Mooners and Shakers: Crypto market nervy ahead of US CPI data; but one metric indicates an ‘alt season’ is coming

Anxious: inflation data fans (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

The Bitcoin and crypto markets seem a little skittish today, and that’s very likely because the next lot of US inflation data is imminent and making people a little antsy.

The latest Consumer Price Index (CPI) report is set to drop some time on Aug 10 Stateside… which has signalled a “fun” time in the markets of late.

How will it play out this time, then? Depends on the data, natch. If the figure come in lower than the previous month’s record-breaking 9.1%, as many seem to believe it will, then it could prove Elon Musk right. Last week he predicted that US inflation has likely peaked out and any recession from here may be “mild to moderate”.

#Bitcoin correcting due to several reasons. 👇

▫️ (Unwarranted) fears among CPI data tomorrow.

▫️ Resistance around $24.3K continuing being resistance.Expecting to see a test around $23-23.2K to hold, so trend continues.

Another test of resistance -> break-out towards $28K. pic.twitter.com/hqcJ6Ry64c

— Michaël van de Poppe (@CryptoMichNL) August 9, 2022

Could a lower CPI number have a further rallying effect from knee-jerk-reactionary crypto traders anticipating a softening of rate hikes from the Fed? More than possible. But then, so is a sense of vindication from the Fed that its aggressive rate-hiking is working, so why stop just yet?

In any case, the Fed’s hand won’t be shown for a little while, as they’re all chilling out until their September powwow – fixing things round the house in plaid shirts… working on their swings… asking Nancy Pelosi for trading tips.

Top 10 overview: A technical ‘alt season’?

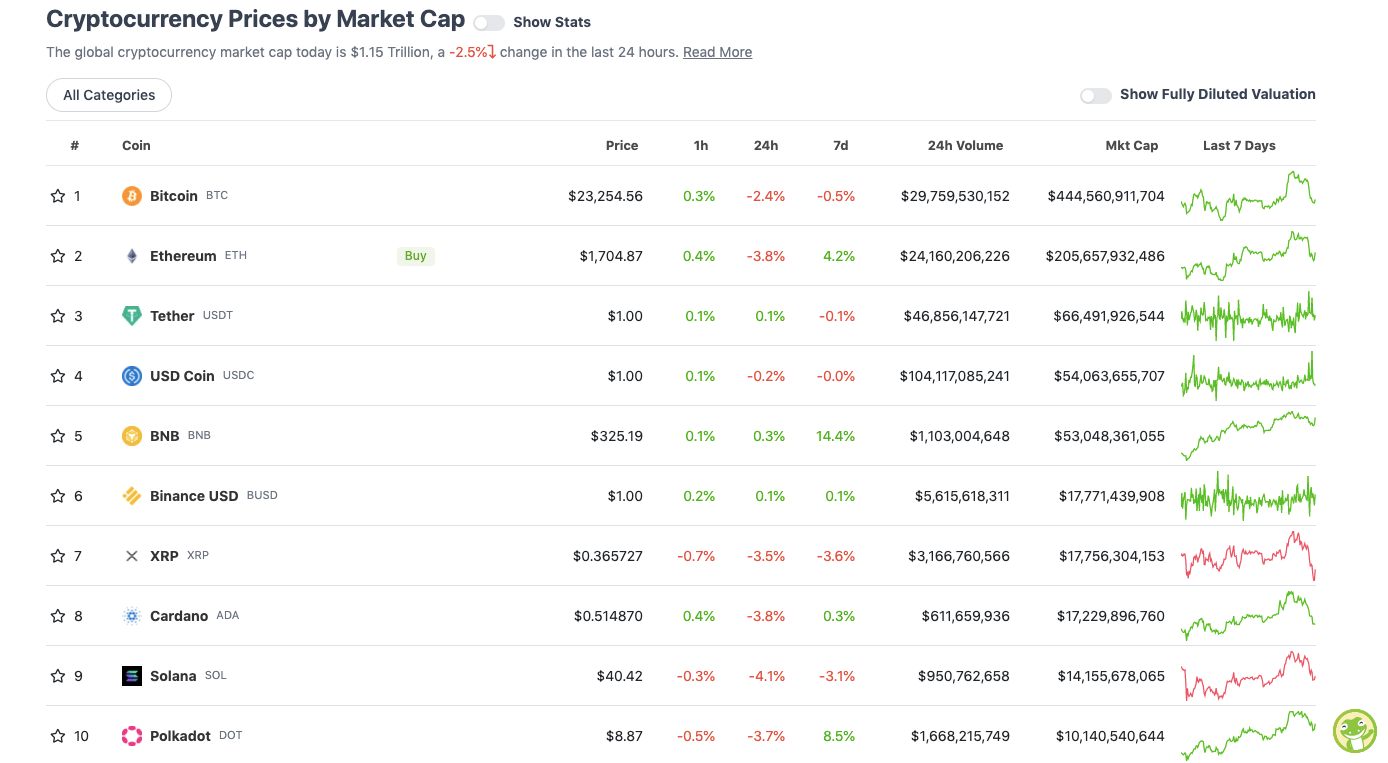

With the overall crypto market cap at US$1.15 trillion and down 2.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Usual crypto-dippage story here on the daily timeframe… Bitcoin shows the way, altcoins react a bit harder.

