Mooners and Shakers: CZ summoned by US court; Cardano, Solana and BNB tumble as Bitcoin hangs in

Getty Images

As the the storm clouds continue to gather around elements of the crypto industry in the US, certain altcoins are having a particularly bad time price-wise today, while Bitcoin remains defiant… for the moment.

Coinbase CEO Brian Armstrong, meanwhile, is also maintaining a line of defiance, telling Bloomberg, regarding the exchange’s impending legal battle with the SEC:

“I think we’re gonna be fine going to the court. Even if this takes some time, that’s OK,” adding:

“We are not going to wind down our staking services. As these court cases play out, it’s really business as usual.”

As for Binance’s global CEO Changpeng “CZ” Zhou, he’s also defiant, in defiantly relentlessly using the expression “FUD” (fear, uncertainty and doubt), often used as a sort of “talk to the hand” diffuser.

CZ has been served a summons by the United States District Court in Washington, D.C. – a couple of days after the Securities and Exchange Commission (SEC) sued the exchange for alleged unregistered securities operations, among other things including (again allegedly) misleading investors about internal controls and allowing the commingling of customer funds.

Eleanor's tweet was accurate. Not FUD.

The FUD I was referring to was other FUD on Twitter or elsewhere, which there are plenty.

— CZ 🔶 BNB (@cz_binance) June 7, 2023

Multiple FUDs going on. This one widely circulated in Asia, saying "there was an argument I had with an American inspection agency, and I took out a AK47. The police then opened fire first, and I got wasted…"

This is the 2nd time I got wasted imaginarily in Asia news. Last one… pic.twitter.com/toKytDmlzj

— CZ 🔶 BNB (@cz_binance) June 7, 2023

It really is difficult to defend “crypto” against those who believe the whole sector is one gigantic clown world, (which includes some very bright colleagues, family, friends and probably Coinhead‘s dog, which must be pleased she’s not a shiba inu right about now). And nor should we even try when it comes to some/several elements of the cryptoverse.

Although this writer very much believes in the central ideas behind, and long-term future of, top assets Bitcoin and Ethereum*, taking a step back and trying to view the sector as a non-invested outsider skimming the mainstream headlines and feeling the smugness of Bored Ape billionaires, it’s easy to see why negative sentiment prevails right now.

(*Yes, Coinhead dabbles in utter crap such as Pepe from time to time… for research purposes. Ahem, always gamble responsibly.)

BTC Markets’ head Caroline Bowler, however, had some good perspectives yesterday in a chat with Coinhead. Referring to Coinbase and Binance, she noted:

“I think that unfortunately for both organisations, staff and their clients, the coming period may be tumultuous. The outcomes certainly will be significant, in either case.

“But crypto is bigger than any one company or any one person – we’ve been shown that repeatedly. I am also firmly of the belief that we are still in the early days for cryptocurrency.

“This will be a different industry and with a refreshed bench of “significant players” in five years’ time.

“Does any of this impact the functionality of Bitcoin or Ethereum, for example? No. Their use cases remain unchanged.”

Independent Reserve boss Adrian Przelonzy also provided some silver-lined words yesterday, including:

“Crypto is here to stay and it looks like we are in for a protracted legal battle between US regulators and exchanges. The end result will likely be a middle ground which will hopefully bring about more regulatory clarity.”

