Mooners and Shakers: FTX accounts drainer dumps ETH for BTC; contagion fears spread; Bitcoin steady

Getty Images

If you wanted a crypto week free from FUD, free from FTX contagion and fallout, this may not be it. It’s the story that keeps on giving and taking. How’s Bitcoin going, though? Hanging in there for now.

Ethereum, however, that’s had a more significant move to the downside over the past 24 hours. And that’s because one of the crypto’s most recently minted whales has been dumping a large quantity of the coin.

That whale is the FTX accounts drainer who, amid the catastrophic collapse and bankruptcy of Sam Bankman-Fried’s firm, siphoned 228,523 ETH from the exchange. That ETH was worth more than US$268 million at the time of, er “acquisition”, and would still be worth more than US$260m now.

It made whoever is controlling them one of the largest ETH owners in the world, and there had been some reports and rumours suggesting that the Bahamian government and its regulators had commandeered the funds.

The blockchain data analytics firm Chainalysis, however, has put itself out there as a debunker of that particular theory:

2/ Reports that the funds stolen from FTX were actually sent to the Securities Commission of The Bahamas are incorrect. Some funds were stolen, and other funds were sent to the regulators.

— Chainalysis (@chainalysis) November 20, 2022

According to another on-chain data provider, LookonChain, the FTX funds siphoner transferred 50k of ETH into another wallet and has, at the time of writing, so far swapped more than 60% of it for a token-pegged form of Bitcoin – $renBTC – which is developed by the Ren crypto protocol and is worth 1:1 BTC.

FTX Accounts Drainer is dumping ETH!

FTX Accounts Drainer transferred 50,000 $ETH ($60M) to address 0x866e.

And swapped 30,990 $ETH for 2197.5 $renBTC.https://t.co/MLYLq9zRMk pic.twitter.com/f4lXd8aSfc

— Lookonchain (@lookonchain) November 20, 2022

The price of ETH has dipped as a result, but has been holding steady again around US$1,150 for the past handful of hours. The fear is that further sell-offs from whoever this whale actually is (potentially a hacker, potentially someone at FTX with “backdoor” access) might cause an undue amount of further panic-selling in the market.

As the no.2 crypto, though, with a lot of long-term believers in it across the industry, you’d like to think a cascading effect due to one whale/bad actor’s dumpage might be limited. Anything can happen from here, though, in a market extremely on edge about further crypto/FTX contagion damage to come.

Grayscale and Genesis issues?

The biggest fear for the next potential FTX contagion dominoes now centres around Grayscale and Genesis.

Grayscale is a firm that has long been seen as the best way for institutional clients to gain exposure to the crypto market. It holds the largest cryptocurrency trust in the industry, however, each share of the trust has lately been trading roughly 40% below the price of BTC as an underlying asset.

There is concern floating around that Digital Currency Group, which owns Grayscale and Genesis Trading, is potentially facing some financial difficulty linked to the FTX fallout. (Genesis Trading halted withdrawals a few days ago on the lending arm of its platform.)

The Wall Street Journal, for instance, reported that Genesis was seeking a US$1 billion bailout from investors, including Mike Novogratz and the Winklevii brothers without any success.

Further fuelling this fear somewhat, Grayscale has declined to share “proof of reserves” due to “security concerns”. The proof of reserves concept has come to the fore post FTX crash, as crypto firms seek to allay fears and build trust through transparency by sharing their backing reserves information.

5) To be perfectly clear: the $BTC underlying Grayscale Bitcoin Trust are owned by $GBTC and $GBTC alone.

— Grayscale (@Grayscale) November 18, 2022

Grayscale has sought to allay fears in its own way, assuring all that all crypto backing its investment products are held by Grayscale alone and stored with Coinbase’s custody service. The trust is said to hold about 633k Bitcoin.

Here’s Bitcoin bull, investment manager and Austrian economist Lawrrence Lepard’s take on the Grayscale Bitcoin Trust (GBTC) situation. He’s written quite a long thread, but in short, he believes it’s unlikely it’s the next tumbling domino.

I believe they have the coins. it is NYState regulated, and it is a Trust. It is audited. This is not a fly by night FTX situation. Lawyers like Davis Polk are involved. For them not to have the coins would be a legal violation. eg: fraud would be required.

