Mooners and Shakers: Bitcoin rallies on inflation data and SBF arrest; Binance fears swirl

Getty Images

Bitcoin and crypto have pumped overnight (AEDT) on the SBF arrest news and lower-than-expected US CPI inflation data. Meanwhile, Binance is dealing with no small amount of FUD.

(Fear, Uncertainty and Doubt, if you didn’t know.)

At the time of writing, BTC is taking a breather and collecting its thoughts around US$17,760, having just about hit $18k in the wee hours.

Is that where the rally stops? Maybe, maybe not. The Fed’s interest-rate-hiking reaction is up next, so stay alert for that. Some think Jerome Powell and co will soften, others think they’ll stay hard.

And either way, when we put it like that, it doesn’t quite bear thinking about.

https://twitter.com/VailshireCap/status/1602657995326124032

‘Fraud in T-shirts and shorts in the sun’

Here’s something the market seems to be morbidly enjoying today – the arrest in the Bahamas of disgraced/embattled/right royally screwed former FTX CEO and video game addict, Sam Bankman-Fried (aka SBF).

US federal agencies have levelled SBF with a slew of charges, including wire fraud, conspiracy to commit money laundering, securities fraud and conspiracy to violate campaign finance laws.

As Stockhead‘s Christian “International Man of Mystery” Edwards reports from Limoges, France, (which we have reason to believe SEC chairman Gary Gensler might have once looked at on a map):

The US Securities and Exchange Commission (SEC) has charged Samuel Bankman-Fried overnight with defrauding a stack of crypto investors out of a stack of money from his self-immolating Asset Trading Platform FTX.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” said Gensler.

https://twitter.com/BitcoinMagazine/status/1602642311439073280

Market pumping as it realizes the guy who was paper-selling all the coins is now locked up

— Will (@WClementeIII) December 13, 2022

Here are some other choice quotes surrounding this developing sh*tstorm for SBF, that, provided he is successfully extradited to the US, might well see him banged up somewhere unpleasant with crap food and no access to League of Legends for rather a long time.

• “You can commit fraud in shorts and T-shirts in the sun” – Damian Williams, United States Attorney for the Southern District of New York.

• “He preyed on his customers, the victims of this case, abusing the trust placed not only in his company but in himself as the lead of that company” – FBI assistant director in charge of the SBF indictment case, Michael Driscoll.

• “The defendant concealed his diversion of FTX customers’ funds to crypto trading firm Alameda Research while raising more than $1.8 billion from investors” – the SEC again.

— Daniel Sempere Pico (@BTCGandalf) December 13, 2022

SBF enjoying his pool one last time pic.twitter.com/s2BnyDipP4

— LilMoonLambo (@LilMoonLambo) December 13, 2022

And, now, squeezing itself next to the SEC in the outraged litigation stakes, the US CFTC (Commodity Futures Trading Commission) has also filed a lawsuit against SBF and his companies FTX and Alameda Research.

The lawsuit claims that “at Bankman-Fried’s direction, FTX executives created features in the underlying code for FTX that allowed Alameda to maintain an essentially unlimited line of credit on FTX”.

The extradition process to bring SBF Stateside could apparently take several weeks, former federal prosecutor Renato Mariotti told CNBC in an interview.

Meanwhile, what’s going on with Binance?

Is another massive crypto-exchange bank run on the cards? There’s a lot of fear, uncertainty and doubt circulating at the moment about the world’s biggest crypto exchange by trading volume.

If you think there’s doom and gloom around crypto now, a major player such as Binance or Tether or Coinbase collapsing (and we’re not saying they are or will) would be nothing short of cataclysmic.

There’d still be plenty calling to BTFD on Bitcoin, though.

If Binance goes down it won't do any good for this space. Back to the stone age. Binance is my #1 exchange. I believe that Binance is fine and this is a coordinated FUD campaign operated by entity that wants crypto to fail.

