Mooners and Shakers: Google has invested $1.5 BILLION into crypto companies; Bitcoin and Ethereum flat as EOS pumps

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

So Bitcoin, Ethereum and various other cryptocurrencies might not be looking amazing today, but here’s one of those “What bear market?” addendums… a recent report reveals Google has been seriously aping into crypto for the best part of a year.

According to the report, conducted by Amsterdam-based research firm Blockdata, Google parent company Alphabet has been actively investing in the crypto space since at least September 2021. The figures are approximated, but the research suggests the tech giant has poured in more than US$1.5 billion into blockchain-focused companies up until June of this year.

Those firms include major crypto player Digital Currency Group (which counts Grayscale, Genesis and CoinDesk among its subsidiaries), Fireblocks, Dapper Labs (of NBA Top Shot NFT fame) and Voltage.

And another eye-popping thing about this is, Alphabet is front-running some fellow seriously big legacy names with these investments, including BlackRock, Morgan Stanley and Samsung, which between them invested around USD$3 billion across various projects in that same timeframe.

Check out the others on this partial list, too. Yeah, Commonwealth Bank’s on there… perhaps when favourable market conditions eventually return, it’ll look to resume the crypto-trading pilot it announced late last year.

All up, per the report, 40 top companies and financial institutions invested more than US$6 billion into blockchain enterprises in this 10-month period.

Take away? If you’re feeling glum, bored, depressed or phone-smashingly angry when you check out your crypto portfolio every 15 minutes or so… then keep in mind various universe bosses (no, not you Chris Gayle) are clearly seeing crypto playing a significant part in their world-dominating future.

Onto some price action…

Top 10 overview

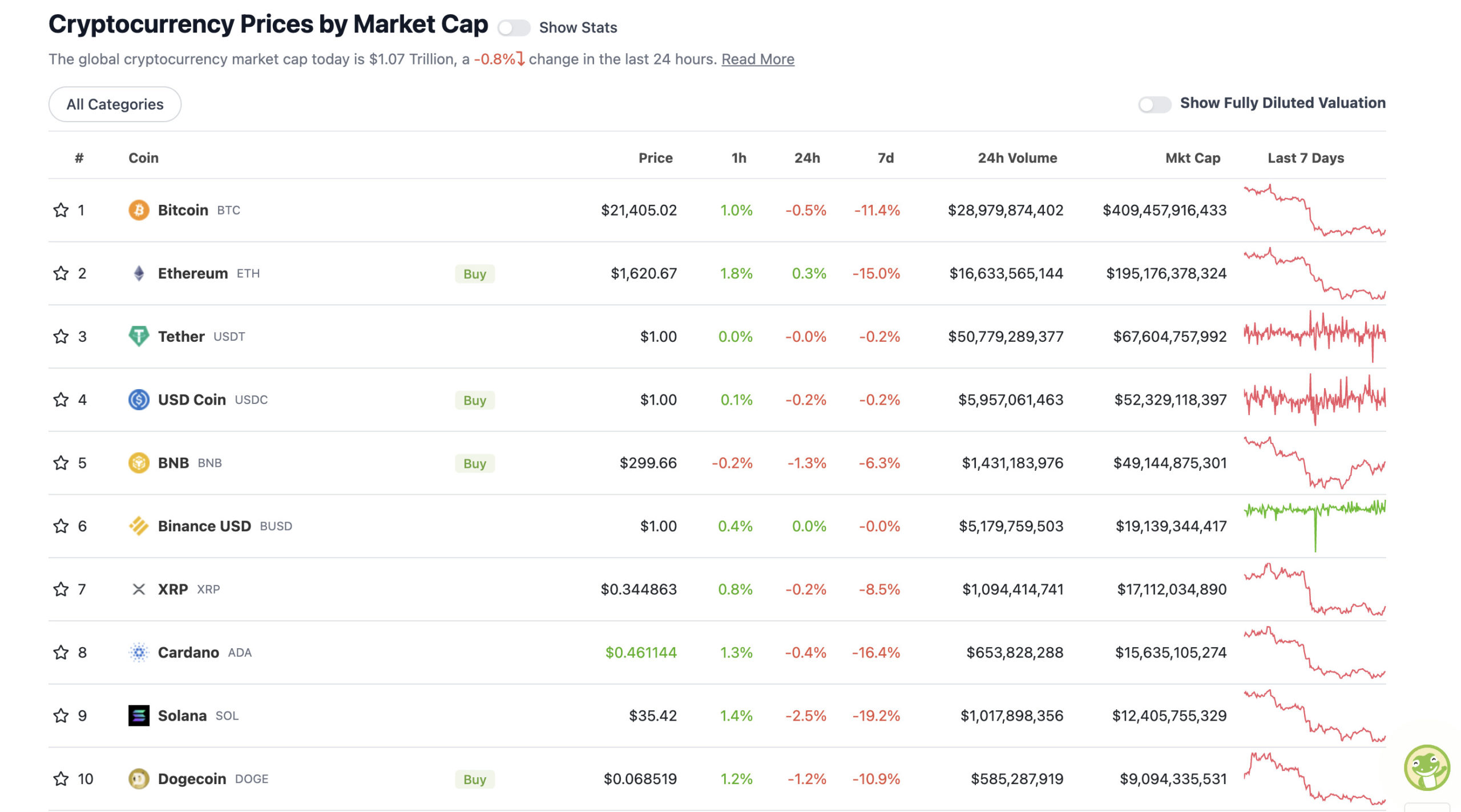

With the overall crypto market cap at US$1.07 trillion and down about 0.8% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Major crypto prices did take a bit of another stumble overnight here in Sydney. However, things seem to be picking up fractionally in the past hour, at the time of writing… leading to a position that’s not a hell of a lot different from this time yesterday.

