Mooners and Shakers: Ethereum Merge upgrade all set for testnet; Bitcoin consolidates above $30k

Getty Images

As Ethereum moves closer to its “Merge”, Bitcoin is apparently in “Bart season” with BTC’s price movements lately resembling an upright or inverted spiky head of the Simpsons character.

And that’s been indicative of some particularly choppy waters (and unpredictability) that’s been keeping day traders on their toes all week. Whale games at play? Maybe.

Gotta love #Bitcoin bart season pic.twitter.com/jyChLPmVV4

— Benjamin Cowen (@intocryptoverse) June 8, 2022

That said, over the past 10 hours or so at the time of writing, the OG crypto has been travelling above US$30k and below $31k, so there’s at least a bit of a consolidation-range respite forming there again.

Wouldn’t bet on that lasting too long before another dramatic move, though. Let’s perhaps hope we don’t see the start of an inverted Marge Simpson pattern…

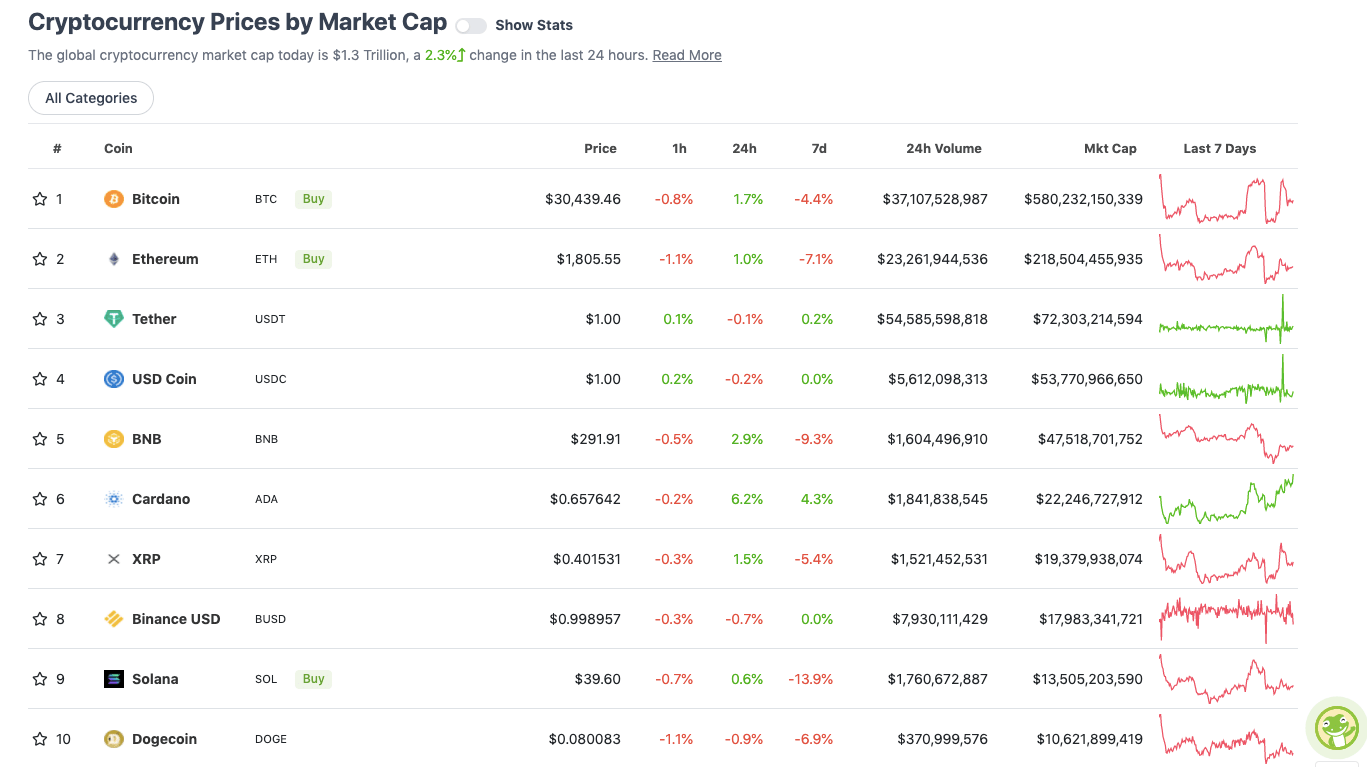

Top 10 overview

With the overall crypto market cap at roughly US$1.3 trillion, up about 2.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin’s ranging conditions today appear to be a “no-trade zone” for Dutch analyst Michaël van de Poppe, who wants to see a breach of US$31.5k for any momentum further north on the charts…

Simple playing field for #Bitcoin.

