Mooners and Shakers: Helium rises 50%; Ethereum keeps Merge momentum; market still extremely fearful

Coinhead

Coinhead

Another day in crypto, another mood swing. Helium’s rising, Bitcoin’s back above $19k and Ethereum’s clearly been hitting the gym.

Fear in the market is still, however, at extreme levels, probably due to the macro-related gloom bubbling beneath the surface that might need a team of analysts working round the clock to diagnose.

In fact, crypto investor sentiment has been fearful for pretty much five months solid. Bottoms in the Bitcoin and crypto charts have historically tended to form during extended times when this indicator posts “extreme fear”.

Five months is a fair old whack of terror, gloom-peddling US crypto analyst Justin Bennett thinks we’re not at the bottom just yet…

The #Bitcoin chart is pretty straightforward.

The $19k region is support. Below that on a daily closing basis, we probably see at least $17,600, if not much lower.$BTC bulls need to reclaim $19,700 to see $20,500 and potentially $21,400.

I still don't think the bottom is in. pic.twitter.com/MEwcyZDlHB

— Justin Bennett (@JustinBennettFX) September 6, 2022

Bennett did, however, note to his 107k Twitter followers just a few hours ago that the US dollar (which reached another 20-year high yesterday) is breaking down from a rising wedge pattern today. “As long as we have dollar weakness, expect relief for stocks and crypto.”

Onto some price daily action…

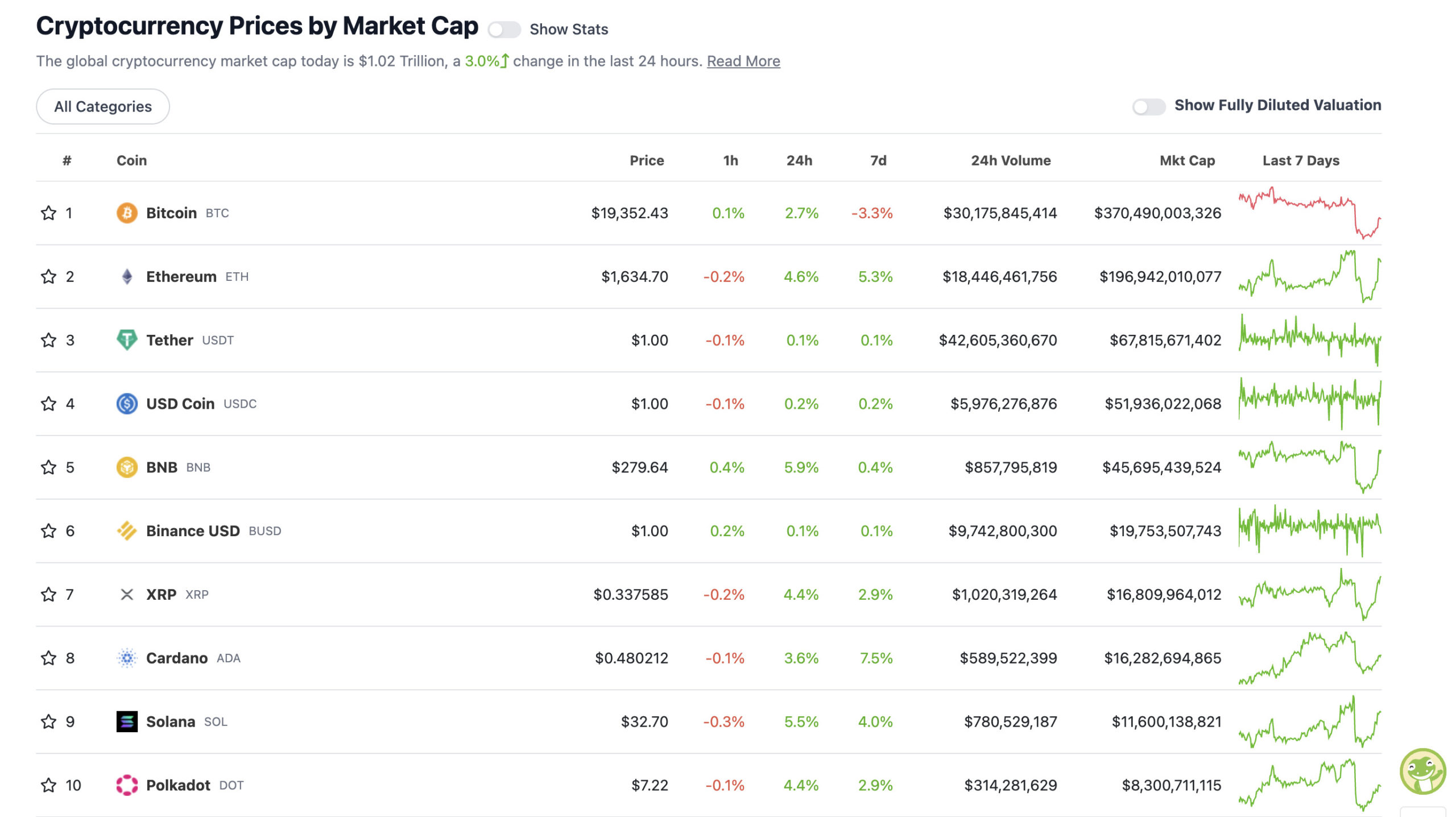

With the overall crypto market cap at US$1.02 trillion and up about 3% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

After a crimson-market day yesterday, the top smart contract platforms have seen some love overnight, with Ethereum, BNB, Cardano, Solana and Polkadot all hitting around or above 5% gainage. XRP, too, and not a dog-meme coin in sight.

