Mooners and Shakers: Crypto market hears Janet Yellen about debt ceiling; Chinese TV airs crypto segment

Coinhead

Coinhead

The crypto market is struggling this morning. Why? Various reasons. But for one thing, it’s because Janet “From the Rooftops” Yellen isn’t exactly giving out the most positive vibes about Congress sorting out the US debt ceiling issue.

US stonks indices are also well down overnight on this dominant narrative du jour, too.

What happened? Essentially, US Treasury Secretary Yellen reiterated her fears that America “could run out of money” to pay its leaning tower of bills as soon as June 1.

Just sort it out, would you, US politicians? We all know you’ll reach some sort of deal before the 9-10-day deadline… r, right? You’d be batsh*t crazy not to, really. But do you have to drag it out like a reality TV show? Yes, yes it seems you do.

BREAKING: 🇺🇸 It's now "highly likely" the US will run out of cash by early June, says Treasury Secretary Janet Yellen – Bloomberg pic.twitter.com/YvMiDKs5JM

— Radar🚨 (@RadarHits) May 23, 2023

There are hopium-smoke-enshrouded schools of thought out there, however, that Bitcoin could even do pretty well off the back of a US debt default, in a “flight to safety” towards financial “safe-haven” alternatives.

We wouldn’t be placing bets on that happening in the short term. That said, it is pretty much what Bitcoin was originally designed for by one Satoshi Nakamoto those 13 or so years ago now.

For the (or at least some sort of) record, JP Morgan has put the likelihood of a US default at 25%, according to our very own non-fungible Eddy Sunarto over at this morning’s Market Highlights.

A couple of other things, by the way, that could be weighing on markets this morning are: a hot inflation report in the UK, and the release of the US Fed’s latest FOMC meeting minutes.

The latter, according to Eddy, “revealed that if inflation ends up being stickier than economists are expecting, the FOMC board could very well skip a June meeting, but follow through with one at the July meeting.”

Macro uncertainty a-go-go. Fun times, eh?

