Mooners and Shakers: Crypto market sweats, RBA hikes, Fed meets and Algorand scores

Getty Images

And so it begins… sorta. The Fed’s latest two-day FOMC meeting to decide the US interest-rate fate, that is. Crypto investors and traders are anxiously awaiting what happens next.

We’ll find out for sure tomorrow just how heavily the US Federal Reserve tackles its next round of inflation combatting. Anything higher than a 50 basis-points interest-rate hike, and tumbling stocks and crypto prices shouldn’t be a surprise.

Everyone is waiting for Jerome Powell to come up tomorrow to have a speech of 45 minutes where he's going to say absolutely nothing.

— Michaël van de Poppe (@CryptoMichNL) May 3, 2022

The crypto market at large will be, at the very least, hoping for the largely expected 50bps increase, or even better, something dovishly unexpected and lower (not happening but firing up the hopium pipe anyway).

If the Reserve Bank of Australia’s latest move is any harbinger, though, maybe a hawkish version of the US Fed spurs into action from here.

Aussie shares were pulling back after the RBA lifted the official cash rate for the first time in more than a decade, with the clear intent of more rate hikes to follow. (Although RBA Governor Philip Lowe is reportedly keeping an open mind on how fast rates need to increase.)

Will the RBA’s hike affect crypto? BTC Markets’ CEO has thoughts

Despite what some might like to think, crypto can’t completely live in its own bubble, unaffected by the changing whims of global fiscal policy, fears of recession and major war-related concerns. Not yet anyway.

In comments shared with Stockhead, Caroline Bowler, CEO of Aussie crypto exchange BTC Markets, gave her perspective on the interest-rate hiking and how it relates…

Bowler said that the change in interest rates in Australia “doesn’t directly impact” the price of Bitcoin and other cryptos.

But she added that the RBA’s move coupled with wider interest rate increases across major economies, particularly the US, “can have a significant impact on the price of Bitcoin and other crypto – with consequences felt by Australian investors”.

And this, said Bowler, is because the US is now the “market epicentre for cryptocurrencies” since China took a backseat.

“In particular, with the tightening of ‘loose money’ induced by the COVID-19 pandemic, we would anticipate a continued dip in trading volume overall, as it contracts alongside supply,” said Bowler, adding:

“However, Bitcoin has demonstrated inflation-protection qualities and we’ve seen ongoing relative stability in the price of Bitcoin in 2022 with US inflation priced in since last November. We expect that stability in Bitcoin to continue.”

