Mooners and Shakers: FTX somehow finds $7.3 billion; Ethereum’s Shanghai upgrade is live; BTC dips after CPI pump

Getty Images

To quote the big-beaked beaut that is Bill Lawry… “It’s all happening”. Yep, all of it. Right now. The Ethereum Shanghai upgrade; the latest US CPI inflation report; Bitcoin pumping then slumping; FTX finding US$7.3 billion down the back of the couch…

It’s probably a bit too much to digest at once – especially when you’ve just come back from a sodden camping trip with limited reception and are scrambling to catch up in order to put together something vaguely all-encompassing for casual crypto observers. But let’s try.

FTT pumps as FTX claws back $7.3 billion

First of all, let’s talk about the embattled, can’t-believe-it’s-not-actually-dead-yet FTX crypto exchange, as there’s been a newsy update to add to Gregor Stronach’s excellent surgical dissection of the situation, published on Stockhead a few hours ago.

It’s a bit of a head scratcher for some/many, actually, and that’s because the failed crypto exchange formerly run by the acronym known as SBF, has reportedly managed to recover a whopping US$7.3 billion in funds previously thought to be lost for good. That’s quite a bit of an influx from January’s US$1.9b tally.

Sorry, what?? https://t.co/q7ksMA7pAQ pic.twitter.com/GIeG3D0uwv

— Justin Bennett (@JustinBennettFX) April 12, 2023

Having filed for bankruptcy in November last year, the exchange, now under the control of liquidation expert John J Ray III, had a US$10 billion IOU note for its users and million or so creditors.

The exchange is even considering re-opening at some point in the future (possibly as soon as early 2024) as it continues to steer through bankruptcy proceedings, although, FTX attorneys have made it clear the firm is still “far away from an equity distribution” to users/creditors.

Still, it’s got to be encouraging news for those who’d all but given up on recovering their funds from the FTX vortex. And wouldn’t you know it, the price of the FTX exchange token, FTT, has absolutely pumped on the news. It’s currently up about 78% over the past 24 hours, surging to US$2.45 from US$1.32.

Bankrupt FTX recovers $7.3 billion in assets (amazing) and wants to relaunch in Q2. (even more amazing)

Absolutely fantastic.

