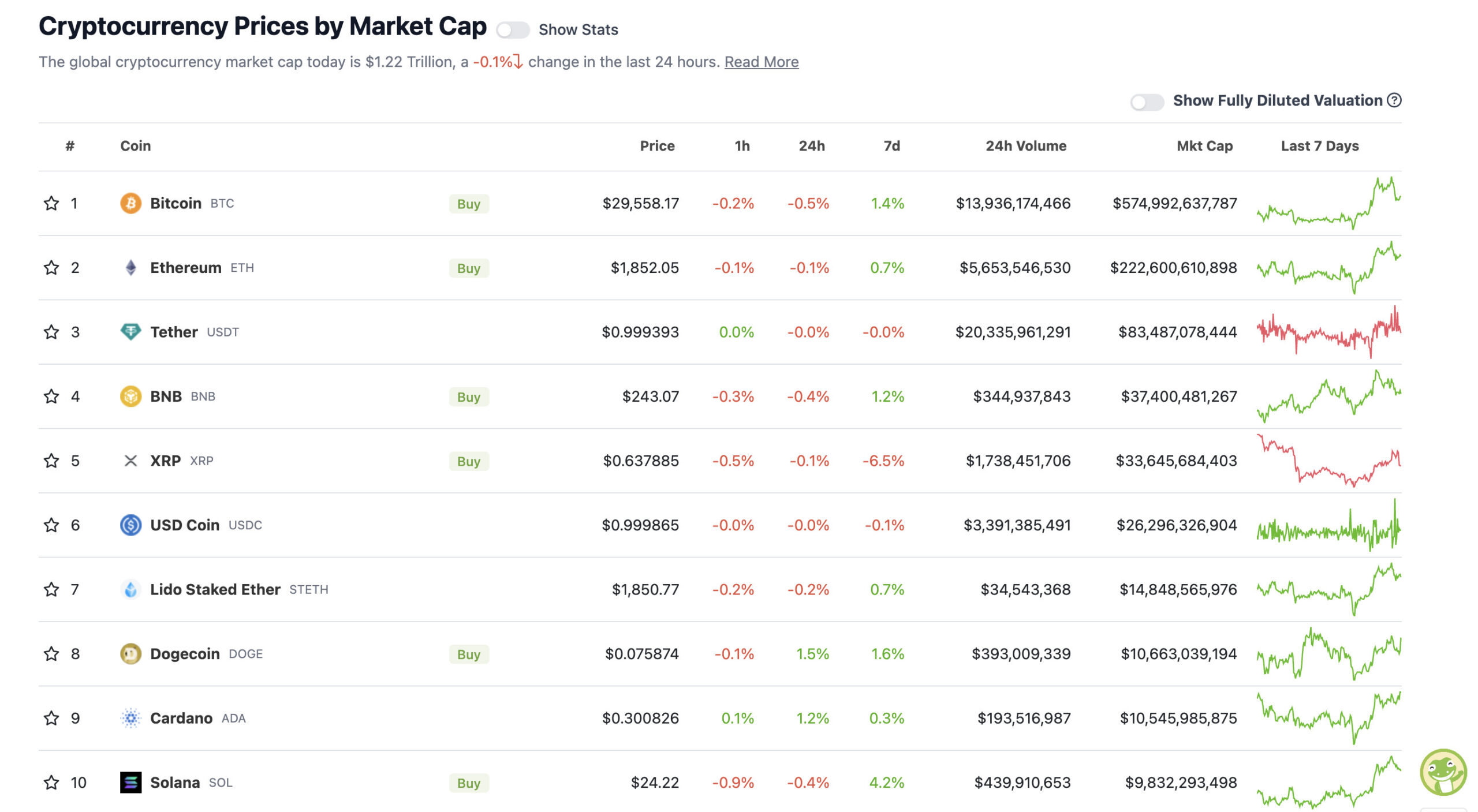

With the overall crypto market cap at US$1.22 trillion, down a very small fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Mooners and Shakers: Whale investors dive deep into Chainlink, while institutional money eyes Solana

Seriously, mate… get a room. (Pic via Getty Images)

Bitcoin is still ranging in the mid-US$29ks, as the stagnation for the crypto market continues. However, there’s still plenty happening behind the charts, including some big interest for altcoins Chainlink and Solana.