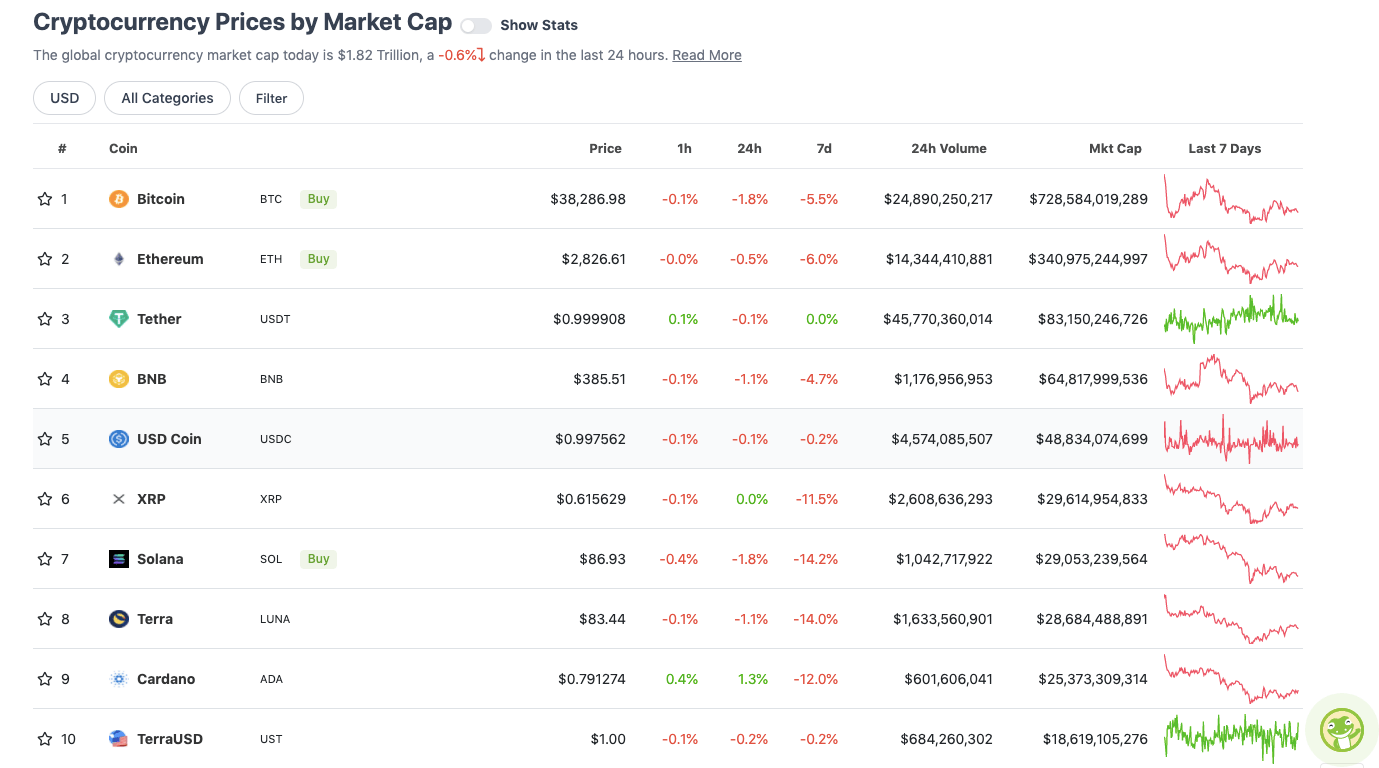

Top 10 overview

With the overall crypto market cap at roughly US$1.82 trillion, down about 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

This doesn’t paint a particularly strong picture for the crypto majors right now, although you might also contend things look reasonably stable for the moment despite a nervy, pivotal week in crypto and TradFi markets.

Some thoughts from a couple of full-time, Twitter-lurking crypto traders and analysts here…

$BTC Daily

No signs of intratrend reversal. Seems like 37k area will be retested. Macro bear flag on line chart was broken.

If price loses 30k, I’d anticipate a drop to the 30k area very quickly.

Watch HTFs as LTFs seem to keep having fakeouts.#bitcoin #cryptocurrency pic.twitter.com/6AFvYEn7dH

— Roman (@Roman_Trading) May 3, 2022

This #BTC pullback is a second chance for a lot of people

If you promised yourself that you'll buy $BTC when it goes lower

And vowed that you wouldn't miss the next uptrend

Do yourself a favour

And follow your own advice#Crypto #Bitcoin

— Rekt Capital (@rektcapital) May 3, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$17.9 billion to about US$907 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Algorand (ALGO), (market cap: US$4.53 billion) 14%

• Helium (HNT), (mc: US$1.5 billion) +10%

• Frax Share (FXS), (mc: US$1.47 billion) +9%

• TRON (TRX), (mc: US$7.36 billion) +8%

• The Sandbox (SAND), (mc: US$2.5 billion) +4%

Back of the net for Algoooooooooooooalrand. The layer 1 protocol (ranked no. 31 on CoinGecko) has scored well with FIFA, becoming the global football association’s first officially partnered blockchain platform.

The deal, announced yesterday but more widely circulating today, will also see Algorand become a regional supporter in North America and Europe for the 2022 FIFA World Cup, held in Qatar in November and December.

FIFA announces partnership with blockchain innovator @Algorand

📸 @MilkenInstitute | #MIGlobal pic.twitter.com/bqCmLFjhnO

— FIFA Media (@fifamedia) May 2, 2022

DAILY SLUMPERS

• Lido DAO (LDO), (mc: US$907 million) -5%

• STEPN (GMT), (mc: US$1.98 billion) -3%

• OKB (OKB), (mc: US$4.85 billion) -3%

• ApeCoin (APE), (mc: US$4.2 million) -3%

• Quant (QNT), (mc: US$1.27 billion) -2%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Cult DAO (CULT), (market cap: US$97 million) +47%

• Crabada (CRA), (mc: US$44m) +24%

• DarkCrypto Share (SKY), (mc: US$51m) +23%

• dHEDGE DAO (DHT), (mc: US$7.8m) +15%

• Rook (ROOK), (mc: US$83m) +14%

DAILY SLUMPERS

• Step App (FITFI), (mc: US$111.5m) -27%

• Pluton (PLU), (mc: US$21m) -20%

• Pocket Network (POKT), (mc: US$446m) -15%

• Fuse (FUSE), (mc: US$34m) -14%

• Kyber Network Crystal (KNC), (mc: US$388m) -9%

Around the blocks

Food (okay, more complete and utter hopium) for thought here…

What happened last time the FED came up with a lot of subsequent rate hikes after being zero for a long time?$BTC entered the 2017 bullmarket. pic.twitter.com/lmcIoxXrvN

— Gert van Lagen (@GertvanLagen) May 3, 2022

Meanwhile, adoption continues, this time over in Argentina…

💥BREAKING: Top 2 banks in Argentina will offer customers #Bitcoin

— Bitcoin Archive (@BTC_Archive) May 3, 2022

… and in the UK…

JUST IN: London Stock Exchange-listed fintech app Mode now offers #bitcoin cashback in online purchases 🙌

— Bitcoin Magazine (@BitcoinMagazine) May 3, 2022

More randomly, though, and thinking briefly ahead to the Aussie tax season, here’s something probably only avid NFT traders will relate to…

I hate me

— loldefi* (@loldefi) May 3, 2022

But lastly, US billionaire investor Paul Tudor Jones is cautious regarding stocks, bonds and crypto in the current climate… but he does still potentially see a bright future for the latter, according to comments he made during an interview with CNBC’s Squawk Box program…

https://twitter.com/frxresearch/status/1521466107861024768

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.