Mooners and Shakers: Top analyst says $100k Bitcoin just ‘a matter of time’; for now, baby steps towards US$24k

"To speak to devs about a new Bitcoin all-time high, please hold…" (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

As George Costanza once said… “it moved!” Bitcoin surged above US$24k for a few hours overnight (AEST) and Ethereum poked its head above US$1,800, too – just for a bit of a look around.

Both pace-setting assets are taking a breather again at the time of writing, but are still maintaining some of that enthusiasm while the crypto market is up a bit in general over the past 24 hours. Will it sustain? Whodahellknows?

Someone who is prepared to make at least some kind of prediction on Bitcoin, though, is Bloomberg Intelligence Senior Commodity Strategist Mike McGlone, who is still forecasting an eventual big move upwards for the OG digital asset, as well as gold…

A Matter of Time? $2,000 #Gold, $100,000 #Bitcoin, $50 #CrudeOil –

The energy spike is proving its own worst enemy, with macroeconomic implications that may buoy gold and help Bitcoin transition toward a high-beta version of the metal and Treasury bonds. pic.twitter.com/4RO3wkMYxf— Mike McGlone (@mikemcglone11) August 8, 2022

In his latest report, McGlone says that a US$100k Bitcoin and $2k ounce gold are both “a matter of time”, pointing to the downwards trajectory of crude oil, its inverse correlation to gold, and his belief that BTC is becoming more of a save haven, stable and less risky asset – akin to the shiny yellow metal.

McGlone has also been chatting about a “great reversion” for Bitcoin with inflationary-combatting forces and the energy spike both helping to transform the no.1 crypto asset into a “high-beta version of the metal [gold] and Treasury bonds”.

Well okay, “a matter of time” sounds good and all, but when… WEN do you think that’ll be, Mike? Two-minute-interval portfolio-checking moonbois need to know. Er, we’ll let you know if he answers, but the go-to analyst’s outlook seems to indicate positive moves for Bitcoin and gold in the second half of this year. And last time we checked, we’re in it.

Looks like #BTC has successfully retested the 200-week MA as support$BTC #Crypto #Bitcoin pic.twitter.com/drxMfxz9lq

— Rekt Capital (@rektcapital) August 8, 2022

Top 10 overview: is ETH setting up a sell-the-Merge news event?

