Mooners and Shakers: SBF banged up in notorious prison; Fed slows rate hikes; Bitcoin… as you were

A running tally of the billions FTX owes creditors. Possibly. (Getty Images)

Bitcoin and the rest of the crypto market made moves early this morning AEDT based on the US Fed’s latest actions. A handful of hours later, prices are pretty much back where they were. Meanwhile, SBF is in prison. A really crappy one.

Woke up this morning expecting the crypto portfolio (BTC and ETH, mainly) to have done one of two things. Pumped or dumped on the Fed rate-hike news. It did the third thing – pretty circling right back to where it was left the night before.

Of course, Bitcoin (BTC) swung violently up and down in between. If only we could think of some sort of theme-park ride analogy to describe the market.

You probably know by now that, based on this week’s cooler than expected US CPI data, the Fed has now slowed its rate-hiking to 50bps. The markets digged that. Then, like last month, shortly after making that announcement, Powell’s follow-up speech threw cold water on much of the initial exuberance.

“Fifty basis points is still a historically large increase and we still have some ways to go,” Powell said at his presser conference following the FOMC statement.

Still, all in all, it’s not a terrible result this time around for markets. Yeah, it’s not a “pivot” per se, but this slowdown is something to perhaps attach some vague hopium to for a potential change of Fed tack some time next year.

Fed 2021: Inflation is going up let's keep printing

Fed now: Inflation is dropping let's keep hiking— Sven Henrich (@NorthmanTrader) December 14, 2022

The crypto market still has lingering fears, however, about contagion risk related to the FTX implosion, including the odd concern being pushed here and there about fellow exchange giant Binance’s reserves and stability.

Binance has been hit by a slew of large withdrawals from its global exchange over the past week, as its highly Twitter-active CEO, CZ, moves to allay fears.

Still, never mind. Jim Cramer over at CNBC isn’t concerned about that. Which means we’re good, right?

https://twitter.com/BowTiedBroke/status/1603027179306192899

Binance had a great run pic.twitter.com/L1SQcWejyZ

— Inverse Cramer (@CramerTracker) December 14, 2022

SBF update: It’s Fox Hill hell for the FTX founder

So, Sam Bankman-Fried, the disgraced FTX founder and former CEO, is currently spending time in Bahmaian prison Fox Hill, after being denied bail. He, and his legal team, will attempt to fight his extradition to the US but he could be banged up until February 8.

He’s apparently being held in the medical wing of the facility for the moment, but overall, the place, which is the only jail in the Bahamas, has a shocking reputation.

Bankman-Fried’s mother audibly laughed several times when her son was referred to as a “fugitive” and his father occasionally put his fingers in his ears as if to drown out the sound of the proceedings.

Bizarre https://t.co/WES1KpKMbf pic.twitter.com/wPXW9yhis7

— db (@tier10k) December 13, 2022

FTX UPDATE: SBF leaves Magistrate’s court. He will be remanded to The Bahamas Department of Corrections until his matter resumes on Feb 8, 2023. pic.twitter.com/dqXsHeNXSK

— Eyewitness News Bahamas (@ewnewsbahamas) December 13, 2022

According to a 2021 human rights report from the US State Department, conditions at Fox Hill were “harsh” due to “overcrowding, poor nutrition, inadequate sanitation, and inadequate medical care”.

We’re talking rat and insect infestations, maggots, inmates sleeping on the concrete floors due to a lack of beds, physical abuse from correctional officers.

For SBF’s sake, let’s hope none of those officers had crypto funds locked up on the FTX exchange. (And if we were to express that sentiment on vitriol-filled Crypto Twitter right now, it’d probably be a controversial take.)