Actually, Dogecoin (+4%) and Shiba Inu (+2%) are scratching at the door at numbers 11 and 12 respectively.

Bitcoin’s back above the US$19k support level Bennett mentions further above, but not quite above his $19.7k safety net yet.

Fellow pro chart scrutiniser Michaël van de Poppe meanwhile seems to have swallowed some Dutch courage as he appears to be calling the bottom in this tweet…

Bottom. #Ethereum mooning.

Other altcoins following.

Dollar dropping.

Long crypto.

— Michaël van de Poppe (@CryptoMichNL) September 7, 2022

Premature? Christ knows, but we do know that Bitcoin’s a hell of a lot closer to its bottom than it is to its Bill and Ted-tastic $69k all-time-high top. You’re welcome – a rudimentary understanding of maths and numbers helped us with that one.

Imagine believing that something is wrong with #Bitcoin just because the price has moved lower during the early stages of a recession.

— Dr. Jeff Ross (Pleb Counselor) (@VailshireCap) September 7, 2022

And just back on the top-10 flavour of the month, which is Ethereum, it’s filled up with Merge unleaded and seems set to ride that carbon-reducing positivity as far as it will take it over the coming week until its much-hyped upgrade finishes somewhere around September 13-15, apparently.

ETH, compared directly with BTC is performing strongly just recently and has been soaking up some of the market share Bitcoin has lately been losing. BTC’s market dominance has declined by more than 2% over the past few days, according to NewsBTC.com, which is significant.

Bitcoin’s market dominance now sits at lows it hasn’t felt since the 2018 bear market. It’s down around 36%, according to CoinGecko, while Ethereum is now up a shade over 19%. The metric measures the percentage of the whole crypto market that a given coin represents.

Sweeping a market-cap range of about US$7.8 billion to about US$405 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Helium (HNT), (market cap: US$663 million) +50%

• EOS (EOS), (mc: US$1.66 billion) +18%

• Curve DAO (CRV), (mc: US$453 million) +11%

• Cosmos Hub (ATOM), (mc: US$3.74 billion) +9%

• NEAR Protocol (NEAR), (mc: US$3.46 billion) +8%

Squeaky-voice time again… Helium… what the? Perhaps the protocol’s proposed move to the super-fast and highly rated (although also sometimes doubted due to the odd network outage) Solana has had some time to sink in with investors?

All the same HNT features that users love, like staking, mining, still work. But users get access to defi, smart contracts, hardware and software wallets, fiat ramps, lending protocols, etc… And I can't wait to use helium as my 5g cellular network https://t.co/cKYGENE8C8

— toly 🇺🇸 (@aeyakovenko) September 7, 2022

Or, is it just some smoke-and-mirror whale manipulation going on behind the scenes? It’s a pretty big spike, and, although last week’s Solana news was significant, we’re not seeing a lot of fresh news overnight to support this. Buyer beware, I guess.

DAILY SLUMPERS

• Chain (XCN), (market cap: US$1.51 billion) -4%

• DeFiChain (DFI), (mc: US$585 million) -3%

• Celsius (CEL), (mc: US$558 million) -1%

• OKB (OKB), (mc: US$3.6 billion) -1%

• Tokenize Xchange (TKX), (mc: US$426 million) -1%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

When your entire family are Web3 degens pic.twitter.com/dBEmvlGAkt

— Alan Carroll (@alancarroII) September 7, 2022

Volatility is Vitality. #Bitcoin

— Michael Saylor⚡️ (@saylor) September 7, 2022

Congratulations to President @nayibbukele and all El Salvador citizens for the first anniversary of the #bitcoin law. Lugano🇨🇭is excited to follow this amazing journey, sharing our experiences!

— Lugano Living Lab (@LuganoLivingLab) September 7, 2022

European Central Bank is going to need to print up a few trilly soon…

— Lark Davis (@TheCryptoLark) September 8, 2022

HOLLYWOOD is calling 📽️ https://t.co/4tbS42cJz4

— Jordan (@hjmomtazi) September 8, 2022

I am excited to announce I am taking on the role of CEO of Blockchain Australia as of next week. I am looking forward to working with the Blockchain community to be the leading voice to drive innovation and change for Australian businesses in the blockch…https://t.co/0zKM403cI1

— Merc25 (@LMerc25) September 7, 2022