Mooners and Shakers: Ravencoin soars and Bitcoin pumps, but Ethereum flattens out ahead of Merge

Getty Images

Okay, Ravencoin. What’s this one all about then? It’s pumping, so let’s peck into it. Meanwhile Bitcoin’s been on a bit of a surge, too, while Ethereum is currently lazing on a deck chair hoping for a decent Merge tan.

Ravencoin – proof of Merge-related price action?

Deep into that crypto winter darkness peering, long I stood there, wondering, fearing, doubting, dreaming dreams no shadowy super coder ever dared to dream before.” “Quoth the Ravencoin, “Nevermore.”

Edgar Allen Poe didn’t quite write that.

That said… we can 99.93% say for sure that the legendary 19th century American fountain pen and opioid user would’ve been a crypto fan. Probably. Apparently, he had a “keen interest in cryptography” and, in fact, had something of an influence on the modern science.

Would love to get into that a bit more but we’ve got magic internet money to natter about.

Now, what the squawk is Ravencoin (RVN) then and why is it flapping and ca-cawwing it’s way up the daily cryptocurrency top 100 chart? Would it surprise you to learn that, in a roundabout sort of way, it’s “Merge” related? Nope? Didn’t think so.

Ravencoin is not, however, a Proof-of-Stake coin, and it’s not new. Launched in 2018, the protocol is an Ethereum mining alternative that uses a Proof-of-Work consensus algorithm blockchain that mimics Bitcoin’s 21 million-coin supply. It’s got its own, sophisticated tokenised ecosystem that uses RVN for various DeFi and NFT applications.

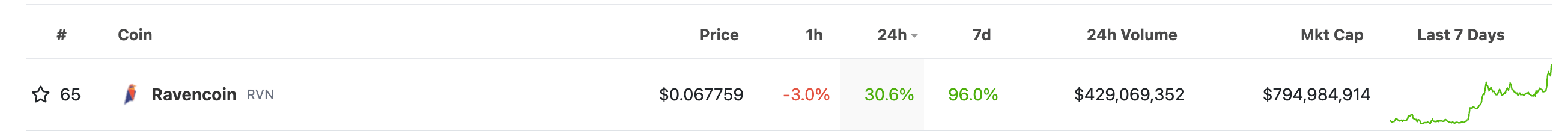

According to CoinGecko data, Ravencoin has surged about 30% over the past day and more than 95% over the week.

Why? Well, all things Ethereum (well, aside from ETH itself today) seem to be taking turns at grabbing the spotlight in the lead up to the leading smart contract blockchain’s Merge to Proof-of-Stake.

Despite the ESG, carbon-reducing positivity that the Merge move is partly building its momentum on, there are still a fair amount of mining, PoW fans out there, making their case and seeking mining alternatives as the main Ethereum chain swaps lanes. That’s partly it, but perhaps the main reason is this…

Breaking Ravencoin $RVN News 🔥

The 2nd largest global #Crypto exchange by volume lists Ravencoin!

👉FTX Exchange is listing Ravencoin.

With the upcoming #EthereumMerge this is another major global announcement regarding the Ravencoin Blockchain ecosystem.

Thank you @FTX_Official https://t.co/ksNwxpHr52— Leon Ravencoin 🅁🅅🄽 ₿ (@leon_texas) September 11, 2022

The RVN pump in price has basically coincided with the news major global crypto exchange FTX announced the listing of Ravencoin perpetual futures on September 12.

Onto other crypto-related pumpery and dumpery…

Top 10 overview

With the overall crypto market cap at US$1.1 trillion and down about 0.3% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As you’d expect, the chart tells the story here. Basically Bitcoin, Ethereum rival Solana and XRP are the only things in the green over the past 24 hours.

Let’s check in on Solana (SOL) for a sec… It seems determined to dodge the Merge shadow. Is there a reason for the exuberance? Other than some ongoing positivity based around the Helium project’s potential migration, nothing major that we’re seeing…

we spent months evaluating potential L1's and scaling solutions, and it's my opinion that @solana is by far the best choice for @helium. i'm so impressed with what @aeyakovenko @rajgokal @garious14 and team have built

HIP70 voting opens in an hour!https://t.co/g7HuaJwYen

— amir 🎈 (@amirhaleem) September 12, 2022

Although there’s this, too… Solana is Ethereum’s greatest rival for NFT-based activity and that appears to be spiking on Solana market place Magic Eden again, according to crypto-data gurus Nansen…

Solana NFT transactions per week presented without comment pic.twitter.com/LCJBtjQMaI

— Nansen Intern 🧭 (@nansen_intern) September 12, 2022

As for Bitcoin, it’s kicked with some confidence into what most think is going to be a vortex of volatility this week. BTC is now trading back above US$22k at the time of writing, after closing its latest weekly candle at US$21,800. That’s the OG crypto’s highest weekly close for about a month.