— Crypto Cognac (@CognacCrypto) December 13, 2022

According to Cointelegraph (and Binance CEO CZ, actually) Binance saw outflows of more than US$1.14 billion in just one day. It’s not completely clear, but judging by CZ’s tweet (see further below), that took place on either December 12 or 13.

What is clear, however, is that over the past seven days, per blockchain analytics firm Nansen, the exchange giant saw more than US$8.78 billion leave its exchange and US$5.1 billion in incoming funds, realising a net outflow of about US$3.66 billion. Hefty.

Binance Netflow 7D ($) -3,660,311,347

8,783,380,428 – Outflow

5,123,069,081 – InflowExchange Flows dashboard ⤵️https://t.co/CYrBQLryQ0 pic.twitter.com/vV6vcqoWKK

— Nansen 🧭 (@nansen_ai) December 13, 2022

This can be partly put down to the negative sentiment about centralised crypto exchanges in general, ever since FTX imploded.

But also, more specifically, it might be attributed to dim perceptions of Binance’s “proof of reserves” audit – disparaged by the likes of former SEC regulator John Reed Stark, who recently called it a “red flag”, adding that the Binance report:

“…doesn’t address the effectiveness of internal financial controls” nor “express an opinion or assurance conclusion,” adding that it fails to “vouch for the numbers.”

This may well end up being a storm in a teacup, and for the crypto market’s sake, hopefully so.

CZ, meanwhile, is equating the hefty withdrawals from the exchange to a “stress test”.

We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us.