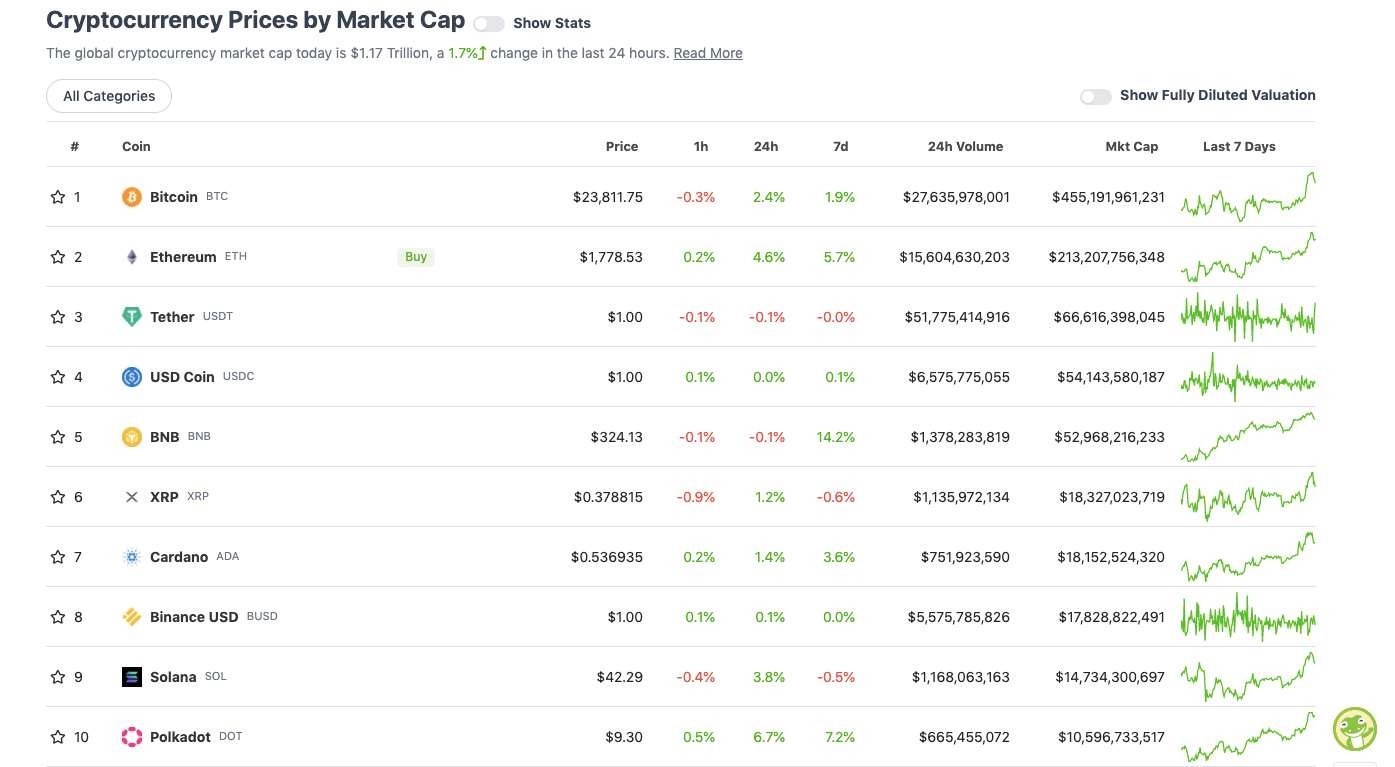

With the overall crypto market cap at US$1.17 trillion and up 1.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The biggest top 10 movers are happening at either end of this table, with layer 1s Polkadot (DOT) and Ethereum (ETH) both making eye-catching runs up the sidelines.

As anyone vaguely interested in crypto this year will know, Ethereum’s proof-of-work “Merge” to proof-of-stake is on its way (around September 19 s the latest prediction) and this has been widely touted as a potential major catalyst for a crypto-market turnaround.

That said… there are also some, perhaps many, who believe it could also be a major buy-the-rumour-sell-the-news event. In fact, former Goldman Sachs bloke Raoul Pal, who is bullish on ETH long term, paints a bit of a bleak picture in the nearer future…

ETH – I still think the path of pain is higher as most participants are still underweight and looking for lower entry points.

Most people expect a failure in this zone of resistance…

1/ #Ethereum pic.twitter.com/mdC3gBOvaN

— Raoul Pal (@RaoulGMI) August 8, 2022

Blockchain analytics firm Glassnode also seems to be spotting a sell-the-news trend for ETH, but not before a “state of extreme bullish bias” for the asset’s price in September.

The firm’s analysis centres around the idea of “backwardation”, which sounds like a tricky karma sutra move, but actually refers to when prices for an asset in the futures market are lower than its underlying spot price. And that’s the case for ETH right now.

The long and the short of it? Ethereum could gain significant short-term momentum and might even be able to crack $2k pre Merge. But even still, things could get a bit dicey again for a while on the back end of September and into October if dwindling call options aligns with a Merge news sell-off.

A level of conjecture here? Absolutely, although respected industry brainiacs are certainly looking at the data currently available, so it’s something to keep in mind.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.6 billion to about US$517 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Celsius Network (CEL), (market cap: US$775 million) +26%

• The Graph (GRT), (mc: US$1.1 billion) +16%

• Flow (FLOW), (mc: US$3.1 billion) +16%

• Near Protocol (NEAR), (mc: US$4.2 billion) +11%

• ZCash (ZEC), (mc: US$981 million) +10%

DAILY SLUMPERS

• Tenset (10SET), (mc: US$517 million) -7%

• Decred (DCR), (mc: US$534 million) -5%

• Lido DAO (LDO), (market cap: US$1.28 billion) -4%

• Theta Network (THETA), (mc: US$1.62 billion) -3%

• LEO Token (LEO), (mc: US$4.5 billion) -2%

Around the blocks

A selection of randomness and pertinence that stuck with us on our daily journey through the Crypto Twitterverse…

Uh-oh… looks like the dreaded “crypto contagion” of troubled CeFi crypto platforms ain’t over yet. As Binance CEO CZ tweets here, Singaporean crypto lender Hodlnaut, which overnight suspended users from withdrawing funds, may not be the last to take a scalding dip in some ridiculously hot water…

Another one. Unfortunately, won't be the last one. Use sustainable platforms only.

https://t.co/VZsMWXcl7L— CZ 🔶 BNB (@cz_binance) August 8, 2022

Meanwhile, da Feds in the US have decided to place a ban on the use of Ethereum “mixing” service Tornado Cash – a popular protocol with newly minted crypto hackers everywhere. Guess privacy advocates will have something to say about this pretty promptly…

Today the US sanctioned Ethereum addresses associated w/ a privacy service called Tornado cash.

Circle immediately froze the USDC in those accounts. GitHub suspended contributors to Tornado.

If you were waiting for the opening shot of big brother’s assault on crypto this was it

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) August 8, 2022

💥CATHIE WOOD: Blackrock’s decision to partner with Coinbase is a strong signal that institutions consider #Bitcoin and crypto a new asset class.

— Bitcoin Archive (@BTC_Archive) August 8, 2022

And we wonder why people think NFTs are a joke pic.twitter.com/EEynDcqJOr

— bandit (@NFTbanditeth) August 8, 2022

Lastly, a shameless plug for another Stockhead/Coinhead article, because… that’s part of the gig…

A great summary of the stablecoin landscape by @CoinheadAU and our analyst @danglissy. https://t.co/lNen8AO3Ah

— Apollo Crypto (@ApolloCryptoAu) August 8, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.