Break through $31.5K = $32.8K and/or $35K.

Support zones for longs probably $30K and $29.3K still.

In between = no trade zone. pic.twitter.com/Q1UfSFFH8r

— Michaël van de Poppe (@CryptoMichNL) June 8, 2022

Cardano (ADA), meanwhile, is still the out-and-out top 10 crypto performer of the week – up 4.3% over the past seven days, and more than 6% in the past 24 hours. Why? See yesterday’s Mooners and Shakers column for that explanation – it still applies.

A step closer to Ethereum’s Merge

Next in line to Bitcoin’s crypto crown, Ethereum (ETH) is travelling along fairly flat road today, but generally going okay around US$1,800.

The premier smart-contract blockchain’s highly anticipated “Merge” – a transition from its current proof-of-work (PoW) mechanism to proof-of-stake (PoS) consensus algorithm – is reportedly moving a step closer in just a few hours.

The trial of the protocol’s upgrade is set to occur on the Ropsten public testnet. And whether this is a short-term price mover or not doesn’t really matter to the many Ethereum faithful, who view the eventual transition as the most significant, positive, crypto event of the year.

That’s because the new PoS model is designed to solve some of Ethereum’s biggest issues, such as high transaction costs and the network’s ability to scale.

This Twitter thread from, erm, “PastryEth” is an excellent, if highly technical explainer…

It's a big day for Ethereum.

Within the next 24 hours, the Ropsten network will undergo The Merge.

This marks the final phase of testing before deployment on mainnet.

Let's dive in… pic.twitter.com/X7GdZqoR8z

— pastry (@PastryEth) June 8, 2022

The thread goes into plenty of detail, but if you want the TLDR angle… maybe just the benefits of the Merge, then here they are:

• “The switch to PoS will signal the end of PoW Ethereum and start the era of a more sustainable, eco-friendly blockchain. In fact, it is estimated PoS will use 99.5% less energy than PoW.”

• “Additionally, The Merge will cause massive changes in supply/demand forces for ETH Immediately following it, issuance will reduce by over 90%, and millions in daily sell pressure will be replaced with buy pressure. This is the equivalent of 3 BTC halvings.”

The actual mainnet Merge itself is scheduled to happen some time in August.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.2 billion to about US$492 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Chainlink (LINK), (market cap: US$4.01 billion) +11%

• Arweave (AR), (mc: US$721 million) +10%

• Theta Network (THETA), (mc: US$1.35 billion) 10%

• FTX (FTT), (mc: US$3.8 billion) 9%

• NEO (NEO), (mc: US$879 million) 8%

DAILY SLUMPERS

• Terra Luna Classic (LUNC), (market cap: US$814 million) -18%

• Tezos (XTZ), (mc: US$1.8 billion) -3%

• Internet Computer (ICP), (market cap: US$1.58 billion) -3%

• Gala (GALA), (mc: US$600 million) -2%

• eCash (XEC), (market cap: US$1.03 million) -2%

Around the blocks

A selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse…

If #bitcoin is not going to zero then it’s going to a million. pic.twitter.com/uY673NAMPf

— Michael Saylor⚡️ (@saylor) June 8, 2022

Paul Krugman says #Bitcoin is like the Housing Bubble.

Paul Krugman also said the internet was like the fax machine.

— Bitcoin Archive (@BTC_Archive) June 8, 2022

BREAKING: Fidelity and Citadel are building a crypto trading platform

– Bloomberg

— Blockworks (@Blockworks_) June 7, 2022

This is your daily reminder that #Bitcoin in your exchange account, isn't *really* yours… pic.twitter.com/mFwAl1KWl7

— Coin Bureau (@coinbureau) June 8, 2022

https://twitter.com/NorthmanTrader/status/1534523895356719104

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.