Mooners and Shakers: It’s Pain and Gainz on the Chains as bears and bulls duke it out on the crypto canvas

Some bloke fighting his way out of a wet paper bag. A bit like Bitcoin. (Getty Images)

Gigapump, gigadump, gigapump… annnd a slight pullback once again. That’s pretty much how it’s played out for Bitcoin and pals over the past day or so. Yep, that’s crypto.

The crypto bulls and bears are in the fight of the century (okay, month) right now. Rumble in the Crypto Jungle? Maybe Pain and (Sick) Gainz on the Chains. Where’s it all heading next exactly? Whodahell knows, but we’ll round up the opinions of a few reasonably popular Cryptoverse analysts anyway.

#Bitcoin clears $29,200 and rallies back to $30,000.

Absolutely insane price action past 24 hours.

— Michaël van de Poppe (@CryptoMichNL) April 27, 2023

Before we get some of their predictions, though, let’s dive directly into the daily and weekly price action.

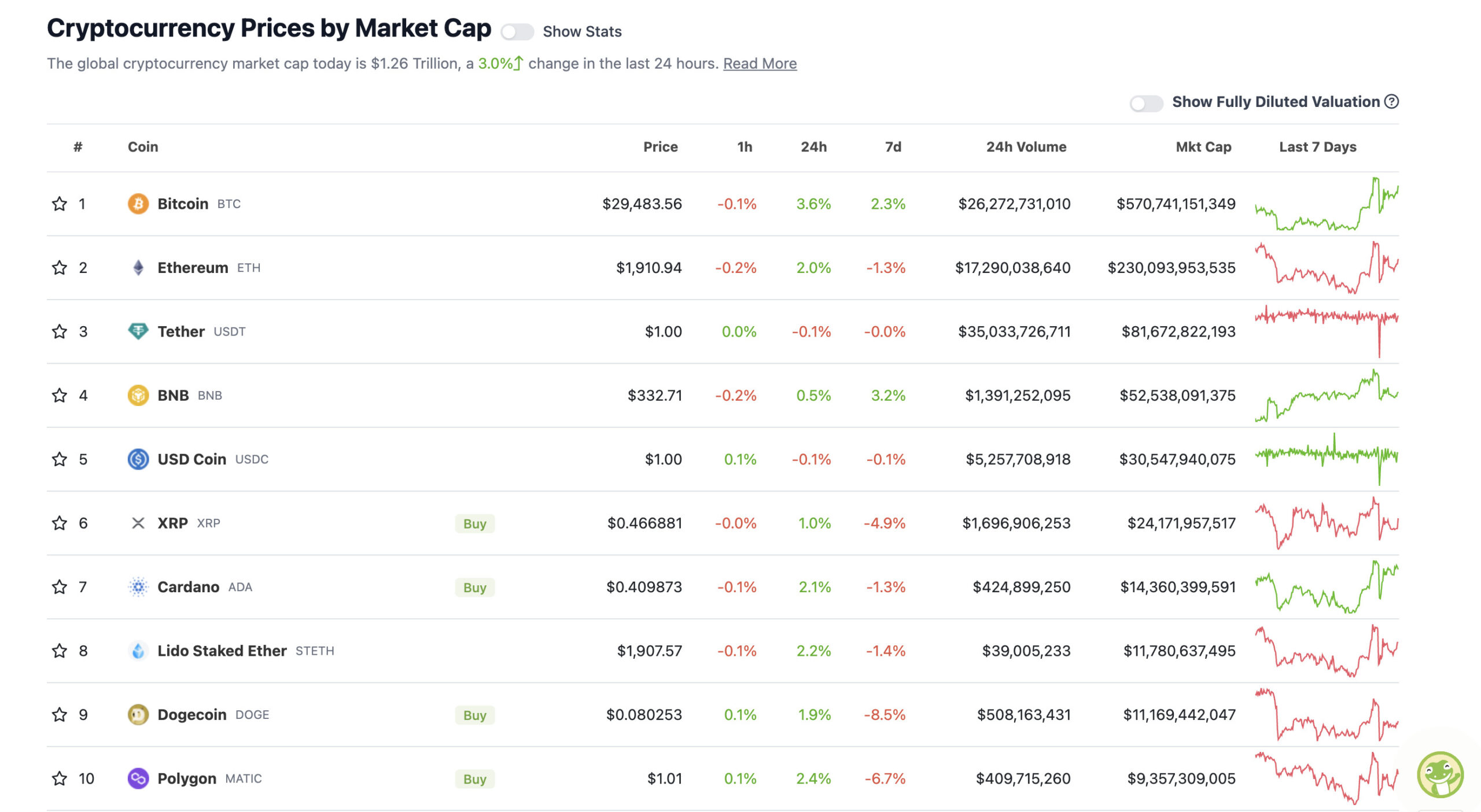

Top 10 overview

With the overall crypto market cap at US$1.26 trillion, up about 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Solid daily green all round in the crypto majors, and it’s probably been helped by the good old (sometimes bad old) US stonks market correlation.

As our very own non-fungible and macroeconomic guru Eddy Sunarto reported in his most-excellent Market Highlights wrap this morning, “Wall Street rallied as mega tech stocks surged on earnings, and fears of a banking meltdown contagion eased”.

The S&P 500 closed 2% higher, the Dow by 1.5% and tech-heavy Nasdaq by 2.5%. And wouldn’t you know it, Bitcoin and co followed suit and lifted themselves off the canvas, too.

Bull goose crypto Bitcoin (BTC) seems to be taking a well-earned breather after a torrid few days. It seems to be settling (at the time of writing) in the mid US$29k range. Previously, analysts were expecting volatility after the top digital asset had been coiling up in a tight range between US$27k and $28k for several days.

Is it now due for some healthy consolidation again before a push higher? That’s what the punchy US trader/analyst “Roman” is rooting (er, in the American sense) for…

