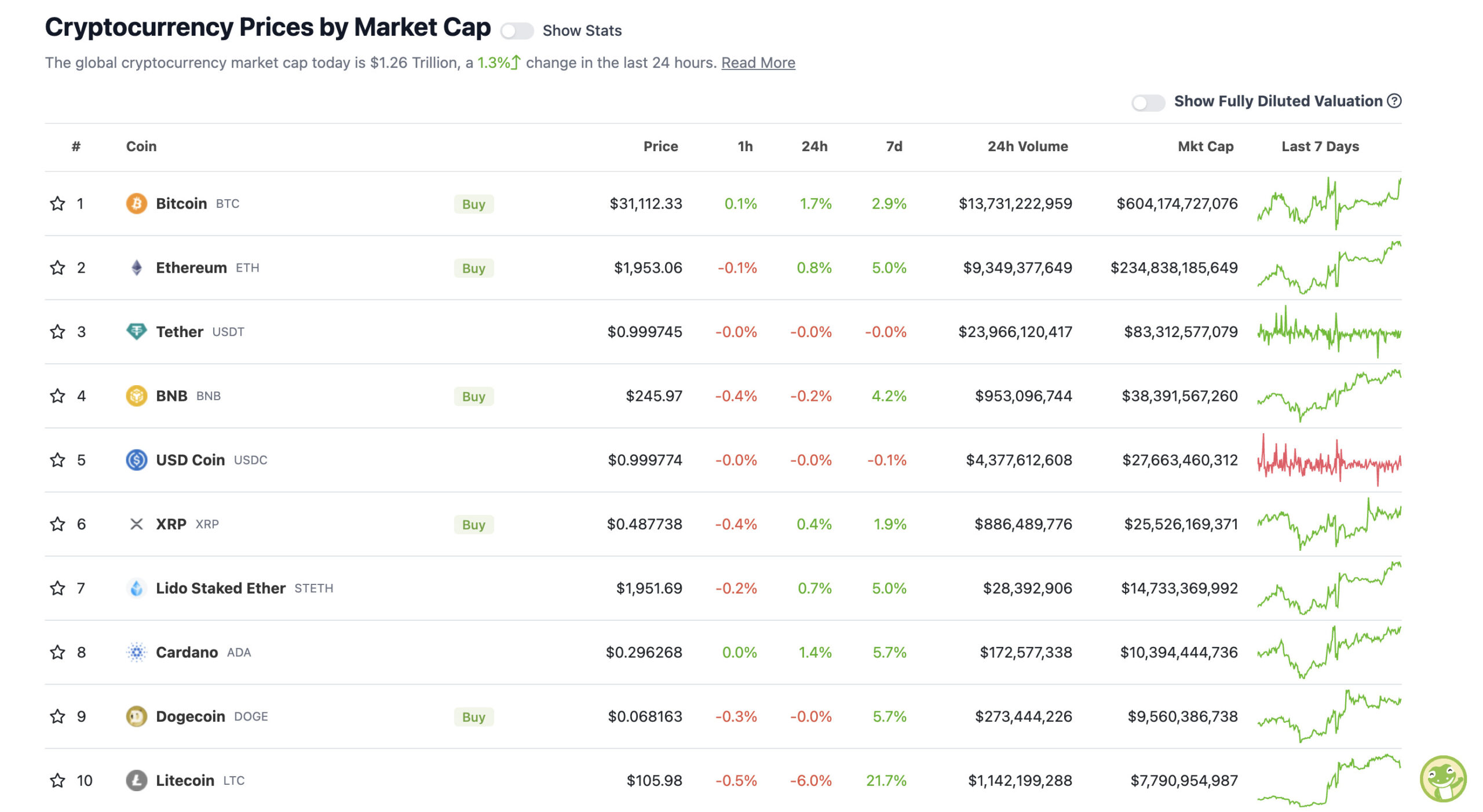

With the overall crypto market cap at US$1.26 trillion, up about 1.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Mooners and Shakers: Bitcoin busts back above $31k as BlackRock refiles BTC ETF

Lars was becoming worryingly too attached to his work. (Getty Images)

- BlackRock is still pushing hard for a spot Bitcoin Exchange-traded fund (ETF)

- Bitcoin is pushing, too – back above US$31k once more as bullish analysts begin to foam at mouth

- Meanwhile Maker, The Graph, Filecoin and, er, Pepe the frogcoin are leading the altcoins in the top 100

The institutional desire for Bitcoin has never been more apparent. The world’s largest Monopoly and Game of Life winner (in a purely materialistic sense), BlackRock, has refiled its spot BTC ETF application with the SEC in the United States.

It’s done so, because the SEC was unhappy with certain aspects of the recent crop of filings, citing a lack of clarification regarding underlying markets in “surveillance-sharing agreements” (SSA).

Essentially, an SSA is meant to protect against market manipulation.

What’s most interesting about this, is that BlackRock has named the prominent US and global exchange Coinbase as its SSA partner in this filing – one of the top exchanges the SEC is currently taking legal action against (in this instance for supposedly operating as an unregistered securities exchange and broker).

The SSA also involves the Nasdaq, and the exchange actually submitted the refiling for BlackRock.

The upshot on all this? Er, the ball is unfortunately in SEC boss Gary Gensler’s court here. A court that has numerous waterlogged, bounce-less balls lying around, unloved in the corners. Some see the re-filing as a “strong signal”, however. Yeah, we’ll see…

BREAKING: BlackRock just re-filed its #Bitcoin ETF, adding Coinbase as the exchange.