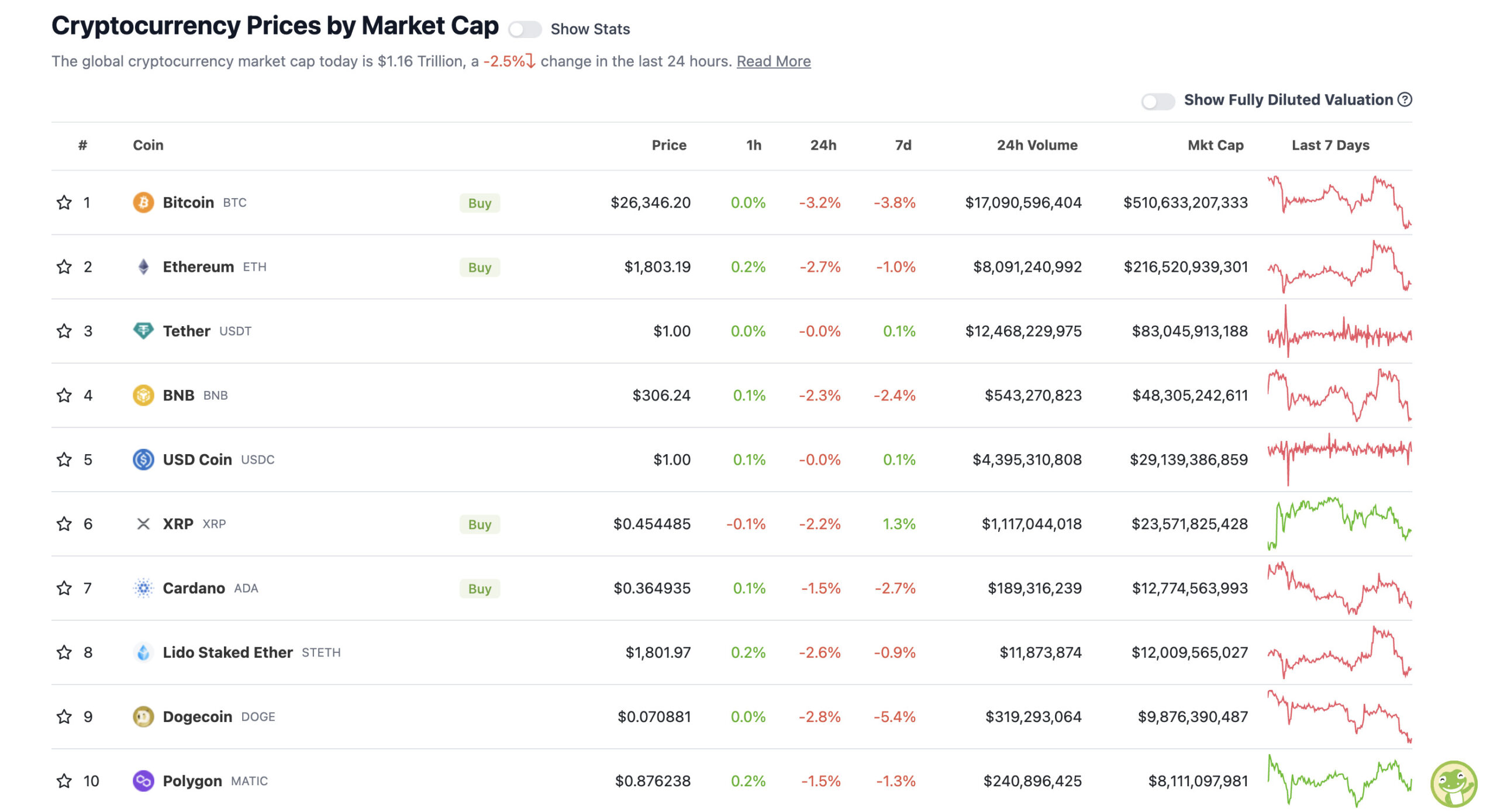

With the overall crypto market cap at US$1.16 trillion, down about 2.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

A sea of red on the 24-hour timeframe, unfort. Weekly, too. Let’s cast a net out to see if we can reel in any, erm, bullfish still swimming about.

Here’s US analyst Roman Trading… and while not exceedingly bullish or bearish, he is at least sticking to his guns for the moment that suggest a serious lack of “bearish vibes” on the Bitcoin charts, based on low volume surrounding these latest dips.

Giving updates where I can here:

Volume isn’t giving me bearish vibes. I had a low risk long at 26.7 that was stopped but I’m still advocating for longs.

There’s nothing that looks truly bearish here as volume isn’t validating a breakdown.#bitcoin #cryptocurrency pic.twitter.com/tTiAHoR5H1

— Roman (@Roman_Trading) May 24, 2023

Dutchman Michaël van de Poppe, meanwhile, thinks things are “still fine” on the “higher timeframes” for the OG digital asset…

If you look at the higher timeframes for #Bitcoin, things are still fine.

Healthy correction in an uptrend, approaching many support levels.

Rather than expecting $12K, it's important to look at what might be support around here. pic.twitter.com/DZm8vBPfGh

— Michaël van de Poppe (@CryptoMichNL) May 24, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• NEO (NEO), (market cap: US$742 million) +5%

• Lido DAO (LDO), (market cap: US$1.8 billion) +2%

PUMPERS (lower, lower caps)

• Samoyedcoin (SAMO), (market cap: US$56 million) +340%

• Ben (BEN), (market cap: US$98 million) +67%

• Kaspa (KAS), (market cap: US$304 million) +27%

• Dejitaru Tsuka (TSUKA), (market cap: US$53 million) +25%

• Elastos (ELA), (market cap: US$30 million) +19%

SLUMPERS

• Pepe (PEPE), (market cap: US$607 million) -10%

• Fantom (FTM), (mc: US$922 million) -10%

• GMX (GMX), (mc: US$471 million) -7%

• Sui (SUI), (mc: US$520 million) -6%

• Litecoin (LTC), (mc: US$6.3 billion) -6%

SLUMPERS (lower, lower caps)

• Multichain (MULTI), (market cap: US$102 million) -25%

• Wojak (WOJAK), (market cap: US$12 million) -22%

• ORDI (ORDI), (market cap: US$157 million) -21%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

So, CCTV, Chinese Central Television that is, has reportedly broadcasted a segment referencing the crypto adoption that seems all set to happen in Hong Kong with the opening of retail trading of digital assets there from June 1.

Here’s the CEO head of the global Binance exchange Changpeng “CZ” Zhou, who seems to think this is a non-financially advised “big deal”.

CCTV (China Central Television) just broadcasted crypto. It's a big deal. The Chinese speaking communities are buzzing. Historically, coverages like these led to bull runs.

Not saying past predicts the future. And not financial advice.https://t.co/2wcArnPI93

— CZ 🔶 BNB (@cz_binance) May 24, 2023

According to an article by The Block, the CCP-controlled broadcaster noted that “starting from June 1, any virtual asset trading platform must apply for a license from the Hong Kong Securities and Futures Commission to operate in the country.”

It matter-of-factly spoke about the Hong Kong regulators detailing compliance measures for crypto firms in the region. And, while that doesn’t sound amazingly bullish, the point is, the Chinese station wasn’t slamming Bitcoin mining and crypto trading broadly. Those things are still, after all, banned in China. Although actual ownership of digital assets is permitted.

“The broadcaster also prominently displayed two images featuring the Bitcoin logo,” reads the Block report, adding: “Another shot contained what appeared to be a screen with Samoyedcoin’s collection of dog NFTs.”

Ahh… so that’s why the memecoin SAMO is up 340% today. Never underestimate the power of a Chinese-related pump (and/or dump), I guess.

JUST IN: 🇨🇳 China's Central Television network just broadcasted the news that Hong Kong is allowing retail investors to buy #bitcoin

China is quietly allowing it again… 👀 pic.twitter.com/M2qy6ig7x0

— Bitcoin Magazine (@BitcoinMagazine) May 24, 2023

In other news, the Ledger hardware wallet firm is still in PR hell over its controversial, proposed Recover feature, which it’s now paused. In the meantime, satirists are having a field day on Twitter…

The new Ledger commercial just got leaked! 👀

"Trust me, bro."pic.twitter.com/nvMePwnWWn

— Daito 💚 (@DaitoYoshi) May 20, 2023