An interesting metric, however, is the Bitcoin dominance figure – the ratio of the market capitalisation of BTC to that of the rest of the cryptocurrency market.

We just read on Cointelegraph that this figure has now reached a six-month low – about 41% on CoinMarketCap and a bit lower still (38.8%) on CoinGecko.

Apparently technically speaking, this means we’re in some kind of “alt season” right now – generally a frothy period in the crypto market where altcoins outperform Bitcoin by a considerable margin.

And it’s true that there has been a bit of an alt rally, led by bull goose altcoin Ethereum, going on for a few weeks now.

If that’s passed you by a bit, though, perhaps you’ve been here a while and are feeling misty-eyed for the 1,000%-gain alt seasons of yore. The retail crowd may have been FOMOing in a tad lately, but this doesn’t feel like a true alt season, tbh.

Is “the worst over” for the 2022 crypto recession, though? Galaxy Digital boss Mike Novogratz thinks so. But then again, he’s a bloke with an embarrasingly MASSIVE tattoo of a LUNA wolf on his left arm… so we’ll take what he says with the level of salt your local fish’n’chip shop bungs on your order.

Uppers and downers: 11–100: Curve exchange compromised

Sweeping a market-cap range of about US$9.2 billion to about US$500 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Mina Protocol (MINA), (market cap: US$565 million) +6%

• ZCash (ZEC), (mc: US$1 billion) +4%

• Celsius (CEL), (mc: US$811 million) +4%

• Chain (XCN), (mc: US$1.92 billion) +3%

• Kava (KAVA), (mc: US$555 million) +2%

DAILY SLUMPERS

• Curve DAO (CRV), (mc: US$509 million) -10%

• Helium (HNT), (mc: US$1 billion) -8%

• Filecoin (FIL), (market cap: US$2.1 billion) -8%

• BitDAO (BIT), (mc: US$785 million) -7%

• Kusama (KSM), (mc: US$543 million) -7%

Seems slightly unusual to see the recently strong-performing DeFi OG Curve heading this list today. And that’s because something’s afoot… specifically with a frontend breach on its exchange website.

“Don’t use the frontend yet. Investigating!” Curve Finance tweeted a few hours ago.

According to Decrypt, hackers apparently compromised a Curve website or domain name to redirect the transactions of unsuspecting users “to a malicious destination”.

Hopefully the $570k quoted below by blockchain detective ZachXBT is the worst of it…

Looks like $570k stolen

0x50f9202e0f1c1577822BD67193960B213CD2f331 pic.twitter.com/IG6nIKVv59

— ZachXBT (@zachxbt) August 9, 2022

Around the blocks

A selection of randomness and pertinence that stuck with us on our daily journey through the Crypto Twitterverse…

It seems an anonymous troll isn’t having a bar of yesterday’s US government ban on ETH mixing service Tornado Cash. Whoever this is, he/she (just hedging my bets in a non-woke way) has been “dusting” celebrity Ethereum wallets with small amounts of ETH, sent from a Tornado Cash wallet.

Max chaos — someone is sending TC’d ETH to big doxxed wallets like Shaq, Beeple, Randi Zuckerberg, Ben Horowitz, Brian Armstrong, etc pic.twitter.com/ztAaOr1pDl

— Jim (@0xJim) August 9, 2022

Meanwhile more positivity from Bloomberg Intelligence strategist Mike McGlone, who probably hasn’t been Tornado Cash dusted…

If CME-listed futures are a guide, the maturation process of #Bitcoin and #Ethereum is progressing well, with price implications. Bitcoin open interest is steadily trending upward, Ether futures' 90-day volume is at an all-time high and the curve is tilting toward earning income pic.twitter.com/Q1ZjYi39LY

— Mike McGlone (@mikemcglone11) August 9, 2022

Olimpio has a new airdrop heads up…

Airdrop Strategy: TheKraken 🐙

There's a new NFT AMM player in town: @sudoswap

No token yet, but $SUDO coming 🪂

• it works with liquidity pools

• you add liquidity (NFT/ETH)

• earn trading fees

• place limit buy/sell ordersA breakdown: how it works and how to try it 🧵

— olimpio (@OlimpioCrypto) August 9, 2022

And apropos of nothing, really… this…

All it takes is like 5 seconds for Joe Biden to forget he shook Chuck Schumer’s hand.

Scary. pic.twitter.com/c4dNRRaDVO

— Steve Guest (@SteveGuest) August 9, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.