

Bill Gates mocking crypto and nfts may be one of the most hilarious things I have heard in my life

he literally made his fortune in a "risky" tech idea

— Wendy O (@CryptoWendyO) June 15, 2022

Bill Gates Says NFTs and Crypto Are '100% Based on Greater Fool Theory' Here's why he's wrong @BillGates #nft #techcrunch #Web3 pic.twitter.com/pq2BKVem3p

— Nifty Nanners 🍌 (@NiftyNanners) June 15, 2022

I have no clue why BAYC has value, but I do know this – facing the serious threat of a continued, painful bear market and potential loss of value on both my BAYC and the ETH behind it, I still somehow don't want to sell.

And I think this insanity is shared by many others. So…

— Blue (@BlueBadger2600) June 15, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.