Some quivering bottom lips based around the US Federal Reserve’s next moves were apparently causing some trading jitters yesterday. Can’t wait till Jerome Powell and mates are nothing but a PS on a footnote at the bottom of the weekly crypto news items that the editor then kicks to the dustiest corner of the cutting-room floor.

Until that time, though, stuffy trad macroeconomic-affecting events like the Jackson Hole Symposium (Aug 25-27) are part of the “shadowy super coder” crypto-trading conversation, too. The mail on that appears to be that Powell will likely sound “hawkish” regarding inflation and interest-rate hiking for the rest of this year.

Is your portfolio going to survive #JacksonHole this week? I can attest, that drop is scary AF. pic.twitter.com/ZloGA20IhI

— Arthur Hayes (@CryptoHayes) August 22, 2022

While that really shouldn’t be a massive surprise, there has been at least some hopium smoke drifting about on the premise that a possible slight slow down to 50 basis-point hiking from 75 would be a sliver of a silver lining for risk-asset markets.

And rebellions are built on hopium, according to Jyn Erso, whose father was forced into building the Death Star and absolutely wasn’t a financial advisor.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.3 billion to about US$425 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• EOS (EOS), (market cap: US$1.85 billion) +2o%

• Chiliz (CHZ), (mc: US$1.19 billion) +19%

• Bitcoin Cash (BCH), (mc: US$2.35 billion) +4%

• EVMOS (EVMOS), (mc: US$540 million) +4%

• The Graph (GRT), (mc: US$823 million) +4%

So why the hell is “forgotten” layer 1 EOS pumping? It’s actually up close to 50% in gainz over the past week or two.

The main thing we’re seeing is that, according to reports, the company has now settled with investors who claimed the project breached US securities laws by failing to register EOS as a security with the US Securities and Exchange Commission (SEC).

Other than that, though, the EOSIO blockchain is also undergoing some rebranding. Ah yes, the good old rebrand pump… wasn’t that more of a crypto-market phenom back in 2017/18? Back when EOS raised a stupendous ICO war chest of US$4 billion? Answer: yes, it was. The AntShares rebrand to NEO springs immediately to mind, for instance. Ridonculous, halcyon crypto-boom, Wild West days.

This week we are revealing the highly anticipated EOSIO rebrand, and next month, $EOS will activate its v3.1 consensus upgrade (hardfork).

🧵 Here’s what you need to know about #TheNewEOS. 🧵

— Yves La Rose (@BigBeardSamurai) August 15, 2022

$EOS is one of the few coins to have bullish price action in the last 24 hours

No wonder it’s up more than 4% with a daily sentiment signal like that 👀 #EOS pic.twitter.com/k6xhTGUEO1

— Trade The Chain 📊 (@tradethechain) August 22, 2022

DAILY SLUMPERS

• Celsius (CEL), (market cap: US$720 million) -25%

• Helium (HNT), (mc: US$823 million) -5%

• Hedera (HBAR), (mc: US$1.5 billion) -4%

• Arweave (AR), (mc: US$611 million) -4%

• Chain (XCN), (mc: US$1.87 billion) -4%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Some bears…

The $20,800 $BTC support is FAR more significant than most realize. 👀

It dates back to 2015, so bulls will defend it with their lives.

A break lower seems more like a matter of "when" than "if."#Bitcoin pic.twitter.com/l5s2w6xigt

— Justin Bennett (@JustinBennettFX) August 22, 2022

Market is about to give you the ultimate exit opportunity (scam pump)

— il Capo Of Crypto (@CryptoCapo_) August 22, 2022

Peter, you tweet more about #bitcoin than gold. Thanks. 😆

— CZ 🔶 BNB (@cz_binance) August 22, 2022

Some not overly palatable food for thought there. Some positivity to finish, then…

Many are worrying whether to buy #BTC at $21000 or $22000 or $23000

Meanwhile failing to realise that anything below $35000 is a bargain over the long-run$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 22, 2022

— naiive (@naiivememe) August 22, 2022

The wheels are turning on @NFTFestAus 2.0

Register your interest in speaking, presenting or sponsoring HERE -> https://t.co/CvaerRsoBL

The story so far? You can find out more HERE -> https://t.co/bbToDC6k6r pic.twitter.com/TrbPx8dQN2

— Steve Vallas (@stevevallas) August 22, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.