Mooners and Shakers: FTX mess is worse than Enron, says the firm’s liquidator; crypto market flat

Getty Images

John Ray III, the lawyer liquidator brought in to try to clean up the FTX crypto exchange mess, says he’s never seen a company in worse shape, and that includes Enron.

And he’d know – he’s the guy who led the restructuring of the crumbled energy company after it made the Accountancy Scandals hall of fame in 2001.

As more and more crazy details emerge from the FTX implosion saga, though, some of which we’ll get to in a sec, let’s get a quick vibe check on the market.

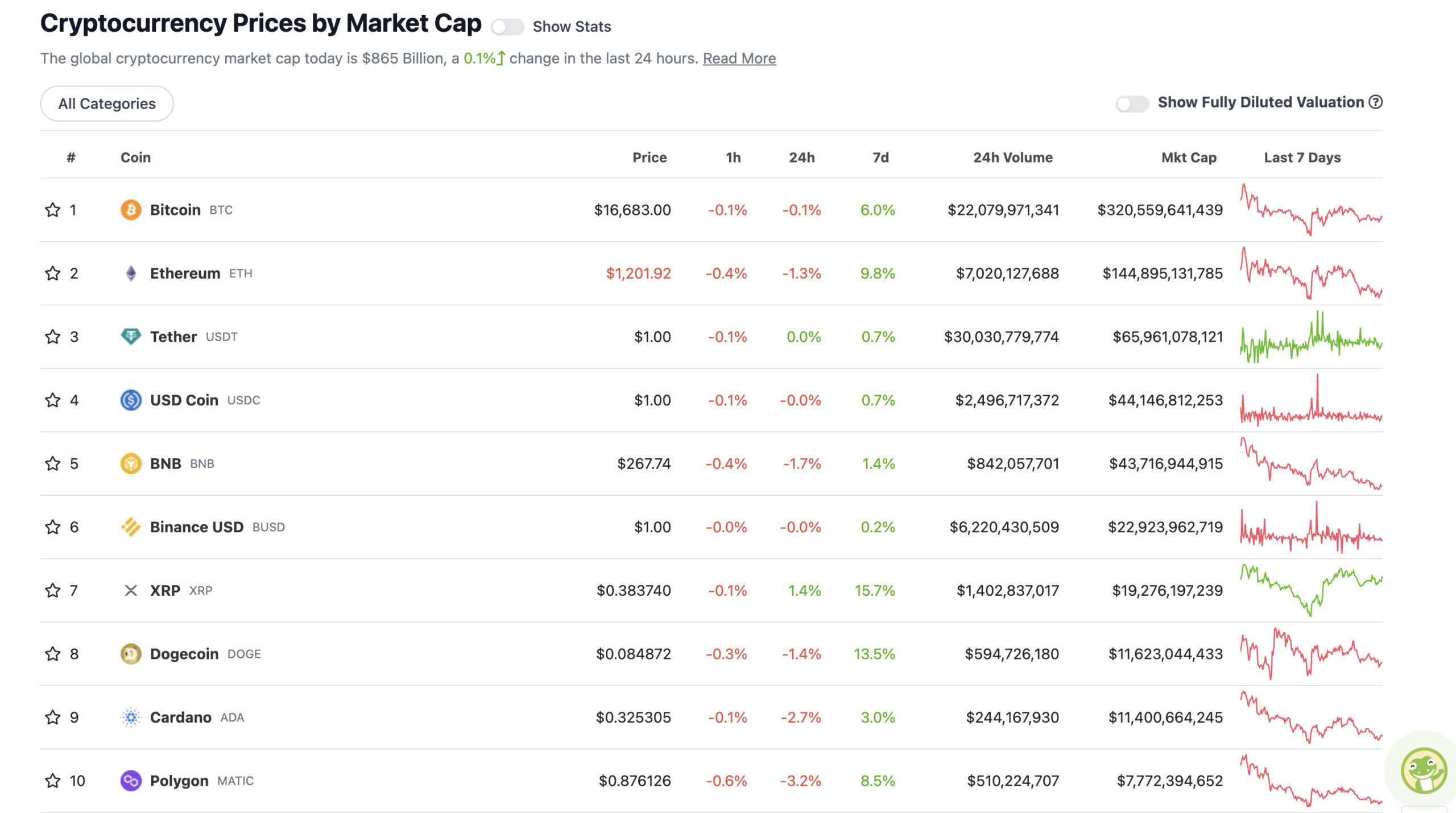

Over the past day, Bitcoin is trading pretty flat, Ethereum is down a fraction, Tether hasn’t suddenly gone bust and XRP (+1.4%) is winning the daily crypto majors gains – which admittedly isn’t a major feat right now.

All in all, considering the continued fallout and general nervy market sentiment that remains, the market by and large is holding up relatively… okay. (Well, since it dramatically crashed when the FTX bankrun took place, that is.)

