Mooners and Shakers: Melbourne woman ordered to sell mansion bought with Crypto.com fat finger funds

Getty Images

What would you do if a measly $100 refund you were supposed to receive from the Crypto.com exchange came back rounded up to roughly $10.5 million? Maybe buy a bloody great big mansion?

That’s precisely what Melbourne woman Thevamanogari Manivel did last year after a particularly pudgy-fingered Crypto.com employee typed an account number into the payments field by accident.

After the screw-up, which happened in May 2021, Manivel and her sister reportedly went on a spending spree, spreading the millions across two separate accounts and placing a $1.35 million, five-bedroom property in Cragieburn at the top of their shopping list.

Maybe they thought it was just another crazy crypto airdrop?

This isn’t exactly fresh news, by the way – in February, for instance, The Australian reported an ongoing legal battle related to it – but it was certainly suddenly doing the rounds on Reddit and Crypto Twitter overnight.

💥NEW: CryptoCom paid $10.5M to a customer instead of a $100 refund.

It took them 7 months to notice the mistake! 🧐

— Bitcoin Archive (@BTC_Archive) August 30, 2022

And that’d probably be because, according to a 7news report, it appears the Singaporean crypto company has now won at least part of its case, with a judge in Victoria’s Supreme Court ordering the luxury home be sold and that portion of the money returned.

Manivel has also been told to return the remaining funds or face potential contempt of court charges. Might be easier said than done, that. Wonder if she has any Bored Apes?

https://twitter.com/guanzhang88/status/1564661329054539777

The other striking thing about this story is that no-one at Crypto.com actually noticed the stupendously costly error for… SEVEN MONTHS, after an audit took place in December 2021.

Perhaps they were too busy dealing with the social media fallout from their turkey of a US$100 million ad campaign starring Matt “Fortune Favors the Brave” Damon. Or maybe the US$700 million spent rebranding the Staples Center in LA to Crypto.com Arena took their focus away from trivial things like basic accounting skills.

Either way, it’s probably fodder for a network’s filler telly show at some point – maybe Kochie’s Accountancy 101 Nightmares.

Onto some daily price action.