Let’s start with Chainlink

What’s that again? It’s a web3 oracle.

Er… righto. Like the Oracle of Omaha or the Oracle of Delphi, one of whom we’re pretty sure hates crypto? Nope.

It’s a web3 services network built on Ethereum and is ubiquitous across the crypto industry. It helps decentralised-app-building developers seamlessly access “real-world data” and off-chain computation and bridge that to smart contracts running on blockchains.

Look, it’s important, okay?

Annnyway, the point of the mention up front here is that it seems things are afoot in the deeper waters of crypto investing when it comes to Chainlink’s token, LINK.

🔗🧑💻 #Chainlink's #github development activity has been notably higher this summer, leading to the asset cracking the top 5 most frequent developed assets. Additionally, whales & sharks with 100K-10M $LINK now hold the most coins since December, 2022. 🐳https://t.co/p1x6LeiRAG pic.twitter.com/wd2tR5p1A1

— Santiment (@santimentfeed) August 7, 2023

New data from the crypto market analytics platform Santiment shows that deep-pocketed investors (aka “whales” and “sharks”) have recently been seen (presumably on crypto fish finders devices) gobbling up some US$192.2 million of the asset in less than four weeks.

That’s a fair bit. Has the price rocketed then? Not exactly, but it’s been trending upwards of late (roughly 30% over the past month, 5% over the past week and 4% over the past 24 hours).

So something’s happening with one of the most respected altcoins. And, notes Santiment, Chainlink’s development activity has been receiving a boost, too.

“Chainlink’s GitHub development activity has been notably higher this summer, leading to the asset cracking the top 5 most frequent developed assets,” said the blockchain data gurus.

“Additionally, whales and sharks with 100,000-10 million LINK now hold the most coins since December 2022.”

$LINK is challenging its multi-year Macro Downtrend for a breakout again#LINK #Crypto #Chainlink pic.twitter.com/zwvP6yr6cH

— Rekt Capital (@rektcapital) August 9, 2023

Meanwhile, institutions eye up Solana

The smart contracts layer 1 blockchain Solana, still one of the main rivals to Ethereum in terms of ecosystem and developer activity, has seen the largest inflows of capital from institutional investors just recently.

This is according to the latest Digital Asset Fund Flows report from CoinShares, which refers to last week’s data.

While the outflows from digital investment products (such as futures ETFs and non-US spot ETFs) show that profit taking, mainly on Bitcoin (outflows of US$11m), has been happening for three weeks in a row, things are a little more encouraging right now for certain altcoins – from an institutional investment angle at least.

“Altcoin sentiment seems to be improving,” wrote CoinShares in its report, “and [has] offset the outflows in Bitcoin and Ethereum.

“Solana saw the largest inflows, totalling US$9.5m, the largest single week of inflows since March 2022.”

But don’t take our, or CoinShares, word for it – here’s a weird mash-up of Max Headroom, Nick Cave and John Wick to believe instead…

CRYPTO BREAKING NEWS

While Exits From Institutional Bitcoin Funds Continue, Money Inflows To Solana And These Altcoins!. Coinshares said that there was an outflow of $107 million from cryptocurrency funds last week, with the majority in Bitcoin. Continue Reading: Whi… check… pic.twitter.com/IMGX5yZzKL— InnovatekMobile (@Neome_com) August 7, 2023

So, just to summarise, SOL received inflows of nearly US$10 million, while XRP and Litecoin (LTC) had inflows of US$0.5 and US$0.46 million respectively.

Multi-asset investment crypto products also saw inflows of US$0.3 million last week.

