Not Gary Gensler being completely fairly dismissed, overnight. (Getty Images)

Bitcoin looks pretty stable, and dare we say it strong, as we open the week. Meanwhile Crypto Twitter has been abuzz with a rumour about SEC chair Gary Gensler.

It regards whether the prominent US financial regulator is about to resign following “an internal investigation” (according to one report floating about, which is very likely false).

There appears to be little substance backing up the rumour. However, the crypto world has been loving the idea regardless. It’s almost as “controversial” as the completely-fair-play dismissal of Jonny Bairstow in the Ashes overnight. Almost.

Gary Gensler is a hugely unpopular figure in crypto circles for his perceived targeting and stifling of the crypto industry in the US. Gensler has been instrumental in bringing about several legal proceedings against high-profile and lower-profile crypto firms (including Coinbase and Binance), an attempt to classify all cryptos bar a select few as securities, and the persistent blocking of Bitcoin spot ETFs.

It’s just not cricket, is it? And completely not in the “spirit of crypto”.

Here are some Crypto Twitterings…

https://twitter.com/twobitidiot/status/1675626084719636486

Oops, how did that last one slip in there?

Unfortunately, the Gensler resignation rumour does indeed appear to be false. (Sorry, crypto fans.) In fact, prominent pro-Ripple/XRP Twitter accounts have been known to circulate unconfirmed news and whip up a Crypto Twitter frenzy when it comes to the SEC.

Right then, carry on? Where were we?