🚨 Strong signal! pic.twitter.com/0P8hZeMjGI

— Bitcoin Archive (@BTC_Archive) July 3, 2023

Josh Gilbert, Market Analyst at eToro, notes:

“The market seems to have really cheered the potential filings, but we won’t get much more movement now until some of these filings come to a conclusion. Approval or denial of these ETFs will have fairly obvious impacts on market sentiment, which is very focused on looking for good news at the moment.”

In the meantime, the odds on BlackRock being the first issuer approved for a spot Bitcoin ETF in the US seem to have just become about as favourable as the Aussies taking the Ashes.

Here’s the latest odds from ETF Draft Kings (aka @NateGeraci). This is a TOUGH choice, which is how you know the odds are good. pic.twitter.com/1t2e2MdUwj

— Eric Balchunas (@EricBalchunas) July 3, 2023

Field, whatever that is, is basically England in this analogy.

Oh, and by the way, in case you’re wondering, how has the publicly listed Coinbase stock COIN fared since its already established partnership with BlackRock has become a bit more widely spread across news sites? Here you go…

https://twitter.com/tedtalksmacro/status/1675975982283472903

Heavy Coinbase investor ARK Invest and its CEO Cathie Wood might be a little chuffed right about now.

Both Bitcoin and Ethereum are leading the surge to the up and right in the crypto majors, although Litecoin is lagging behind today, having made its way back into the top 10 the other day.

Various analysts appear to be licking lips for a higher Bitcoin push. Economist and crypto charts watcher Alex Krüger, for instance, believes the crypto king could stage a big rally in the very near future.

Speaking on the Wolf of All Streets YouTube channel, Krüger referenced the importance and decent chances of the BlackRock ETF filing being approved (“50% to 75%), and added that from a technical standpoint:

“We are right on the edge of resistance, between $31,000 and $37,000, $37,000 being the lunar level from May 18th or whatever… When some of us had a heart attack and when some of us went out and danced for joy. Anyway. That’s the point of Bitcoin. We’re right at the edge of a breakout. Once it breaks, it should keep on running.”

Meanwhile, another widely followed Crypto Twittering analyst, who goes by the pseudonym “CrediBULL Crypto” has put forth the wild idea that Bitcoin could even hit an all-time high by… wait for it… October. Of THIS year.

The chart below perfectly demonstrates all the reasons why I think most are going to be completely caught off guard over the next 6 months and into '24 and '25.

Whether you believe in a new ATH on #Bitcoin this year or not, this is an idea worth considering imo.

Let's dive… https://t.co/7j4hhIRzcj pic.twitter.com/vpz9DRnAF7

— CrediBULL Crypto (@CredibleCrypto) July 1, 2023

Crazy? Probably.

His rationale is partly based on the 2020 bull market movement, in which Bitcoin went pretty much ape for about six months in a row.

“For example,” he writes “on our last impulse ($10,000-$60,000) the monthly candles following our major monthly retest at $10,000 (equivalent to the one we just got here at $25,000) were larger than any of the preceding ones and continued to grow in size till our peak.

“The first was a $3,600 move, the next a near $7,000 move, the one after that a whopping $12,000 move, after that a $15,000 move and the 2nd to last monthly candle prior to our peak an incredible $25,000 move.

“Thus, we can assume that the monthly candles as we move up will only increase in size.”

We’ll believe it when we see it, which, of course, will be too late to profit from it.

Note: as always, none of the contents of this article, and Coinhead broadly, should be construed as financial advice.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Filecoin (FIL), (market cap: US$2.05 billion) +15%

• Pepe (PEPE), (market cap: US$765 million) +15%

• Maker (MKR), (market cap: US$884 million) +14%

• The Graph (GRT), (market cap: US$1.23 billion) +11%

• BitDAO (BIT), (market cap: US$724 million) +11%

PUMPERS (lower, lower caps)

• CrossWallet (CWT), (market cap: US$21 million) +2,192%

• Verge (XVG), (market cap: US$123 million) +95%

• FUNToken (FUN), (market cap: US$73 million) +65%

SLUMPERS

• Compound (COMP), (market cap: US$436 million) -9%

• Synthetix (SNX), (market cap: US$706 million) -6%

• eCash (XEC), (market cap: US$671 million) -3%

• Flow (FLOW), (market cap: US$724 million) -3%

SLUMPERS (lower, lower caps)

• Pendle (PENDLE), (market cap: US$82 million) -12%

• dYdX (DYDX), (market cap: US$333 million) -7%

• Serum (SRM), (market cap: US$45 million) -6%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#XRP IS NOT A SECURITY

Just as 🦫s, 🍊 groves, 🥃, chinchillas, condos, and #BTC are not securities. All of these assets may have been once marketed, packaged, offered, and sold as an investment contract, but the asset remained what it always was.

— John E Deaton (@JohnEDeaton1) July 3, 2023

Everyone should have Bitcoin & Ethereum in their portfolio.

Even if it's just 1%

The asymmetric upside is unlike any other asset class in the world.

If it succeeds in doing just a small % of what it COULD do, the upside is insane.

The downside is just 1% of your portfolio.…

— Ben Simpson (@bensimpsonau) July 3, 2023

[Buy bitcoin 6 months before a halving and sell 18 months after a halving] has historically beaten [buy&hold]. The next halving is in April 2024 … will this strategy work again?https://t.co/9kjaCUulwb pic.twitter.com/cbO80Ym7iC

— PlanB (@100trillionUSD) July 3, 2023

https://twitter.com/BitcoinMagazine/status/1675912354163458048

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.