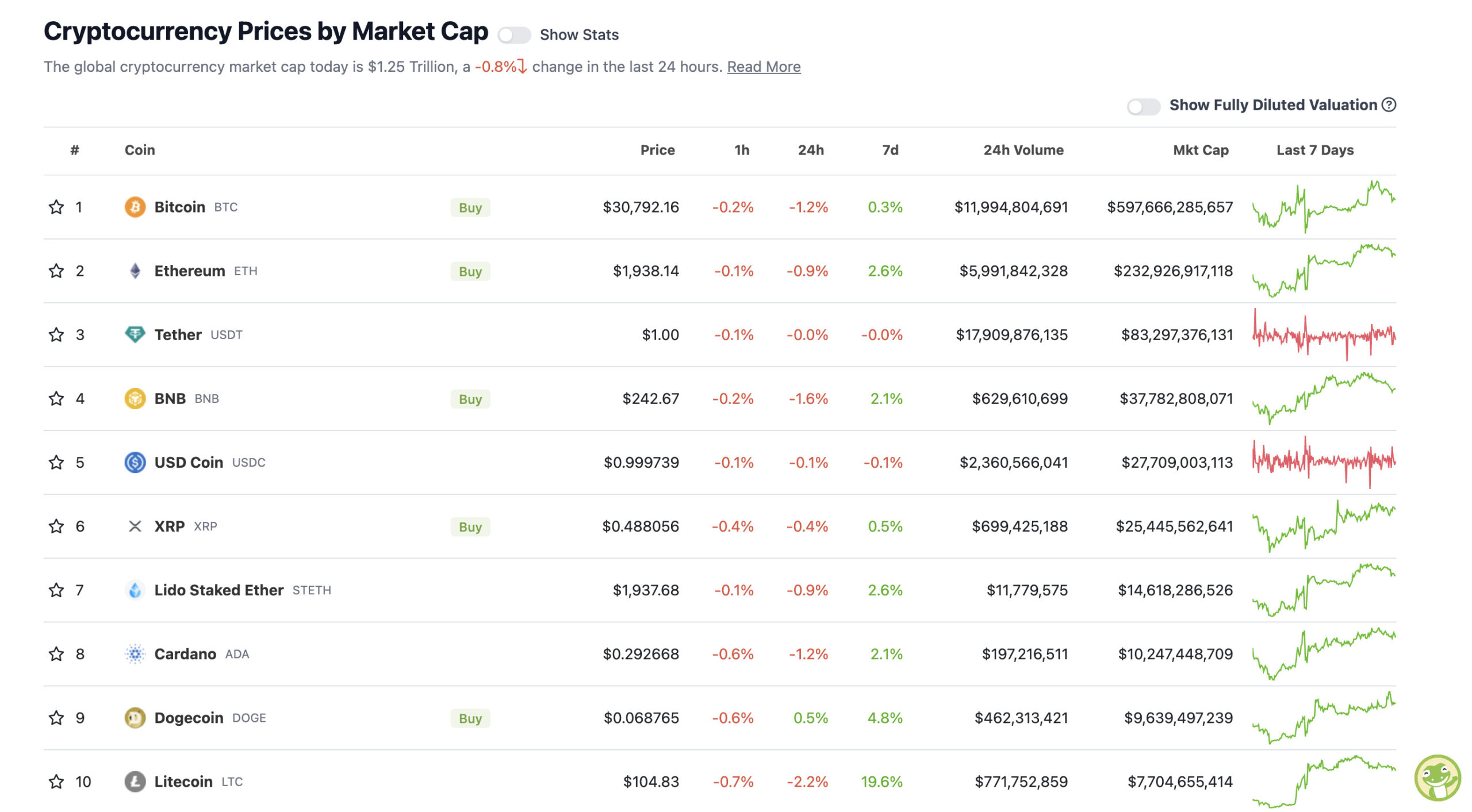

With the overall crypto market cap at US$1.25 trillion, down about 0.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Mooners and Shakers: Crypto sentiment still up after Bitcoin posts two green quarters in a row