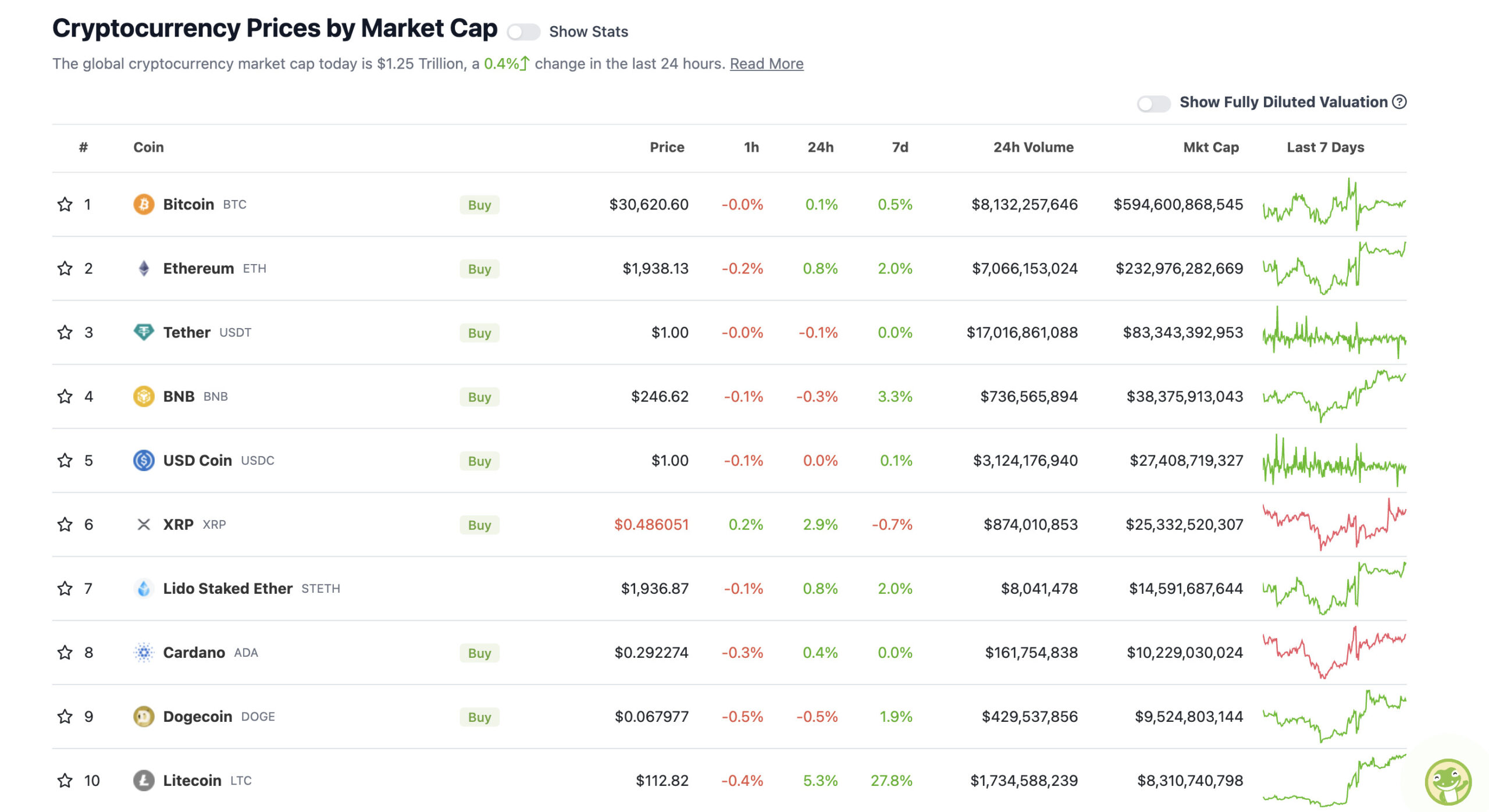

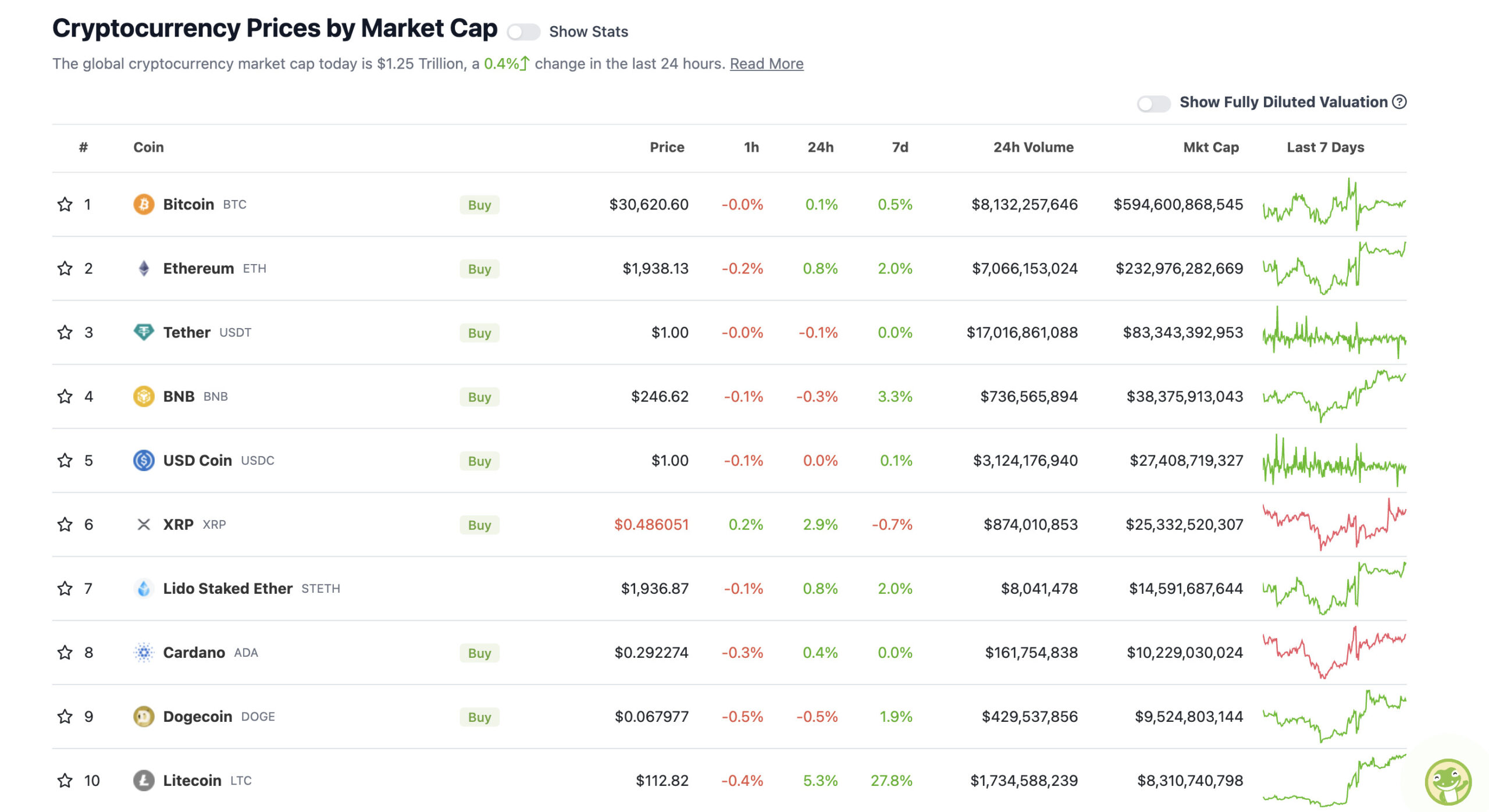

With the overall crypto market cap at US$1.25 trillion, up about 0.4%since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin and Ethereum are indeed holding steady, although BTC did suffer a brief early-weekend dip below US$30k when the SEC noted that the current crop of Bitcoin spot ETF filings were “inadequate”.

The mid-$30k BTC level has since been recovered. Meanwhile, Litecoin (LTC) has burst back into the top 10 cryptos by market cap, as TRON slips further down the pecking order.

The Litecoin halving narrative continues, as does a possibility LTC might not be deemed a security by the SEC.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Compound (COMP), (market cap: US$474 million) +31%

• The Graph (GRT), (market cap: US$1.08 billion) +14%

• BitDAO (BIT), (market cap: US$654 million) +7%

• Aave (AAVE), (market cap: US$1.03 billion) +5%

• Bitcoin Cash (BCH), (market cap: US$5.79 billion) +4%

• Solana (SOL), (market cap: US$7.8 billion) +4%

Compound (COMP) – a highly regarded DeFi project, is on fire today. Whales appear to be buying?

As for The Graph (GRT), again, not 100% sure about the reason for the overnight the surge here, although we recently covered some potential reasons why this one is holding up well this year.

SLUMPERS

• Leo Token (LEO), (market cap: US$3.6 billion) -7%

• ApeCoin (APE), (market cap: US$802 million) -4%

• Kaspa (KAS), (market cap: US$483 million) -3%

• The Sandbox (SAND), (market cap: US$835 million) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.