Mooners and Shakers: Crypto market cracks a winning 4… pc gain; Financial titans’ EDXM exchange begins trading

Aussie Test captain Pat Cummins, like BTC, in fine fettle this morn. (Getty Images)

If you took your eye off the ball in the wee hours thinking it was all a lost cause, you should be feeling pretty chuffed with the score this morning.

And Bitcoin and crypto have done very well overnight, too.

The crypto market as a whole is up 4% since this time last night, surging ahead as Australian skipper Pat Cummins sealed an epic Ashes Test victory for the ages with a four.

Do you see? Do you see how crypto and cricket can be analogised in a strangely niche way that I’m too tired to extrapolate on with any coherently convincing argument? (They both begin with “cr” and end in an “oh” when you bore people with the topics at social gatherings.)

But anyways, that’s the last this highly self-indulgent and tenuous linkage will be mentioned here today, honest. (Possibly.)

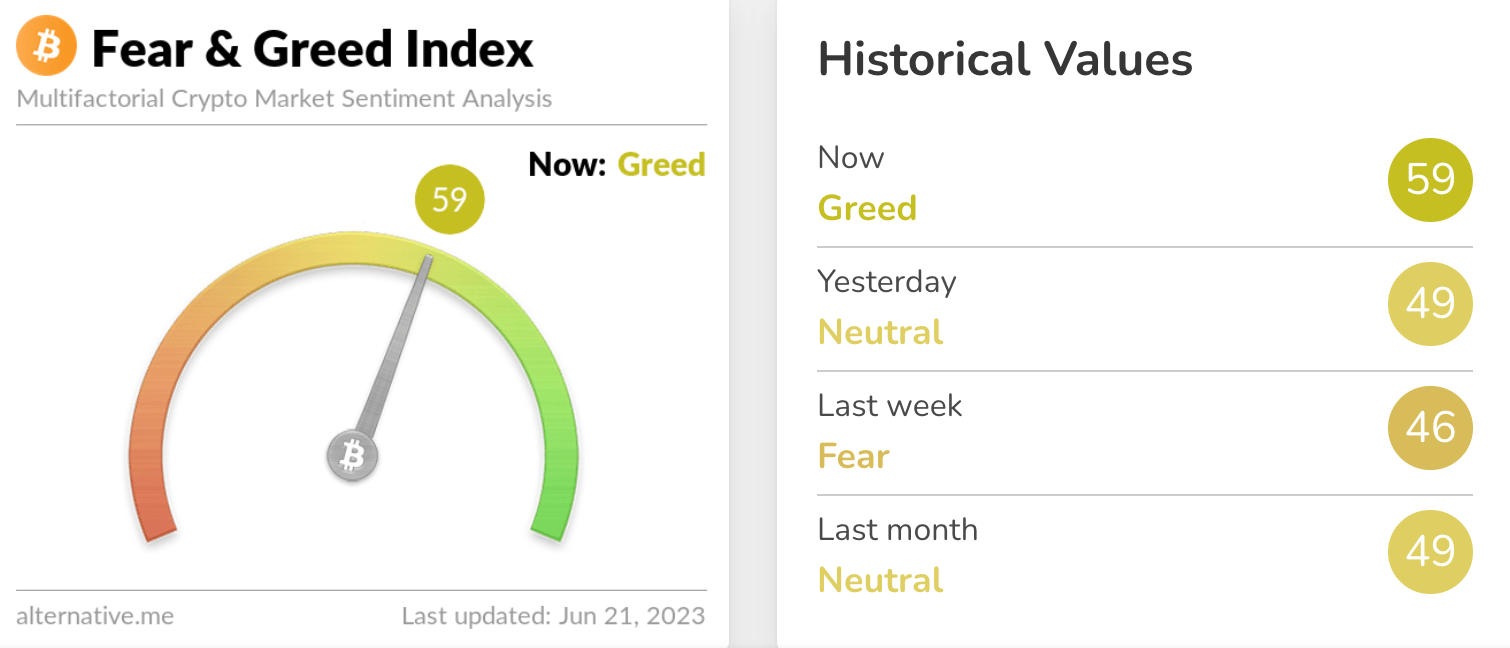

So, what’s with the overnight crypto gainz, then? The cryptoverse has certainly suddenly got its Greed on again…

And here are some possible reasons:

• Continued optimism around the renewed big-player institutional interest in Bitcoin – from BlackRock and its ETF filing primarily, but also Fidelity and a few other major “TradFi” titans.