"Hide the Pain Harold Jr", yesterday. (Getty Images)

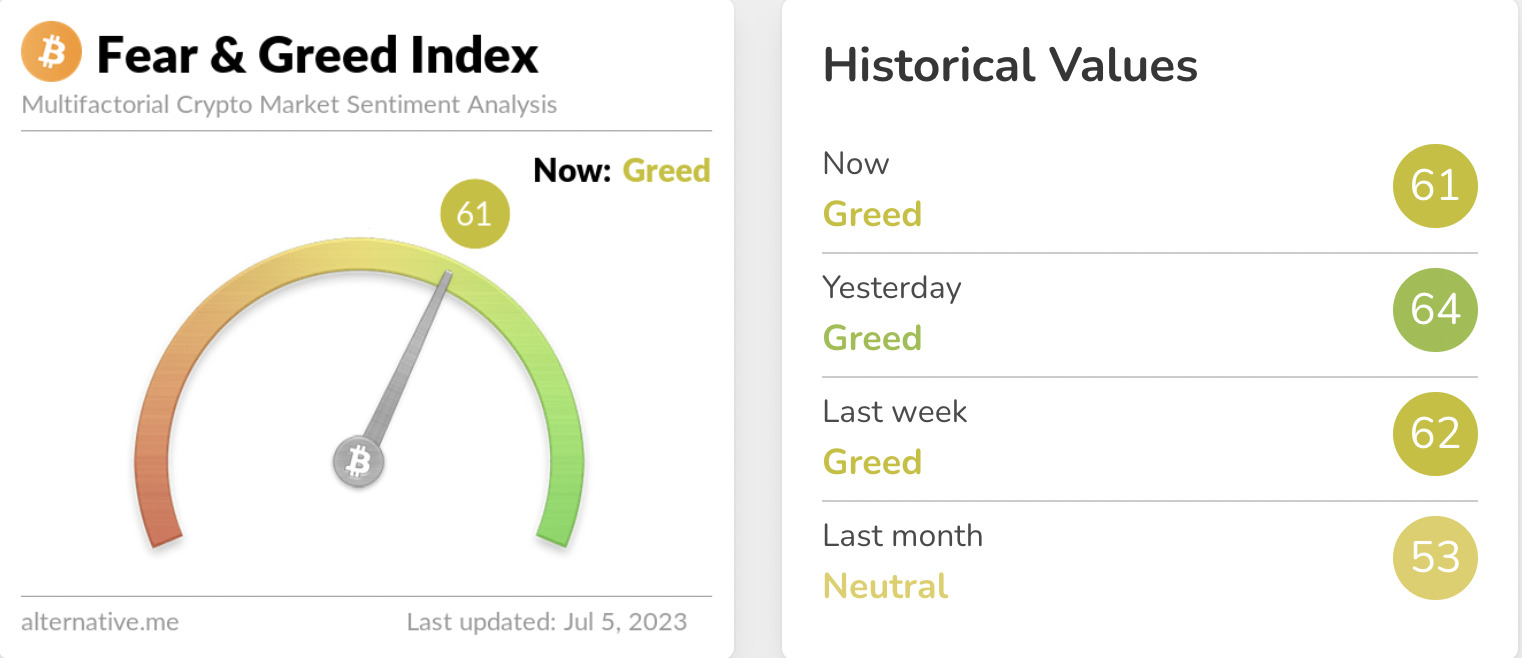

Bitcoin dipped a tad overnight but remains fairly steady in the high US$30ks for now. Meanwhile, the market sentiment is still leaning towards “Greed”.

For all the naysaying about crypto that bled into this year after last year’s disastrous PR for the industry thanks to the likes of SBF and Do Kwon and others, it’s actually been a pretty decent 2023 so far.

