Mooners and Shakers: US jobs report could spark crypto move; Big banks ‘ready to flood in’: analyst

Getty Images

Bitcoin has dipped below US$20k again at the time of writing, but a huge move (one way or another) could be imminent for the stocks and crypto markets due to Friday’s US jobs report.

Meanwhile, certain prominent financial analysts are again forecasting big potential for positive Bitcoin and crypto price action, with the right regulatory conditions.

But first, the US jobs report (set to land at about 11.30pm AEDT) – why is everyone eyeing this all of a sudden? To be very simplistic about it, a slowdown of jobs – a weak jobs report – might be bad for unemployment figures in the US, but it could actually be a boon for stock markets and crypto.

And why is that? Some analysts are predicting the US Federal Reserve could begin a softer stance on its inflation fighting if it sees job health in the US is affected, which would see unemployment figures rise. A “dovish” Fed would likely see a stock market turnaround to the upside.

According to FactSet, economists are expecting an increase of 250,000 jobs in September, which would be a slowdown from the 315,000 reported in August – in other words, a weaker data report. Bad for those looking for work in the US, good for markets. It’s a weird world.

Friday's US jobs report will be a big deal. If jobs are down then "the markets" will react positively, if jobs are up they will go down. That's because the stock market is looking for the effect these numbers will have on the policy of the Fed.

— lines down @linesdown.bsky.social (@lines_down) October 6, 2022

Banks ready to flood in, but key is regulation

Meanwhile David Mercer, the CEO of large, London-based institutional exchange LMAX Group had a bullish-headline-inducing conversation with investor and YouTuber Anthony Pompliano this week.

Bullish, with the condition that US and global crypto regulations must be sorted with full clarity.

“It’s just a fact that the biggest [financial] organisations across the globe need that regulatory determinator,” said Mercer. “They need [to know] the rules of the game, so they can add to the value of the game.”

He added: “But, what I’d say is… get ready everyone… because they’re readying themselves… I can name probably six of the largest banks in the world that, if and when they get the green for go sign, I think they can be active throughout all the markets in crypto within a month.”

I spoke with @mercerdavid, who runs LMAX Group – one of the largest institutional exchanges in the world.

He says that conviction has never been higher in the institutional world for bitcoin and cryptocurrencies.

WATCH: https://t.co/iSax1j869X pic.twitter.com/FFaUgQJDUZ

— Anthony Pompliano 🌪 (@APompliano) October 5, 2022

Mercer did caveat that although he thinks big banks are prepared now, he predicts “the floodgates” to truly open into crypto in either 2023 or 2024.

“If I had to bet, then the floodgates to true institutionalisation of crypto will be 2024… and the key will be regulation.”

‘Bitcoin and Ethereum to outperform’: Mike McGlone

Want a more imminent prediction that aligns with that potential weakening US jobs data? Then Bloomberg’s senior commodity strategist Mike McGlone is your man.

Along with gold, he’s once again this week highlighted Bitcoin and Ethereum as go-to assets for the remainder of the year.

In an October 5 Bloomberg Crypto Outlook report, McGlone wrote: “When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum, and the Bloomberg Galaxy Crypto Index to outperform most major assets.”

The analyst also suggested that, after some low volatility seen in September and a potential peak in commodity prices, the second half of 2022 could see BTC “shift toward becoming a risk-off asset, like gold and US Treasury’s”.

Onto some daily crypto price action.

