Mooners and Shakers: Crypto at ‘extreme fear’ COVID-crash levels; Fed hikes rates by 75 basis points

An extremely fearful crypto-investing noob, yesterday. (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Can’t sleep, can’t eat, can’t stop checking your dwindling crypto portfolio? Then maybe you’re new around here (not to mention highly overexposed). The “extreme fear” the market’s feeling right now is nothing new for this space.

Granted, this does feel like an even deeper, darker, more concerning hole than the COVID crypto crash of March 2020 – which was the last time the Crypto Fear & Greed Index’s dial was this low.

And that might mainly be because we know that downturn morphed into the most stupendous of bull runs, borne from America’s now-busted 24/7 money printer.

Sky-high inflation, Eastern European war (lest we forget), looming global recession, crypto-company layoffs (Coinbase, Crypto.com and BlockFi are saying goodbye to hundreds of staff) and over-leveraged VCs and lending platforms… it’s all one big unappetising, bubbling soupy mush. What slop will be added to the dish next?

Article update: Well, now we can tell you. Per a few hours ago, the US Federal Reserve, aka da Fed, announced a 75 basis points interest-rate hike at its latest FOMC (Federal Open Market Committee) meeting. It’s the largest rate hike in the US since 1994.

The #Fed raised interest rates 75 bps. How exactly are they planning on avoiding a hard landing? Inflation is still sky high and partially due to things that raising interest rates will not even fix.

— Benjamin Cowen (@intocryptoverse) June 15, 2022

#FOMC a 50 bps rate hike was expected, however there have been whispers about a possible 75 bps hike. Looks like the markets have priced in the 75 bps hike. Some investment firms like JP Morgan said that we may actually see a rally if the Fed does hike 75 bps and a sell off.

— Matthew Schultz (@mschultz33) June 15, 2022

It’s a bit early to say for sure, but it seems the “priced in” narrative might actually be playing out this time. The crypto market’s actually bounced a little on the news – guess it’s a fan of clarity. Probably nothing to get excited about, although let’s see how the dust settles on it tomorrow…

Powell translated: We understand how much you are hurting so we will hurt you more.

— Sven Henrich (@NorthmanTrader) June 15, 2022

In the meantime, as usual, let’s look for any silver lining or positivity we can find right now. Actually, how is silver going? Hmm, year-to-date, down about 9.5%. Not incredible, but better than most of this stuff at the moment.

The DCA opportunity (minus professional financial advice)

At the risk of sounding like a broken record, the main silver lining we’re still seeing to the crypto-market downturn is the most obvious one – the possible opportunity afforded by dollar-cost averaging back in “when there’s blood on the streets”.

That is, the potential longterm upside for incremental deployment of set-aside capital into a market at its lowest levels in about 18 months. A market led by an asset (Bitcoin) that’s showing oversold characteristics on at least a few metrics – for example…

#BTC is down -10% below the 200-MA right now

Historically, $BTC tends to wick -14% to -28% below the 200-MA#Crypto #Bitcoin pic.twitter.com/zUpxqBUvBc

— Rekt Capital (@rektcapital) June 15, 2022

#Bitcoin Weekly RSI is the lowest EVER! pic.twitter.com/XmT8UUlS38

— Bitcoin Archive (@BTC_Archive) June 15, 2022

Needless to say, the DCAing strat still comes with a good amount of risk, as there’s actually no guarantee the crypto market will ever see all-time-highs again. Also, choosing wisely is key, as plenty of cryptos are unlikely to survive this bear market – probably a good thing in the long run.

As the blokes at Collective Shift told us yesterday, though, if you’re looking to start deploying soon, then, it’s much safer to forget about “hot, cheap alts”. BTC and ETH are the more sensible plays, although Bitcoin maxis would only agree with half that statement.