And we don’t need to look any further than Bitcoin’s performance for that…

#Bitcoin just closed up 2 quarters in a row for the first time in 2 years. pic.twitter.com/bLJebga10s

— Bitcoin Archive (@BTC_Archive) July 4, 2023

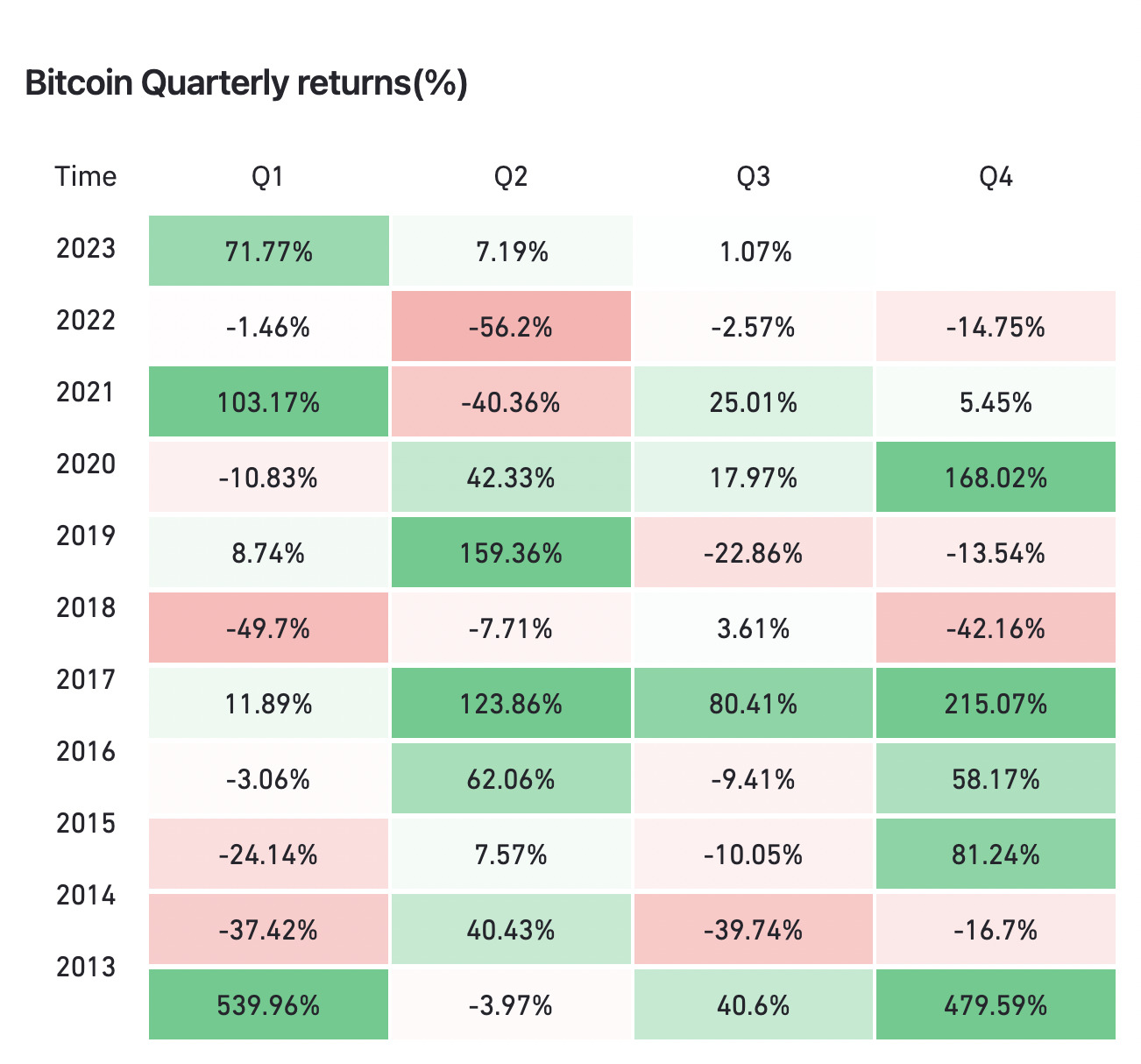

According to data analytics gurus Coinglass, the bull goose crypto asset has posted positive returns for the first two quarters of this year. A bit like the Aussies in the Ashes in England, it’s the first time it’s gone two for two in quite some time. (Actually, for Bitcoin it’s only been since 2021, but Ashes references are a contractual obligation for this column – when Australia is winning, that is.)