— Michaël van de Poppe (@CryptoMichNL) April 12, 2023

Top 10 overview

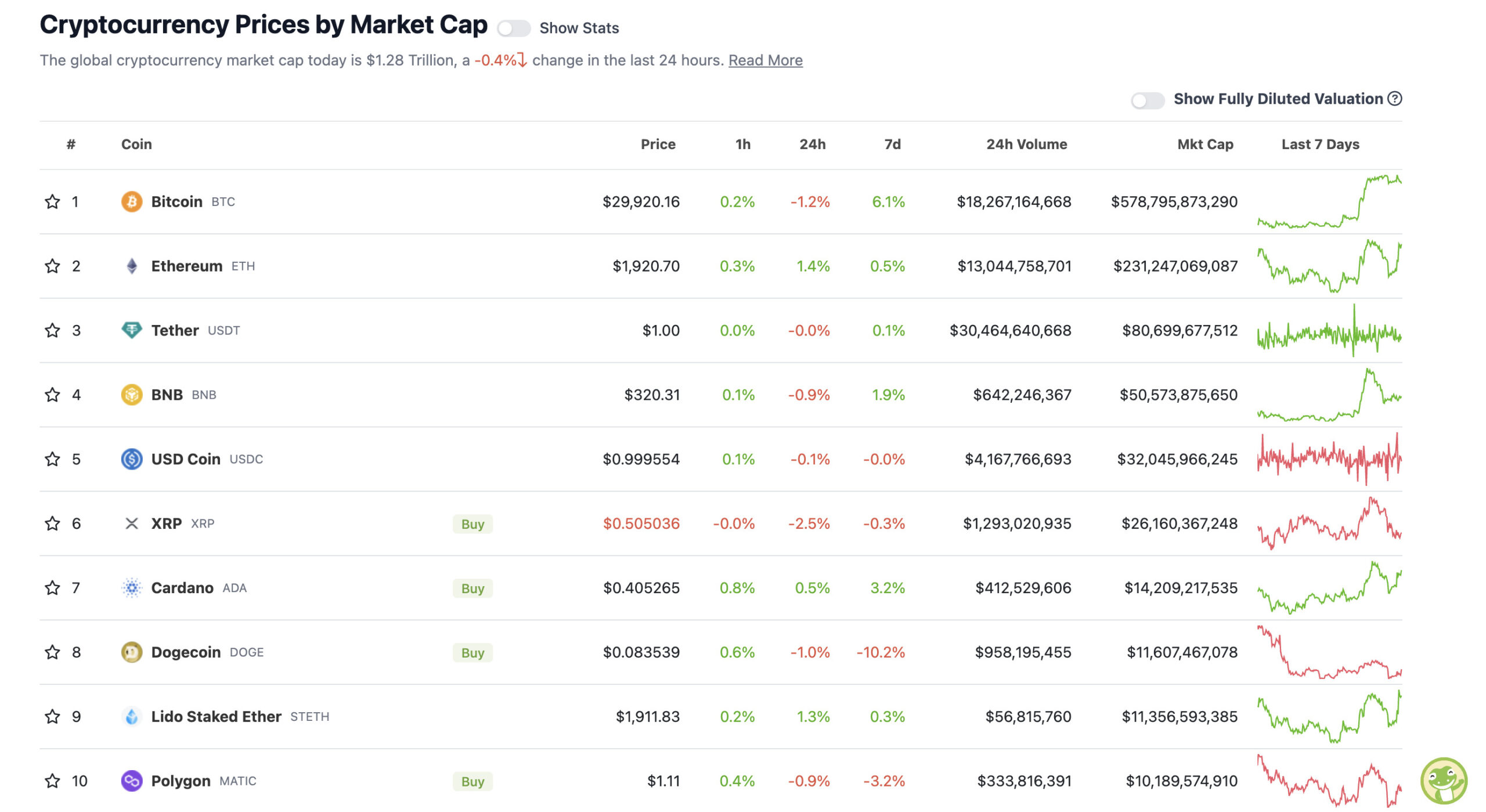

With the overall crypto market cap at US$1.24 trillion, up 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

On the surface, it looks like there’s not much to talk about based on the 24-hour price landings on that top 10 chart.

But the Consumer Price Index inflation data hit overnight in the US, and initially it gave markets a boost, with Bitcoin (BTC) climbing as high as US$30,500. As Stockhead’s very own, non-fungible Eddy Sunarto reports in his morning Market Highlights wrap, the inflation figure for March came in at 5% (from 6% in Feb), “the lowest since 2021 when it first began to climb”.

However, he notes, core inflation (sans energy and food prices) rose 0.4% from the prior month, meaning we still have a sticky inflation situation and, well, it’s still anyone’s guess as to what the US Federal Reserve will do next in terms of interest rate rises or pauses.

And it’s likely this uncertainty, really, that’s caused Bitcoin to dip back down below US$30k again at the time of writing.

If people stopped focusing so much on it, it can go back to being a non event where it doesn’t screw the entire trading day.

— Roman (@Roman_Trading) April 12, 2023

Meanwhile, Shanghai…

But let’s chat about Ethereum for a sec. Shanghai, the network’s major, much-discussed staking-funds-release upgrade, has gone live at last – as part of what’s dubbed the Shapella hard fork (a combo of the “Shanghai” and “Capella” network upgrades).

Some have feared the unlock will cause the price of ETH to dump as hundreds of thousands, nay, millions of ETH become available once more to potentially hit the market.