$BTC 1D

This is the scenario I’d like to see for continuation upwards. Consolidation would provide volatility to build to break HTF resistances.

If we move to 31k right now, there’s a possible DT with low volume & potential bear divs.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/9fJ79Au9rS

— Roman (@Roman_Trading) April 27, 2023

He’s also taken the opportunity on the latest Bitcoin surge back up to take another swing at the shorting bears…

Recession is over folks. No one wanted to short at 60-50-40-30k with me.

Now you want to short after an 80% drop?

Weird.

— Roman (@Roman_Trading) April 27, 2023

And Roman has been having a bit of Twittering back and forth with another popular US analyst just lately – Justin Bennett, who has been camping himself more on the bearish side of the ledger recently. Here he is, referencing the total crypto market cap, as opposed to just BTC.

$TOTAL is one reason I'm not comfortable longing crypto right now despite $BTC closing back above $28,800.

TOTAL is still holding below the $1.18T range highs after the recent deviation.

Mixed signals. pic.twitter.com/R3NJ1TkBRY

— Justin Bennett (@JustinBennettFX) April 27, 2023

(The US$1.18 trillion TOTAL market cap referenced below is taken from a similar but slightly different metric to that of CoinGecko’s, further above. CoinMarketCap, for instance, grabs its data from a vaster array of cryptos/sh*tcoins.)

Here’s the Twitter-popular Rekt Capital, who’s been leaning bullish for most, if not all, of this year so far.

#BTC has already broken its Downtrend

Now it's all about continuing the new Uptrend

Whether a retest is needed or not is the question

But history suggests the mid-term to long-term outlook looks bullish$BTC #Crypto #Bitcoin pic.twitter.com/OhFan73uwW

— Rekt Capital (@rektcapital) April 27, 2023

Mags, aka thescalpingpro, agrees… as does “Moustache”…

#Bitcoin ✍️

Ignore the noise on LTF & Bears calling for $10k , HTF Price action looks promising 💪#crypto #btc pic.twitter.com/XrLO4jYsfM

— Mags (@thescalpingpro) April 27, 2023

#Bitcoin (M)🎯

After the correction in the last few days, $BTC is still holding above the EMA21-Line.

