Mooners and Shakers: SBF’s going ho-ho-home for Xmas, and Satoshi Nakamoto still nowhere to be found

Thanks heaps, mum and dad! I'll pay you back... honest! Pic via Getty Images.

OMG it’s the last Mooners and Shakers before Christmas! Huzzah!

Rob “Yeah, nah… I’m outta here” Badman is off on Christmas holidays today, so you’re stuck with me for today – but before he ducked out early, mumbling something about Christmas shopping and desperately needing to sleep, he left us all a Christmas gift which is an amazing read.

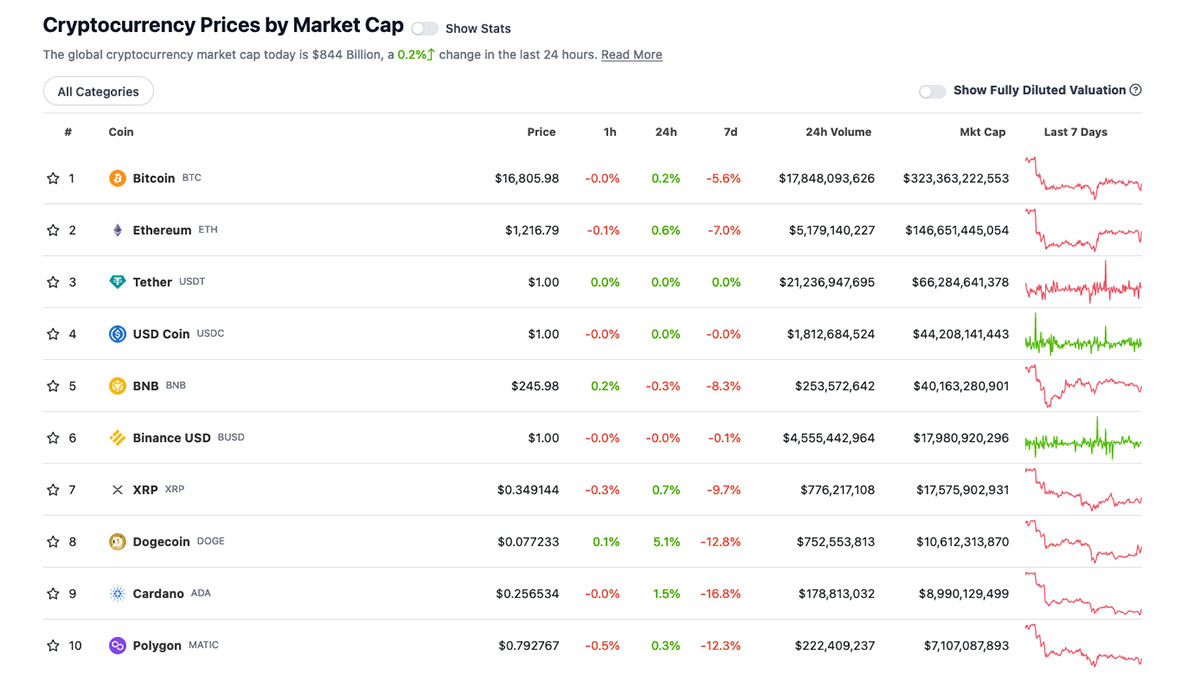

A quick look around shows that it’s been a reasonably quiet 24 hours for the majors in general. BTC and ETH are largely flat for the period, at +0.2% and +0.5% respectively, and the only big mover in the Top 10 today is Dogecoin, up 5.2%.

Here’s a quick snapshot of how abundantly awful Sam Bankman-Fried’s Christmas is going to be. Spoiler alert: he’s not going to spend it in a prison cell…

Now here’s me with the headlines:

SBF posts $375m bond to go ho-ho-home for Christmas

In a stroke of good fortune for Sam Bankman-Fried, the young fella will – officially – get to spend Christmas Day dealing with the disapproving stares of his relatives over the dinner table, after a judge allowed him to await trial in the US in the comfort of his parents’ home.

Prosecutor Nicolas Roos reportedly told Judge Gabriel Gorenstein that the government was prepared to let SBF out of prison on a bail package that included a record-high $375 million bond.

But before you ask the question that everybody is asking – “Where did a guy who quite famously lost billions of dollars find $375 million to pay for this?” – it’s not quite what it sounds like.

SBF is on what’s called a “recognisance bond”, which is a ‘for realsies, no cap, pinky swear, totally unbreakable promise’ that he’ll follow the rules of his bond, and show up in court… or he – more accurately, whoever signs the papers guaranteeing the bond – will have to cough up the cash.

In this case, that’s his parents – and they’ve offered up their Palo Alto home as collateral for now. So if SBF skips town, they are gonna be suuuuuper pissed with him.

The other restrictions are that the former FTX guru will be under home detention and have his location monitored 24 hours a day, presumably with one of those funky ankle bracelets. And he’s not allowed to spend more than $1,000 on anything other than defence lawyers (so no fancy Christmas presents for his folks this year).

Plus, he’s banned from starting a new business, and has had to surrender his passport; all of which the judge took into consideration when granting SBF’s supervised release.