I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 💪

— CZ 🔶 BNB (@cz_binance) December 13, 2022

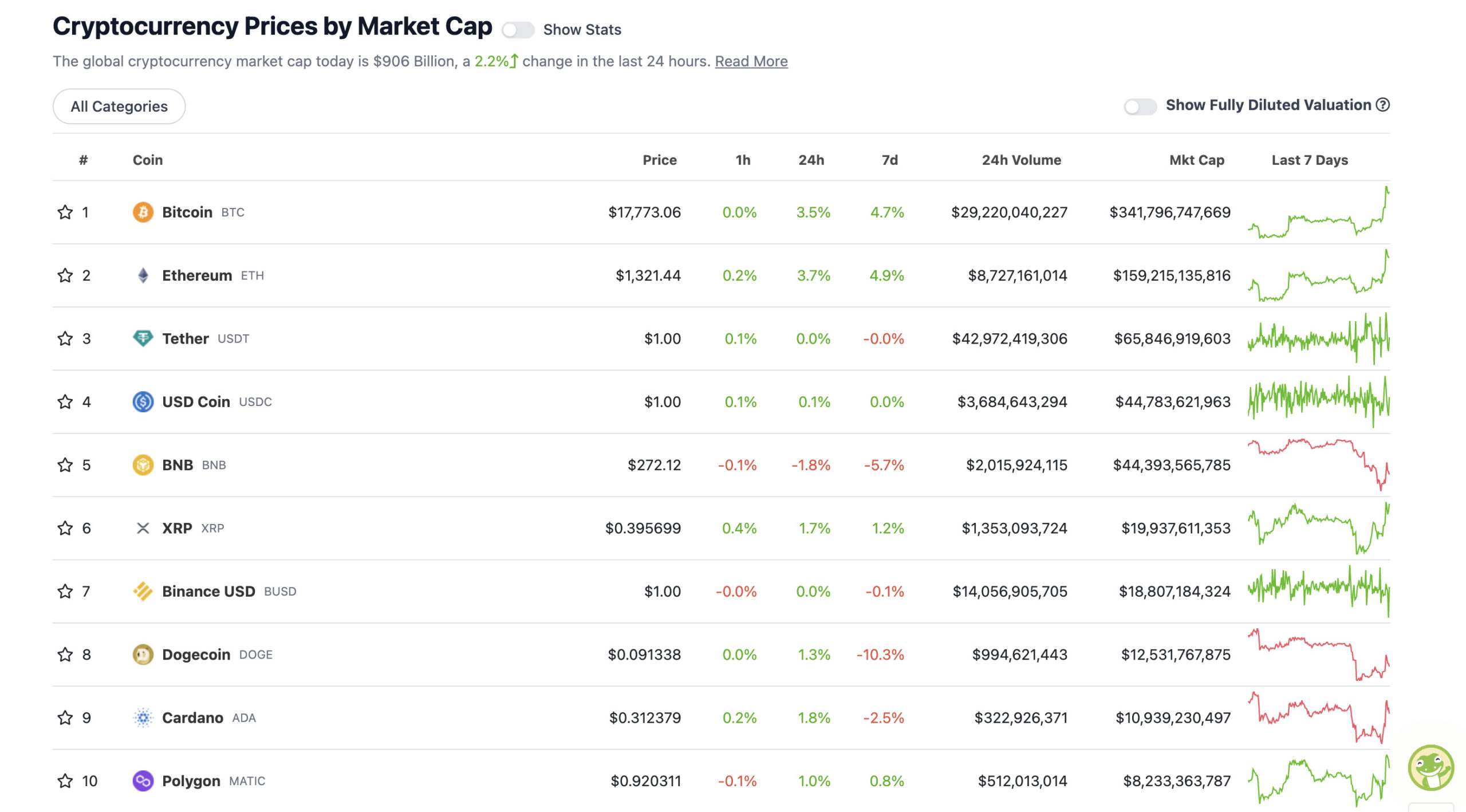

Top 10 overview

With the overall crypto market cap at US$906 billion, up about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Because major crypto exchange dramas are dominating just about all crypto news at the moment, it’s relieving to see a sea of green in the crypto majors today.

Time will tell if the Fed keeps it rolling or initiates another bloodbath. (Not much time, mind – Powell’s speech is happening around 2pm ET Dec 14, which is 6am AEDT on Thursday.)

The usual conjecture and difference of opinions abound on Twitter:

Why the Fed will cut rates again in one simple chart.

Because it has to.#math pic.twitter.com/S2uOKBZpJ0

— Sven Henrich (@NorthmanTrader) December 13, 2022

FOMC tomorrow. Make no mistake, the Fed does not want to see markets rally.

Yes, inflation is trending lower, but an overexuberant stock market heading into 2023 threatens that trend.

The higher stocks trade today, the more likely Powell will try to talk them down tomorrow.

— Justin Bennett (@JustinBennettFX) December 13, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.27 billion to about US$338 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• OKC (OKT), (market cap: US$422 million) +20%

• Toncoin (TON), (mc: US$3.4 billion) +13%

• OKB (OKB), (mc: US$5.7 billion) +8%

• Fantom (FTM), (mc: US$635 million) +7%

• Lido DAO (LDO), (mc: US$913 million) +6%

DAILY SLUMPERS

• GMX (GMX), (market cap: US$445 million) -9%

• ApeCoin (APE), (market cap: US$1.46 billion) -7%

• Trust Wallet (TWT), (mc: US$931 million) -5%

• Stacks (STX), (mc: US$405 million) -3%

• Chain (XCN), (mc: US$757 million) -3%

Around the blocks

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Bitcoin loves justice. This is a major turning point. Now that the SEC has labelled SBF a fraud, the industry has a clear pathway to washout the corruption. All platforms are working at breakneck pace to prove their legitimacy. Peak fear. Peak value. Time to rinse the negativity.

— Charles Edwards (@caprioleio) December 13, 2022

NEW: Goldman Sachs says Gold will outperform #Bitcoin over long-term.

