Market Highlights: Fed comments to cripple markets and 5 ASX small caps to watch

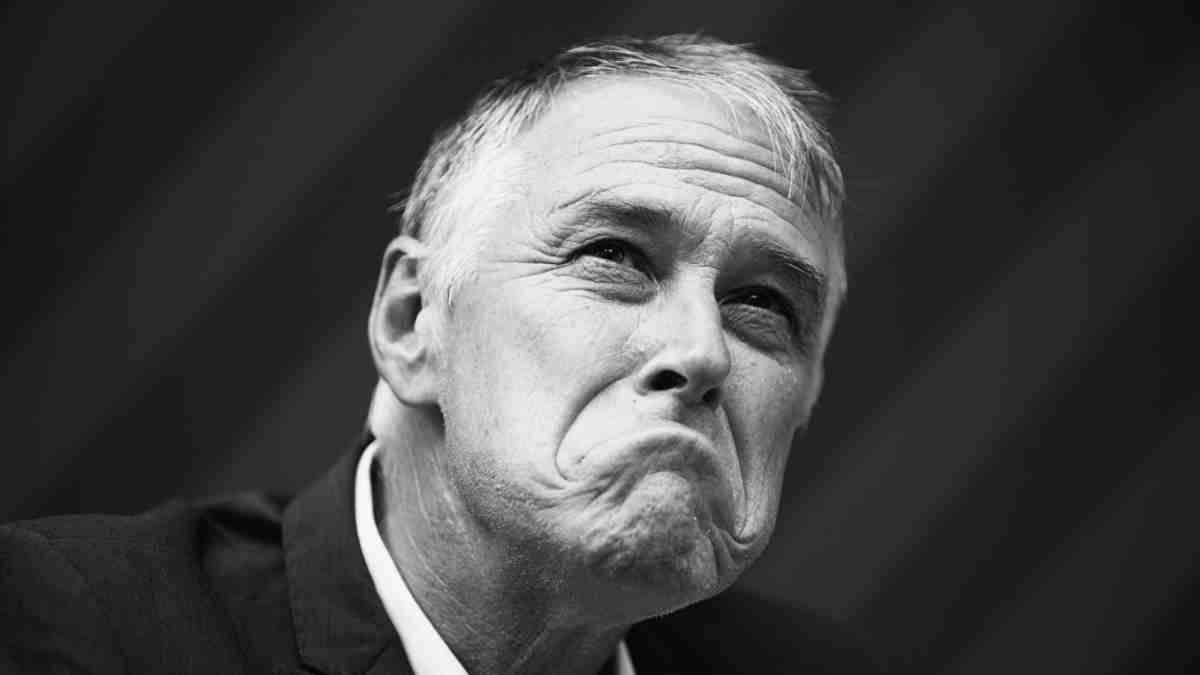

ASX small caps roundup for 29 Aug 2022. Picture Getty

- The ASX 200 index will open much lower on Monday

- Wall Street plunged on Friday after comments from US Fed Chairman

- Retail sales data due later today

Local shares are set to open much lower today. At 8am AEST, the ASX 200 September futures contract is pointing down by 1.5%.

Wall Street plunged on Friday after a speech by US Fed’s Jerome Powell, who said the Fed must must continue to raise interest rates to stop inflation from becoming a permanent aspect of the US economy.

“We must keep at it until the job is done,” Powell said, twice, in his unusually short eight-minute speech.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” he added.

Powell said that the successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years.

“A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation,” Powell noted.

“Our aim is to avoid that outcome by acting with resolve now.”

The S&P 500 fell by 3.37%, the Dow Jones by 3.03% and tech heavy Nasdaq by 3.94%.

Oanda’s senior analyst Edward Moya said: “There was no dovish pivot, but it seems financial markets are getting close to fully pricing in the remaining Fed rate hikes.”

“Downside for equities may remain limited if inflation pressures continue to ease sharply.”

Bitcoin also tumbled from above US$21k to US$19,915 on the news, supporting the notion that cryptos are correlated with the stock market, and not a hedge for it.

Powell’s speech also caused interest rate futures traders to beef up their bets on a third straight 75bp rate hike at the next Fed’s meeting on September 20.

In other markets, Brent crude rose by 2% to US$100.47/barrel on fears that OPEC+ could cut its productions, while the iron ore price was up by 3.5% to US$105.8 a tonne.

Spot gold meanwhile is trading lower near US$1,737 an ounce.

“Gold could straighten out in a day or two. But if equities gain strength, gold could weaken. Longer term, I’m still bullish on gold,” RJO strategist Peter Mooses told Kitco News.

Later today, the ABS will release Australian retail sales data for July.

5 ASX small caps to watch today

Galileo Mining (ASX:GAL)

Diamond drilling at the Callisto palladium discovery has intersected massive sulphide mineralisation. 1.25 metres of massive sulphides were logged within a larger 29.1 metre zone of disseminated and stringer sulphides. An RC drill program with an initial 10,000m and diamond core drilling with an initial 2,000m program are ongoing.

HitIQ (ASX:HIQ)

HitIQ has renewed a subscription agreement with the English Cricket Broad (ECB) for another two years, covering the use of its concussion technology by more than 1,800 players across 32 ECB and County cricket clubs. No figures have been disclosed.

Mach7 Tech (ASX:M7T)

Mach7 reported record revenues of $27.1m for FY22; up $8.1m or 42% yoy. Bottom line EBITDA was $2.8m; up $4.6m or 253% yoy. It was the most successful year in the company’s history with record sales orders, revenue, cash receipts and operating cashflows.

Symbio Holdings (ASX:SYM)

The software company reported that its recurring revenue for FY22 increased by 12% to $112.3m. The company reported bottom line EBITDA of $35.4m, and has released an EBITDA guidance of $36m to $39m for FY23.

intelliHR (ASX:IHR)

Recurring revenue was $7.7m, up 97% YoY. Total revenue was $5.14m, up 28% YoY.

intelliHR says it is negotiating in ANZ and global markets with multiple Tier 1 and 2 consulting firms to drive further sales opportunities.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.