Mooners and Shakers: Bitcoin does a Bart Simpson as market dips again; Cardano holds up well

Those clouds look kinda familiar… (Getty Images)

Don’t have a cow, man, but Bitcoin (BTC) and the rest of the market haven’t been able to build on a strong start to the week. That said, at the time of writing the OG digital asset is holding pretty firm just under US$30k.

In the space of 24 hours, the prices of the two leading cryptos – Bitcoin and Ethereum (ETH) – lost 6% and 7% respectively, completely wiping out the gains made at the very beginning of the week.

That’s crypto… and some analysts yesterday called it – guess it’s not particularly surprising to see a pump falter when coupled with low trading volume.

To get a visual sense of how things have been playing out for Bitcoin since yesterday, this TradingView chart tells a Bart Simpson-head story.

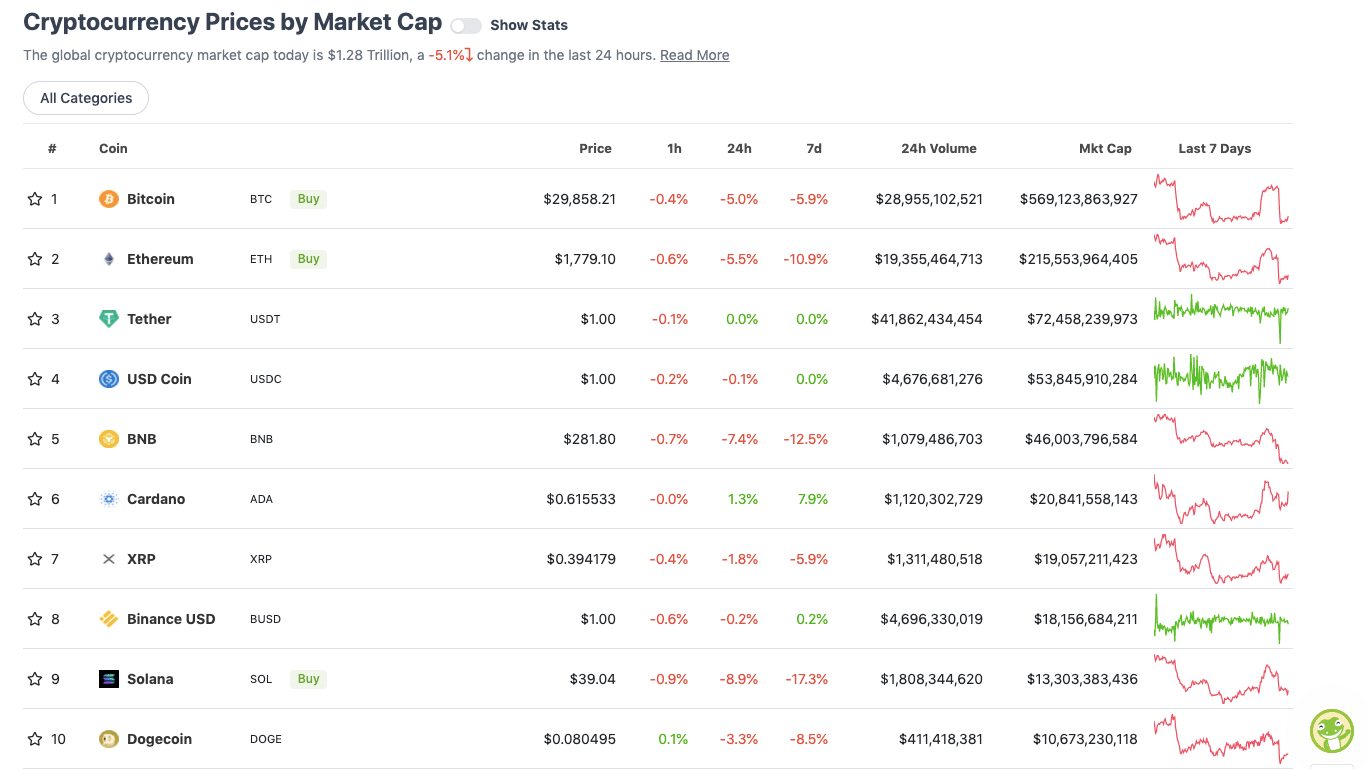

Top 10 overview

With the overall crypto market cap at roughly US$1.28 trillion, down about 5.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin, Ethereum and the market at large have at least found support again for the moment, arresting any particularly dramatic fall. A bit more consolidation here? Perhaps a dip further down? Wouldn’t be the worst thing for dollar-cost averagers.