Sure bro…

— Bitcoin Archive (@BTC_Archive) December 13, 2022

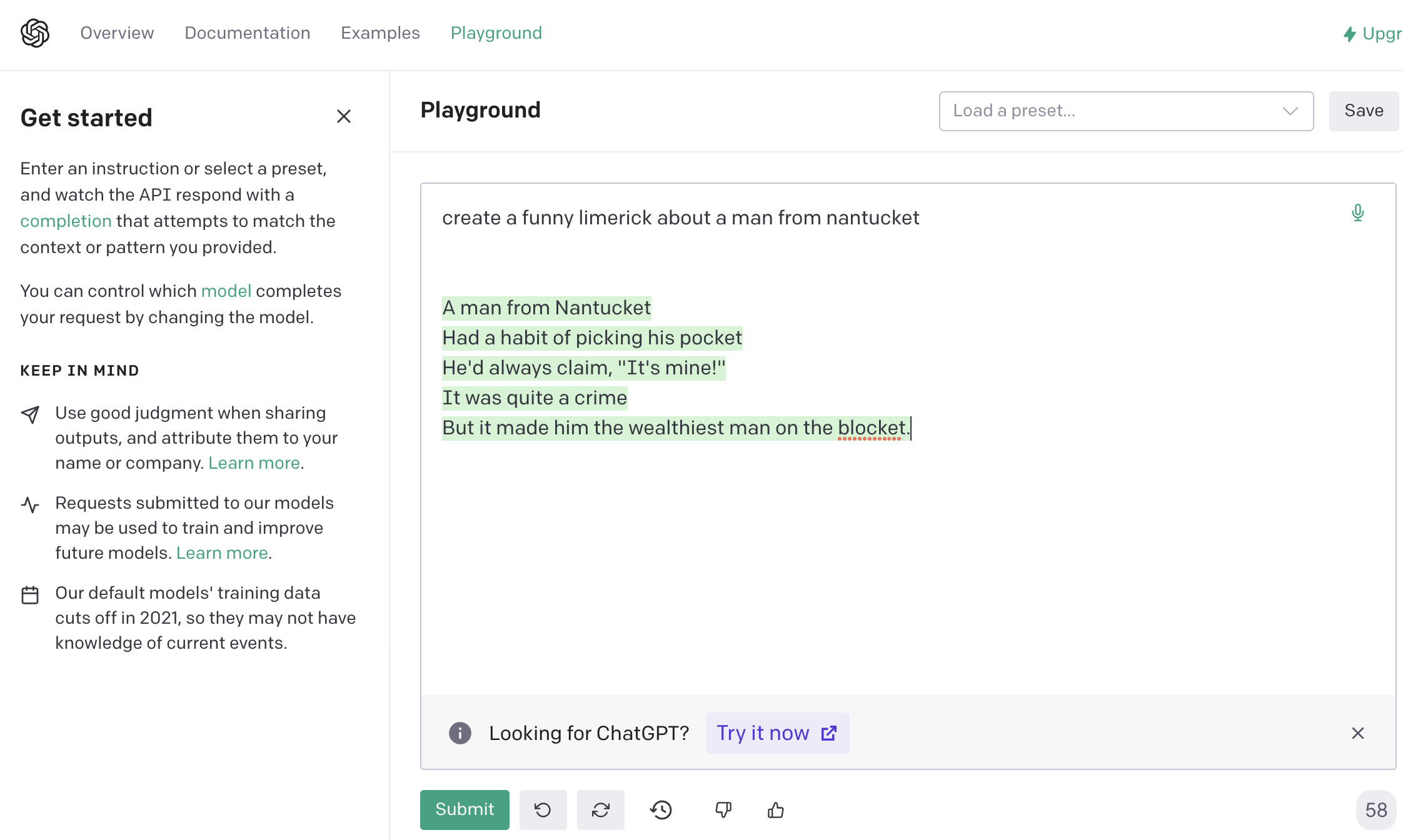

Something to finish on. Worried about AI stealing your job any time soon? Here’s a take from Collective Shift’s Aaron Berghuber.

“When it comes to AI, I firmly believe that it will not replace humans. But humans utilising AI will replace those that do not.”

NEW PODCAST 🚨

📲 How We Use ChatGPT & AI In Our Business

🕶 What are @nounsdao doing with over $30M in ETH?

🫡 Actionable mental frameworks to make life easierhttps://t.co/lsuox2CBHj pic.twitter.com/uBtkMqKFcJ— Ben Simpson (@bensimpsonau) December 13, 2022

Noted. We’d best get ahead of it, then. Here’s our first attempt:

This Coinhead job is safe for a few more months yet. Probably.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.