Mooners and Shakers: Bitcoin rises amid Fidelity ETF rumour; Mastercard makes new crypto move

"And THEN he said, 'I'm into crypto'." "Haha, no way! OMG, etc." (Getty Images)

Another multi-trillionaire asset manager looks set to join the Bitcoin spot ETF hunt in competition with BlackRock, if you believe some circulating crypto Twitterings.

Fidelity, the world’s third-biggest real-life Monopoly winner, owns/manages about US$4.25 trillion in assets under management and has been dabbling in institutional crypto investment for a good couple of years.

According to rumours floating about this morning, the investment bigwig might be considering filing for a spot Bitcoin ETF, a la rival BlackRock… or a buyout of one of the largest holders of Bitcoin in the space – Grayscale.

Either way, according to Andrew Parish, a founder of trading group Arch Public, the move could be “seismic” for the crypto industry. “BlackRock and Fidelity will own the crypto space in the US,” he tweeted.

UPDATE: @DigitalAssets and @Fidelity is about to make a seismic move in crypto via both $BTC and $ETH.

Sources expect Fidelity to either make a bid for @Grayscale or quickly launch their own spot #bitcoin ETF. One or both are coming, soon.

**Blackrock and Fidelity will own…

— Andrew (@AP_Abacus) June 18, 2023

Grayscale, which manages 17 crypto trusts, including its GBTC Bitcoin trust, worth US$16.5 billion, enables “accredited investors” exposure to various underlying cryptocurrencies, and is heavily regulated by the SEC. At present, it’s the closest thing the crypto market has to a spot Bitcoin ETF, without actually being one.

In fact, Grayscale has been pushing for its own BTC ETF for some time, and its rejection thus far pushed the firm to sue the regulator about 12 months ago for unfair treatment, accusing the SEC of “arbitrary, capricious and discriminatory” decision-making.

Just another legal case for Gary Gensler and co over at the SEC, and that one, like the Ripple drama, is ongoing.

BREAKING:

After Blackrock, now Fidelity is planning to apply for a #Bitcoin Spot ETF.

Now is the time to accumulate & invest.