Yes, Q2 (+7.19%) hasn’t been anywhere near as verdant and price-positive as Q1 (+71.77%) but the upshot is, Bitcoin is still the very best-performing asset class this year.

In fact, notes Coinglass, BTC has an average annual rate of 230% since 2011, 10x higher than the next best, which is the Nasdaq 100 index.

“Over the same period, large US stocks experienced an annualized return of 14%, high-yield bonds saw a growth of 5.4%, and gold had a return rate of 1.5%,” noted the blockchain analytics firm.

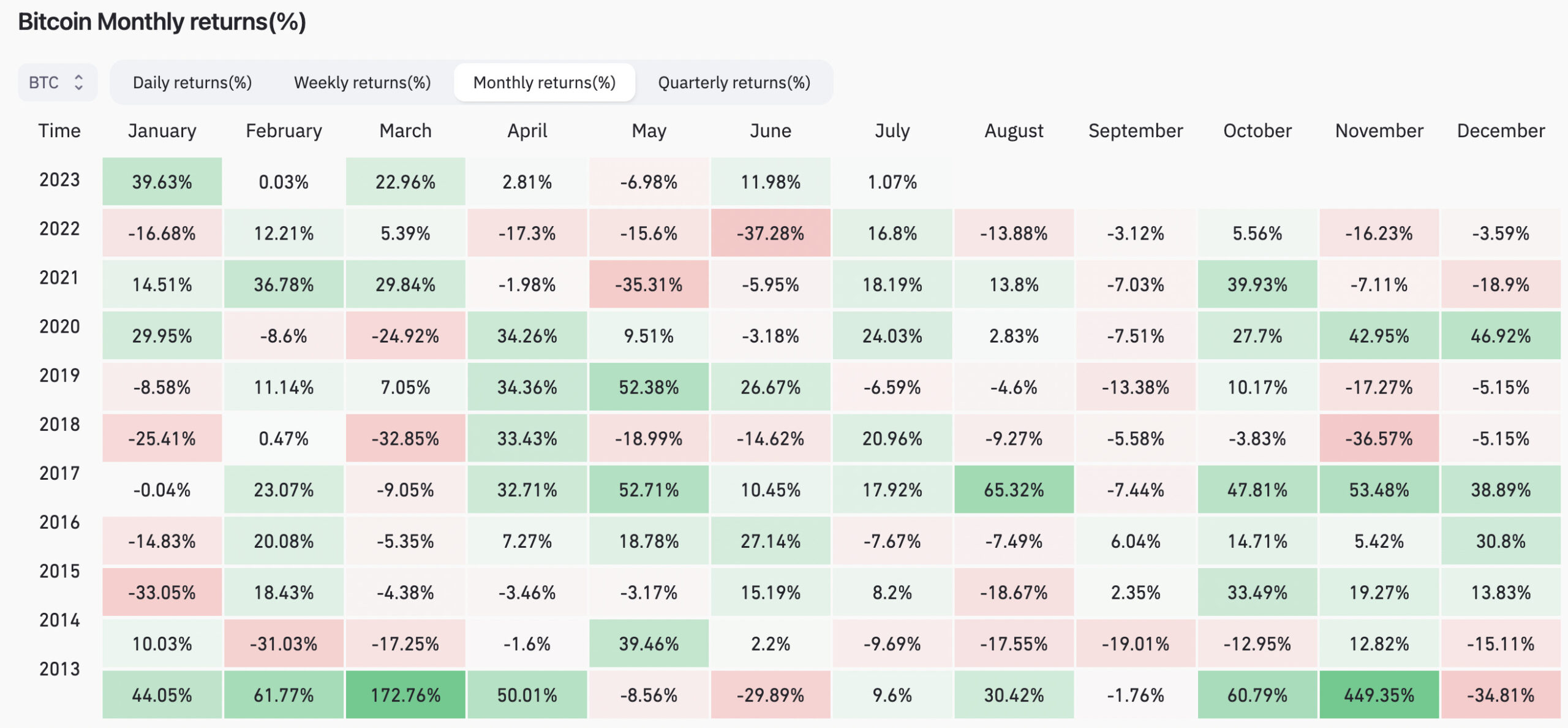

Bitcoin, which, along with Ethereum (to a less-dominant degree), is still the barometer of health for the entire crypto market. And it just posted a pretty decent June, too, after a small stumble in May – the only red month of the year to date.

And in terms of overall market sentiment? Yes, there are still plenty of bearish voices in the woods, but here’s some sort of overall snapshot for you, courtesy of the Crypto Fear & Greed Index.

Bit of a dip, then. Hmm, have US stonks fallen overnight? Well, no, and that’s because American traders are “suckin’ on a chilli dog outside the Tastee Freez”, lighting firecrackers, watching “ridiculous marching bands” and generally enjoying some time off for Independence Day in the States.

But let’s grab some Crypto Twittering trader thoughts in the meantime.

Ah, “Roman Trading” is taking some time off, too…

Green close.

Bear divs negated for now.

With the American Holiday I expect a move to happen around Thursday this week.

Probably won’t be very active until then.

Happy 4th! https://t.co/1CBHHQzjQ1

— Roman (@Roman_Trading) July 3, 2023

Okay, then, we’ll turn to some Europeans. Here’s Dutchman trader Michaël van de Poppe.

Ultimately,

The biggest runners of the upcoming cycle are new coins.

If you want to trade the markets, make sure to keep an eye on those.

Then I mean things like; $ARB, $APT, $SUI.