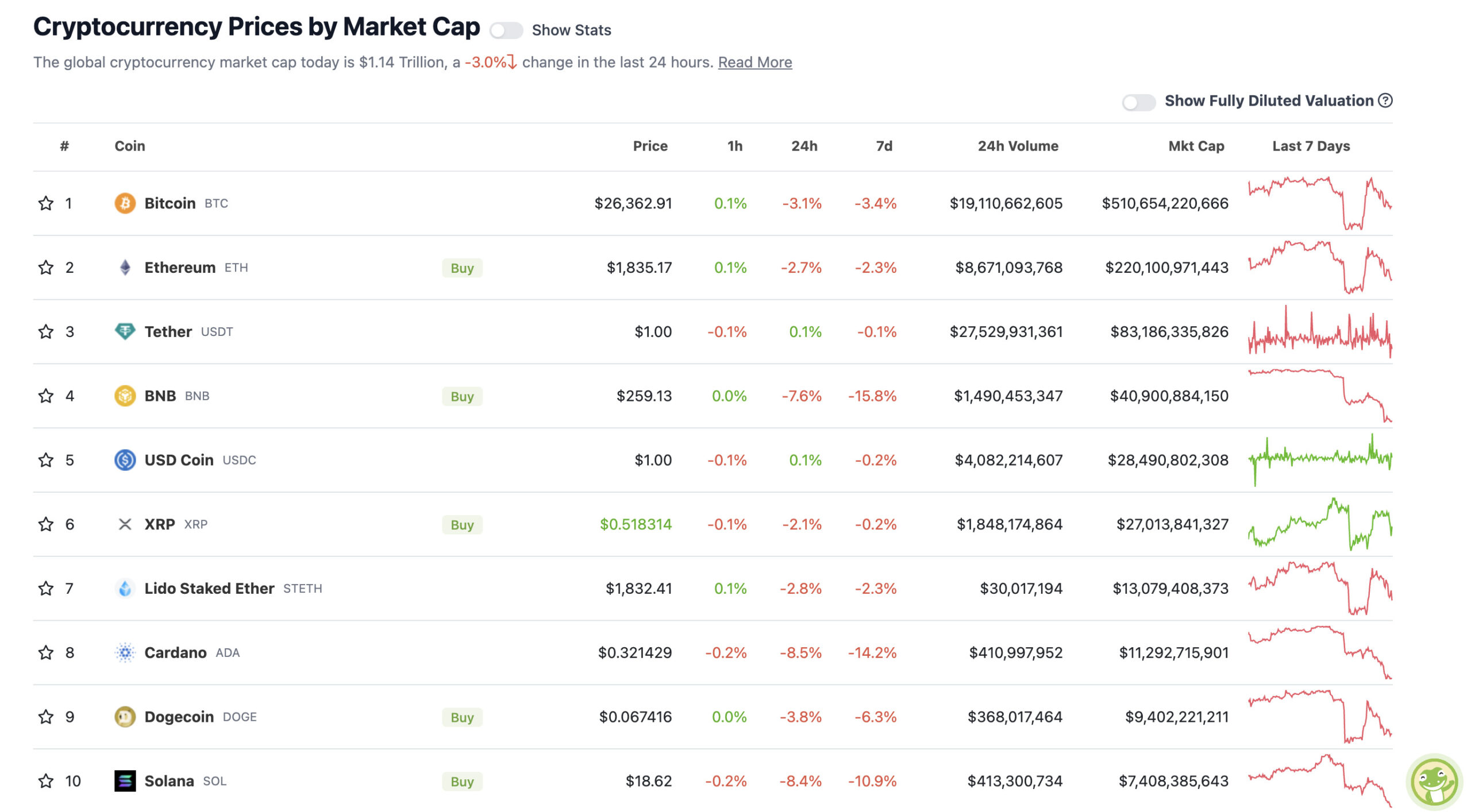

Top 10 overview

With the overall crypto market cap at US$1.14 trillion, down about 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Cardano (ADA) is the leading loser in the majors over the past 24 hours, while Binance token BNB leads the weekly bleed. Solana (SOL) is also having a crap time of things in the top 10, while Polygon (MATIC) has slipped back to no.11 and is down about 15% over the past seven days.

Why are these tokens, specifically having the roughest of times? As noted in our coverage of Sheriff Gensler’s Posse actions yesterday, those coins, among others, have been specifically mentioned in the SEC’s lawsuit filings against both exchanges.

Righto then, what are a couple of our go-to Crypto Twittering analysts feeling regarding the bull goose, market-moving crypto Bitcoin right now?

Roman reckons he “could care less about price movements” while Bitcoin hangs on to macro support, which it is for now…

$BTC 1D

Until we lose macro support, I could care less about price movements.

I’m still looking for a long setup because RR not only favors longs but there’s nothing bearish yet.

Price action heavily favors upward movement.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/OSCC4ciUXK

— Roman (@Roman_Trading) June 7, 2023

While Michaël van de Poppe thinks something similar yet seems disgusted by the price action right now. Ah well, there’s no pleasing everyone.

#Bitcoin is still holding onto the range low, but the price action is simply disgusting.

Needs to hold above $26,100 to avoid a cascade. pic.twitter.com/HbWBgREkyK

— Michaël van de Poppe (@CryptoMichNL) June 7, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Stacks (STX), (market cap: US$890 million) +5%

• XDC Network (XDC), (market cap: US$475 million) +3%

SLUMPERS

• Kava (KAVA), (market cap: US$551 million) -11%

• Pepe (PEPE), (mc: US$451 million) -11%

• Render (RNDR), (mc: US$802 million) -9%

• Decentraland (MANA), (mc: US$766 million) -9%

• Chiliz (CHZ), (mc: US$462 million) -9%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

In 2019, Gary Gensler offered to serve as an advisor to Binance.

In 2021, he was appointed as chair of the SEC by Biden.

In 2023, he filed 13 charges against Binance and @cz_binance.

— Miles Deutscher (@milesdeutscher) June 8, 2023

The @SECGov is weaponizing their role to kill an industry. Allowing a company to list publicly and then stonewalling their attempts to register is indefensible. @GaryGensler, expect to hear from Congress.https://t.co/GdprSW1Yns

— Senator Bill Hagerty (@SenatorHagerty) June 6, 2023

It's been a tough 48 hours for crypto – but there are some silver linings and green shoots. pic.twitter.com/RDVJWnzSRP

— Coin Bureau (@coinbureau) June 7, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.