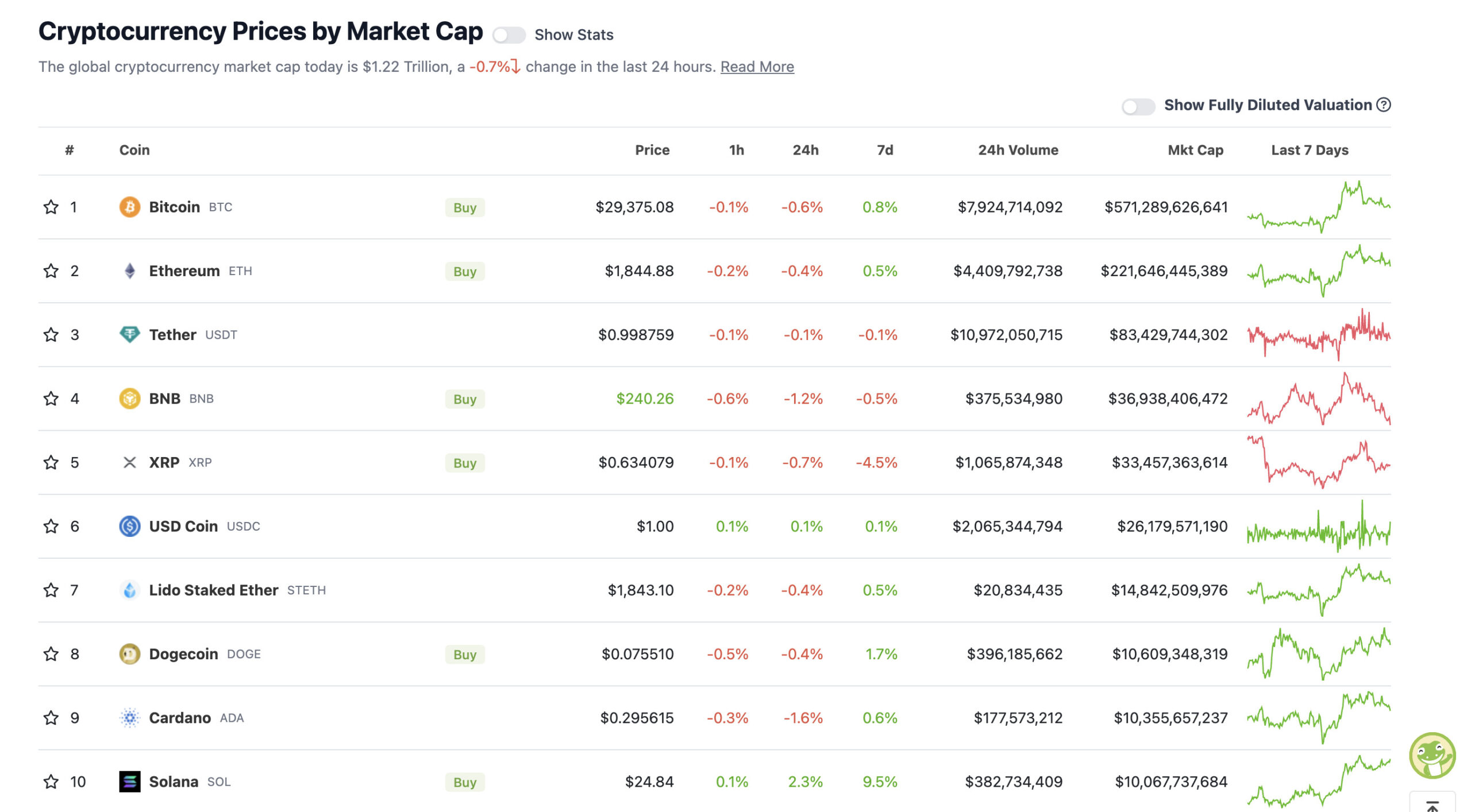

With the overall crypto market cap at US$1.22 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Mooners and Shakers: Room temperature US inflation data affects Bitcoin in (shock) no way at all

Getty Images

The US CPI inflation figures markets were sweating on came in cool-ish – perhaps sitting just around a comfortable room temperature.

And, for crypto, the survey says… not much. Somebody poke Bitcoin with a stick, because this is getting boring.

As our very own non-fungible Eddy “Market Highlights” Sunarto reported earlier:

“US inflation rose by a tamed 0.2% in July, and 3.2% from a year earlier. This was the first time inflation has risen in the US after 12 straight months of declines, but housing and used car prices have cooled down.”

“It doesn’t seem likely that we will see a re-acceleration with prices, given the weakening labor market and as lending takes a hit,” said Oanda analyst, Edward Moya.

“Wall Street remains optimistic that the Fed won’t need to raise rates in September.”

BREAKING: CPI expectations 3.3%, reality is that we hit 3.2%.

Core CPI 4.7% instead of 4.8% expected.

Unemployment claims also rallying to 248K.

This means, no fear, but continuation.