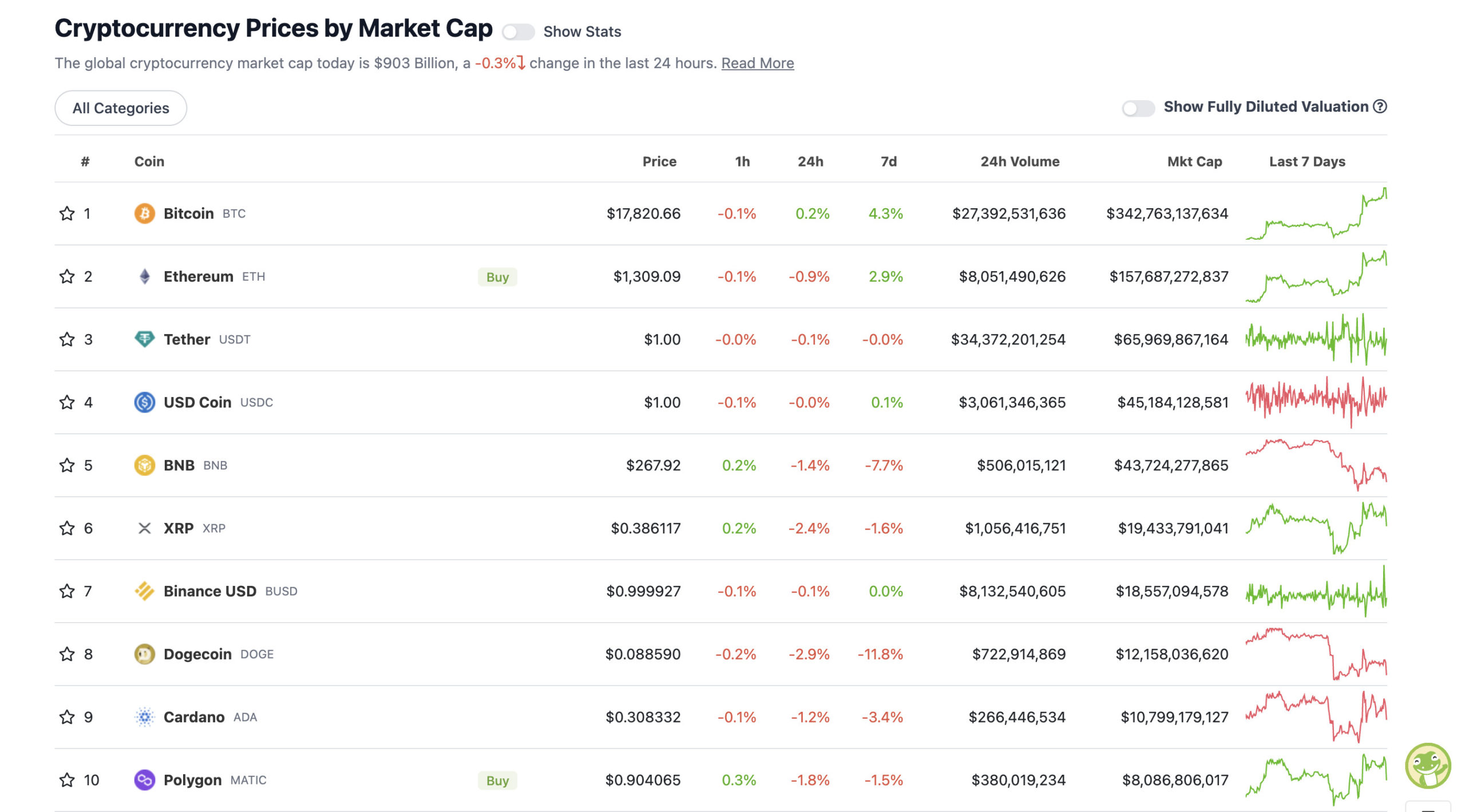

Top 10 overview

With the overall crypto market cap at US$903 billion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.1 billion to about US$330 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Toncoin (TON), (market cap: US$3.6 billion) +5%

• THORChain (RUNE), (mc: US$442 million) +4%

• Solana (SOL), (mc: US$5.2 billion) +3%

• TRON (TRX), (mc: US$5.1 billion) +2%

• Quant (QNT), (mc: US$1.8 billion) +2%

DAILY SLUMPERS

• Stacks (STX), (market cap: US$374 million) -8%

• Klaytn (KLAY), (market cap: US$542 million) -4%

• Fantom (FTM), (mc: US$609 million) -4%

• Internet Computer (ICP), (mc: US$1.1 billion) -4%

• IOTA (MIOTA), (mc: US$545 million) -4%

Around the blocks

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Excessive pessimism reaches new highs. Small traders are max bidding puts. What will happen to all these poorly positioned traders if continue to squeeze a little higher? Yes, that's right. pic.twitter.com/cCKWGRHKlo

— Charles Edwards (@caprioleio) December 14, 2022

I asked @cz_binance about what's next for @binance's proof-of-reserve (PoR) system.

CZ: "I do expect over the next couple of weeks we will see more [tokens being added to PoR]."

Listen to (or read) his entire answer below👇

— Matt Willemsen (@matt_willemsen) December 14, 2022

Optimism Airdrop Guide v2

People earned up to $50k from the first Optimism airdrop and v2 will be even bigger

– Quick guide to get the highest amount of $OP tokens from the v2 airdrop

Let’s dive in 👇 pic.twitter.com/HulSGzBzRF

— Corleone (@corleonescrypto) December 14, 2022

Since Nov 2021, $2.2 trillion has been wiped from the total crypto market cap.

An industry worth $3 trillion in 2021 is $800 billion today.

Even if we go back to previous ATHs, a small investment here can turn into massive returns.

Keep stacking those blue-chip assets 💰

— Ben Simpson (@bensimpsonau) December 15, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.