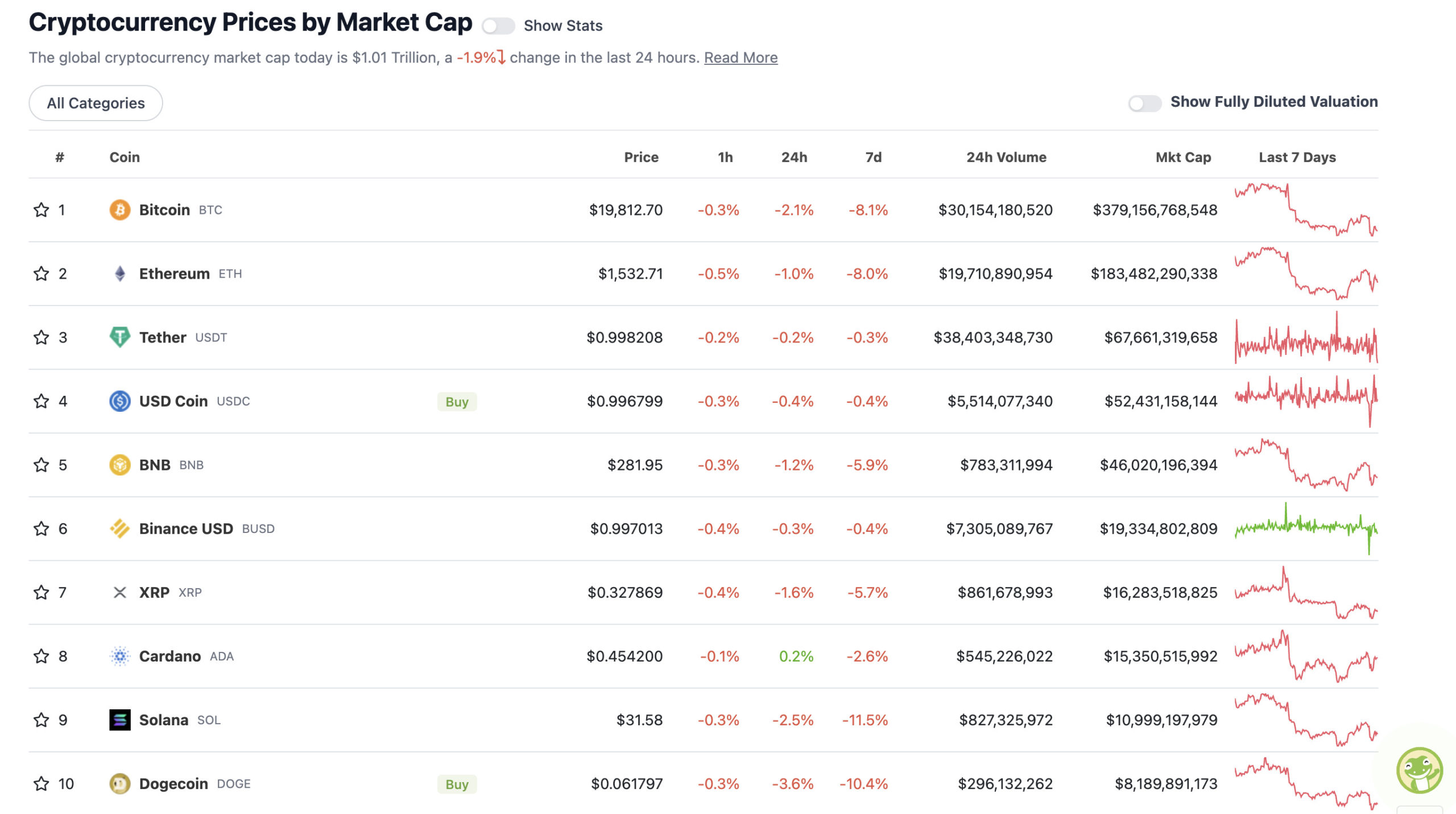

Top 10 overview

With the overall crypto market cap at US$1.01 trillion and down about 1.9% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So, yeah, that little Bitcoin bounce yesterday, probably reasonably predictably, couldn’t be sustained*, with the leading crypto by market cap currently having a ciggie just outside Club $20k once again. Admittedly, it’s a pretty empty club.

(* Update: Bitcoin just rubber-banded back up to about US$20.4k a few hours after hitting publish on this story. Hard. To. Keep. Up.)

Sentiment in the market is still trending lower into extreme fear territory, which has been the norm this year – pretty much every time US Fed boss Jerome Powell opens his mouth, actually.

Also, data from crypto analytics research firm Santiment has been showing a spike in short positions for both Bitcoin and Ethereum, indicating traders think prices are likely on the edge of going lower in Septembear.

One thing, though, – any large build up of consensus to the bearish or bullish is risky territory for anyone playing that game. Markets have an occasional habit of suddenly trending in the opposite direction in these trader-led conditions. Could this be setting up for a good old short squeeze? Santiment isn’t ruling it out for both ETH and BTC…

📉 The #Ethereum disbelief is strong from traders during a particularly volatile week of trading. The crowd has #shorted, across exchanges, at the largest ratio since June of 2021. Historically, price rises are more prevalent in these conditions. https://t.co/DpG1E1TI9Y pic.twitter.com/e6xAWOXeFM

— Santiment (@santimentfeed) August 30, 2022

📉 Traders continue to #short whenever prices see a notable price dump. According to the $BTC average funding rate across #Binance, #BitMEX, #DYDX, and #FTX, the reaction to Friday's drop was the most aggressive traders went against markets since May. 😮 https://t.co/x3rRvK9VOV pic.twitter.com/QzuyELTCws

— Santiment (@santimentfeed) August 30, 2022

And yet…

#CNBC cuts off guest immediately for mentioning “#shorts covering”

Her face was priceless. She told the truth about short covering and how the rally is not a real rally, in other words, we aren't out of the woods.

Source: Stocks With Cam pic.twitter.com/VQ8WBmMpKt

— Rob Kientz | The Freedom Report (@freedom_rpt) August 29, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• NEAR Protocol (NEAR), (market cap: US$3.28 billion) +7%

• FLOW (FLOW), (mc: US$2.1 billion) +6%

• Axie Infinity (AXS), (mc: US$1.27 billion) +5%

• Cosmos Hub (ATOM), (mc: US$3.49 billion) +4%

• NEXO (NEXO), (mc: US$571 million) +4%

DAILY SLUMPERS

• Synthetix Network (SNX), (market cap: US$713 million) -11%

• Celsius (CEL), (mc: US$479 million) -12%

• eCash (XEC), (mc: US$868 million) -12%

• Helium (HNT), (mc: US$713 million) -9%

• Chiliz (CHZ), (mc: US$1.06 billion) -7%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

It's been ~300 days since the #BTC Bull Market peak at $65000

Which means that this Bear Market is getting close to ending

Historically, $BTC Bear Markets tend to find their absolute bottom price approximately 365 days after the previous Bull Market peak#Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 30, 2022

Today I had the pleasure of touring the largest #Bitcoin mining facility in North America in Rockdale!

I am proud to lead the fight for the crypto industry in the Senate.

Texas will continue to be the center for crypto innovation! pic.twitter.com/28BYfEhJzQ

— Senator Ted Cruz (@SenTedCruz) August 30, 2022

Meanwhile, a somewhat amusingly immature tweet regarding Ethereum co-founder Vitalik Buterin is flying around Crypto Twitter. Is the protocol’s Merge actually all about moving to a “Proof of Snake” consensus mechanism?

https://twitter.com/TheCryptoLark/status/1564536302380273664?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1564551031127678978%7Ctwgr%5Eb303fce21d7755d6bff9cdae5ced9e77c74b5a63%7Ctwcon%5Es2_&ref_url=https%3A%2F%2Fstockhead.com.au%2Fwp-admin%2Fpost.php%3Fpost%3D235505action%3Dedit

Everyone's super crazed and surprised today by the size of the #Vitalik pump-action-gun 😳🤯

But did you guys forget that he had been giving us signs in the past? 😉@VitalikButerin#VitalikButerin #EthereumMerge #ProofOfSnake 🐍 pic.twitter.com/Wn01HUkMjo

— Satoshi Stacker (@StackerSatoshi) August 30, 2022

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.