The month has only a few days to go. This would be the perfect retest.

Another crucial month for Bitcoin.

Don't get shaken out.

They want your cryptos cheap imo. pic.twitter.com/VEOYcqEtxh— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) April 27, 2023

There’s absolutely been a lot of noise from the bears this week, though, and a lot of told-you-so tweets based around the Mt. Gox and US Govt BTC-selling “event”, which turned out to be a false narrative (for now).

It looks like we’ll be in for another volatile week coming up, though, with the Fed gearing up to announce its next monthly rate-hiking course. A 25bps hike seems to be pretty much priced in.

Will it be the final hike before a Fed pause or pivot? “Tedtalksmacro” thinks so…

https://twitter.com/tedtalksmacro/status/1651521945903439873

And just on that, actually, did you catch this? Did Fed boss Jerome Powell let the rate-hiking-plan cat out of the bag to a someone impersonating Ukrainian President Volodymyr Zelensky earlier this year?

NEW: 🇺🇸 FED Chair Jerome Powell admits he took a call with Russian pranksters pretending to be Ukrainian President Zelenskyy. 🤡 pic.twitter.com/z3xJoGUSmh

— Radar🚨 (@RadarHits) April 27, 2023

“The market is already pricing in two more quarter percentage price hikes,” said the unwitting Powell to the imposter at the time. Gregor might well have some comically incisive things to say about this in his always must-read ASX Small Caps Lunch Wrap.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Cronos (CRO), (market cap: US$1.96 billion) +8%

• ImmutableX (IMX), (market cap: US$1.01 billion) +7%

• Bitget Token (BGB), (market cap: US$572 million) +6%

• Radix (XRD), (market cap: US$1.14 billion) +6%

• Internet Computer (ICP), (market cap: US$2.49 billion) +5%

PUMPERS (lower caps)

• Maple (MPL), (market cap: US$59 million) +15%

• Pepe (PEPE), (market cap: US$108 million) +13%

• Blur (BLUR), (market cap: US$317 million) +11%

SLUMPERS

• Stacks (STX), (market cap: US$1.02 billion) -3%

• Monero (XMR), (mc: US$2.77 billion) -3%

• Bitcoin Cash (BCH), (mc: US$2.26 billion) -2%

• Optimism (OP), (mc: US$683 million) -2%

• The Graph (GRT), (mc: US$1.26 billion) -1.5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

NEW🇭🇰 Hong Kong authorities have told banks they are free to offer services to #Bitcoin and crypto businesses, and not to impose unnecessary processes – Cointelegraph pic.twitter.com/mUYFGj3ttV

— Bitcoin Archive (@BTC_Archive) April 27, 2023

Another one – The below clip is from a Fall 2018 Graduate MIT course called "Blockchain and Money"

Gary Gensler – the current President of the SEC, was the professor.

Once again, I will let the below video speak for itself.

Lecture 8: Public Policy – October 1, 2018

"We'll… pic.twitter.com/rvweW2rz5t

— zk-🦈 (@ZK_shark) April 27, 2023

It’s been a volatile week in crypto.

Republic Bank, a top 15 bank in the US, dives in stock price as depositors flee, pushing Bitcoin up +8% in minutes.

We’re witnessing some of the most unstable conditions for U.S. banks in a very long time.

This is all playing in the Bitcoin…

— Ben Simpson (@bensimpsonau) April 27, 2023

https://twitter.com/naiivememe/status/1651737049777721345

Finally, how about a delicious piece of conspiracy theorising to round things off this week?

✨ Exactly 12 years ago today, a #Bitcoin developer decided to visit the CIA. Satoshi Nakamoto was never heard from again. 💫 pic.twitter.com/L5XcAsSL8B

— The Bitcoin Historian (@pete_rizzo_) April 27, 2023

Only from the public dialogue. He was still working privately and corresponding with other bitcoin developers up until this date

— The Bitcoin Historian (@pete_rizzo_) April 27, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.