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) November 19, 2022

Top 10 overview

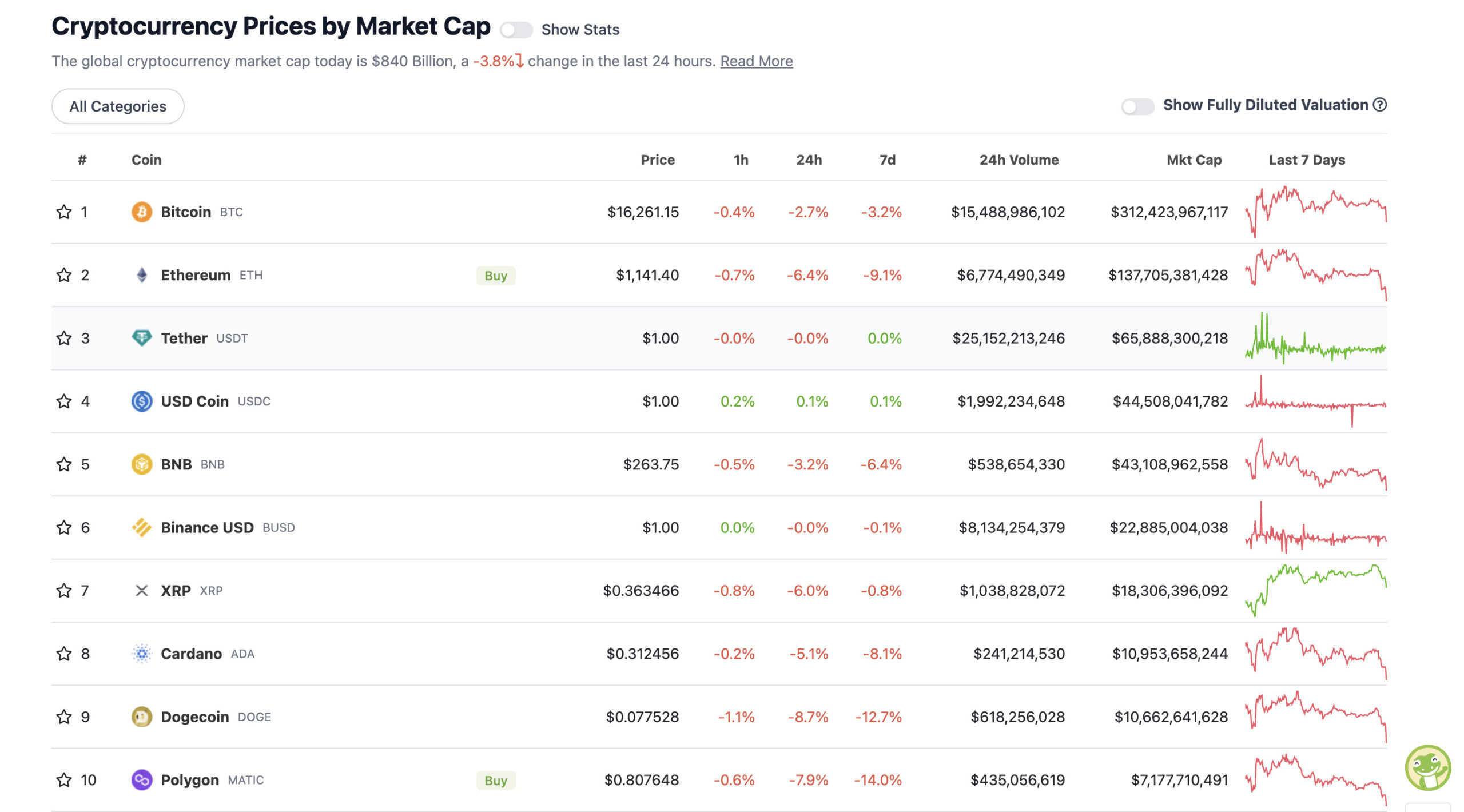

With the overall crypto market cap at US$840 billion, down 3.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So we said ETH had dumpedm and that’s true, but so have other crypto majors, including XRP, Cardano, Dogecoin and Polygon.

The latter, MATIC – despite a spate of high-profile partnerships and adoption news just lately – has taken a bit of a beating over the past week or so. There’s no real reason that we can see for that, however, other than being a project that caught a good run of positivity but has been caught in the market-wide sell-off since FTX imploded.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.64 billion to about US$318 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Leo Token (LEO), (market cap: US$4.03 billion) +3%

• Chain (XCN), (mc: US$1.05 billion) +2%

One massive pump, which has since massively dumped, did catch the eye overnight. The crypto project is SONM, a decentralised fog-computing platform, and its token is SNM.

The thing moved by more than 4,000% to US$10.91 overnight. Before plummeting right back down to where it currently sits, at about US$1.57.

Not exactly the most trust-inducing price action, is it.

Not sure if it is a contra trading involving stolen coins or a lack of liquidity due to the withdrawal of market makers.

— Wu Blockchain (@WuBlockchain) November 20, 2022

DAILY SLUMPERS

• Chiliz (CHZ), (market cap: US$1.05 billion) -19%

• Algorand (ALGO), (market cap: US$1.82 billion) -15%

• EthereumPoW (ETHW), (mc: US$346 million) -13%

• Trust Wallet (TWT), (mc: US$811 million) -11%

• NEAR Protocol (NEAR), (mc: US$1.3 billion) -10%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

BREAKING: Joe Biden calls for global #Bitcoin and crypto rules after FTX collapse – Forbes

— Bitcoin Archive (@BTC_Archive) November 20, 2022

To the FTX hacker (aka Sam):

I'll buy as much ETH as you have, right now, at $1164.

Sell me all you want.

Then go fuck off.

— sassal.eth/acc 🦇🔊 (@sassal0x) November 20, 2022

— Helin Ulker (@beautyofhelin) November 19, 2022

#Bitcoin – is about to enter the most boring stage of the market cycle. The area of least interest but most opportunity.

"buy when it's boring." … and be willing to wait.

It's unclear if the market has truly bottomed or not, but $BTC is likely gonna spend 1-year sideways. pic.twitter.com/24MaYc4FzP

— Kevin Svenson (@KevinSvenson_) November 19, 2022

Meanwhile. At @nftfestaus ticket HQ…

Please send your best wishes to ticket boss, the unsinkable @rvchellecox

Pick your ticket up today. DM Richelle for details 🙂 pic.twitter.com/jfseKkbz7Z

— Steve Vallas (@stevevallas) November 21, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.