— Michaël van de Poppe (@CryptoMichNL) June 19, 2023

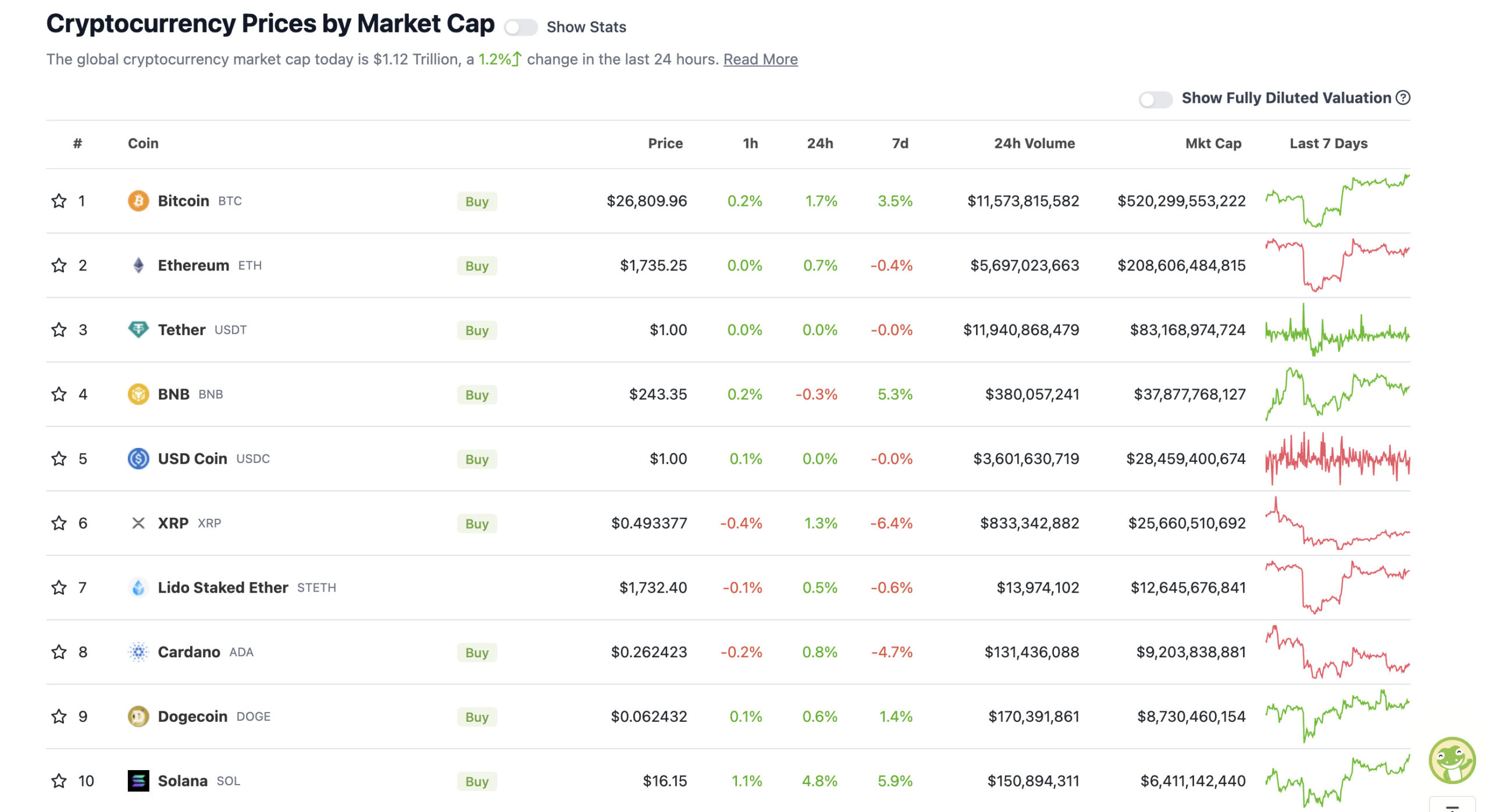

Top 10 overview

With the overall crypto market cap at US$1.12 trillion, up about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) actually made a run for US$27k a few hours ago and was swiftly rejected there. It’s currently receiving a frank and inspiring pep talk by a wet-towel-wielding trainer and is gearing up to step back in the ring for that particular fight as we speak.

The biggest daily mover in the crypto majors this morning is Solana (SOL), which sneaks back into the top 10 ahead of Justin Sun’s Ethereum copycat Tron (TRX).

A quick scour of some crypto twittering analysis, and Roman Trading has the goods today. We think, here, he’s referring to the recent assaults on the US crypto industry from the SEC, when he mentions the “bearish news” that hasn’t had quite the major impact on the market that some have been anticipating. Not yet, anyway.

The $DXY is showing not only a bear flag but money flow shows out.

I’ve been saying for the last 3-4 months that the market is going to be led by investor capital, not economic gains.

Good luck.

— Roman (@Roman_Trading) June 19, 2023

He’s also spotting a “bear flag” for the US Dollar, and if that plays out to its natural conclusion, then, well, that’d be a boon for risk assets.

Rekt Capital, meanwhile, sees potential for additional downside on the crypto market as a whole, however, notes a successful retest of a level of support he’s charted. He still appears to belive the market is operating within a bullish technical framework.

Total #Crypto Market Cap successfully retests the very bottom of the green support area

Of course, additional downside could still occur but still maintain a bullish technical framework$BTC #BTC #Bitcoin https://t.co/SFj2aDdhjL pic.twitter.com/KyFPNUr9y5

— Rekt Capital (@rektcapital) June 19, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Sui (SUI), (market cap: US$415 million) +10%

• Stacks (STX), (market cap: US$837 million) +8%

• Kaspa (KAS), (market cap: US$409 million) +7%

• Maker (MKR), (market cap: US$641 million) +6%

• Injective (INJ), (market cap: US$495 million) +4%

SLUMPERS

• KuCoin (KCS), (market cap: US$618 million) -7%

• BitTorrent (BTT), (mc: US$450 million) -2%

• XDC Network (XDC), (mc: US$439 million) -2%

• Toncoin (TON), (mc: US$2.02 billion) -2%

• Rocket Pool (RPL), (mc: US$789 million) -1%

Around the blocks: Mastercard stays the crypto path

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

According to prominent US patents lawyer Mike Kondoudis, payments giant Mastercard is continuing its move into crypto, filing for a trademark application regarding the development of a series of crypto and blockchain-based software tools.

#Mastercard is continuing its move into #crypto!

The payment processor has filed a trademark application claiming plans for

▶️ Software for crypto + blockchain transactions

▶️ Interconnecting virtual asset service providers for crypto transactions#Web3 #DeFi #Cryptocurrency pic.twitter.com/Pz1m5gau10— Mike Kondoudis (@KondoudisLaw) June 19, 2023

Both Mastercard and rival Visa have been making strong moves into the crypto space since early 2021.

JUST IN: International Monetary Fund is developing a digital currency platform to enable transactions between countries.

— Watcher.Guru (@WatcherGuru) June 19, 2023

Binance is the latest exchange to announce a layer-2 blockchain 👀

opBNB will be based on Optimism's OP Stack and is live on testnet.

Joins other exchanges in building L2s 👇

– Coinbase's involvement in Base on OP Stack

– Bybit's involvement in Mantle pic.twitter.com/PyF5WhnmHa— Matt Willemsen (@matt_willemsen) June 19, 2023

#Bitcoin pic.twitter.com/zuyNHuptA3

— naiive (@naiivememe) June 19, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.