Top 10 overview

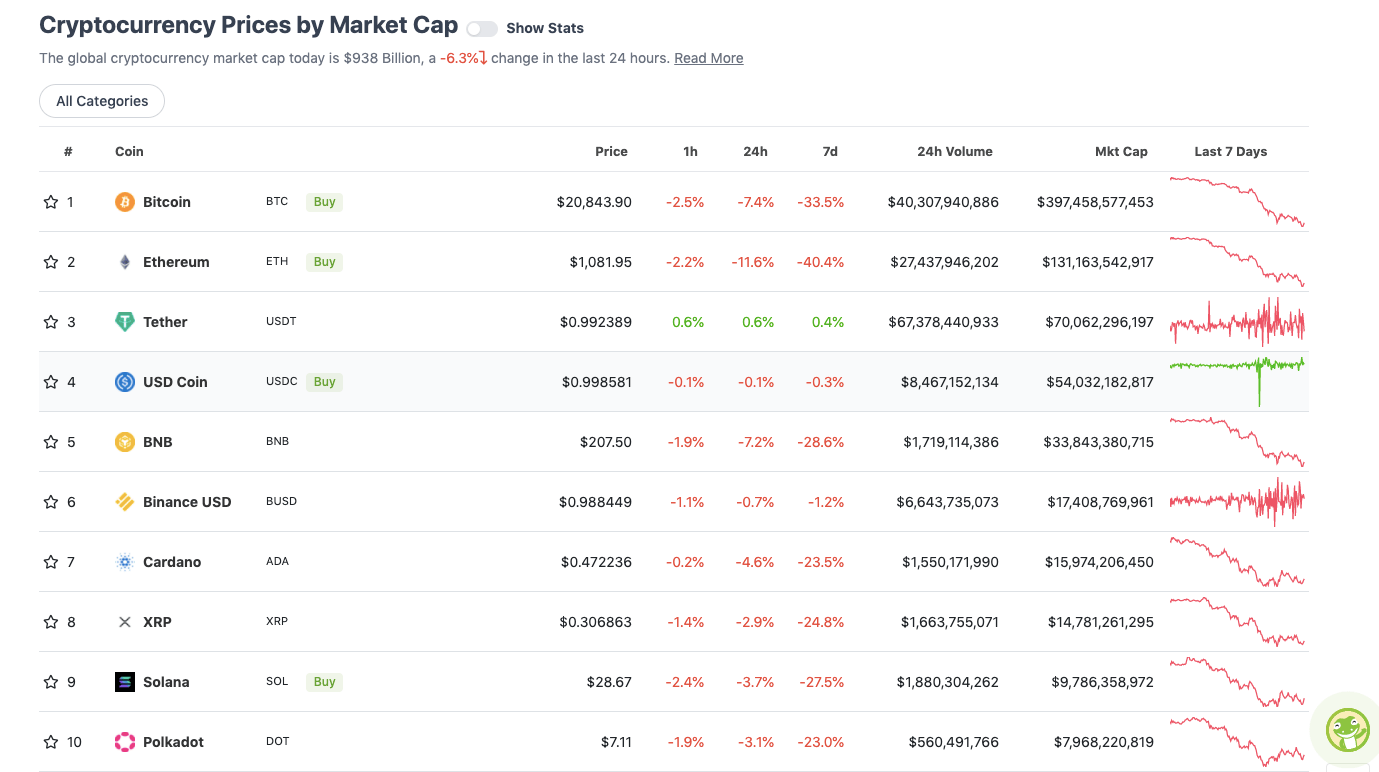

With the overall crypto market cap at roughly US$938 billion, down 6.3% since this time yesterday, here’s the current* state of play among top 10 tokens – according to CoinGecko.

Okay, did we call Ethereum (ETH) one of the two “safer” investment plays earlier? Sheesh, currently down 40% over the past week, it looks well on its way to Three Digit City.

Comments like this from independent Ethereum educator, angel investor and advisor Anthony Sassano aren’t too encouraging right now, either…

RIP guys – it's been fun – I am now bearish on ETH pic.twitter.com/aGkzgpthyl

— sassal.eth/acc 🦇🔊 (@sassal0x) June 15, 2022

… although he’s half joking, of course. We think.

But really, though, it’ll take a lot more than this to shake the Ethereum faithful out of the market. Ethheads tend to share the kind of thinking prominent Bitcoin investor and educator Anthony Pompliano has for the OG digi asset in this tweet…

There is no price that will shake my conviction.

Bitcoin's price has completely detached from the underlying value and adoption of the network.

Long-term investors obsess over value and durability. https://t.co/Ma3dHaWcAb

— Anthony Pompliano 🌪 (@APompliano) June 15, 2022

* (Note: this market update was put together before the Fed’s rate-hike announcement, which occurred at 4am AEST / 7pm BST. Bitcoin is now trading at US$21,900 as of 7.30am AEST / 10.30pm GMT. Ethereum is currently changing hands for US$1,194.)

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7 billion to about US$338 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS / BOULDER DODGERS

• Basic Attention Token (BAT), (market cap: US$466 million) +13%

• Chain (XCN), (mc: US$1.97 billion) +4%

• Cosmos Hub (ATOM), (mc: US$607 million) +1%

• PAX Gold (PAXG), (mc: US$1 billion) +0.5%

• Algorand (ALGO), (mc: US$1.16 billion) +0.2%

DAILY SLUMPERS

• DeFiChain (DFI), (mc: US$591 million) -15%

• NEXO (NEXO), (market cap: US$377 million) -14%

• Waves (WAVES), (mc: US$428 million) -13%

• Lido Staked Ether (STETH), (mc: US$4.32 billion) -12%

• ApeCoin (APE), (mc: US$931 million) -11%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

Price corrections are painful, but the big question for crypto is if the market itself stays healthy.

So far it has. It's normal to see high-risk firms punished in these conditions, but the market structure is handling the volatility well.

We've come a long way in a short time.

— Jake Chervinsky (@jchervinsky) June 15, 2022

💥BREAKING: #Bitcoin is technically oversold, says Fidelity

— Bitcoin Archive (@BTC_Archive) June 15, 2022

#Bitcoin is the only digital scarcity, backed by the world’s most secure computer network, and meets the fundamental need everyone has for a long term Store of Value. My conversation with @davidfaber, @michaelsantoli, & @carlquintanilla on @SquawkStreet. pic.twitter.com/ho7rEaHS1M

— Michael Saylor⚡️ (@saylor) June 15, 2022

And yep, this is the actor/comedian Jim Carrey, who’s currently dipping his creative toe into producing NFT-based artworks…

https://twitter.com/JimCarrey/status/1536799654171381760

…while fellow thespian Anthony Hopkins navigates the OpenSea to some Beeple digital works…

An old nerd lost in OpenSea 🤓 pic.twitter.com/4DtsiIhJPW

— Anthony Hopkins (@AnthonyHopkins) June 15, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.