Although some in the space believe around US$25k was the Bitcoin bottom, judging by analyst Rekt Capital’s calculations, it might not be wise to assume things have finished flushing out quite yet.

#BTC tends to confirm uptrends when it breaks above the blue 50-week EMA$BTC tends to confirm maximum financial opportunity when it reaches & breaks down from the black 200-week EMA

Is the BTC bottom in already or is there more downside to come?

A thread…#Crypto #Bitcoin pic.twitter.com/Matflwh6uQ

— Rekt Capital (@rektcapital) June 7, 2022

But wait… but wait… one of Rekt’s fellow analysts and traders, Roman, is seeing a possible bullish divergence and double bottom potentially forming for BTC. Short-term timeframe stuff… but one to watch.

$BTC H4

Revisiting the idea of the “diagonal breakdown”. I don’t believe this is a breakdown considering volume is much lower here.

I’m seeing possible bull Divs on RSI/MACD as well as possible bull PA on LTF.

Looking for a double bottom reversal.#bitcoin #cryptocurrency pic.twitter.com/33xqtNMWIK

— Roman (@Roman_Trading) June 7, 2022

Meanwhile, one crypto major that is holding up particularly well today is Ethereum’s layer 1 rival Cardano (ADA).

The Charles Hoskinson-founded blockchain will undergo a “hard fork” on July 29, dubbed “Vasil”. The upgrade promises to enhance Cardano’s scalability and its smart-contract capabilities.

$ADA Holders MUST WATCH – Vasil Hardfork Explained

This video was a fun project! I explain all of the technical updates happening to #Cardano on June 29th

Dedicated to @VStDabov ❤️🌱

Thank you for watching! Be sure to LIKE & RT-> https://t.co/y91DHth2xi pic.twitter.com/rSpe7KFTh0

— K₳izen Crypto (@KaizenCrypto) June 6, 2022

Conversely, another layer 1, Solana (SOL) has slipped to a near 10-month low, as its bad run of form and loss of investor confidence continues, following another network outage last week.

That said, it’s a project with a lot of big backers… and the lower it falls, the more opportunity it potentially presents for a stupendous rebound when favourable conditions return? Look, we couldn’t possibly say one way or another on that front.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.2 billion to about US$488 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• eCash (XEC), (mc: US$1.05 billion) +5%

• Leo Token (LEO), (market cap: US$4.89 billion) +4%

• Gala (GALA), (mc: US$608 million) 3%

• Decred (DCR), (mc: US$497 million) 1%

DAILY SLUMPERS

• Terra Luna Classic (LUNC), (mc: US$795 million) -14%

• NEO (NEO), (mc: US$806 million) -10%

• Internet Computer (ICP), (market cap: US$1.6 billion) -9%

• Helium (HNT), (market cap: US$987 million) -8%

• Theta Network (THETA), (market cap: US$1.2 million) -8%

Around the blocks

Want some hopium? Here’s some, courtesy of “ciniz.eth”. Caveat… no idea who this is, other than the fact they’re apparently a “web3 enthusiast, metaverse expert, defi enjoyooor, and nft collector” with a Twitter following of about 29k. Sounds legit.

https://twitter.com/screentimes/status/1533912889261805569

Meanwhile, two US senators (Cynthia Lummis and Kirsten Gillibrand) have drafted a new, bipartisan crypto-industry bill with several fairly innovation-friendly proposals. It ain’t perfect, but it’s a good step forward for regulatory clarity…

"The most important goal of this legislation was to create transparency, accountability and certainty," says @SenGillibrand on new #crypto legislation. "Regulation is necessary. You need to make sure that you have consumer protections. You need basic rules of the road." pic.twitter.com/DWkzXmveUN

— Squawk Box (@SquawkCNBC) June 7, 2022

Buy YouTube next

— JP | Arcade 👾 (@missionpoole) June 7, 2022

https://twitter.com/NorthmanTrader/status/1534191155180609540

https://twitter.com/NorthmanTrader/status/1534191850847870976

News just in… seems big…

💥 PayPal users can now withdraw their crypto to external wallets.

This is HUGE for adoption! 🚀

— Layah Heilpern (@LayahHeilpern) June 7, 2022

Annnnd one last fresh update to this roundup… looks like Bart Simpson just inverted…

A classic #Bitcoin bart, immediately followed up by an inverse bart. pic.twitter.com/l0iS58Qq0p

— Benjamin Cowen (@intocryptoverse) June 7, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.