• Speaking of which, Fidelity Digital Assets, along with Charles Schwab and Citadel Securities have revealed that their regulator-friendly, joint crypto exchange venture, EDX Markets (aka EDXM – which we first wrote about last year) has finally begun trading. It was big news that flew under the radar back in September, and it’s still big news now.

Eddy “Market Highlights” Sunarto gave it a mention this morning, too:

“EDX Markets has a different business model than other crypto exchanges in that it it doesn’t custody customers’ digital assets. Instead, users will have to go through financial intermediaries to buy and sell crypto assets, similar to how trades are executed on the NYSE or the Nasdaq.”

Oh and Fidelity and Charles Schwab.

— Adam Cochran (adamscochran.eth) (@adamscochran) June 20, 2023

• The US Dollar Index (DXY) has cooled off these past five days or so, ever since the US Federal Reserve last week hit the pause button on its year-long interest-rates hiking. That’s an uncertain narrative, of course, so we’ll see what Fed chair Jerome Powell and pals have to say next.

Nevertheless, belief that the dismal (for equities, crypto, risk assets) macroeconomic climate might just be starting to shift, despite recession fears still being in the mix, is on the table for some.

Zelensky after learning there’s another $6.2 billion coming his way after a Pentagon accounting error pic.twitter.com/fC3RO2buHz