In the very short term, the US dollar tapering off and seemingly hitting some chart-based resistance seems to be helping Bitcoin, other cryptos and stonks so far this week.

Dollar currently shows a monthly rejection candle after failing to break above trend.

Month not over, but notable as resistance has held again.$DXY pic.twitter.com/MpaEI1ofXs— Sven Henrich (@NorthmanTrader) September 12, 2022

Don’t forget, though (well, you can if you want), that the fresh US Consumer Price Index inflation-related data for the month of August is set to be released. And, for those who are a tad over-exposed to risk assets, lately these figures have been a recipe for nervy toilet sessions and/or “Hey EVERYONE, this round’s on me!”

CPI tomorrow – what do you think it will be?

— Benjamin Cowen (@intocryptoverse) September 12, 2022

It seems like 7/10 people on Twitter are bullish going into Tuesday's CPI, and 9/10 believe inflation has peaked.

Maybe it will play out that way, but don't forget to have a plan in case it doesn't.

— Justin Bennett (@JustinBennettFX) September 12, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.4 billion to about US$446 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Ravencoin (RVN), (market cap: US$783 million) +32%

• Hedera (HBAR), (mc: US$1.6 billion) +10%

• The Graph (GRT), (mc: US$932 million) +9%

• Helium (HNT), (mc: US$682 million) +6%

• NEAR Protocol (NEAR), (mc: US$3.9 billion) +5%

DAILY SLUMPERS

• Terra (LUNA), (market cap: US$661 million) -28%

• Terra Luna Classic (LUNC), (mc: US$2.13 billion) -21%

• Celsius Network (CEL), (mc: US$608 million) -9%

• Rocket Pool (RPL), (mc: US$588 million) -7%

• Amp (AMP), (mc: US$472 million) -6%

Well, probably shoulda known this would happen. As soon as we open our traps about a Terra LUNA revival, its coins go and dump harder than that Brent Naden spear tackle a couple of months back. If you follow such things, that is.

This, however, doesn’t change the fact that both LUNA (or LUNA2 as it’s also now known) and LUNC have made stupendous gains just recently.

That said, as per yesterday’s column, we’ve been very much cautioning with “buyer beware” when it comes to CeFi tokens struggling for revival, especially considering Terra LUNA’s catastrophic and crypto-contagion-inducing collapse in May.

Touch them with an extendable barge pole? Not financially advising on that, or anything for that matter, as there’s, unsurprisingly, no qualification for that hanging in my pool room.

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

It's very simple; #Bitcoin is taking the spotlight, and therefore #altcoins are dropping down as they lose momentum.

Even $ETH is dropping down.

The moment that $BTC calms down (which can take some time), #altcoins will have their run significantly.

— Michaël van de Poppe (@CryptoMichNL) September 12, 2022

💥BREAKING: Russia's largest tech and industrial company, Rostec, is preparing to use cryptocurrencies for international trade.

— Bitcoin Archive (@BTC_Archive) September 12, 2022

3 days for the Ethereum Merge 🚀

ETH will be forked, that's a fact. Everyone will have ETH and $ETHW in their wallets

Can $ETHW be sold?

Short answer: yes

Long answer: it's simply an unnecessary risk, and probably not worth itHere is how to do it – and why you shouldn't 🧵

— olimpio (@OlimpioCrypto) September 12, 2022

#ethereum pic.twitter.com/sFaUbEKMyz

— Lark Davis (@TheCryptoLark) September 13, 2022

Starbuck's and $matic are teaming up for the Starbuck's Odyssey program which will be their web3 experience and integrate #nfts!

— Lark Davis (@TheCryptoLark) September 12, 2022

[DB] Novogratz: "A Little Birdie" Told Me Fidelity Are Going to Shift Retail Customers Into Crypto Soon

— db (@tier10k) September 12, 2022

One of the best traders I worked with while at GS, always looked to #Silver for a heads up on what comes next for #Gold. #Silver +5% overnight

— Tony Sycamore_IG (@Tony_Sycamore) September 12, 2022

Get yourself ready for what will be an EPIC event & line-up from our fam @NFTFestAus 🔥💜🔥 https://t.co/lrbiQcxVtG

— OSHI (@oshi_au) September 13, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.