Top 10 overview

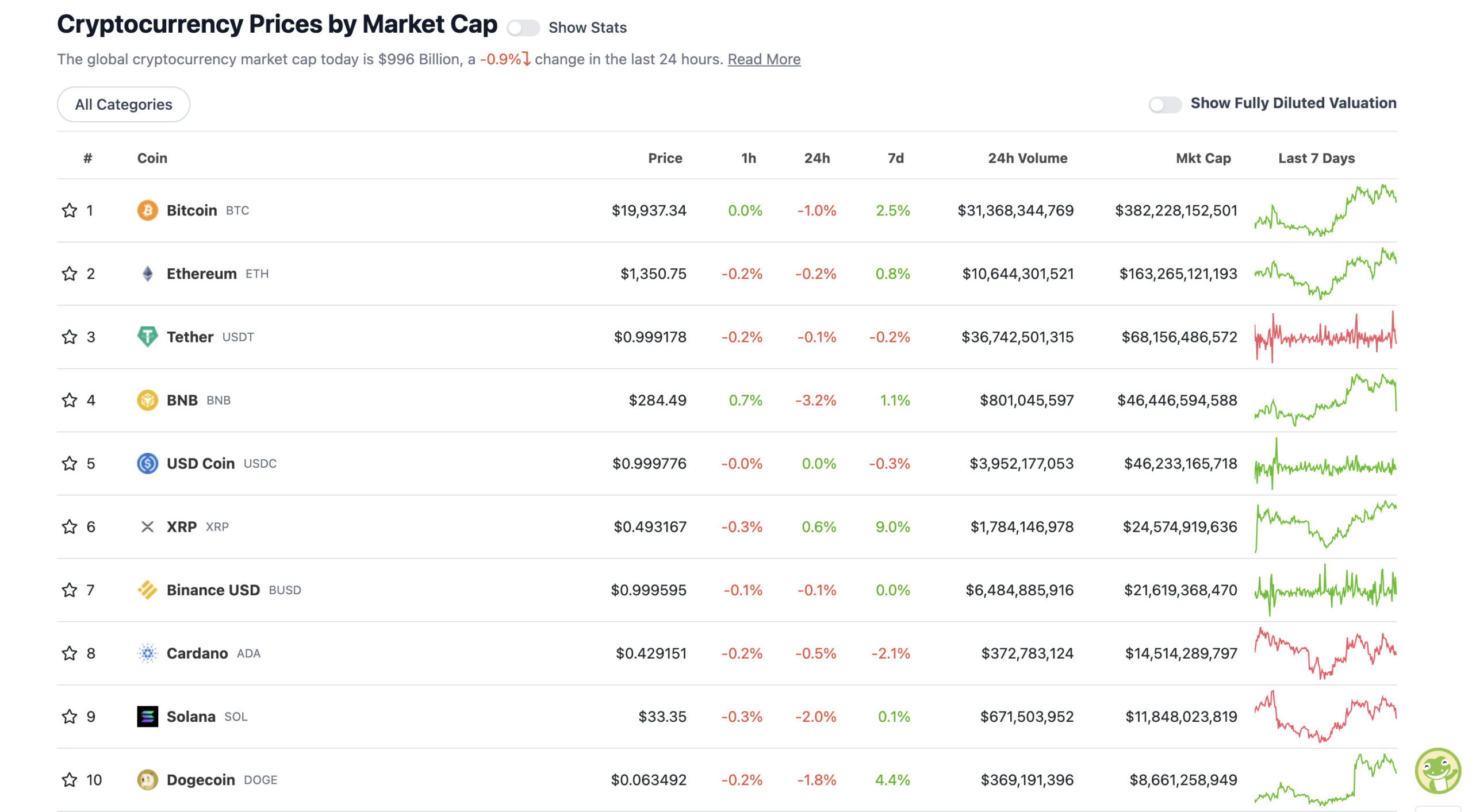

With the overall crypto market cap at US$996 billion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Is this the calm before the US jobs-market-data storm? Yes, it very likely is. Not much movement here at all in the crypto majors over the past 24 hours. (That said, news JUST in – the Binance Smart Chain and its BNB token have just experienced a pretty big breach by the sounds. Maybe more than half a billion, US. See “Around the blocks” further below for related tweets.)

XRP and DOGE, however, are still the biggest gainers on the weekly timeframe in the top 10 crypto assets by market cap. The former based on hope and positive developments surrounding its legal battle with the SEC, and the latter – three words: Elon. Musk. Twitter.

Here’s some tongue-in-cheek searing analysis on Bitcoin’s price action at the moment from “Dr Jeff Ross” of US-based hedge fund Vailshire Capital Management:

https://twitter.com/VailshireCap/status/1578143525144694784

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.34 billion to about US$402 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Ravencoin (RVN), (market cap: US$426 million) +5%

• XDC Network (XDC), (mc: US$429 million) +5%

• Tokenize Xchange (TKX), (mc: US$864 million) +3%

• Elrond (EGLD), (mc: US$1.3 billion) +2%

• Monero (XMR), (mc: US$2.7 billion) +2%

DAILY SLUMPERS

• Celsius (CEL), (market cap: US$645 million) -19%

• Helium (HNT), (mc: US$662 million) -10%

• Terra Luna Classic (LUNC), (mc: US$1.98 billion) -5%

• Arweave (AR), (mc: US$457 million) -4%

• Synthetix (SNX), (mc: US$540 million) -3%

Around the blocks: just in – Binance blockchain paused?

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

US Trader/analyst John Wick (aka ZeroHedge) has taken time out again from stabbing bad guys with a pencil to give his thoughts on patient investing. Yes, there’s positive sentiment forming in the crypto market this week, but bears still roam. He’s crystal balling lower prices yet, which he views as the “opportunity of a lifetime”.

I see a scenario where #BTC is possibly much much lower.

Those that wait, and are patient might get the opportunity of a life time. But that is not now.

Imo buy now and regret it later.

— Wick (@ZeroHedge_) October 6, 2022

“Crypto Ricardo” has an interesting Bitcoin-buying strategy, though, that’s based purely on the market’s leading sentiment tracker – the Bitcoin/Crypto Fear & Greed Index.

https://twitter.com/Crypt0Ricard0/status/1560855927963746311

It’s certainly been in a “buy” zone for him lately. That said, the current reading is 23. It’s still “Extreme Fear”, though, so wonder if he’s actually prepared to dollar cost average in slightly above his “small buy” target of a 20 reading.

Meanwhile…

BREAKING: 🇪🇺 EU has confirmed a total ban on providing crypto-custody and payment services to Russians. 🤔

— Bitcoin Archive (@BTC_Archive) October 6, 2022

And this, regarding BNB and the Binance BSC blockchain… yikes:

somebody on BNB just got hacked for ~2 million BNB ($600 million USD)

the attacker is spewing funds across liquidity pools and utilizing every bridge they can to get to safer chains

complete chaos on the chain

— foobar | Clusters (@0xfoobar) October 6, 2022

Why doesn’t anything exciting like this happen directly to the #Bitcoin protocol? I feel left out 😩😉😅 https://t.co/6HmUKrDq5L

— Lord Fusitu'a (@LordFusitua) October 7, 2022

When you’re teaching a class full of NFT degens pic.twitter.com/vVr9nkKimP

— Alan Carroll (@alancarroII) October 6, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.