— Michaël van de Poppe (@CryptoMichNL) July 4, 2023

And Rekt Capital…

Both #BTC & $LTC have recently broken out

Doesn't make sense that they would've topped out now

Unless they were to fake-breakout

In which case they would need to have retraced & failed their crucial post-breakout retests

At the moment, both are in mid-breakout trend$BTC…

— Rekt Capital (@rektcapital) July 4, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Aave (AAVE), (market cap: US$1.11 billion) +8%

• Curve DAO (CRV), (market cap: US$701 million) +3%

• BitDAO (BIT), (market cap: US$739 million) +1%

PUMPERS (lower, lower caps)

• Rari Governance (RGT), (market cap: US$33 million) +104%

• Storj (STORJ), (market cap: US$71 million) +40%

• Wanchain (WAN), (market cap: US$47 million) +24%

SLUMPERS

• eCash (XEC), (market cap: US$634 million) -11%

• Bitcoin SV (BSV), (market cap: US$881 million) -9%

• Flow (FLOW), (market cap: US$661 million) -8%

• WOO Network (WOO), (market cap: US$421 million) -7%

• Pepe (PEPE), (market cap: US$723 million) -5%

SLUMPERS (lower, lower caps)

• FunToken (FUN), (market cap: US$20 million) -20%

• Open Exchange Token (OX), (market cap: US$106 million) -13%

• Celo (CELO), (market cap: US$277 million) -13%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Benjamin Franklin would have loved #Bitcoin 🔥 pic.twitter.com/Y5AGwTGIik

— Bitcoin Magazine (@BitcoinMagazine) July 4, 2023

$1.5 Trillion asset manager Franklin Templeton says a #Bitcoin ETF will open up "new access point" for traditional portfolios. pic.twitter.com/dJ5cQ89BHW

— Bitcoin Archive (@BTC_Archive) July 4, 2023

Hmm, there are rumblings of an “alt season” floating about again. We’ll believe it when we see it etc…

If history repeats, then we're close to the top on the #Bitcoin dominance. pic.twitter.com/zSynMqejIO

— Michaël van de Poppe (@CryptoMichNL) July 4, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.