Has it reached a level of completely numb seller exhaustion? Wouldn’t want to be overly deterministic about that, or anything when it comes to crypto, but trader analyst Alex Krüger seems to think there’s a general apathy that’s kicked in.

Notice how the market does not care any longer https://t.co/nt4H2mDPjo

— Alex Krüger (@krugermacro) November 17, 2022

It’s official: FTX is in worse shape than Enron

John Ray III has no problem identifying a company that’s rotten to its core. He’s the lawyer who’s been appointed as CEO to clean up the FTX mess and the guy who was appointed to oversee Enron’s liquidation process.

The Texas energy company rose to dizzying heights before a dramatic fall (US$90.75 share price down to less than a dollar) in one of the most horrific Wall Street plummets from grace of all time.

John Ray III thinks FTX is in worse shape.

“I have over 40 years of legal and restructuring experience,” Ray said in an updated, 30-page bankruptcy filing for the crypto exchange. “I have been the chief restructuring officer or chief executive officer in several of the largest corporate failures in history … Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Here then, are some of the most shocking details from the FTX bankruptcy filing, according to Grit Capital CEO Genevieve Roch-Decter – a “former $100mm money manager”. She’s written a good summarising post of the filing:

I read the 30 page FTX Bankruptcy court filing.

How bad were FTX's internal controls?

Here are the worst examples 👇

— Genevieve Roch-Decter, CFA (@GRDecter) November 17, 2022

Some highlights:

• Employees submitted expense reimbursements over a chat app. A random supervisor accepted or rejected the payments using an emoji. In fact, few records were kept and most decisions were made over chat, with messages automatically deleting over time.

• Alameda Research – FTX’s trading firm and hedge fund – gave Sam Bankman-Fried a US$1 billion personal loan. They also loaned Director of Engineering Nishad Singh US$543 million.

• The US$32 billion company (at its peak) never held board meetings and had no cash-management system and no proper records of who it employed.

• The firm’s corporate funds were used to purchase personal use real estate. And employees and executives put their names on homes purchased with company funds.

• Customer-deposited crypto wasn’t even recorded on the FTX balance sheet, which is probably the most shocking revelation of all.

JUST IN: FTX customer funds were used to buy homes for employees and advisors in the Bahamas – FTX new CEO John Ray

— Bitcoin Archive (@BTC_Archive) November 17, 2022

Top 10 overview

With the overall crypto market cap at US$865 billion, up 0.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

If you don’t like the colour red, then move your eyes slightly right from middle on the chart to the seven-day timeframe. It backs up the fairly conservative thesis we gave earlier in this article – that the crypto majors, at least, have been managing to hold up reasonably well since the worst of the FTX news unfolded.

At least, we hope we’ve seen the worst of it. Nothing much can surely surprise the crypto market any more. Can it? (Tether FUD, anyone?)

Tired of the SBF/FTX rumors after one week.

Twitter has a way of making weeks feel like years. 👴

Looking forward to more constructive topics like how do we get even a portion of people's money back and how do we put SBF in prison?

— Justin Bennett (@JustinBennettFX) November 17, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.64 billion to about US$318 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Kava (KAVA), (market cap: US$318 million) +9%

• Litecoin (LTC), (mc: US$4.44 billion) +8%

• Arweave (AR), (mc: US$497 million) +5%

• LEO Token (LEO), (mc: US$3.76 billion) +5%

• Aptos (APT), (mc: US$605 million) +4%

DAILY SLUMPERS

• Curve DAO (CRV), (market cap: US$349 million) -6%

• BTSE Token (BTSE), (market cap: US$518 million) -6%

• NEAR Protocol (NEAR), (mc: US$1.5 billion) -5%

• Solana (SOL), (mc: US$4.95 billion) -5%

• Synthetix Network (SNX), (mc: US$413 million) -4%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

JUST IN – Binance US planning to acquire bankrupt crypto lender Voyager, who had been bailed out by FTX: CoinDesk

— Bitcoin Magazine (@BitcoinMagazine) November 17, 2022

Breaking: Sources say a GOP House means hearings into @SBF_FTX. One focus: SBF meeting w @GaryGensler to create a crypto exchange and if he was given preference because of his ties to Dem Party. Also why @SECGov didn’t see the FTX implosion coming more now @FoxNews @JesseBWatters

— Charles Gasparino (@CGasparino) November 16, 2022

I've started a chart to track the FTX contagion.https://t.co/uwK24F0dsV

— Molly White (@molly0xFFF) November 16, 2022

There's $1.5M worth of Coachella NFTs stuck on FTX.

Ouch.

— MattyVerse (@DCLBlogger) November 17, 2022

You've probably been too busy following the #FTX drama to have noticed some news this week:

The NY Fed along with Citi, HSBC, Mastercard, Wells Fargo and others are starting a 12-week digital dollar #CBDC pilot study.

Big deal or NBD? Get your ☕️ and follow along:

🧵

1/20 pic.twitter.com/iQtFogdVz3— Coinbits | Bitcoin made easy (@CoinbitsApp) November 17, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.