Crypto Espresso: BTC’s holding steady over US$30k, but a hard fork for ETH could go either way

Oh yeah, baby... it's forkin' tine. Pic via Getty Images.

Good morning Coinheads! Your usual correspondent is off being despondent in a tent somewhere for a “holiday”, so here’s a ‘not-quite Mooners and Shakers’ Crypto Espresso to fill that pretend-money hole in your knowledge bank for the day.

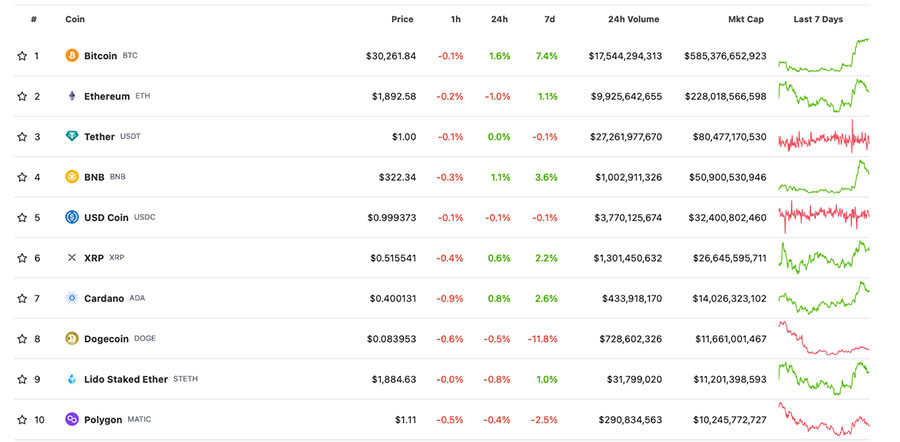

First up, a quick look at the Top 10 this morning, and the happy news is that Bitcoin has managed to find what looks like a solid foothold above the US$30,000 mark, despite a bit of a tug-of-war to keep it over the line yesterday.

As of right this moment, BTC is at US$30,253, up 1.9% for the past 24 hours, with support from the US tech-heavy Nasdaq which has, I am told by reliable sources – and Eddy Sunarto – officially ticked over into Bull Market status.

The rest of the Big Names are a mixed bag of gainers and losers, with most of them getting caught up in a sell-off that started around 6:00pm last night local time.

Here’s a pretty picture – see if you can spot when things turned sour for everyone except BTC…

It’s left Cardano and BNB in positive territory for the past 24 hours, both up around 1.4%.

However, Dogecoin is continuing to flounder, down another 0.6% since this time yesterday, taking its loss for the week to 12.5%.

And Ethereum is showing a fairly solid drop as well, down 1.0% over 24 hours to just under US$1,900 a pop ahead of what could turn out to be a fairly significant day…

Hold onto your ankles… it’s Shapella Day for Ethereum.

Later on today, once folks have woken up a bit in the US, there’s a major event happening for Ethereum, the so-called ‘Shapella’ upgrade – a day where everyone holding more than $60,000 worth of ETH has to smuggle a boogie board full of marijuana into Bali.

… My apologies. I’ve just been informed that I read the memo wrong, and that the ‘Shapella’ upgrade is actually a Really Big Deal for Ethereum – a hard fork that will enable stakers and validators to withdraw assets from the Beacon Chain.

If you’re out of the loop, here’s a super-quick rundown:

- Staked Ether accounts for around 14.2% of the total supply of the token.

- That’s roughly 16 million coins, worth more than US$30 billion, with a B.

- That $30 billion will be ‘unlocked’, and available for stakers and validators to withdraw.

- There’s a bunch of crazy technobabble about who staked what and why.

- ETH was staked in Validator blocks of 32

- Each 32 ETH block is worth around US$60,000

- Validators will have three options;

- Withdraw the block rewards and leave the stake

- Withdraw the rewards and the stake completely

- Let it all ride.

- ETH could plunge because the market is about to be flooded.

- It probably won’t because there’s incentive for stakers to keep on staking.

That’s about all you need to know for now – but ETH will be an interesting one to watch, as stakers, some of whom have had their ETH tied up in making the system work for several years, will now have a chance to yank their value out of the system to spend on stuff, like rent, food and jet skis.

Meanwhile, in slightly more understandable news

News from CoinSpot this morning is that the exchange has announced the listing of the Australian Carbon Token (BCAU) on its platform, offering customers the opportunity to invest in the emerging asset class of carbon credits.

Carbon credits are those things which allow a country or company to produce a specified amount of carbon emissions – and, should that country (or company) not produce that amount of carbon, the credits can be traded to another country (or company).

CoinSpot says that the Australian Carbon Token is “notionally backed by the value of Australian Carbon Credit Units (ACCUs), which represent 1,000kg of carbon dioxide emissions reductions, and the BCAU represents 1kg of Carbon per token”.

Australian Carbon Credits are issued by the Australian Government’s Clean Energy Regulator, when green energy projects capture or reduce emissions – which is rapidly becoming a major part of a lot of small ASX-listed companies’ strategies to offset other capital costs for things like digging stuff out of the ground.

Core Scientific gets a new head honcho

Crypto hosting and mining company Core Scientific has appointed a new president, snagging the services of XMS Capital Partners veteran Adam Sullivan from his role as managing director and head of the digital asset and infrastructure group.

Sullivan comes on board at a difficult time for Core Scientific, after the Austin (that’s in Texas) based company filed for bankruptcy in December, after the one-two punch of sinking crypto values and rampant, thick-skulled idiocy by the Texas state legislature that sent energy prices soaring in the opposite direction.

Despite that, the mining rigs at Core Scientific have continued to operate throughout the bankruptcy procedures. There’s no word on just how much the company has managed to churn out in the past four months, but with BTC prices skytrocketing past US$30,000, the balance sheet would be looking a lot healthier than it was before Christmas.

Helping Sullivan out will be Todd DuChene, Core Scientific’s current president, who will step into the dual role of chief legal officer and chief administrative officer, while the company works to unpack the pickle it found itself in late last year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.