Mooners and Shakers: Bitcoin and Ethereum’s mission misfires as NASA readies for lift-off

Getty Images

US taxpayers’ dosh is being shuttled to Artemis 1 as we type, while funds are also rapidly burning up in a crypto launchpad fire, as the market loses about US$100 billion since Friday.

Ground Control, aka the interest-rate-hiking, pain-inducing Fed, can take the blame for this one. Again. For risk assets like crypto, Jerome “JPow” Powell’s Jackson Hole speech was received about as well as a Morrison family Hawaiian vacation Christmas card.

And what’s more, if Bitcoin’s history is anything to go by, September might be about to bring exactly zero relief.

That’s because some/many crypto observers are predicting a bit of a brutal SeptemBEAR. The following chart from crypto futures trading and info platform CoinGlass shows why, really…

Two out of Nine Ain’t Bad? A song title for the Bit Out of Hell tracklist maybe. Still, October’s history isn’t looking too shabby…

Onto some daily price action…

Top 10 overview

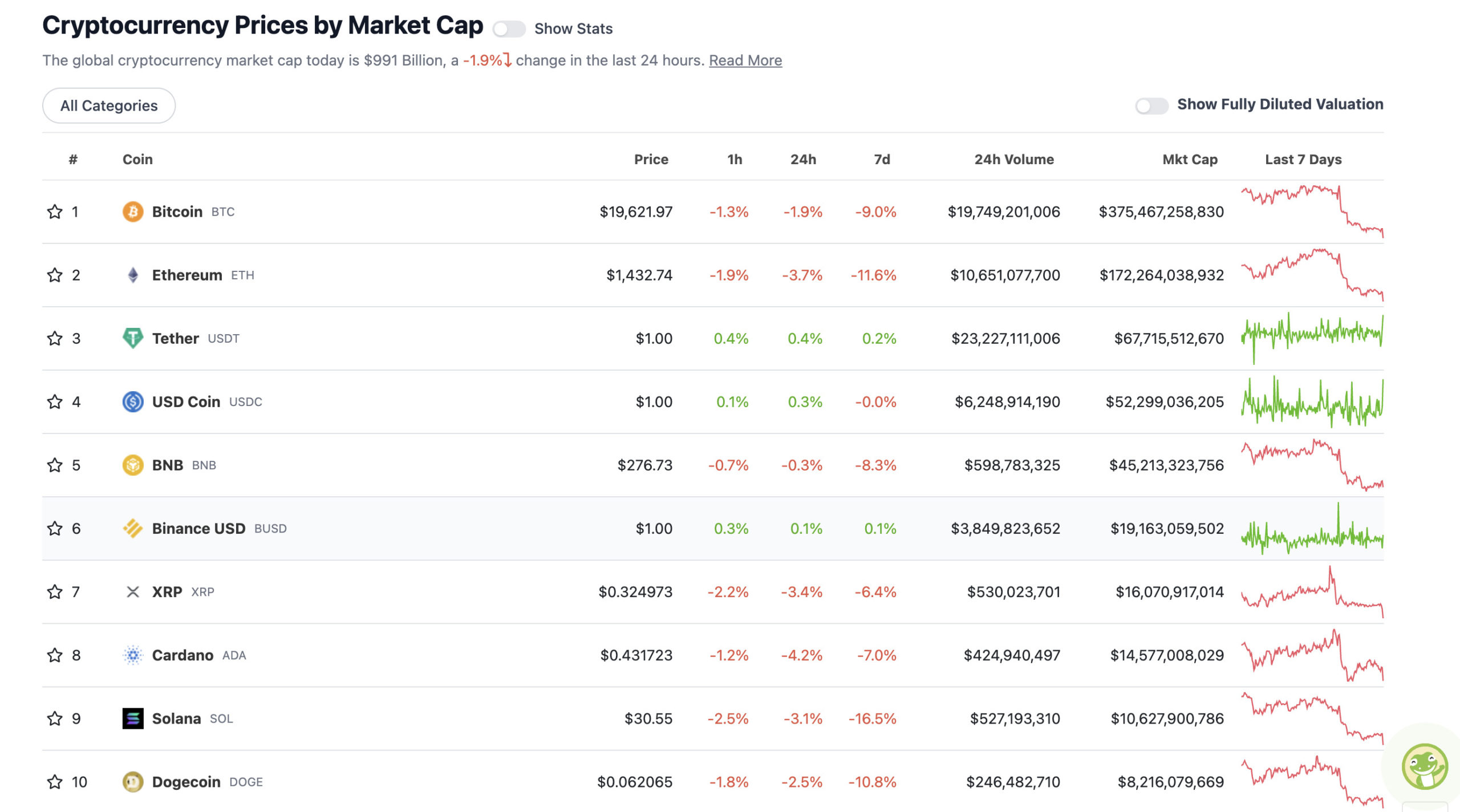

With the overall crypto market cap at US$988 billion and down about 2.2% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As you can see, between the fingers covering your eyes, the crypto market has lost its trillion-dollar market-cap magic number.

Major layer 1 smart-contract platform rivals Ethereum and Cardano, are leading the charge downwards. Both have rather large events on the very near horizon. Ethereum’s Merge to proof-of-stake, of course, and Cardano’s own upgrade, it’s Vasil hardfork, designed to improve throughput and scaling capabilities.

Regarding the Merge, there seems to be a school of thought swiftly building that it’s shaping up to be a classic sell-the-news event in the short term, even if it is widely regarded as a long-term positive transformation for the future of the network and its scalability.

Popular crypto YouTubers Hashoshi and ElioTrades and Benjamin Cowen have all been theorising a post-Merge dump, the latter even suggesting it could pull back to about US$500.

I think #ETH is heading home my friends pic.twitter.com/WLaiPuo244

— Benjamin Cowen (@intocryptoverse) August 27, 2022

“Heading home” sounds nice, but the CryptoQuant analyst is referring to an accumulation range that ETH seems to reach during every correction. The good news is that, historically it always bounces off this curve.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Celsius (CEL), (market cap: US$532 million) +47%

• eCash (XEC), (mc: US$963 million) +34%

• Synthetix (SNX), (mc: US$728 million) +8%

• Internet Computer (ICP), (mc: US$1.67 billion) +5%

• PancakeSwap (CAKE), (mc: US$558 million) +4%

DAILY SLUMPERS

• Cosmos Hub (ATOM), (market cap: US$3 billion) -9%

• EOS (EOS), (mc: US$1.43 billion) -8%

• Avalanche (AVAX), (mc: US$5.25 billion) -8%

• Flow (FLOW), (mc: US$1.78 billion) -7%

• Arweave (AR), (mc: US$511 million) -6%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

#bitcoin is going to a million dollars per coin.

Does it really even matter that much if you bought it for it 20, 30, or 40K?

The patient will be rewarded!

— Lark Davis (@TheCryptoLark) August 28, 2022

my entire net worth is in this man's handspic.twitter.com/TfzpQzcn8m

— LilMoonLambo (@LilMoonLambo) August 27, 2022

There’s been a bit of Mt. Gox-related dumping fear intensifying on Crypto Twitter just lately. “Cobie” of UpOnly podcast relative fame seems to think any BTC unloading in this regard is still several months away…

https://twitter.com/cobie/status/1563587638136737793

Meanwhile, NFT fan Shaq (also a DJ and former basketball star, apparently) has left the building… and country…

I’m gonna miss u Australia pic.twitter.com/EQp7eF3VYm

— SHAQ (@SHAQ) August 28, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.