I'm buying. #bitcoin

— Michaël van de Poppe (@CryptoMichNL) August 10, 2023

So then, Bitcoin is still sailing up the middle of the US$29k-$30k channel, chilling to some music, sipping a beer, taking in the view and not doing much at all.

In actual fact, boring sideways ranging works just fine for those set on accumulating BTC and other cryptos before what many a crypto head predicts will be a more explosive year in 2024.

And those predictions are largely based around the Bitcoin halving narrative, which is set to take place early in Q2, but also around hopium for a spot BTC ETF approval.

The wildcard in that perfect storm, however, (aside from the chance Gary Gensler decides not to approve a single ETF) is the US election.

The current administration hasn’t looked upon the crypto industry too favourably, to say the least, with some prominent Democrats (Elizabeth Warren, Brad Sherman and others) openly hostile.

Plenty of Republicans on the other hand, (Tom Emmer, Patrick McHenry, Cynthia Lummis for example) are fighting the Bitcoin and crypto corner.

It almost feels like a partisan issue, but it’s more complicated or grey than that. There are crypto lovers and haters on both sides of the American political corridor and confusion and buffoonery just about everywhere you turn.

Top 10 overview

So, yep, we’re crawling into the weekend. But at least it’s not all dumping at this point, right?

In actual fact, we’re led to believe (from various X-housed crypto analysts) that technical support for BTC right now is closer to US$28k, so a short turn further south wouldn’t surprise at all.

$BTC 1D

Still thinking we see 28k before a bounce to 32k or higher.

Really liking PA here as it isn’t showing downtrend continuation.

Still waiting for a reversal pattern before I enter any longs.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/a27WIrxJmN

— Roman (@Roman_Trading) August 10, 2023

At least Ethereum rival Solana is up decently in the majors today, though. Perhaps more institutional investors have been piling in…

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$621 million) +23%

• XDC Network (XDC), (market cap: US$946 million) +10%

• Rocket Pool (RPL), (market cap: US$559 million) +5%

• Maker (MKR), (market cap: US$1.13 billion) +4%

• Shiba Inu (SHIB), (market cap: US$5.84 billion) +3%

SLUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$861 million) -9%

• FLEX Coin (FLEX), (market cap: US$721 million) -8%

• GMX (GMX), (market cap: US$428 million) -5%

• Hedera (HBAR), (market cap: US$1.88 billion) -4%

• Aptos (APT), (market cap: US$1.57 billion) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Earlier, Eddy mentioned this:

“US watchdog SEC is about to announce a crucial decision concerning Bitcoin ETFs later today (US time).

“Major asset managers of the likes of BlackRock, Bitwise, Van Eck, are currently seeking approval for their respective Bitcoin ETFs.”

It may or may not prove to be crucial, but Cathie Wood’s Ark Invest (in cahoots with 21Shares) is in the running for a spot BTC ETF in the States, and its second deadline is due.

It’s highly likely Gary Gensler will shift the filing back under the lunch menu atop his in-tray and just delay, delay, delay as long as he can before BlackRock’s Larry Fink calls him up with “Gazza… mate… we need to talk.”

TIMELINE: I've had questions in DMs and mentions over the last few days. The next SEC deadline for #Bitcoin ETFs is @ARKInvest/@21co__'s on 8/13. That's a Sunday so we should see a decision by tomorrow. My bet is after market close tomorrow. We are fully expecting a DELAY. pic.twitter.com/meejrBZaQp

— James Seyffart (@JSeyff) August 10, 2023

Meanwhile, The SEC is involved elsewhere in the cryptoverse Gensler hates so much, planning to appeal the recent court decision that went in Ripple’s favour. The one that classified XRP as not a security.

Pro Ripple lawyer bloke John Deaton seems confident that the regulator will fail in its appeal.

The SEC argues that Torres’ ruling could impact its other lawsuits, which are of similar nature. This is the weakest of the SEC’s arguments IMO. In fact, the Rakoff decision in Terra proves the argument fails. A District Court Jude can clearly distinguish the Torres ruling on… https://t.co/OR7D4EQKoH

— John E Deaton (@JohnEDeaton1) August 10, 2023

#BTC still holding just above the ~$29250 level after experiencing a strong rejection most recently

Can $BTC hold here until the end of the week, in time for the Weekly Close?#Crypto #Bitcoin pic.twitter.com/wcreqGkTbT

— Rekt Capital (@rektcapital) August 10, 2023

Meanwhile, hmm… the banking caution in Australia regarding crypto exchanges is still prevalent and causing a bit of a stir here and there…

Errr… Cuscal is who we (Aussie Exchanges) all bank with. If I am reading this correctly soon Australians will be limited to $10 000 deposits per month across the board for all exchanges. pic.twitter.com/yK0g9wOHhS

— Daniel Wilczynski (@danWilcz) August 10, 2023

The amount of messages and comments I received on this has been huge.

Crazy to hear how many people have been affected by this already.

We won't lie down.

We will push on.https://t.co/lEDxwXRmZs pic.twitter.com/QxkqgsnI8h

— Ben Simpson (@bensimpsonau) August 7, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.