— Not Jerome Powell (@alifarhat79) June 20, 2023

Top 10 overview

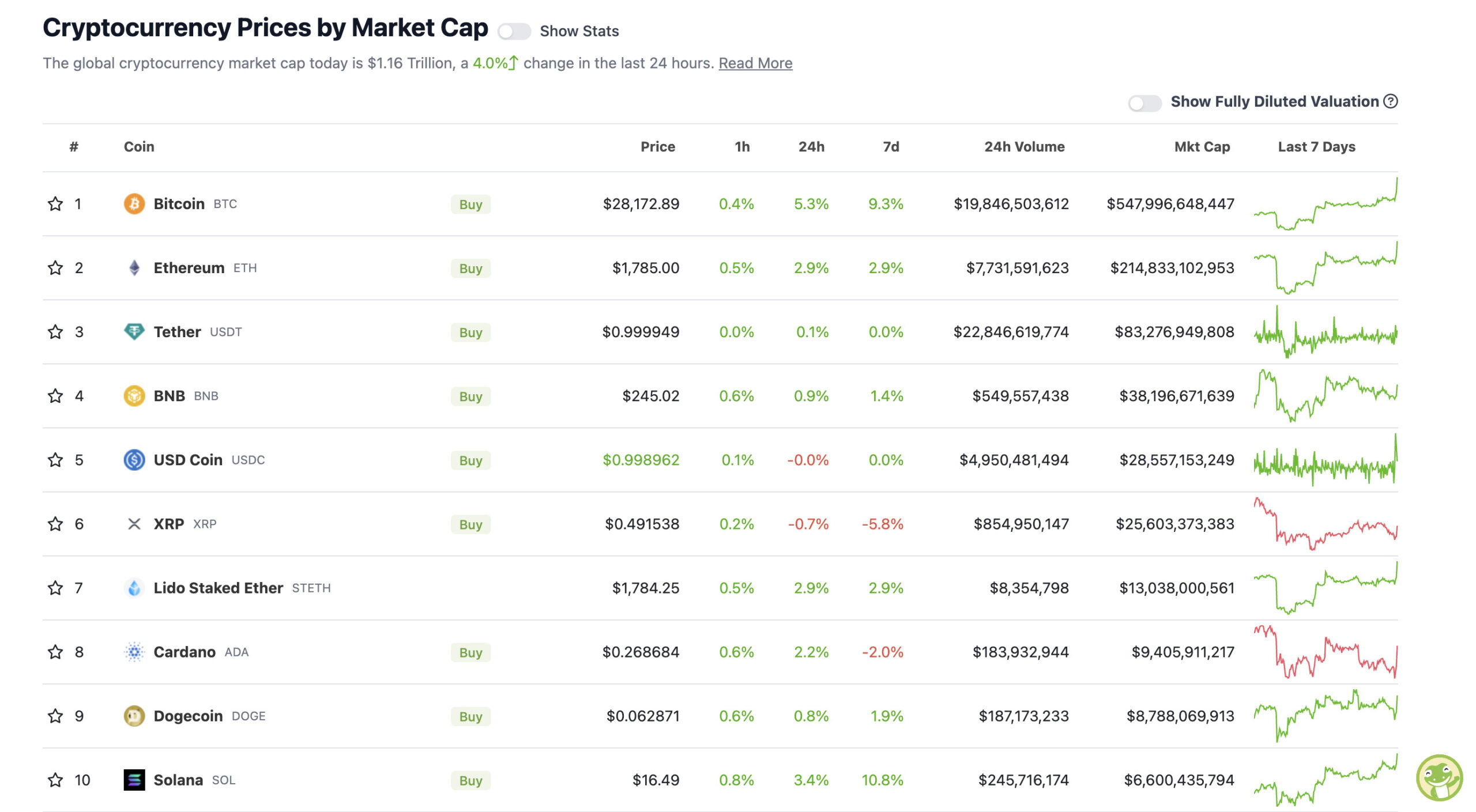

With the overall crypto market cap at US$1.16 trillion, up about 4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Fan of (baggy) green? (Sorry.) Then you’ll dig this crypto majors chart. Crypto captain Bitcoin is leading the way today, as it should, with deputy Ethereum offering good support.

BTC has now broken US$28k for the first time since May 8. Is it all smiles and rainbows and clear sailing from here, then? Nah, but let’s enjoy this small victory in a larger battle for now, shall we?

$BTC 1D

Excellent into close. Volume validating breakout. Gave the call to long the original breakout at 27.6 with stops below 27.5. Unfortunately did not get lower entries but my DCA is looking strong.

Will wait for pullback to 27.7 to add more.#bitcoin #cryptocurrency pic.twitter.com/MlXoCGtACS

— Roman (@Roman_Trading) June 20, 2023

Buy your #Altcoins.

Ten months prior to the halving is the best moment.

This cycle is the big one.

Accumulate.

— Michaël van de Poppe (@CryptoMichNL) June 20, 2023

Ahem, please note – nothing presented here in any way represents anything remotely like financial advice and should absolutely not be construed as such. Just a friendly reminder.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

There’s way more pumping than slumping in the top 100 cryptos by market cap today.

PUMPERS (11-100 market cap position)

• Stacks (STX), (market cap: US$1.06 billion) +25%

• Conflux (CFX), (market cap: US$457 million) +19%

• Optimism (OP), (market cap: US$854 million) +17%

• Pepe (PEPE), (market cap: US$443 million) +11%

• Injective (INJ), (market cap: US$537 million) +10%

LOWER-ORDER PUMPERS

• SuperWalk (GRND), (market cap: US$9 million) +31%

• Lybra Finance (LBR), (market cap: US$25 million) +11%

• Joe (JOE), (market cap: US$125 million) +1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

WisdomTree joins Blackrock and applies for a #Bitcoin Spot ETF.

In one week, all the big guys are joining.

It’s time.

— Michaël van de Poppe (@CryptoMichNL) June 20, 2023

#Bitcoin https://t.co/MfIxWQ6hOC

— naiive (@naiivememe) June 20, 2023

JUST IN: BlackRock recruiter says politicians are easy to buy and war is good for business.pic.twitter.com/aZPK74E2fv

— Watcher.Guru (@WatcherGuru) June 20, 2023

Anyhoo, where were we?…

https://twitter.com/_spartan_45/status/1671237619659976705

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.