The upgrade can, in theory, see 18.1 million staked ETH unlocked from the Beacon Chain, which amounts to nearly US$35 billion. As Cointelegraph points out, however, The Ethereum Foundation has “several mechanisms” in place to prevent a flood of ETH hitting exchanges at once.

Shapella is upon us! Here is what you need to know!$ETH pic.twitter.com/nBc2eu1ale

— Coin Bureau (@coinbureau) April 12, 2023

Kraken Australia managing director Jonathon Miller noted in an email sent to Coinhead this morning that:

“The Ethereum Shanghai + Capella upgrade is one of the most significant moments in recent blockchain development history.

“Whilst this unlocking event may create conditions for an exodus from the staking protocol, the ability to freely stake [ETH] and unstake (in accordance with bonding periods specified by the protocol) could equally attract many ETH holders who to this point had not been able to contemplate staking their assets due to the uncertain timeframe for the upgrade.

“One thing is for certain, we can expect volatility in the coming weeks as holders come to terms with the very new landscape.”

That will likely be the case, but so far at least, we haven’t seen much, or any volatility in ETH’s price since the upgrade went live a few hours ago.

In a recent report, blockchain analytics gurus Glassnode noted that less than 1% of the total unlock would be released over the first week.

The highly anticipated Shanghai/Capella hard fork is scheduled to take place on 12-April-2023, enabling the withdrawal of staked #Ethereum.

In this extended edition of the Week On-Chain, we shall evaluate the overall Ethereum staking landscape, develop a framework to establish… pic.twitter.com/EVgsz3s6GG

— glassnode (@glassnode) April 11, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.38 billion to about US$439 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Radix (XRD), (market cap: US$634 million) +20%

• Near Protocol (NEAR), (mc: US$1.94 billion) +8%

• ImmutableX (IMX), (mc: US$1.05 billion) +7%

• Mina Protocol (MINA), (mc: US$674 million) +4%

• Solana (SOL), (mc: US$9.38 billion) +2%

SLUMPERS

• Stacks (STX), (market cap: US$1.2 billion) -8%

• Conflux (CFX), (mc: US$801 million) -5%

• Aptos (APT), (mc: US$2.1 billion) -4%

• Bitget Token (BGB), (mc: US$606 million) -4%

• Quant (QNT), (mc: US$1.76 billion) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Warren Buffett’s at it again. That said, so is CNBC, which seems to routinely love asking him his predictable thoughts about Bitcoin…

"#Bitcoin is a gambling token and it doesn't have any intrinsic value. But that doesn't stop people from wanting to play the roulette wheel," says Warren Buffett on #crypto. pic.twitter.com/6MQAiyrS5J

— Squawk Box (@SquawkCNBC) April 12, 2023

Warren Buffet is discretely sitting on ~420 #Bitcoin

Berkshire Hathaway owns 12.67% of Bank of America.

Bank of America owns 2.37% of MicroStrategy.

MicroStrategy owns 140,000 Bitcoin..003 X 140,000 = 418.7 BTC Berkshire Hathaway has claims to 👀🤯 pic.twitter.com/St3rXws7uZ

— Bitcoin News (@BitcoinNewsCom) April 12, 2023

BREAKING‼️ US State of Montana just passed the ‘Right to Mine’ #Bitcoin bill in both houses – Satoshi Act Fund pic.twitter.com/UPT52KQSXs

— Bitcoin Archive (@BTC_Archive) April 12, 2023

The Hong Kong Web3 Festival is this week.

It features a HUGE lineup of 300 speakers, including @cz_binance & almost every big project + VC.

There could be some massive announcements. 👀

Something BIG is brewing in Hong Kong & Asia.

🧵: Here's everything you need to know. 👇 pic.twitter.com/q5lHON7q3n

— Miles Deutscher (@milesdeutscher) April 12, 2023

Finally, nothing to do with crypto this last one, but it sure stopped us in our tracks…

This is REAL …

👀the eyes … you can almost see the strings.

— Wall Street Mav (@WallStreetMav) April 12, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.