According to @CoinSharesCo, #Solana saw the largest inflow of institutional investment last week, by far. $SOL pic.twitter.com/9xs96Ar0pI

— InvestAnswers (@invest_answers) August 8, 2023

Coinbase’s ace of Base

• Coinbase’s brand, spanking new Ethereum Layer 2 blockchain Base is up and running and open to the public and ready to bridge over some ETH for all those interested and still wondering if Base will do an airdrop.

Note… Coinbase/Base has indicated in the past that they won’t be creating and distributing a token, but in this cautious era of SEC boss Gary Gensler’s draconian oversight on the US crypto industry, people say a lot of things to keep the regulators sweet.

But… surely GG’s days are numbered… right? Right?

Multi-billionaire Carlyle Group co-founder David Rubenstein certainly reckons “waiting out regulators you don’t like” is a popular strategy in Washington. He also talked up Bitcoin, saying “it’s not going away”. Well, that’s kind of talking it up.

Bloomberg / Rubenstein gaslighting the public into believing #BTC is anything other than a dangling carrot to lure people into the new system. Its a distraction from “legit” digital assets that are infrastructure

“Gensler is anti crypto” 🤡

Maybe the least bullish clip to date https://t.co/6xiaGTDyaD

— Truth Maximalist (@TommaSidor) August 9, 2023

But asides aside, the Base news carries some significance, seeing as Coinbase is the only publicly listed native crypto company.

It certainly carries meaning for those who hold COIN, and that’s because the company expects Base to add a lucrative stream of revenue once development really kicks into gear with applications built upon its blockchain layer.

I just bridged some ETH to Base. Try it – it's quite simple https://t.co/4KOiiU4Pps

(You can also do it from @CoinbaseWallet)Layer 2 feels great – changes the usability of crypto.

Plus you get this sweet NFThttps://t.co/nvtkeCBjWu

— Brian Armstrong (@brian_armstrong) August 9, 2023

Top 10 overview

#BTC is not yet at the resistance it needs to break to invalidate the Higher High

And the RSI has not yet broken the downtrend it needs to invalidate the Weekly Bearish Divergence

Nice to see BTC back at $30,000 but no real trend shift has occurred yet$BTC #Crypto #Bitcoin pic.twitter.com/ZOu5QrSBVc

— Rekt Capital (@rektcapital) August 9, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• FLEX Coin (FLEX), (market cap: US$785 million) +13%

• Aptos (APT), (market cap: US$1.62 billion) +10%

• Rocket Pool (RPL), (market cap: US$536 million) +9%

• Pepe (PEPE), (market cap: US$519 million) +5%

• Chainlink (LINK), (market cap: US$4.14 billion) +4%

SLUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$505 million) -9%

• XDC Network (XDC), (market cap: US$861 million) -8%

• Optimism (OP), (market cap: US$1.11 billion) -8%

• Hedera (HBAR), (market cap: US$1.95 billion) -3%

• Injective (INJ), (market cap: US$663 million) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Crypto analyst Michaël van de Poppe has a suggestion for you for the next crypto bull cycle (strictly not financial advice, of course). And it comes in the shape of a popular dog meme…

I present to you: the easiest trade of them all this cycle, $DOGE. pic.twitter.com/ePFRi19Ro0

— Michaël van de Poppe (@CryptoMichNL) August 9, 2023

An interestingly negative take here on the state of NFTs right now from “NFT God”…

Here’s why almost everyone hates NFTs and crypto:

They solve almost 0 real world problems

Right now the only problem solved by anything blockchain related is quicker and cheaper transaction times

That’s it

Here's a list of every problem NFTs solve:… pic.twitter.com/dNNwhPPtZd

— Alex Finn (@AlexFinnX) August 9, 2023

Speaking of NFT projects…

Y00ts just announced its departure from Polygon.

Here’s what this means for y00ts and what you can expect to see in the coming weeks. 👇

(1/11) 🧵 pic.twitter.com/OXxGpaKwFD

— Kermit 🐸 (@crypto__kermit) August 9, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.