“The defendant has achieved sufficient notoriety it would be impossible for him to continue financial transactions,” Judge Gorenstein said. “This notoriety also goes to risk of flight – he would be recognised – so I am going to permit release.”

Which means he won’t be waking up on Christmas morning with this guy in a prison cell…

Is the SEC gearing up to take down exchanges?

And still on the FTX tip, Decrypt is reporting that the SEC has started stockpiling legal arguments that could “take on the beating heart of the global crypto economy: centralised crypto exchanges”.

That theory comes as the US financial legal beagles stuck Caroline Ellison, former CEO of FTX’s affiliate trading firm Alameda Research, and Gary Wang, an FTX co-founder, with criminal charges for their alleged role in the FTX debacle.

In a blow to whatever possible defence SBF reckons he’s going to be able to mount against his own charges, both Ellison and Wang have reportedly already been slapped with charges by the Southern District of New York, pleaded guilty and are set to flip on SBF to cooperate with prosecutors.

And that’s on top of the pair being hit by the Commodities Futures Trading Commission (FTC) with a fraud complaint – going public with the information that both Ellison and Wang “do not contest their liability” for their role in what went on.

But it’s the SEC complaint, Decrypt says, that includes a few linguistic jabs that do sound quite a lot like the organisation is building up to something even bigger than just sending SBF and his mates to a minimum security farm upstate for the rest of their lives.

The SEC complaint “labeled FTT ‘an illiquid crypto asset security,’ making the subtle—but crucial—point that the SEC views FTT as a security in itself, regardless of the manner in which it was offered or sold,” Decrypt says.

It’s a subtle change in the language by the SEC that appears to be an escalation of efforts to regulate crypto entirely, as it essentially labels all crypto assets as securities in all contexts.

“If the SEC can get courts to agree that crypto tokens like FTT are securities regardless of how they are offered, the agency would be able to go after more than just the projects that create those tokens,” Decrypt says.

And that means major exchanges face a host of new problems – including being exposed to a range of fresh legal liabilities, and possibly staring down the barrel of being forced to operate under the umbrella of government regulated exchange practices, or shutting down entirely.

However this all pans out, the closing word on it for today goes to prosecutors from New York Southern District, who issued this stark warning to anyone else that was involved in the FTX collapse:

Statement of U.S. Attorney Damian Williams on U.S. v. Samuel Bankman-Fried, Caroline Ellison, and Gary Wang pic.twitter.com/u1y4cs3Koz

— US Attorney SDNY (@SDNYnews) December 22, 2022

It’s gonna be a fraught Christmas for quite a few people this year…

Is Wright giving up on his ‘Father of Crypto’ fight?

And, over at Coindesk, there’s a report that Australian computer whiz Craig Wright might be winding back his efforts to convince the world that he’s the apparently Japanese guy who invented Bitcoin.

I have been too angry for too long as I cared for external validation. That ends.

The only validation I seek now is from my family and from seeing my ideas come to fruition and to be used by the world.

Not everyone wants what I have to offer…

— Dr Craig S Wright (@Dr_CSWright) December 22, 2022

Publicly stating on Twitter that you’re no longer craving external validation seems a bit counterintuitive, but anyway…

Wright infamously claimed in 2016 that he was Satoshi Nakamoto, and promptly started firing lawsuits in all directions after being labelled a fraud by cypto heavyweight Magnus “Hodlnaught” Granath, and to fight – successfully – to have the Bitcoin white paper authored by Nakamoto taken down from the Bitcoin.org website with a copyright claim.

“Wright’s tweet thread followed the latest in a series of blows to his Bitcoin inventor claim, which he has thus far struggled to back up with concrete proof in the eyes of courts and much of the public,” Coindesk says.

“Just before Wright’s tweets, a judge unequivocally stated that “[i]t is important to be clear that Dr. Wright has not established that he is Satoshi” in the final judgement in a defamation case between Wright and podcast personality Peter McCormack.”

Has Wright run out of steam in his efforts to convince us all that he invented Bitcoin? Only time will tell… but it’s highly likely that this is just another small chapter in the utterly bizarre part of Bitcoin’s weird, weird history.

Top 10 overview

With the overall crypto market cap at US$845 Billion, up 0.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DAILY PUMPERS

- Terra Luna Classic (LUNC), (market cap: US$816 million) +6.4%

- Dogecoin (DOGE), (mc: US$10.6 billion) +4.9%

- Huobi (HT), (mc: US$885 million) +3.8%

- Axie Infinity (AXS), (mc: US$806 million) +3.6%

- OKC (OKT), (mc: US$443 million) +3.5%

DAILY SLUMPERS

- Foncoin (FIL), (market cap: US$3.46 billion) -6.0%

- Frax Share (FXS), (market cap: US$337 million) -5.8%

- Chain (XCN), (mc: US$419 million) -4.8%

- Zcash (ZEC), (mc: US$515 million) -4.5%

- Lido DAO (LDO), (mc: US$740 million) -4.2%

(Stats accurate at time of publishing, based on CoinGecko.com data.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.